Estimated Tax Instructions for Unrelated Business Income Tax (Ubit) - Minnesota

Estimated Tax Unrelated Business Income Tax (Ubit) is a legal document that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota.

FAQ

Q: What is Unrelated Business Income Tax (UBIT)?

A: Unrelated Business Income Tax (UBIT) is a tax on income from unrelated business activities conducted by tax-exempt organizations.

Q: Who is required to pay UBIT?

A: Tax-exempt organizations, such as nonprofits, are required to pay UBIT if they have unrelated business income.

Q: What are unrelated business activities?

A: Unrelated business activities are regular trade or business activities that are not substantially related to the organization's exempt purpose.

Q: How is UBIT calculated?

A: UBIT is calculated based on the organization's gross income from unrelated business activities minus any allowable deductions.

Q: What is the purpose of estimated tax?

A: Estimated tax is used to pay income taxes on income that is not subject to withholding, such as UBIT.

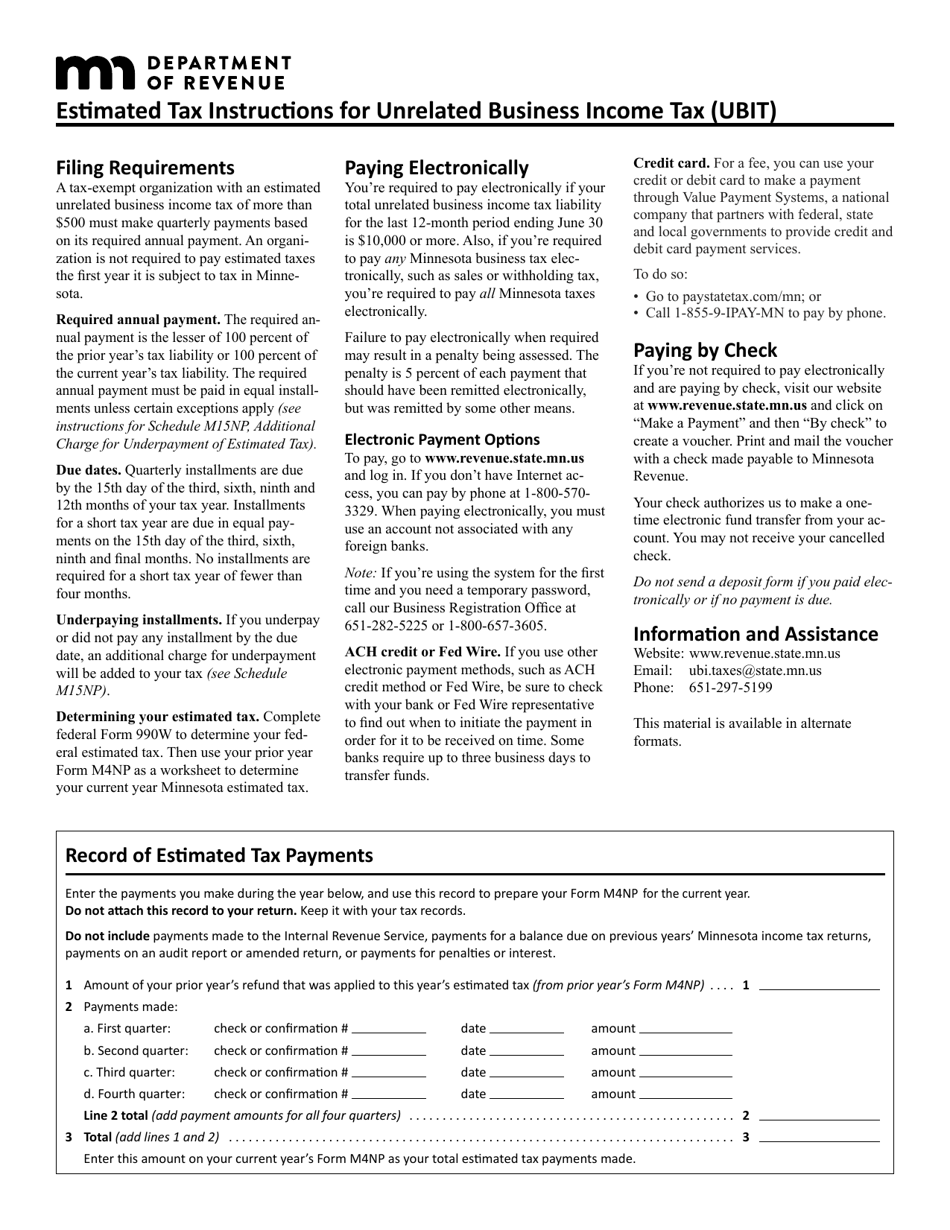

Q: When are estimated tax payments due?

A: Estimated tax payments for UBIT are due on a quarterly basis, typically on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Q: Are there any penalties for not paying estimated tax?

A: Yes, failure to pay estimated tax or underpaying can result in penalties and interest charges.

Form Details:

- The latest edition currently provided by the Minnesota Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.