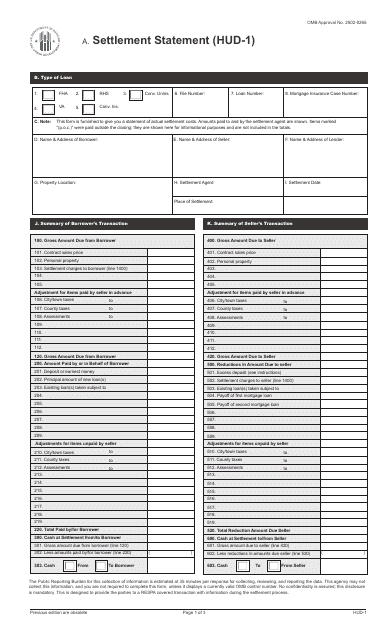

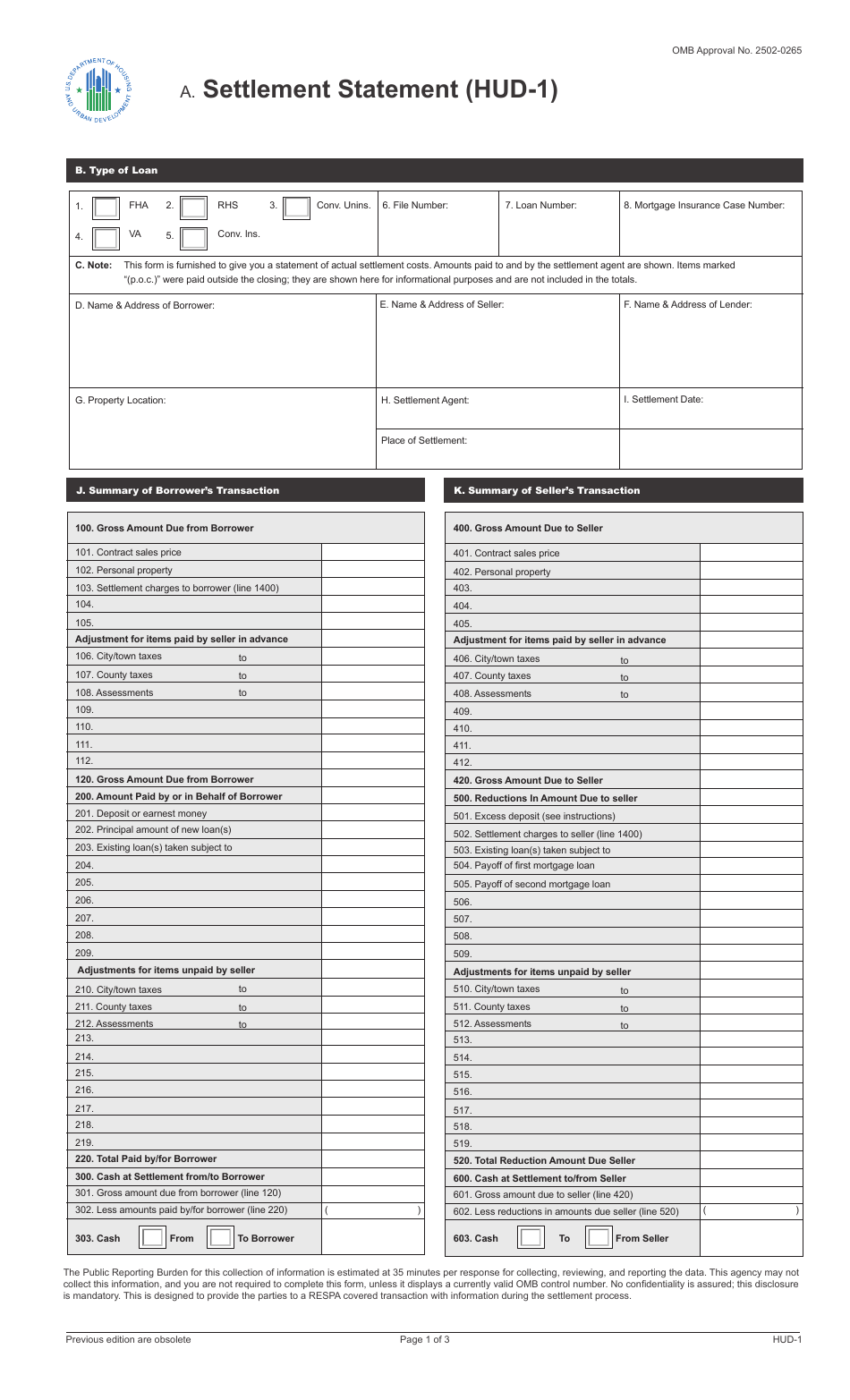

Form HUD-1 Settlement Statement

What Is Form HUD-1?

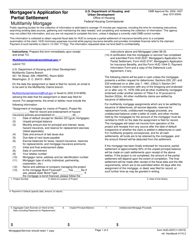

Form HUD-1, Settlement Statement , is a complex document developed for the purpose of listing all charges connected with a home purchase transaction. The application was required to be used in all transactions that include federal mortgage loans, however, now it is only being used for reverse mortgages. The purpose of the form is to give both sides of the transaction, a seller and a borrower, a complete list of their outgoing and incoming funds.

The HUD-1 Form was issued by the U.S. Department of Housing and Urban Development . Since the document is only being used for a certain type of mortgages, there are no recent developments in it.

How Do I Get a HUD-1 Settlement Statement?

Borrowers and sellers are supposed to get their Form HUD-1 from the settlement agent or a creditor one day prior to their settlement. The document is prepared after a borrower's loan is approved and a closing agent can put all the numbers in the form. HUD-1 Form contains very important information about the loan and its terms, that's why it's essential to pay a lot of attention to its content and the numbers. A fillable HUD-1 Form is available for download below.

HUD-1 Settlement Statement Instructions

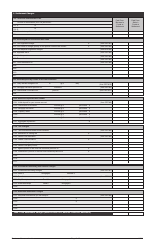

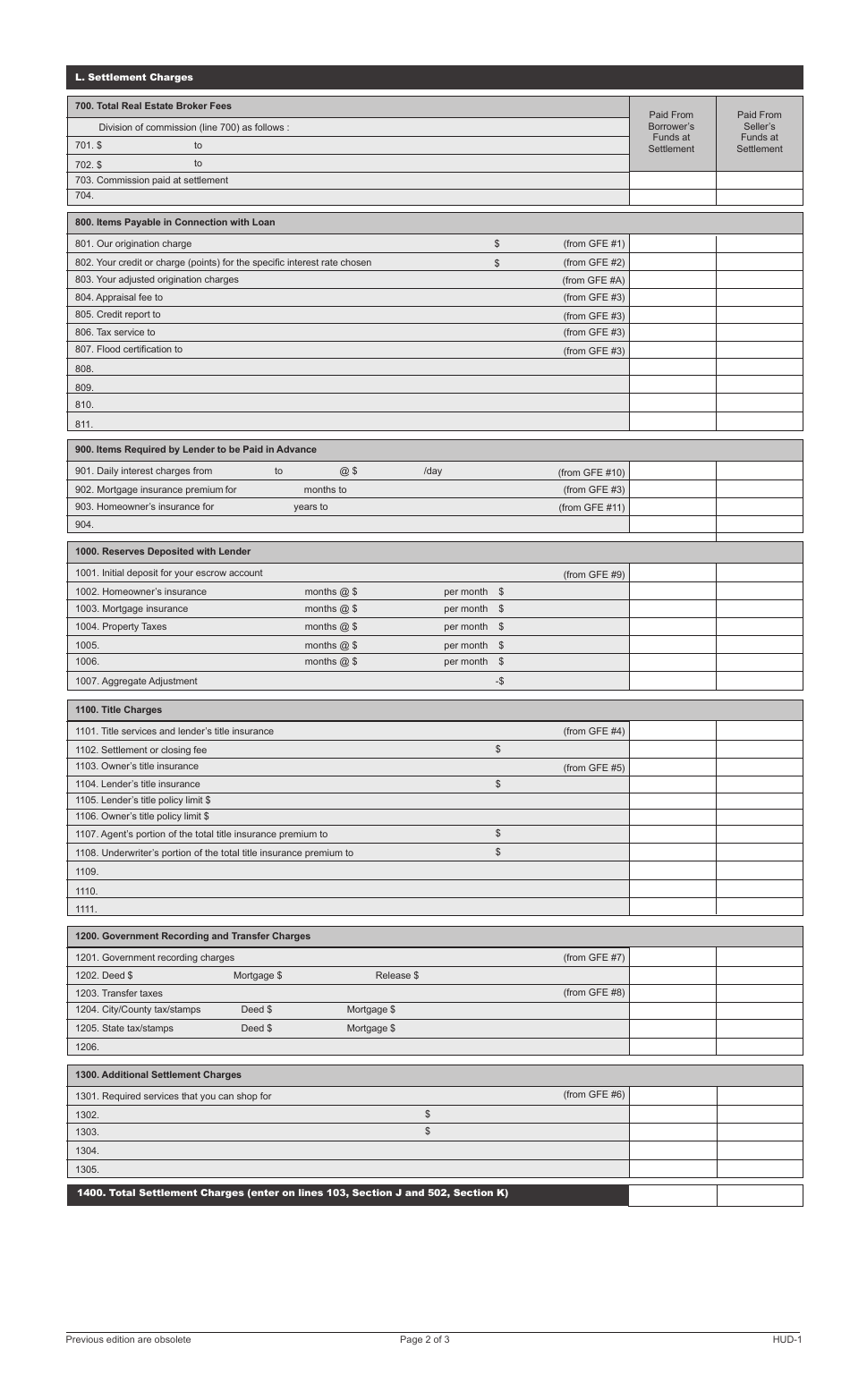

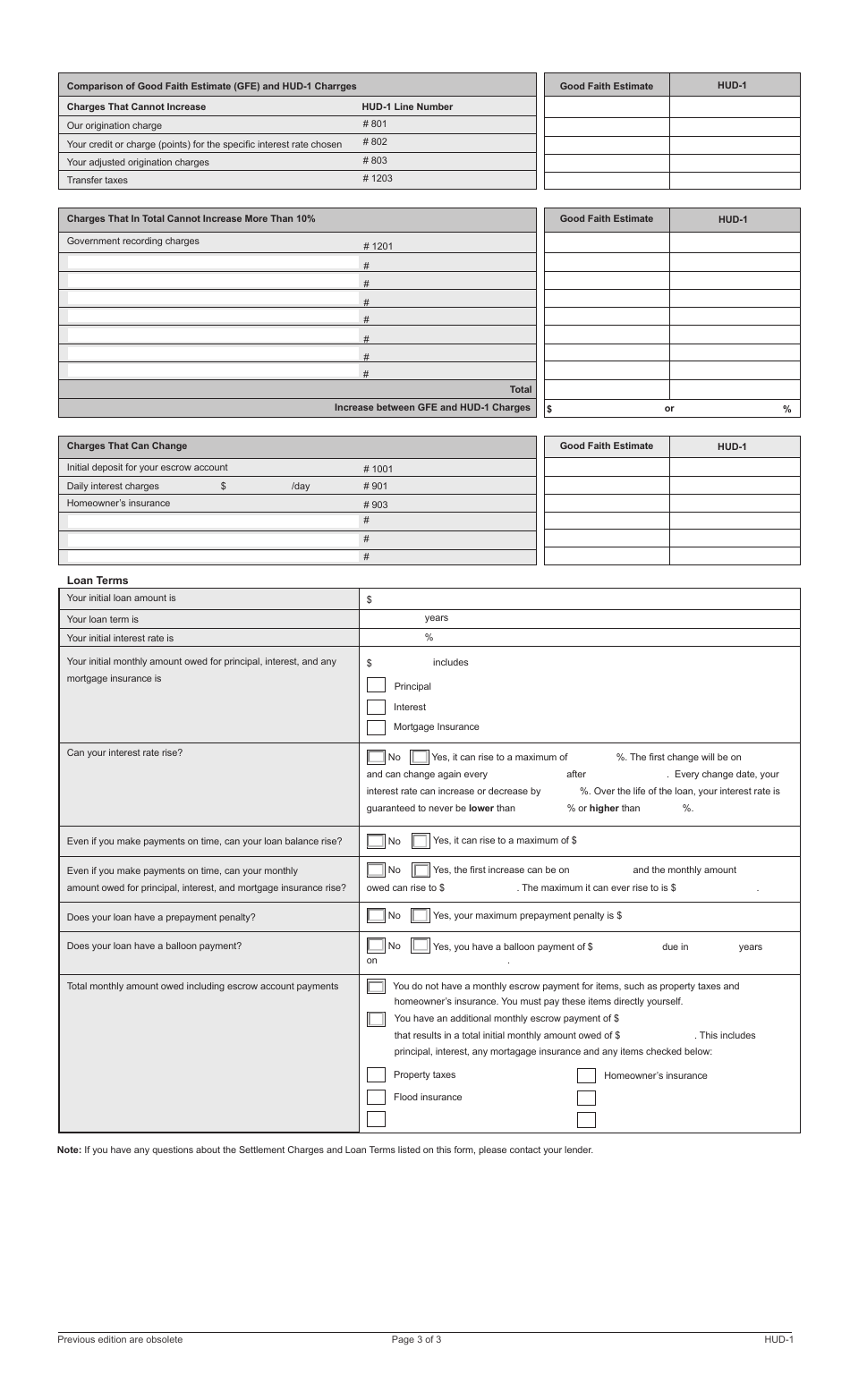

HUD-1 Form is presented on three pages, where all the costs are listed one by one. The document consists of several sections, which include the following:

- Type of Loan . In the first part of the application a filer must designate a type of loan, file number, loan number, and mortgage insurancecase number;

- Information about the parties involved in the settlement . Here an applicant must state names and addresses of a seller, a borrower, and a lender, the location of the property, settlement agent and settlement date, etc.;

- Summary of the borrower's transaction . This section presents a list of lines which include the gross amount due from the borrower, adjustments for items paid by the seller in advance, the amount paid by the borrower, adjustments for items unpaid by seller, etc.;

- Summary of the seller's transaction . By the analogy with the previous section, this column present information about the seller, such as gross amount due for the seller, adjustments for items paid by the seller in advance, reductions in the amount due to a seller, etc.;

- The Settlement Charges . Individuals use this part of the document to designate total real estate broker fees, payable items in connection with the loan, title charges, government recording and transfer charges, items required by the lender to be paid in advance, etc.;

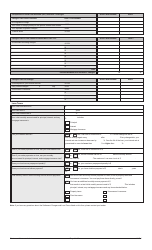

- Loan Terms . In the last part of the application, filers must state the initial loan amount, loan term, initial interest rate. They must also designate if the initial interest rate can rise, if the loan has a prepayment penalty, etc.

The only HUD-1 tax deductions are real estate taxes and mortgage interest. If a buyer of real estate wants to figure out their HUD-1 tax deductions, they should use Form 1040 Schedule A, Itemized Deductions.

Who is Responsible for Preparing the HUD-1 Document?

Normally the HUD-1 Document is prepared by the settlement agent, closing agent, or a creditor. Even though agents are responsible for preparing the document, each side of the settlement is responsible for its content. Errors may occur often since sometimes a filer receives all the data necessary to prepare the document in the last moment.

When Should I Receive the HUD Settlement Statement?

According to the Real Estate Settlement Procedures Act (RESPA), the Settlement Statement is supposed to be received by the parties one day before closing. However, in practice, a borrower can receive the document right before the settlement. It depends on when a loan was approved, when a settlement agent got the necessary information, how long it took to prepare the form, etc.

Which Type of Loan Will Use a HUD-1 in Place of a Closing Disclosure?

In 2015 RESPA integrated a HUD-1 Replacement, the Closing Disclosure form. It replaces the HUD-1 from use in real estate transactions, except for one situation - reverse mortgages. A reverse mortgage is a type of loan commonly used by the seniors (who are 62 or older), who can borrow from their home's equity without having to make mortgage payments on a monthly basis.

Related Topics and Forms: