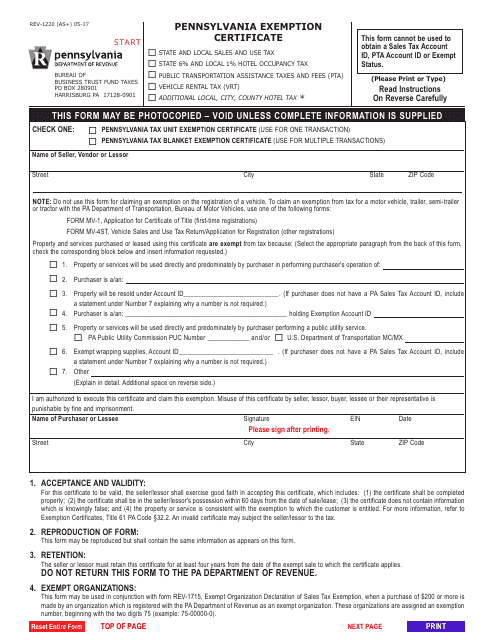

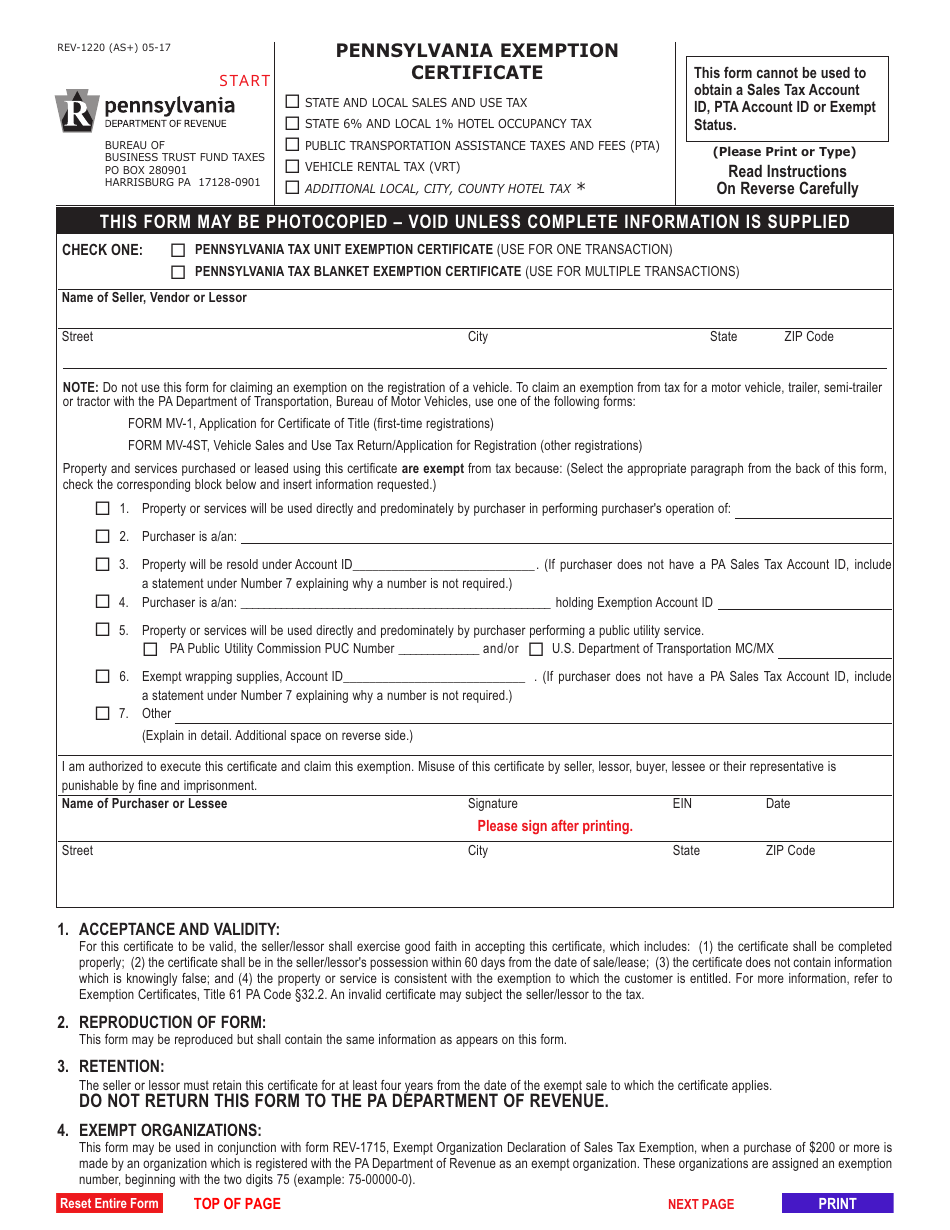

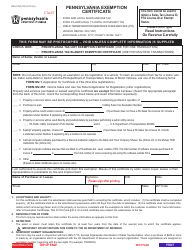

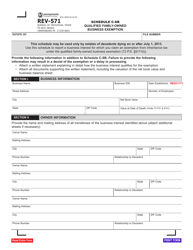

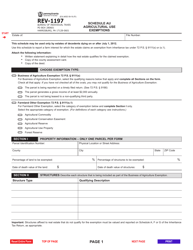

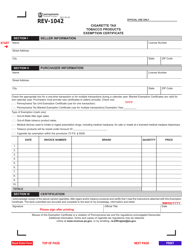

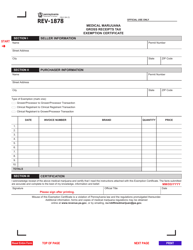

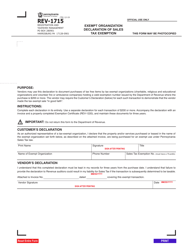

Form REV-1220 (AS+) Pennsylvania Exemption Certificate - Pennsylvania

What Is Form REV-1220 (AS+)?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1220?

A: Form REV-1220 is the Pennsylvania Exemption Certificate.

Q: What is the purpose of Form REV-1220?

A: The purpose of Form REV-1220 is to claim exemption from certain Pennsylvania taxes.

Q: Who should use Form REV-1220?

A: This form should be used by individuals or businesses who qualify for exemption from Pennsylvania taxes.

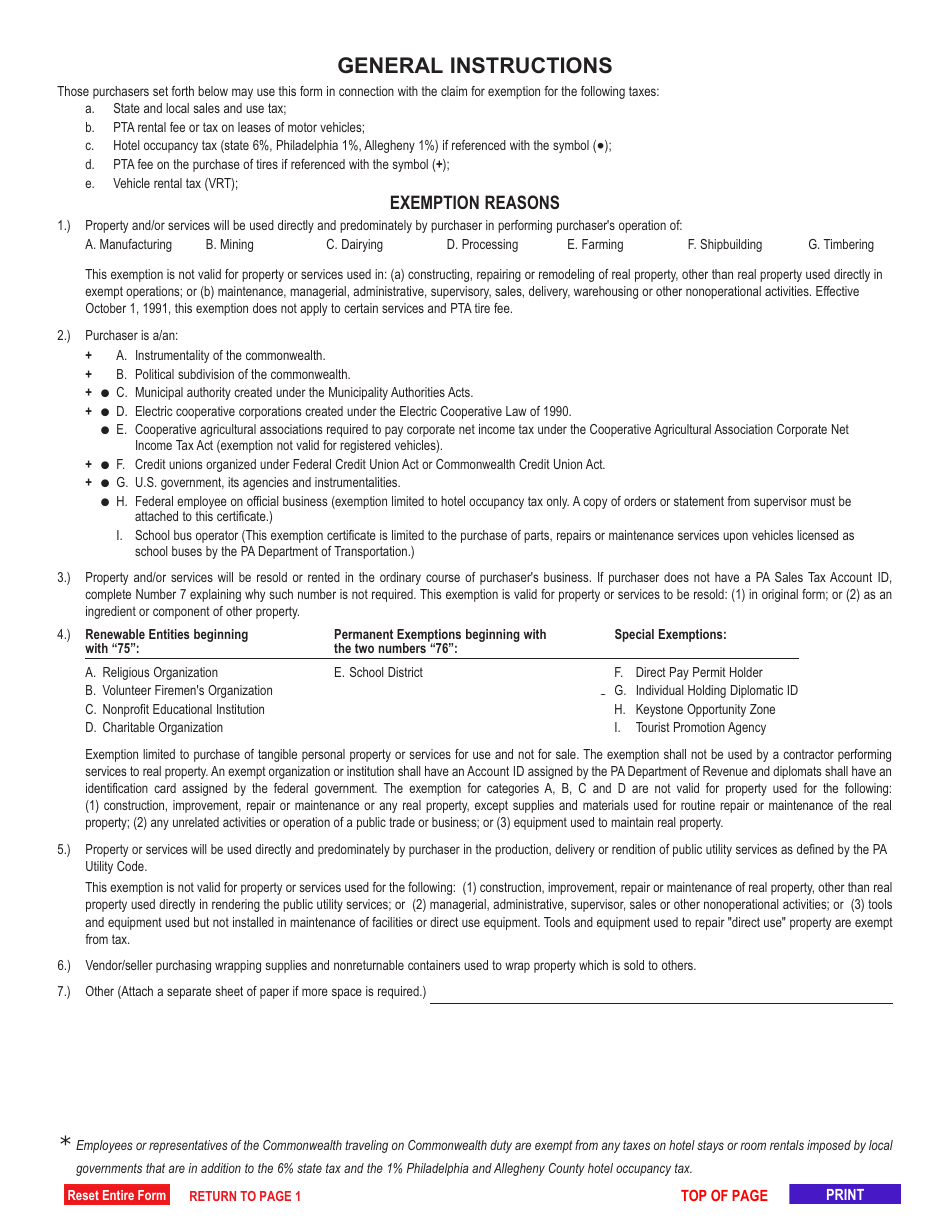

Q: What taxes can be exempted using Form REV-1220?

A: Form REV-1220 can be used to claim exemption from Pennsylvania sales and use tax, hotel occupancy tax, and vehicle rental tax.

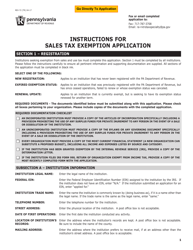

Q: How do I fill out Form REV-1220?

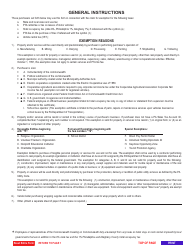

A: You should fill out the form completely and accurately, providing all required information and supporting documentation.

Q: Do I need to submit Form REV-1220 to the Pennsylvania Department of Revenue?

A: Yes, you must submit Form REV-1220 to the Pennsylvania Department of Revenue in order to claim the exemption.

Q: Can I claim exemption for multiple taxes on one Form REV-1220?

A: Yes, you can claim exemption for multiple taxes on one Form REV-1220, as long as you meet the qualifying criteria for each exemption.

Q: Is there a deadline for submitting Form REV-1220?

A: There is no specific deadline for submitting Form REV-1220, but it should be submitted before the tax is due.

Q: What happens if my Form REV-1220 is approved?

A: If your Form REV-1220 is approved, you will be exempt from the specified Pennsylvania taxes for the period indicated on the form.

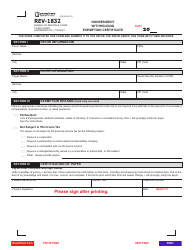

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1220 (AS+) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.