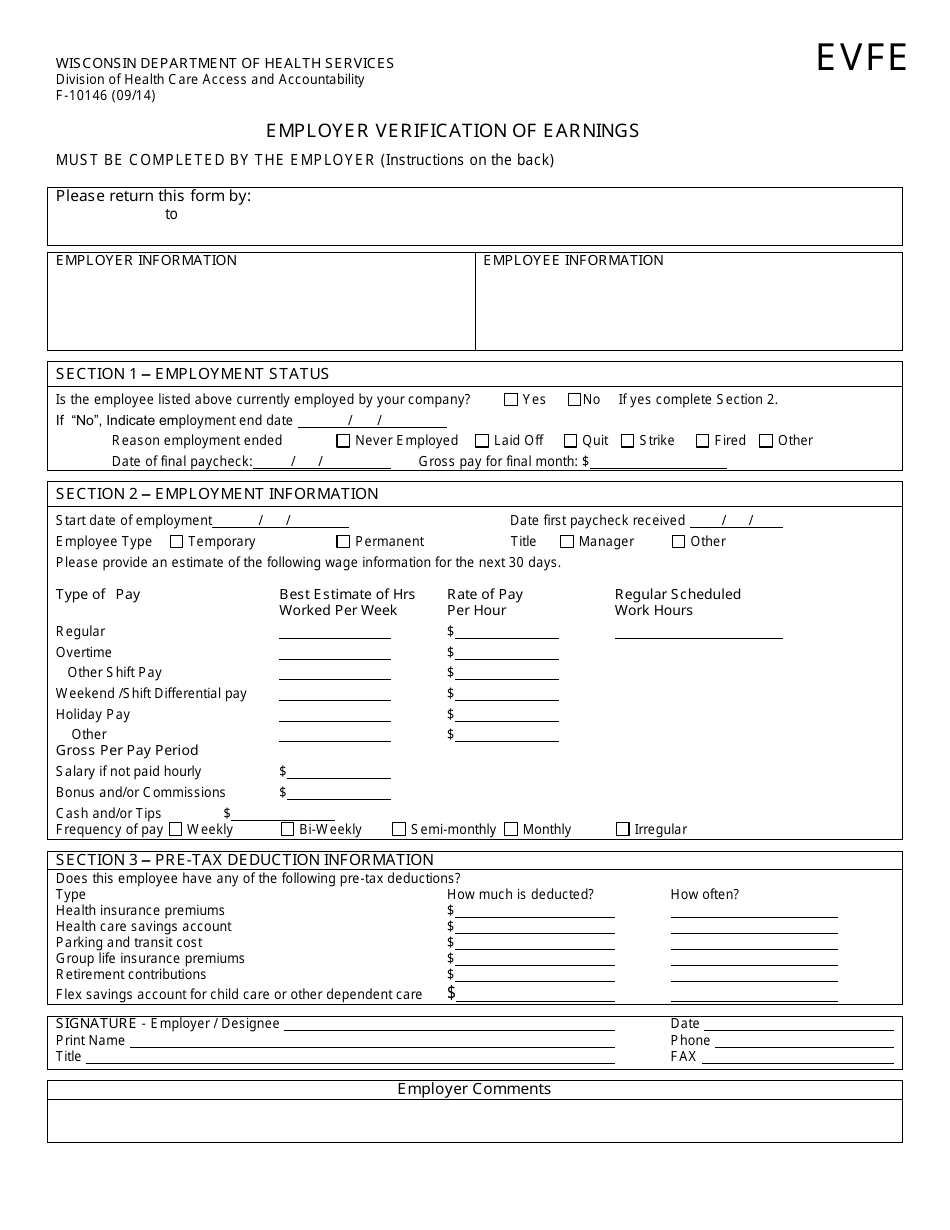

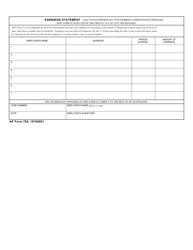

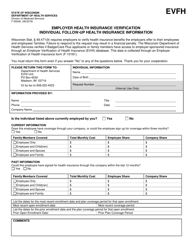

Form F-10146 Employer Verification of Earnings - Wisconsin

What Is Form F-10146?

This is a legal form that was released by the Wisconsin Department of Health Services - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-10146?

A: Form F-10146 is the Employer Verification of Earnings form used in Wisconsin.

Q: Who uses Form F-10146?

A: Employers in Wisconsin use Form F-10146 to verify their employees' earnings.

Q: What is the purpose of Form F-10146?

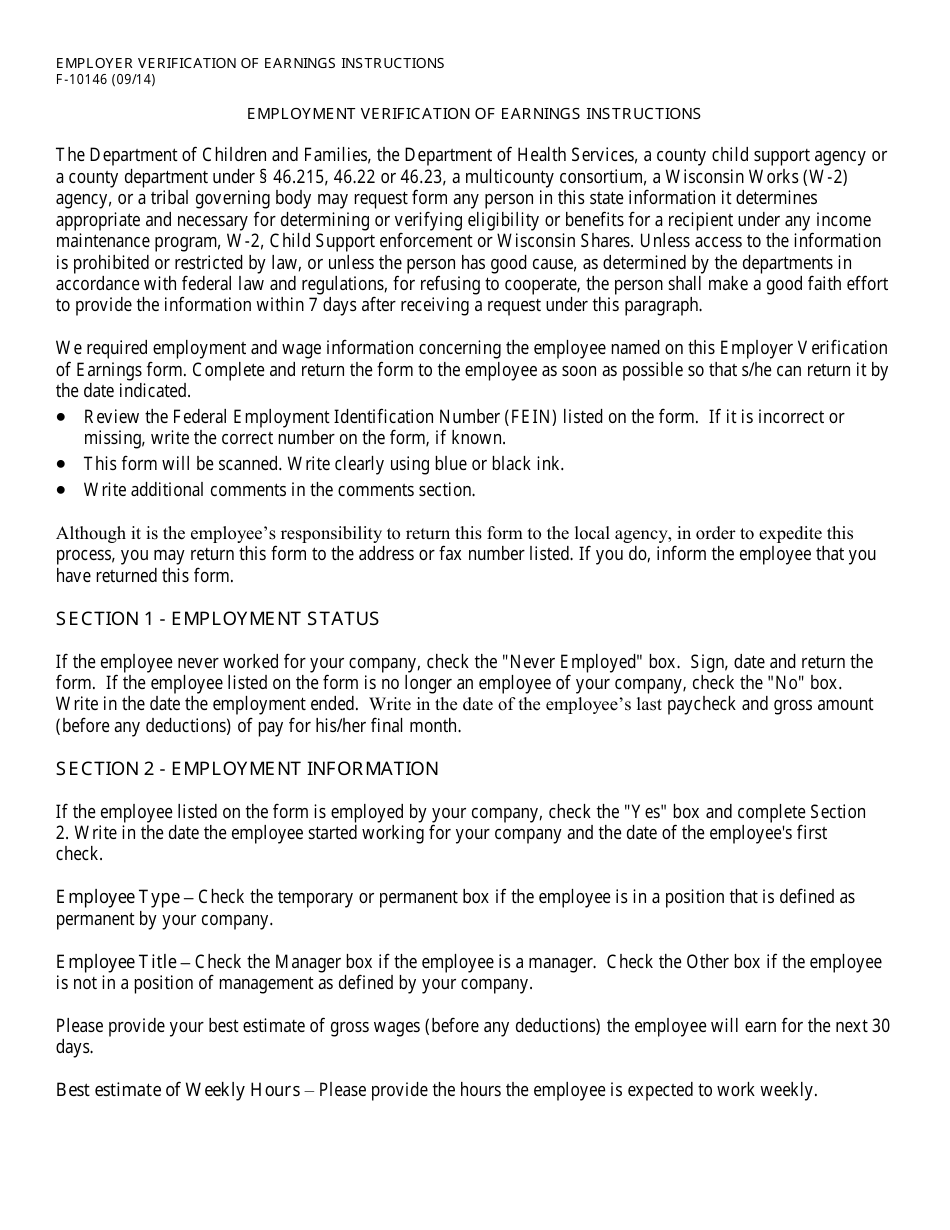

A: The purpose of Form F-10146 is to verify an employee's earnings for the purpose of determining eligibility for certain benefits or programs.

Q: Do I need to submit Form F-10146?

A: You may be required to submit Form F-10146 if you are applying for certain benefits or programs that require verification of your earnings.

Q: What information is required on Form F-10146?

A: Form F-10146 requires information such as the employee's name, Social Security number, earnings details, and employer information.

Q: How should I complete Form F-10146?

A: You should carefully fill out all the required information on Form F-10146, including accurate earnings details for the specified time period.

Q: Can my employer refuse to complete Form F-10146?

A: Your employer is required by law to complete Form F-10146 if requested, as it is a necessary document for determining eligibility for certain benefits.

Q: Are there any fees associated with Form F-10146?

A: There are no fees associated with Form F-10146.

Q: What should I do if there are errors on Form F-10146?

A: If there are errors on Form F-10146, you should contact your employer to make the necessary corrections.

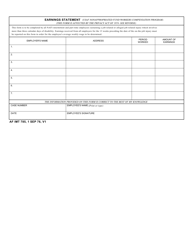

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the Wisconsin Department of Health Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-10146 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Health Services.