This version of the form is not currently in use and is provided for reference only. Download this version of

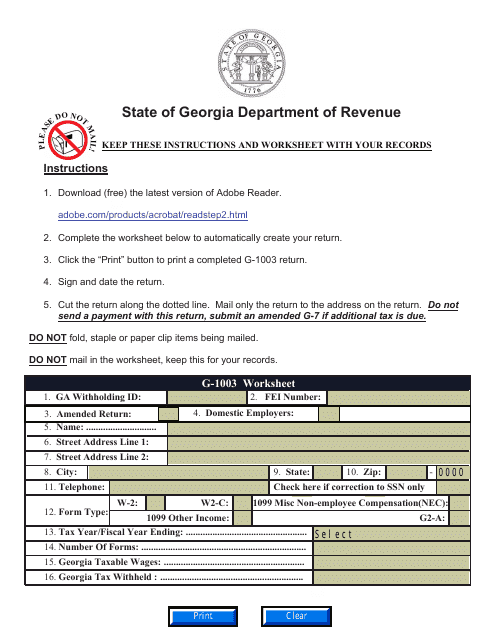

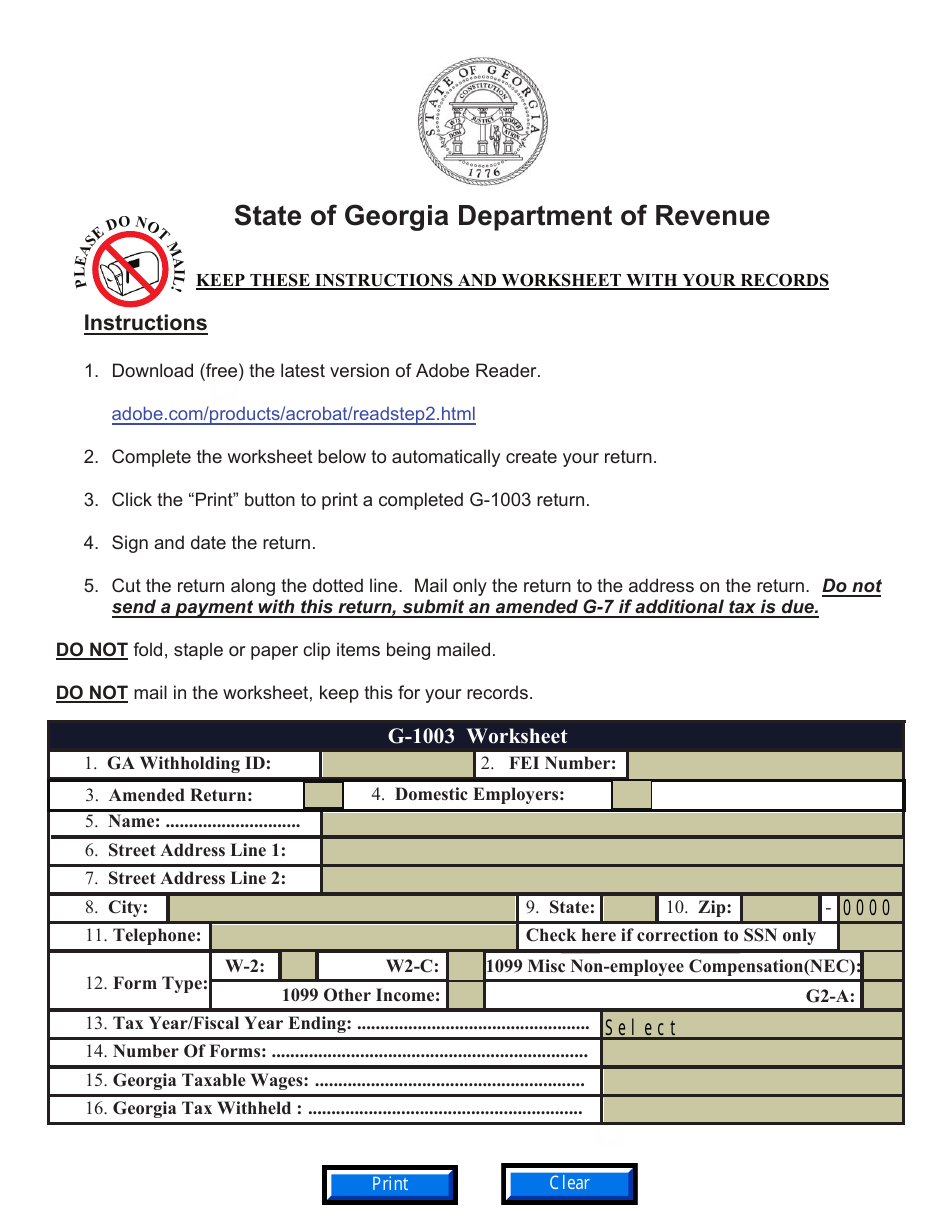

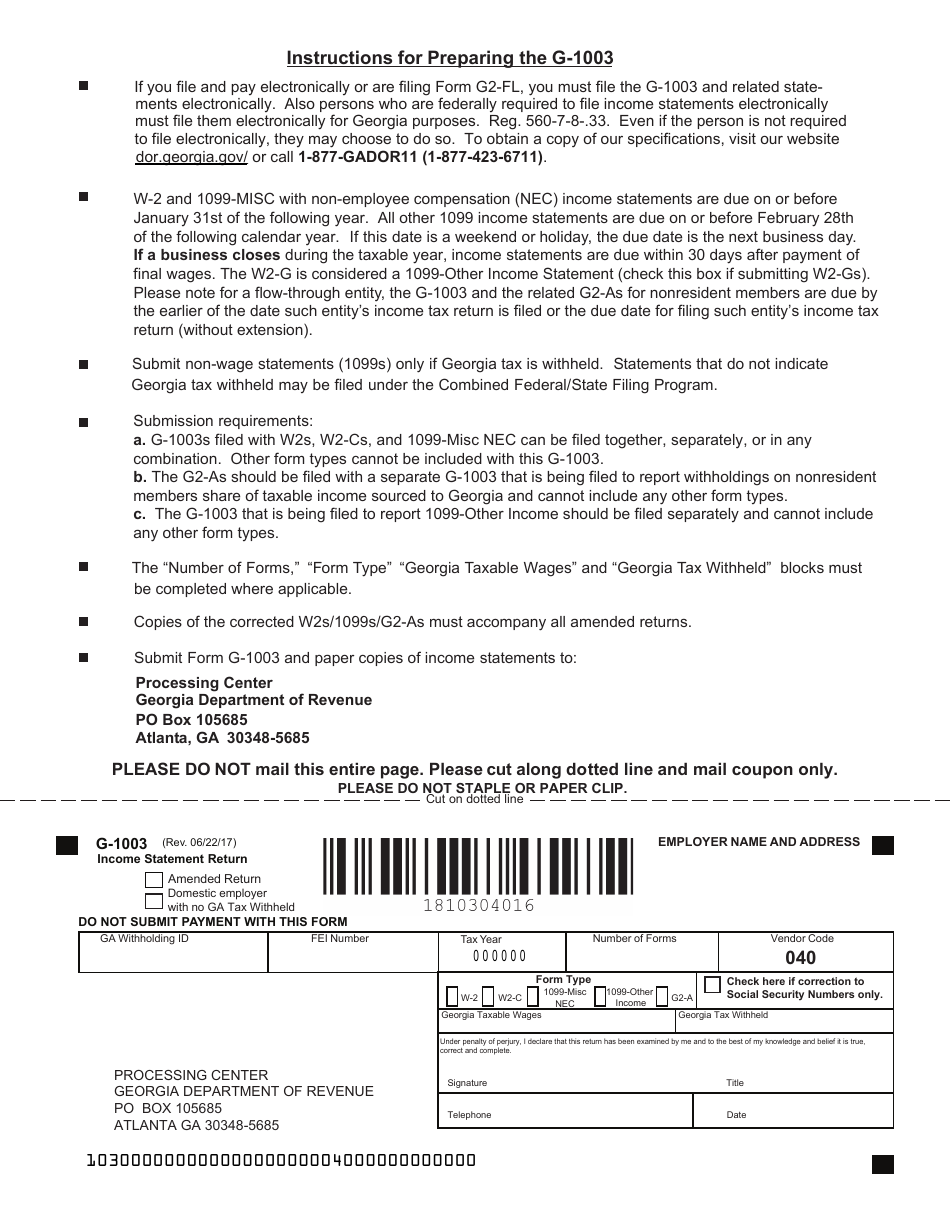

Form G-1003

for the current year.

Form G-1003 Income Statement Return - Georgia (United States)

What Is Form G-1003?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-1003?

A: Form G-1003 is an Income Statement Return for the state of Georgia in the United States.

Q: Who needs to file Form G-1003?

A: Businesses operating in Georgia and subject to income tax are required to file Form G-1003.

Q: What is the purpose of Form G-1003?

A: Form G-1003 is used to report and calculate the income tax liability of businesses in Georgia.

Q: What information is required on Form G-1003?

A: Form G-1003 requires businesses to provide details of their income, deductions, credits, and tax liability.

Q: When is Form G-1003 due?

A: Form G-1003 is due on or before the 15th day of the 4th month following the close of the taxable year.

Q: Are there any penalties for late filing of Form G-1003?

A: Yes, there are penalties for late filing of Form G-1003, including possible interest charges and additional fees.

Q: Can Form G-1003 be filed electronically?

A: Yes, businesses have the option to file Form G-1003 electronically.

Q: Is Form G-1003 specific to Georgia only?

A: Yes, Form G-1003 is specific to the state of Georgia and cannot be used for filing income tax returns in other states.

Q: Are there any exemptions or deductions available on Form G-1003?

A: Yes, there are various exemptions and deductions available on Form G-1003, which can help reduce the tax liability of businesses.

Form Details:

- Released on June 22, 2017;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form G-1003 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.