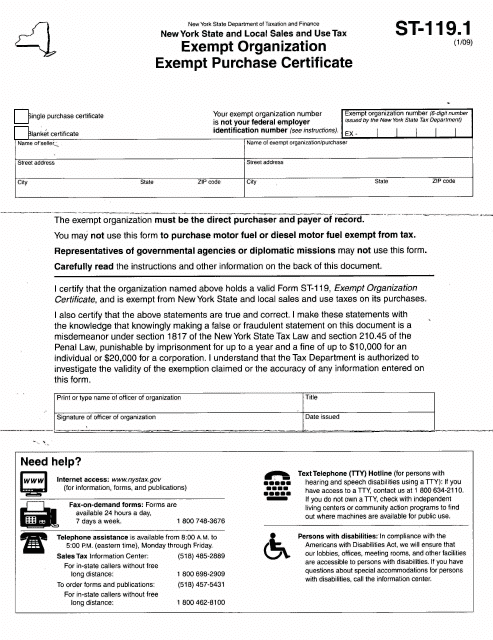

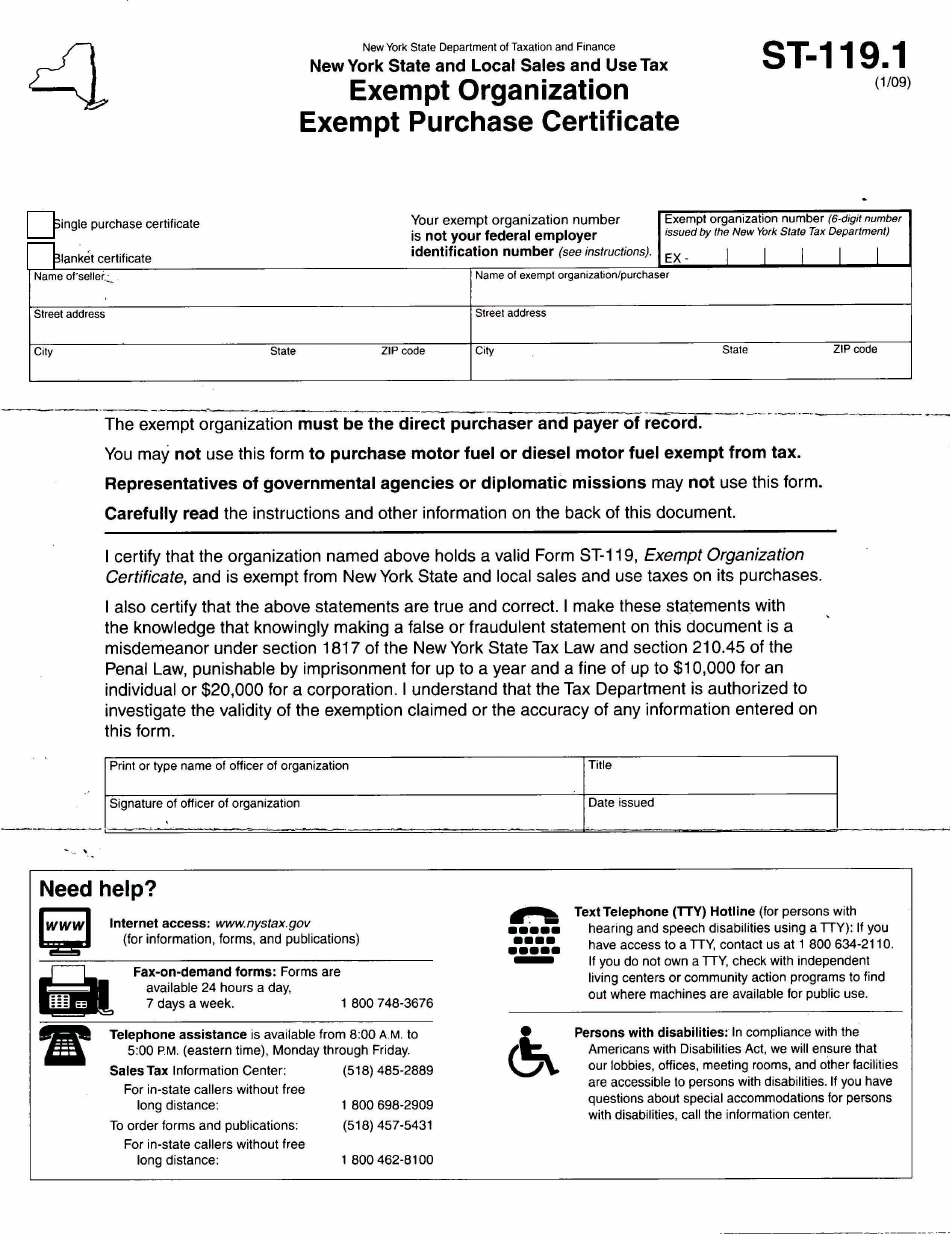

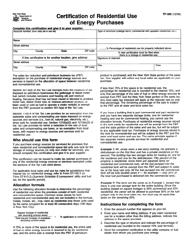

Form ST-119.1 New York State and Local Sales and Use Tax - Exempt Organization - Exempt Purchase Certificate - New York

What Is Form ST-119.1?

Form ST-119.1, New York State and Local Sales and Use Tax Exempt Organization Exempt Purchase Certificate, is a document that enables you to make tax-free purchases of products usually subject to sales tax. The form is a state-specific document issued by the New York State Department of Taxation and Finance and was last revised on January 1, 2009 . The ST-119.1 fillable form is available for download below.

Alternate Name:

- NYS Tax Exempt Form ST-119.1.

A tax exemption certificate is used to purchase taxable items and services free of taxes. A purchaser should provide the seller with the completed certificate at the time of sale or no later than 90 days since the purchase was made.

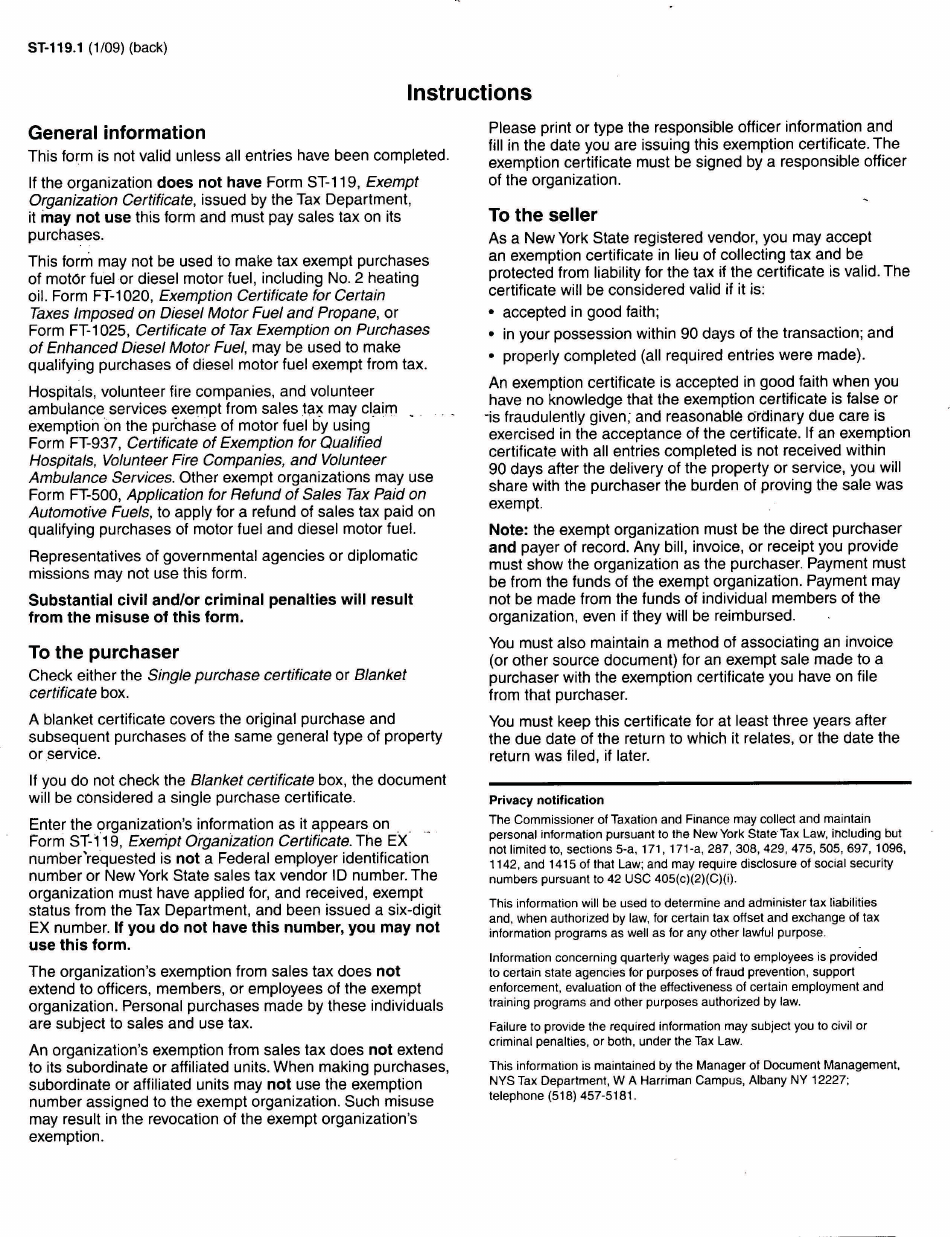

Form ST-119.1 Instructions

The instructions for Form ST-119.1 are as follows:

- You are not allowed to use New York State exempt organization exempt purchase certificate unless you have Form ST-119, Exempt Organization Certificate;

- The form cannot be used by the representatives of governmental agencies or diplomatic missions;

- Do not use this form for the tax-free purchase of motor fuel or diesel motor fuel;

- Misuse of the form results in civil or criminal penalties.

The exempt purchase certificate form will be mailed to you with Form ST-119. If you need some extra copies, call the Department of Taxation. Find the detailed instructions attached to the form.

How to Fill Out ST-119.1 Form?

Most fields on the document are self-explanatory. To fill it properly use the following tips:

- Check either Single Purchase Certificate or Blanket Certificate. Check the Blanket Certificate box if you regularly buy similar products or services from the same seller to cover all similar purchases with the same certificate.

- Provide your organization information exactly as it appears on Form ST-119.

- Enter the Exempt Organization Number issued by the NYS Tax Department. You are not allowed to use this form if you do not have one. Note that Exempt Organization Number is not your Federal Employer Organization number.

- Enter the responsible officer information and the completion date.

- Complete all entries for the form to be valid.

New York Tax Exempt Forms

New York Tax-exempt forms include:

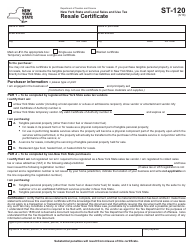

- Form ST-120, Resale Certificate - used for the tax-exempt purchase of property or services for resale;

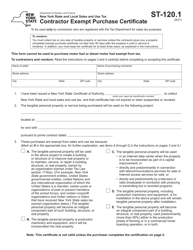

- Form ST-120.1, Contractor Exempt Purchase Certificate - used to claim an exemption from tax on the purchase of personal property that will be integrated into the real property;

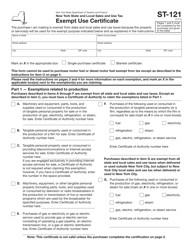

- Form ST-121, Exempt Use Certificate - used to buy property or services that will be applied for exempt purposes;

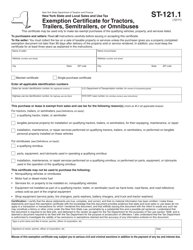

- Form ST-121.1, Exemption Certificate for Tractors, Trailers, Semitrailers, or Omnibuses - used for a tax-free purchase of qualifying vehicles (certain tractors, trailers semitrailers, and omnibuses), their supplies, parts, and services;

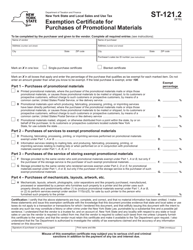

- Form ST-121.2, Exemption Certificate for Purchases of Promotional Materials - used to claim the tax-exempt purchase of promotional materials and coherent services;

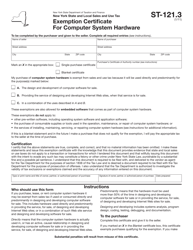

- Form ST-121.3, Exemption Certificate for Computer System Hardware - used for the tax-free purchase of computer hardware used for design and creation of computer software for sale and for embedded software that is a part of the hardware;

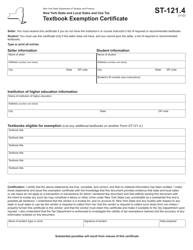

- Form ST-121.4, Textbook Exemption Certificate - used by full-time and part-time students to purchase textbooks required or recommended by their educational institution tax-free;

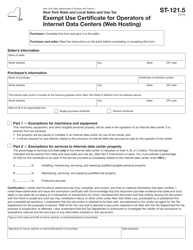

- Form ST-121.5, Exempt Use Certificate for Operators of Internet Data Centers (Web Hosting) - used for the tax-exempt purchase of personal property and services that will be used by an Internet data center located in New York State;

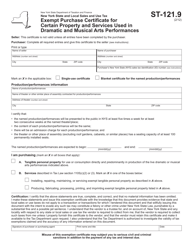

- Form ST-121.9, Exempt Purchase Certificate for Certain Property and Services Used in Dramatic and Musical Arts Performances - used to buy certain property for live dramatic or musical arts performances free of tax;

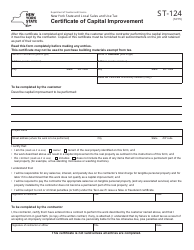

- Form ST-124, Certificate of Capital Improvement - used for tax-exempt real property capital improvement services received from building contractors;

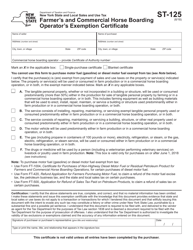

- Form ST-125, Farmer's and Commercial Horse Boarding Operator's Exemption Certificate - used for the purchase of property and services for commercial horse boarding or farm production exempt from payment of sales and use taxes;

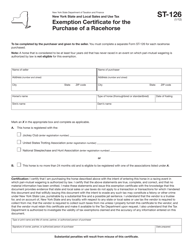

- Form ST-126, Exemption Certificate for the Purchase of a Racehorse - used to make tax-free purchases of certain registered racehorses;

- Form ST-860, Exemption Certificate for Purchases Relating to Guide, Hearing, and Service Dogs - used to make a tax-exempt purchase of a guide, hearing, or service dog for a disabled person, as well as a purchase of products and services required for the care of this dog;

- Form TP-385, Certification of Residential Use of Energy Purchases - used for tax-free purchases of energy sources or premises that include residential and nonresidential space;

- Form AU-297, Direct Payment Permit - used by business in the situation when a business cannot determine how property or services (otherwise taxable) will be used. The form allows the eligible business to pay tax to the Tax Department directly;

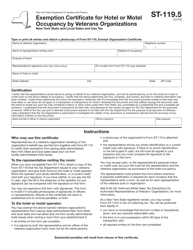

- Form ST-119.5, Exemption Certificate for Hotel or Motel Occupancy by Veterans Organizations - used to certify a veteran organization representative's exemption from New York State and local sales taxes when renting a room during the travel on behalf of the organization;

- Form ST-129, Exemption Certificate - used by New York State or federal government employees to rent hotel or motel room tax-free;

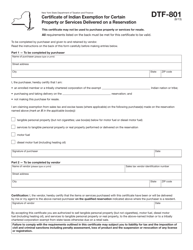

- Form DTF-801, Certificate of Indian Exemption for Certain Property or Services Delivered on a Reservation - used to make tax-exempt purchases by enrolled members of the exempt nations or tribes;

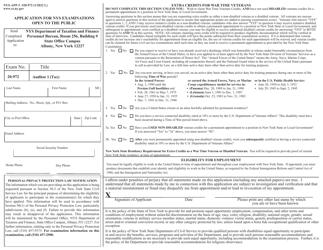

- Form AC946, Tax Exemption Certificate - used by a New York State government employee for the tax-exempt purchase of property or services, which are paid for by New York State;

- New York State Governmental Purchase Order - used by a New York State governmental entity for the tax-free purchase of taxable personal property or service;

- Federal Purchase Order - used by a United States governmental entity for making a tax-exempt purchase of any taxable personal property or service.