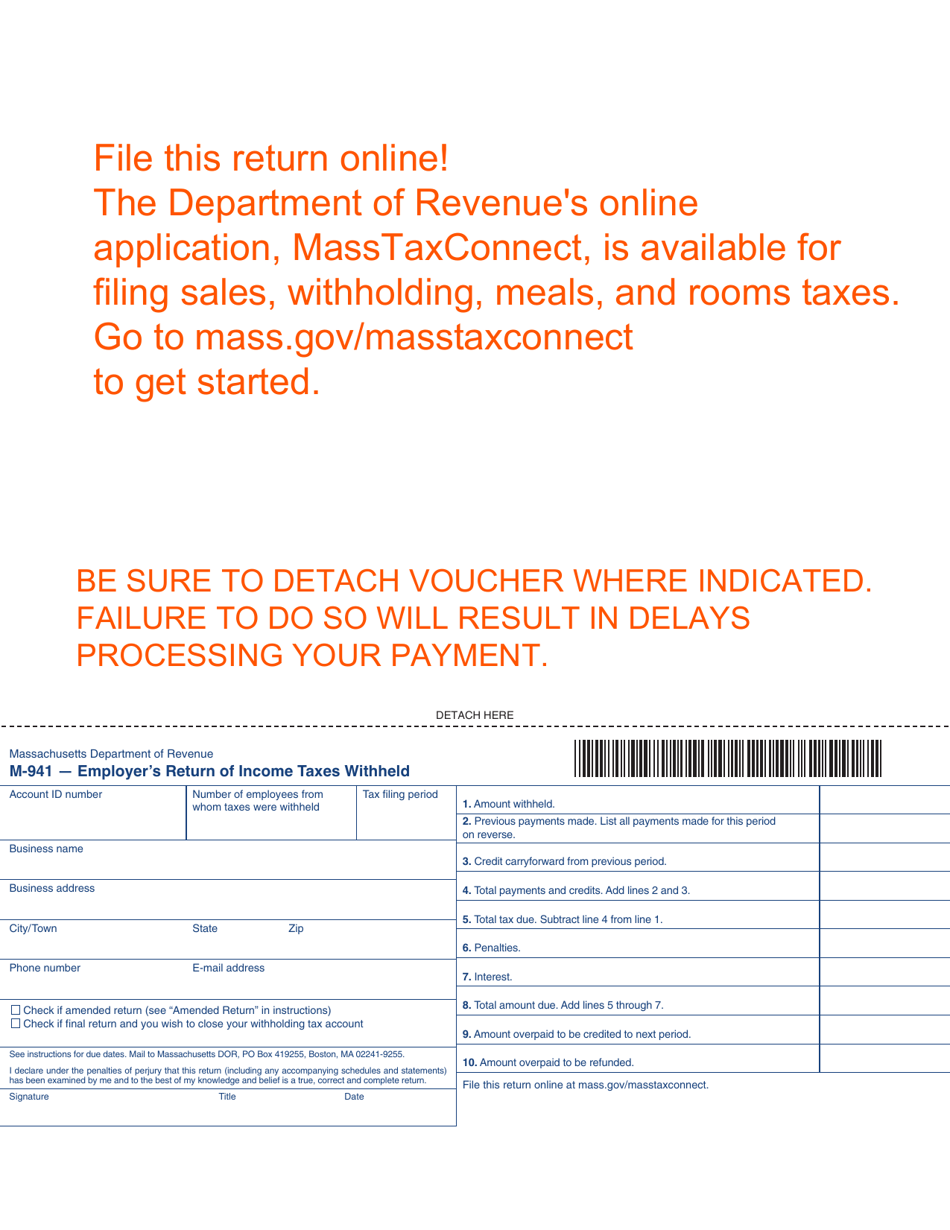

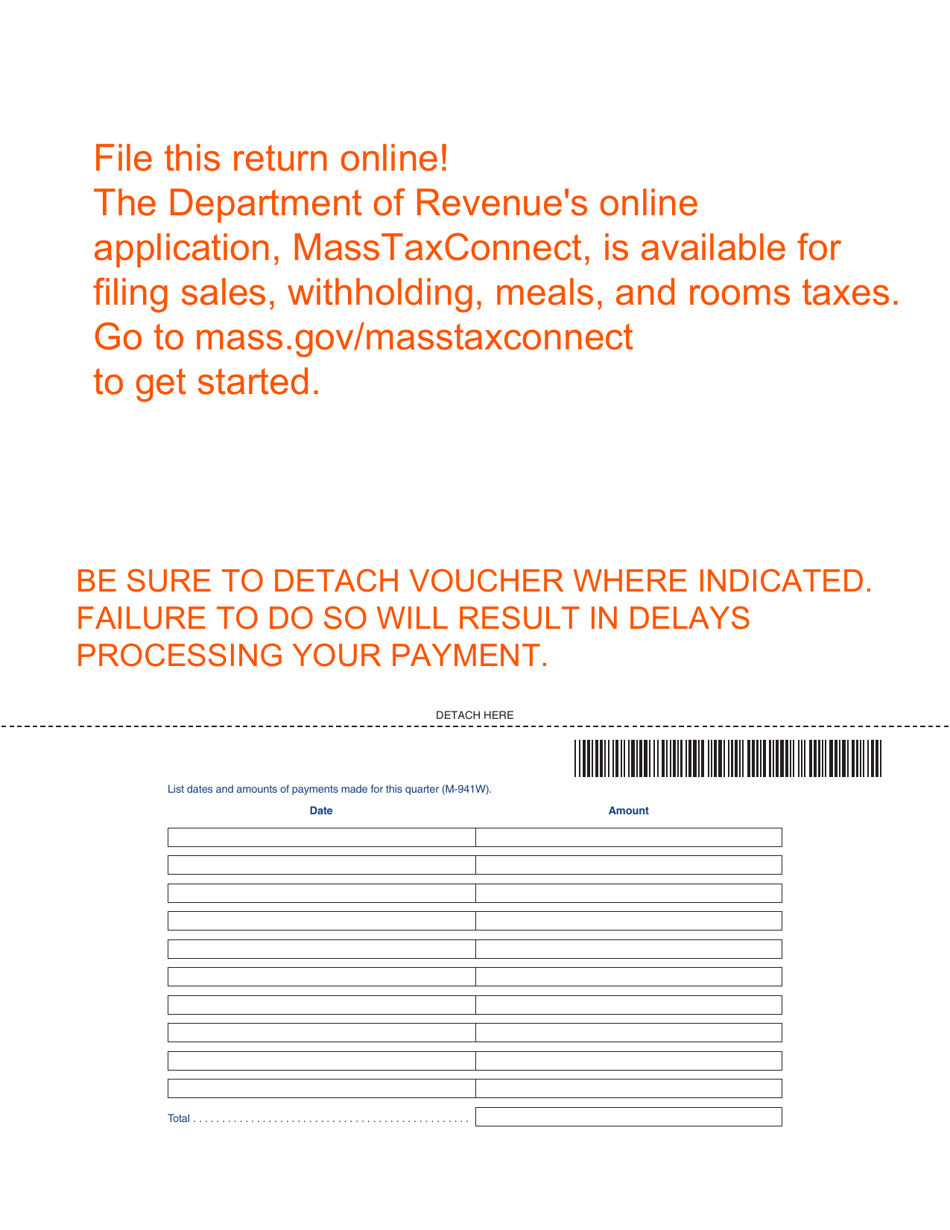

Form M-941 Employer's Return of Income Taxes Withheld - Massachusetts

What Is Form M-941?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M-941?

A: Form M-941 is the Employer's Return of Income Taxes Withheld for employers in Massachusetts.

Q: Who needs to file Form M-941?

A: Employers in Massachusetts who withhold income taxes from their employees' wages need to file Form M-941.

Q: When is Form M-941 due?

A: Form M-941 is generally due on a quarterly basis. The due dates are April 30th, July 31st, October 31st, and January 31st.

Q: What information is required on Form M-941?

A: Form M-941 requires information about the employer, the employees, and the income taxes withheld.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-941 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.