Allowable Amount Templates

The Allowable Amount document group provides important information regarding the maximum amount of non-refundable tax credits that can be claimed by individuals. These documents outline the specific allowable amounts for various categories of non-refundable tax credits, ensuring compliance with tax regulations.

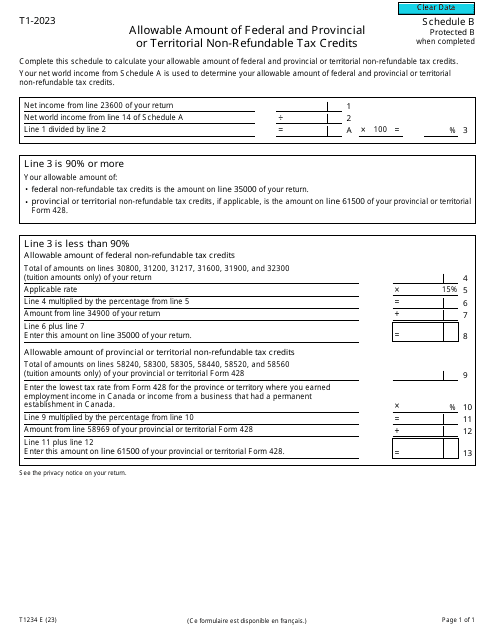

Whether you are a non-resident of Canada or a Canadian taxpayer, the Allowable Amount documents provide clear guidelines on how to calculate and claim non-refundable tax credits. With variations such as the Form 5013-SB Schedule B and Form T1234 Schedule B, these documents cater to different taxpayer scenarios, making it easy to determine the maximum tax credits available.

Understanding the allowable amount of federal and provincial or territorial non-refundable tax credits is crucial for maximizing your tax savings. By referring to the Allowable Amount documents, you will have the necessary information to accurately determine the eligible tax credits you can claim, potentially reducing your tax liability.

Stay informed and informed with the Allowable Amount documents, aka the definitive guide to non-refundable tax credits. By reviewing these documents, you can confidently navigate the tax system and ensure that you are claiming the allowable amounts you are entitled to. Start optimizing your tax savings today by utilizing the insights provided in the Allowable Amount document group.

Documents:

7

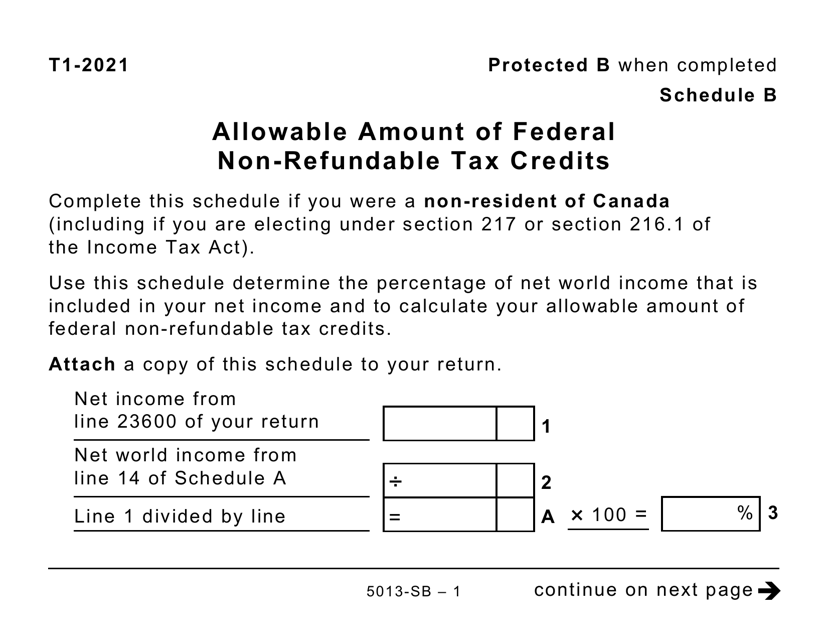

This document for reporting the allowable amount of federal non-refundable tax credits in Canada, in large print format.

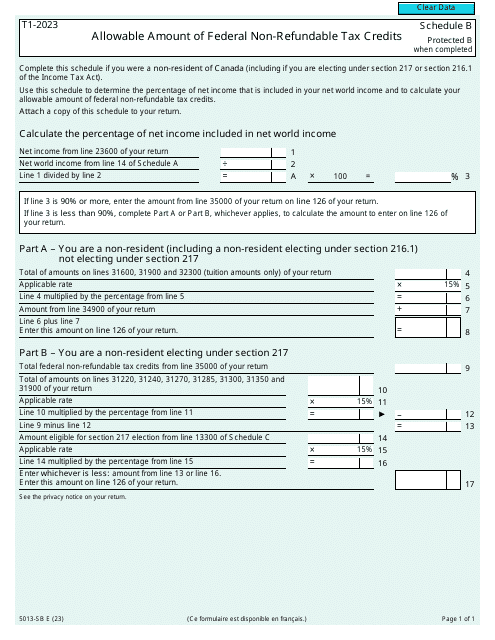

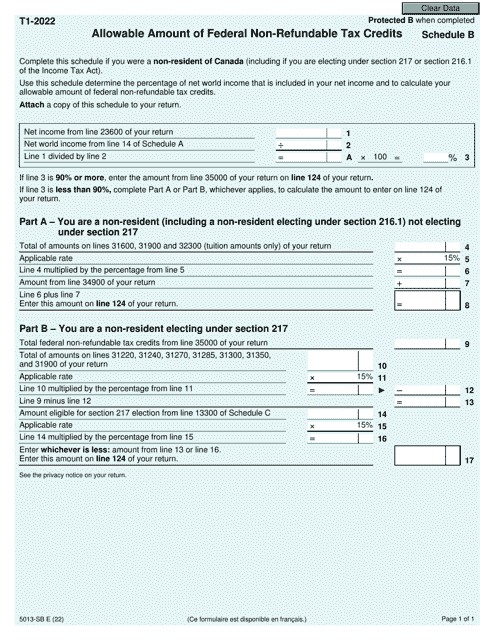

This form is used for calculating the allowable amount of federal non-refundable tax credits in Canada.

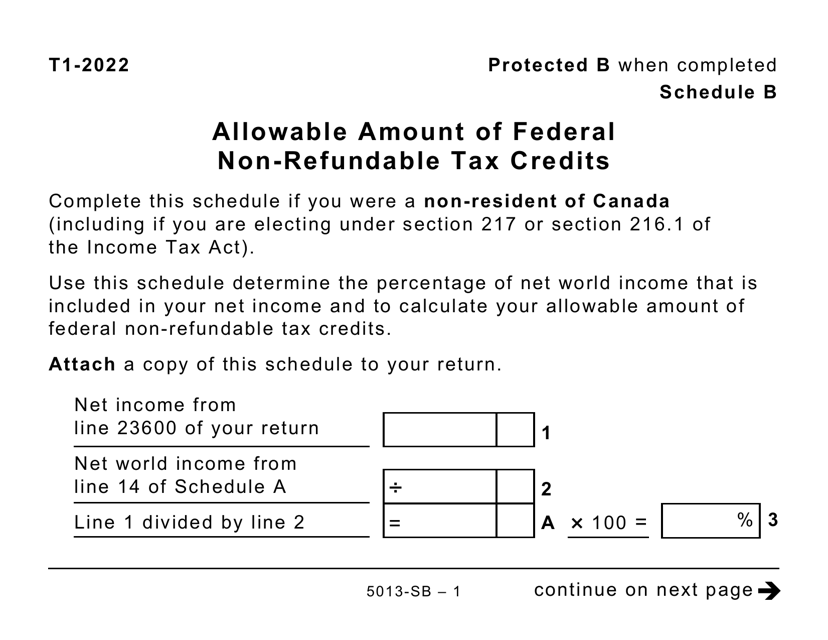

This document is for reporting the allowable amount of federal non-refundable tax credits in Canada.