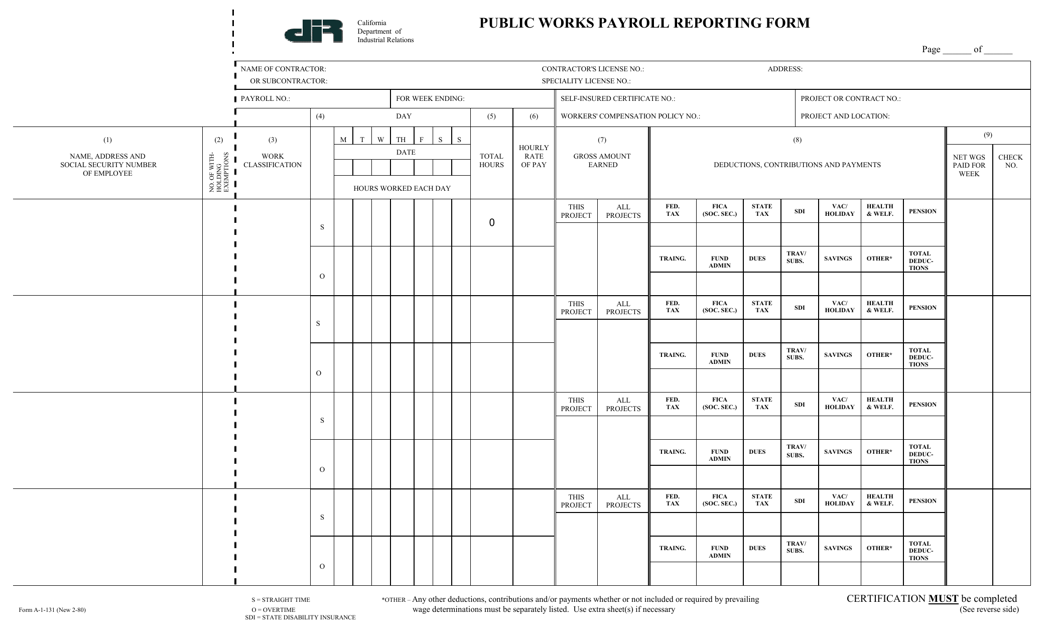

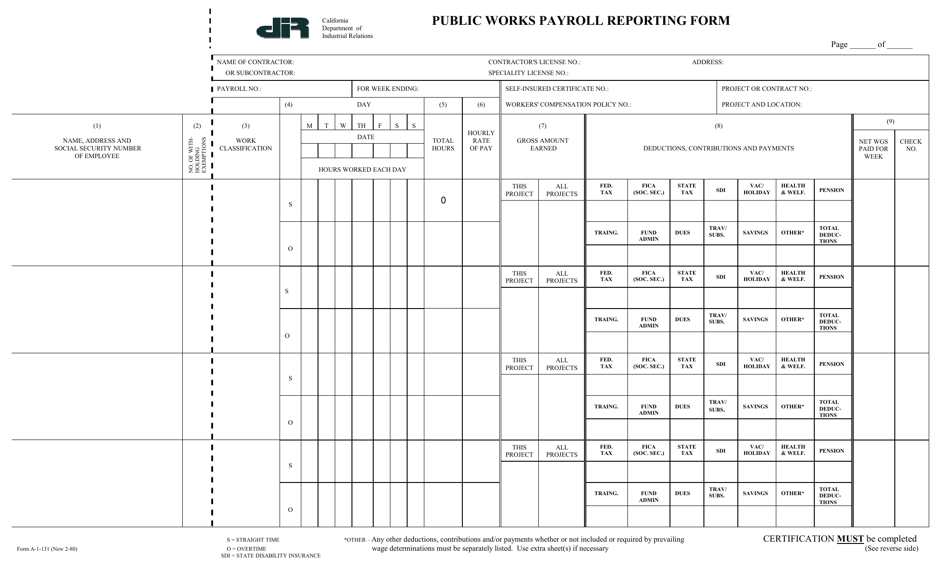

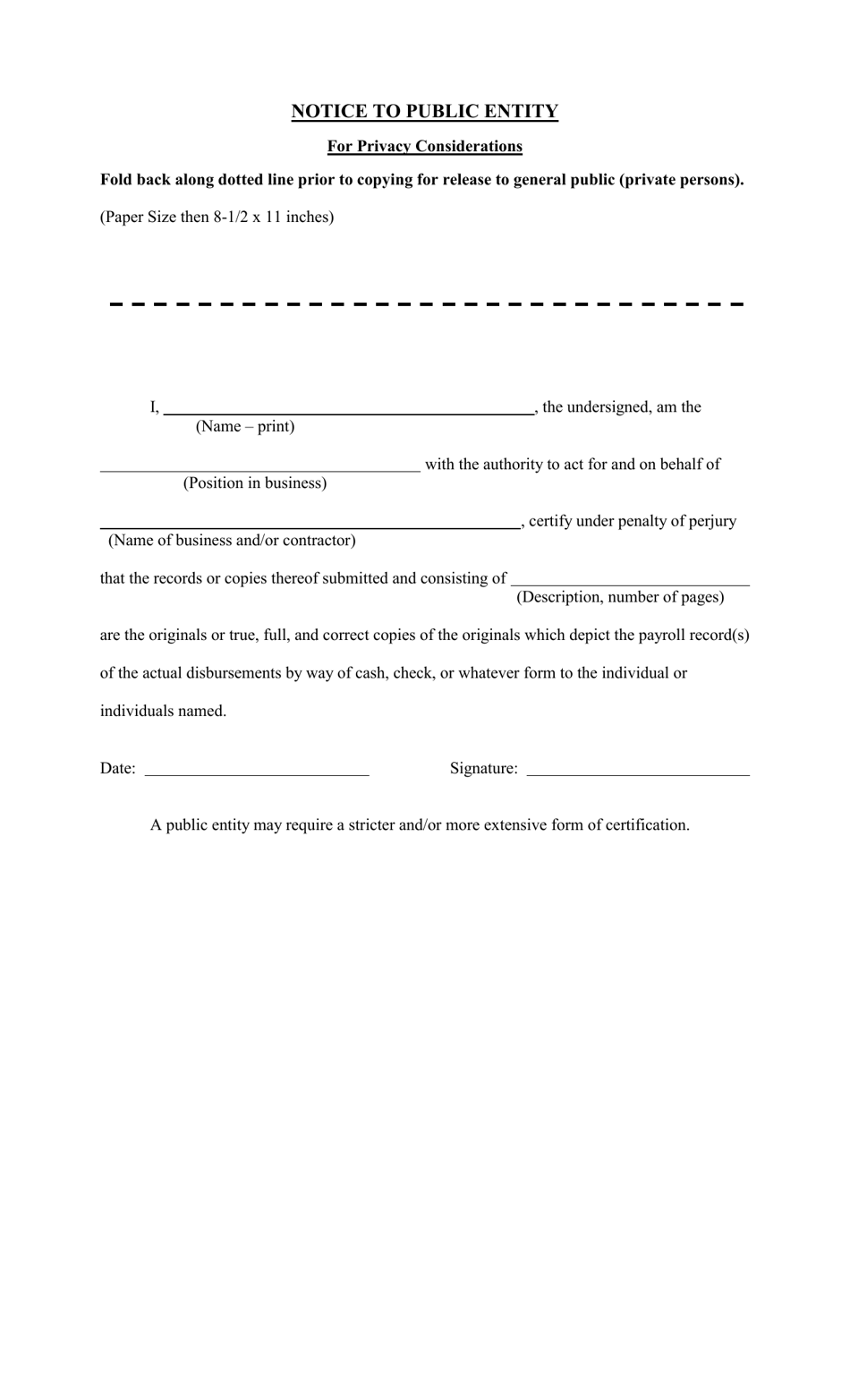

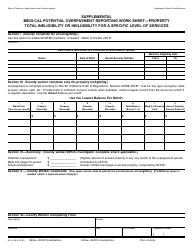

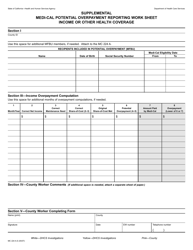

Form A-1-131 Public Works Payroll Reporting Form - California

What Is Form A-1-131?

This is a legal form that was released by the California Department of Industrial Relations - Division of Labor Standards Enforcement - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form A-1-131?

A: The Form A-1-131 is the Public WorksPayroll Reporting Form used in California.

Q: What is the purpose of the Form A-1-131?

A: The Form A-1-131 is used to report payroll information on public works projects in California.

Q: Who is required to submit the Form A-1-131?

A: Contractors and subcontractors working on public works projects in California are required to submit the Form A-1-131.

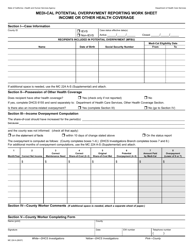

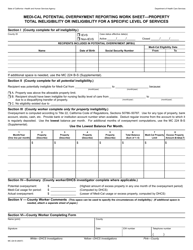

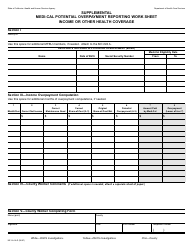

Q: What information is included in the Form A-1-131?

A: The Form A-1-131 includes details on the workers employed, their wages, hours worked, and other relevant payroll information.

Q: When should the Form A-1-131 be submitted?

A: The Form A-1-131 should be submitted monthly, within 10 days after the end of each month.

Q: Is there a penalty for not submitting the Form A-1-131?

A: Yes, there are penalties for not submitting the Form A-1-131, including fines and potential exclusion from future public works projects in California.

Form Details:

- Released on February 1, 1980;

- The latest edition provided by the California Department of Industrial Relations - Division of Labor Standards Enforcement;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-1-131 by clicking the link below or browse more documents and templates provided by the California Department of Industrial Relations - Division of Labor Standards Enforcement.