This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0100

for the current year.

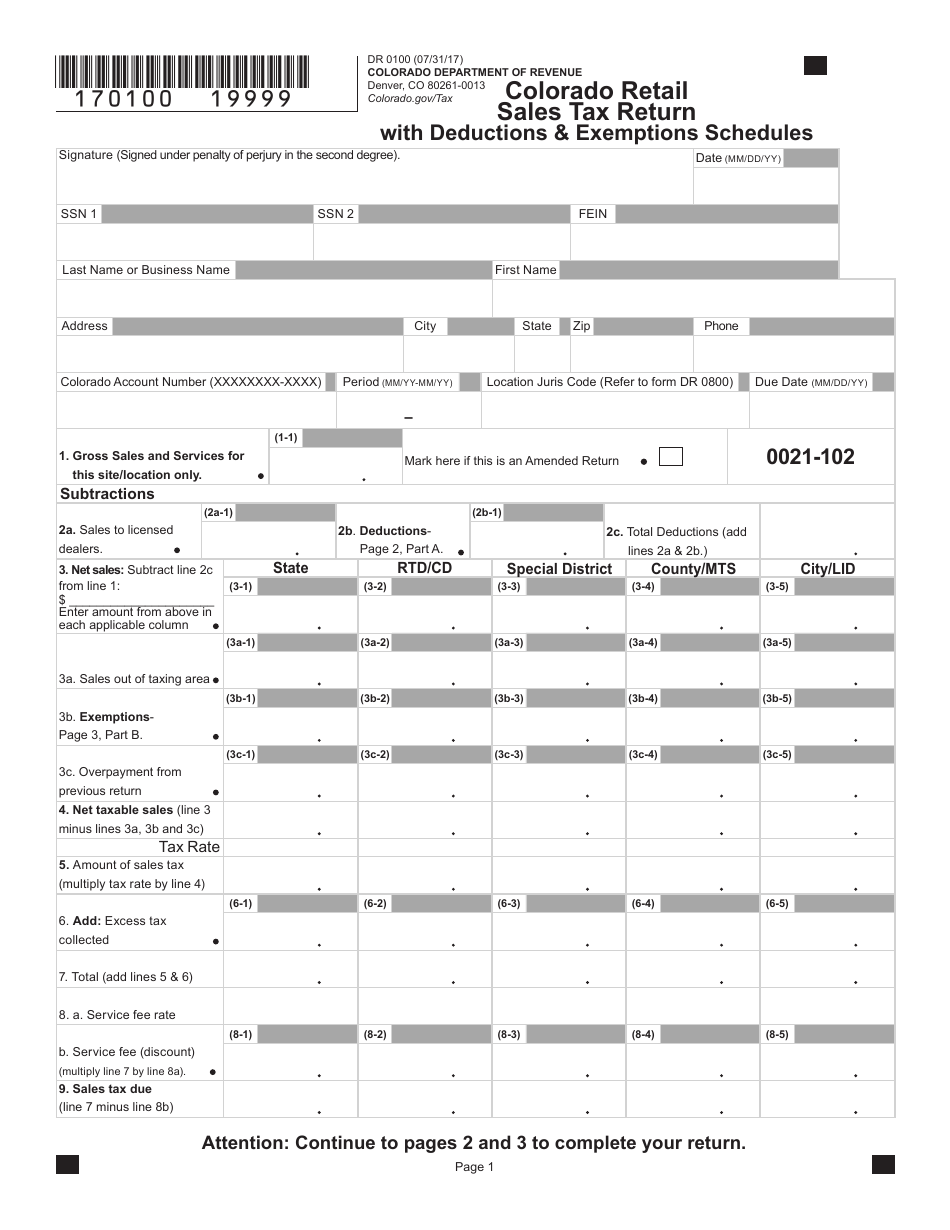

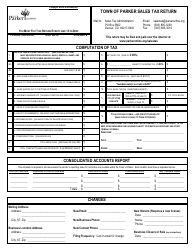

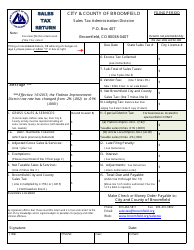

Form DR0100 Colorado Retail Sales Tax Return With Deductions & Exemptions Schedules - Colorado

What Is Form DR 0100 Form?

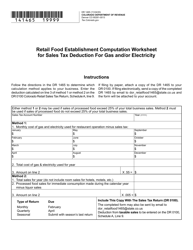

Form DR 0100, Colorado Retail Sales Tax Return With Deductions & Exemptions Schedules , is required for any retail establishment within the state of Colorado and must be filed every quarter, even if no tax has been collected or no tax is due. The purpose of this form is to calculate how much a retail establishment will owe the state of Colorado in Sales Tax, minus deductions and exemptions.

The Colorado DR 0100 Form is issued by the Colorado Department of Revenue (CDOR) on July 31, 2017 , and is available for download here. Starting on January 1, 2018 , the CDOR will require that ALL Colorado sales tax licensees report and pay sales tax, regardless of the filing format.

How to Fill Out Form DR 0100?

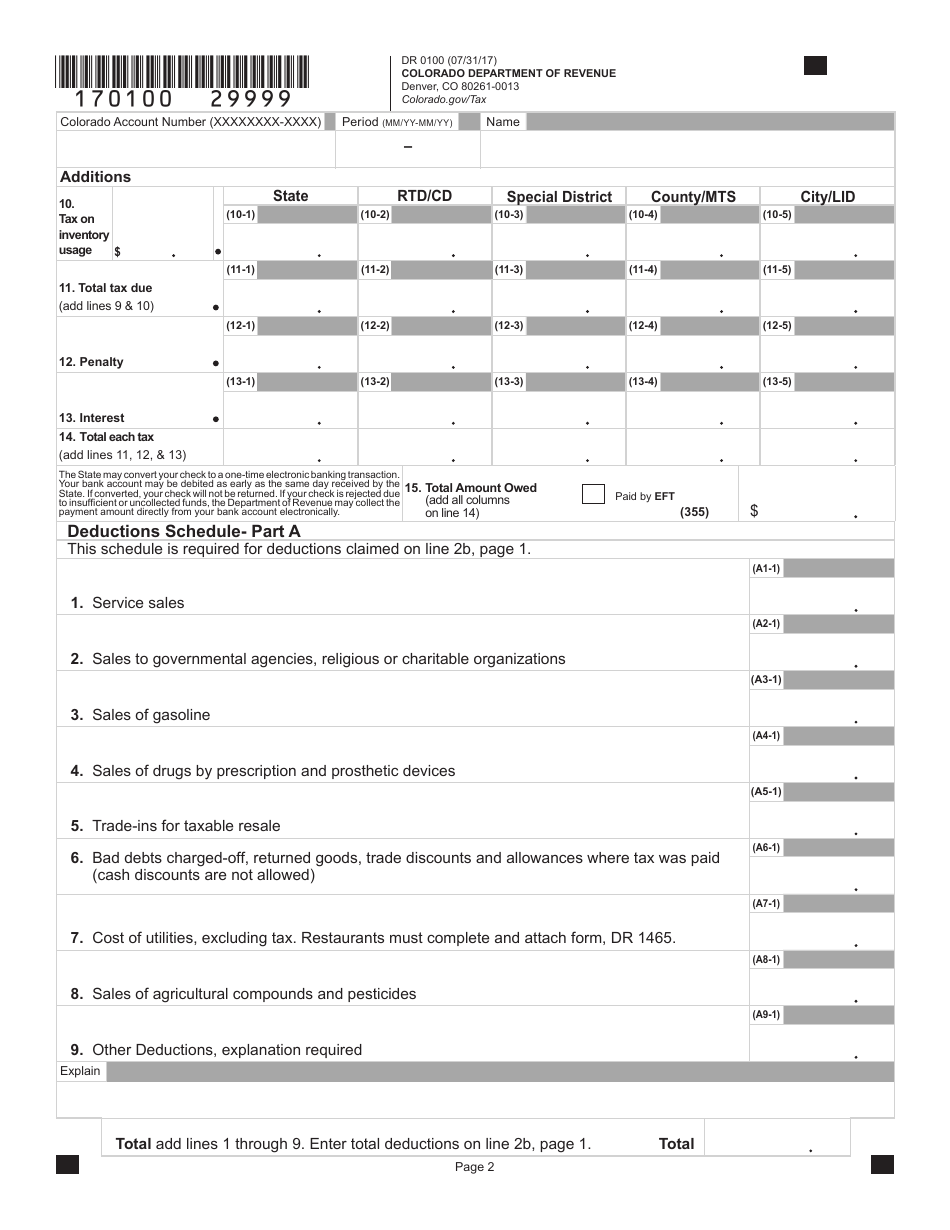

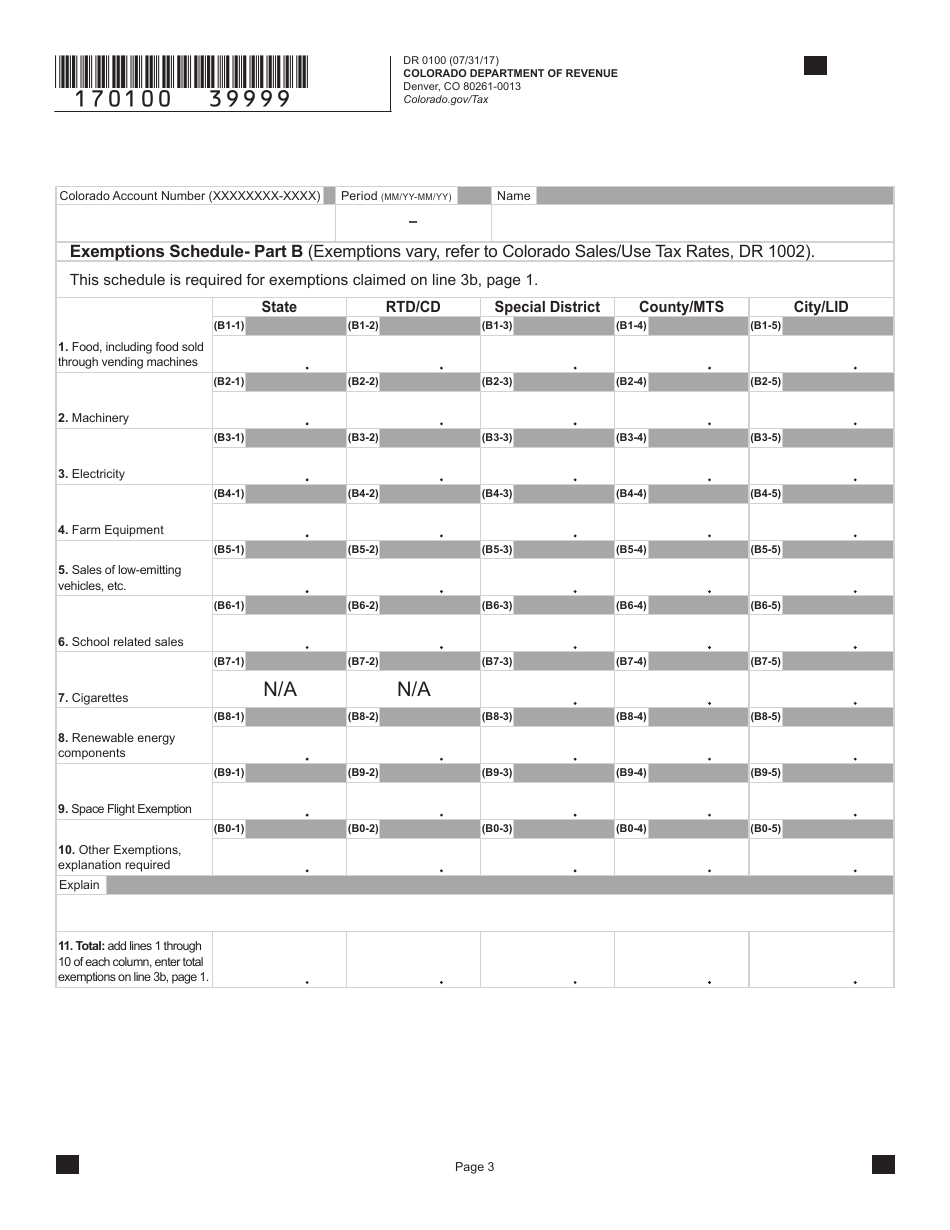

The CO DR 0100 Form can be filled out either online or in print. CO DR 0100 Instructions will ask for the following information to be completed:

- General information about the company's information and owner, including social security numbers, location;

- Gross sales of goods and services for this site/location only;

- Any Penalties or Interest due;

- Wholesale sales, including wholesale sales of ingredients and component parts ;

- Sales made to nonresidents or sourced to locations outside of Colorado;

- Sales of nontaxable services;

- Sales to exempt entities and organizations;

- Sales of gasoline, dyed diesel, and other exempt fuels;

- Sales of exempt drugs and medical devices;

- Fair market value of property received in exchange and held for resale;

- Goods that have been returned, bad debts listed as charged-off, discounts for trade and allowances when tax was charged;

- Cost of exempt utilities upon which tax was previously paid;

- Exempt agricultural sales, not including farm and dairy equipment;

- Sales of computer software that is not taxable;

- Other exempt sales.

The easiest way to complete Colorado Form DR 100 is to create a profile on CDOR's Revenue Online service following these steps:

- Go to the state of Colorado's government website to create your login ID through the Revenue Online page and click "Create a Login ID" to start.

- Select the entity type, follow the instructions and click "Next" to move to the next step.

- Fill in all requested fields.

- Fill in the Login/Password for your account.

- Complete the Account Information.

- Once you have entered this information you will see a confirmation page.

- An Authorization Code will at this point be sent to the email listed. Make a note of this code, return to Revenue Online, and enter the code given.

Retailers can remit payment electronically through either Electronic Funds Transfer (EFT) or by credit card or e-check. They can also remit payment by credit card or electronic check, but a processing fee is charged for any payments remitted by credit card or electronic check. Additionally, there is the option to remit payment with a paper check and this is possible whether they file electronically or with a paper return. Depending on the type of business, filings may be due monthly, quarterly, or annually.

Where to Mail Form DR 0100?

Retailers electing to file electronically can complete the form through CDOR's Revenue Online system.

Retailers electing to file a paper return must sign, date, and mail the return, along with their payment, if applicable, to the Colorado Department of Revenue in Denver, CO (80261-0013).