Group Insurance Templates

Group insurance, also known as employee benefits or workplace insurance, is a type of insurance coverage that provides protection and benefits to a group of people who are connected through employment, membership, or some other organized relationship. This type of insurance offers various policies and plans that cater to the needs and requirements of a particular group, such as employees of a company or members of an organization.

Group insurance is designed to provide coverage for a wide range of needs, including but not limited to health insurance, life insurance, disability insurance, and dental insurance. It offers several advantages compared to individual insurance, including cost savings, simplified administration, and ease of enrollment.

Employers often offer group insurance as part of their employee benefits package to attract and retain talented employees. By providing access to comprehensive and affordable insurance plans, employers can enhance the overall well-being and job satisfaction of their workforce.

Group insurance plans typically come with a variety of options and features to suit the unique needs of a specific group. This can include coverage for pre-existing conditions, flexible deductibles and copayments, and the ability to customize the plan to include additional benefits beyond the basic coverage.

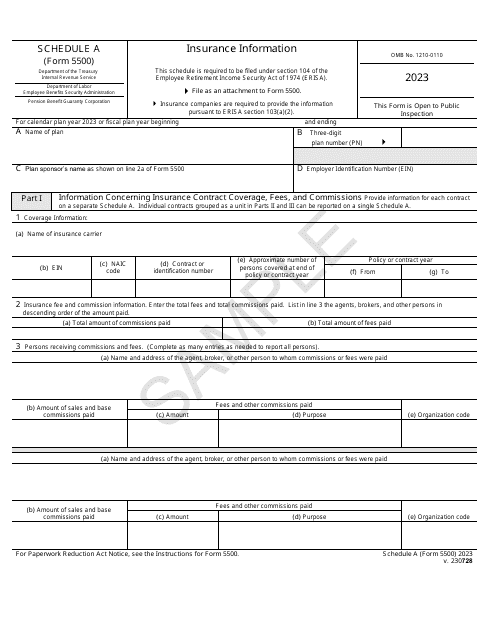

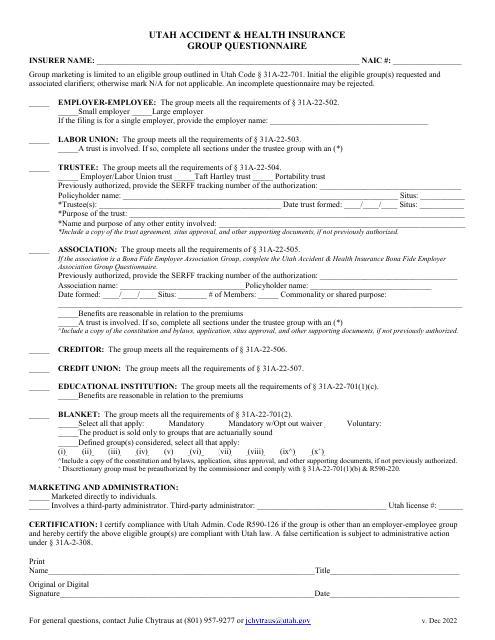

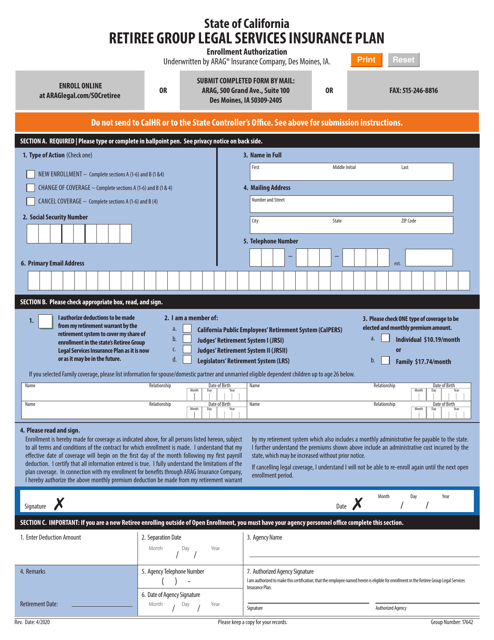

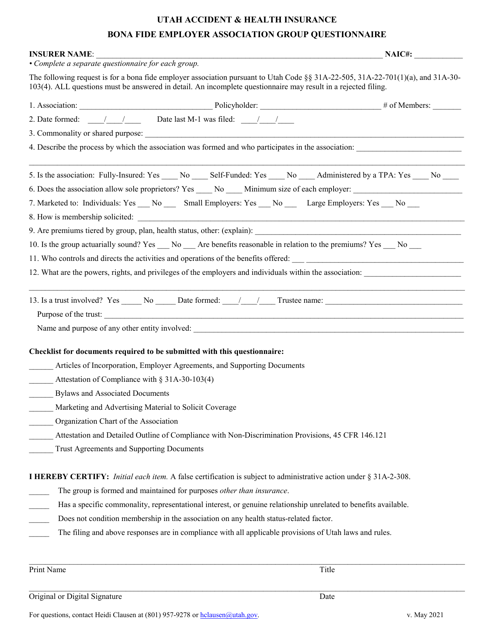

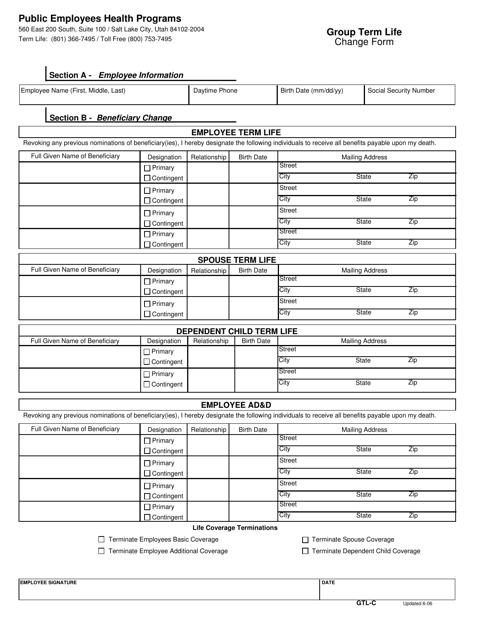

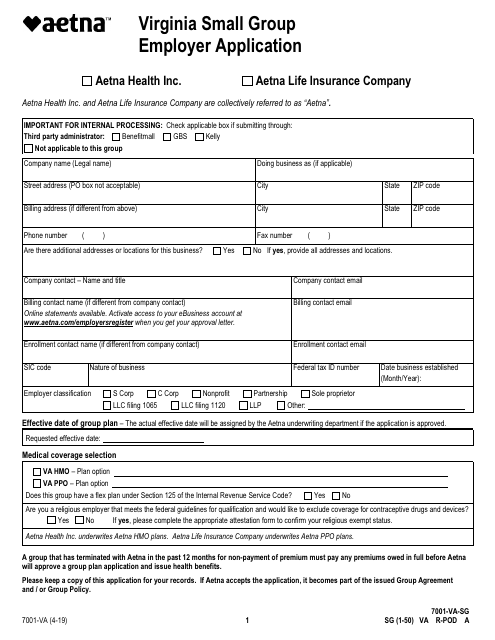

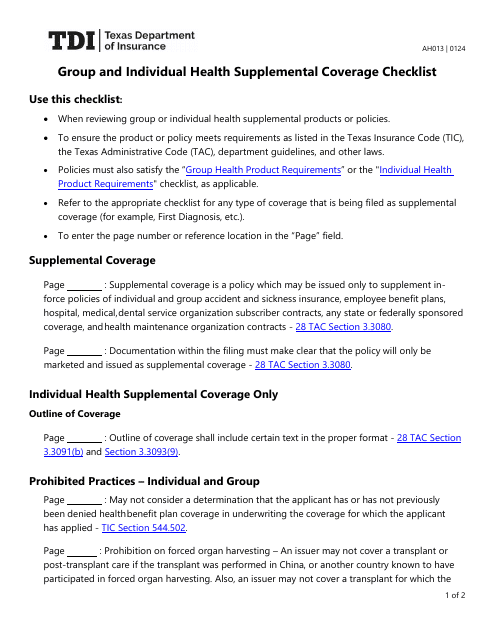

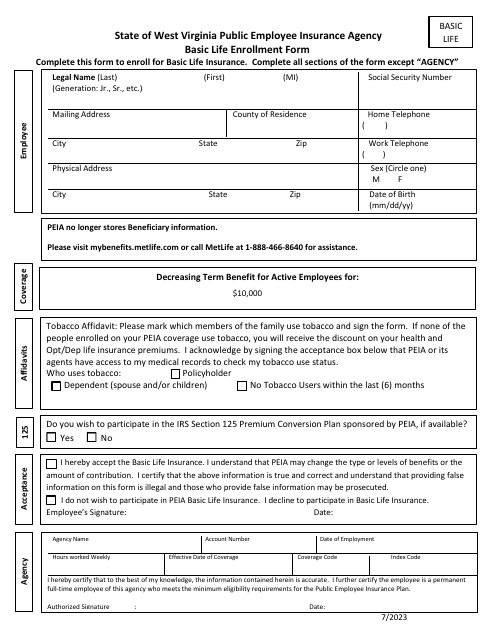

In order to manage and administer group insurance plans effectively, employers or plan administrators are required to complete certain documents and forms. These documents ensure that the insurance coverage is properly maintained, benefits are distributed correctly, and any changes or updates to the plan are documented.

Some common documents associated with group insurance include the Wrap Plan - Oklahoma, IRS Form 5500 Schedule A Insurance Information, Form GTL-C Group Term Life Change Form - Utah, Form AH013 Group and Individual Health Supplemental Coverage Checklist - Texas, and Basic Life Enrollment Form - West Virginia. These documents help streamline the process of managing and maintaining group insurance plans, ensuring compliance with relevant laws and regulations.

If you are an employer or plan administrator seeking to provide comprehensive insurance coverage to your employees or members, group insurance offers a convenient and cost-effective solution. By pooling the risk and resources of a group, you can provide access to quality insurance coverage that meets the diverse needs of your workforce or organization. With the proper documentation and administration, group insurance can be a valuable asset in attracting and retaining top talent, while safeguarding the financial well-being and security of your group members.

Documents:

13

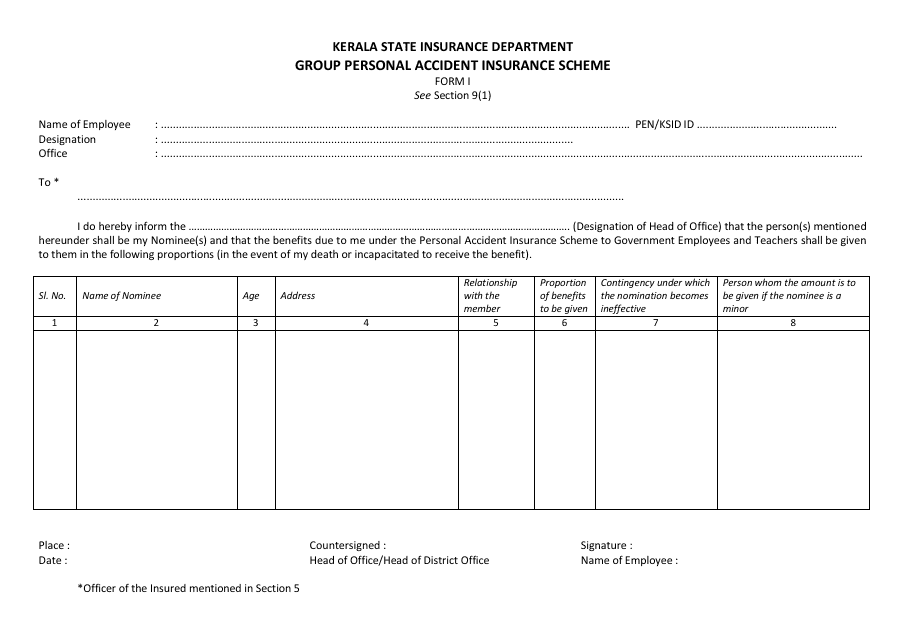

This Form is used for applying for the Group Personal Accident Insurance Scheme in Kerala, India.

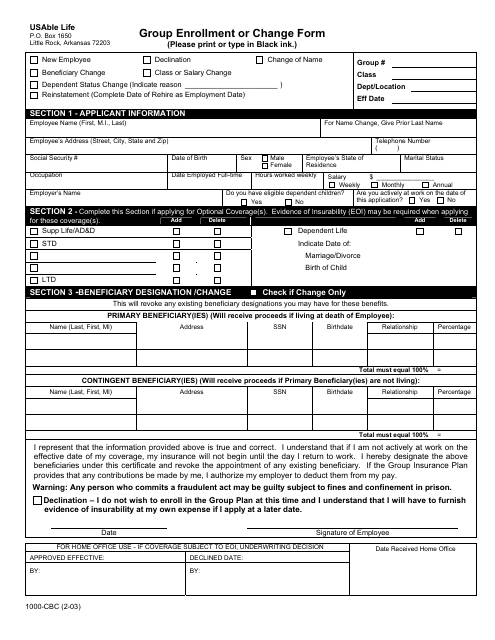

This form is used for enrolling or making changes to group life insurance coverage offered by Usable Life.

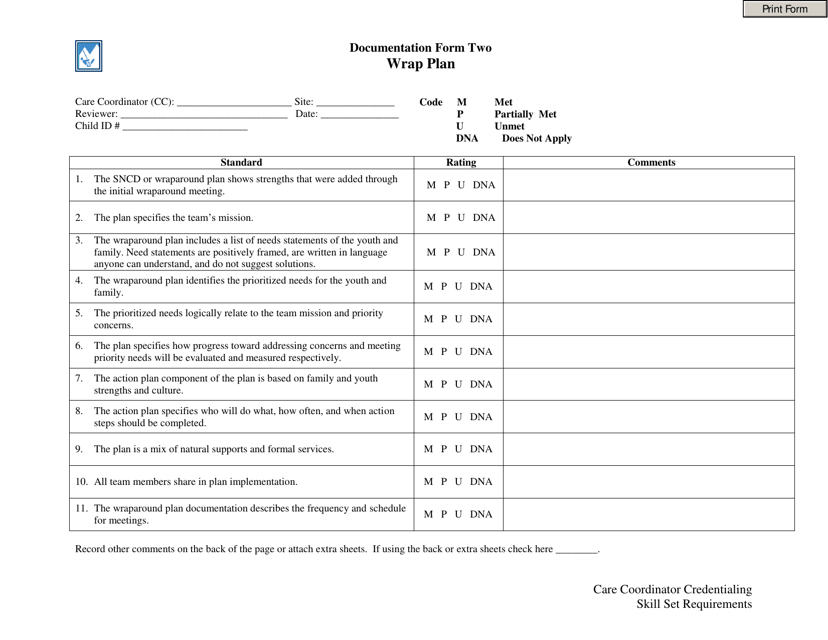

This document is a Wrap Plan for businesses in Oklahoma. It outlines the terms and provisions of an insurance policy that combines multiple insurance coverages into one policy. Businesses can use this document to ensure they have adequate coverage for their specific needs.

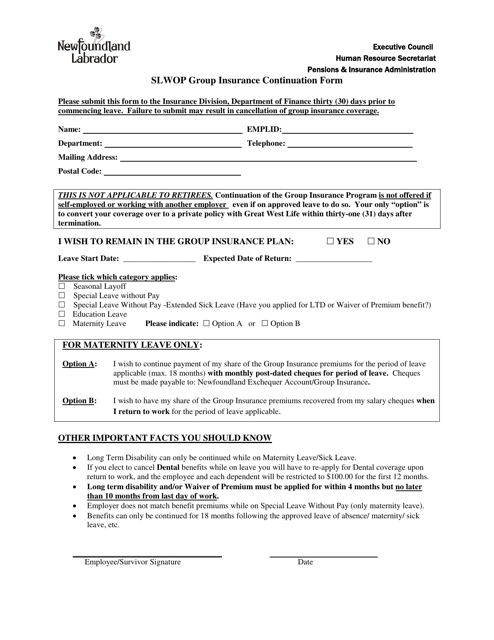

This Form is used for continuing group insurance coverage in Newfoundland and Labrador, Canada. It allows individuals to maintain their insurance benefits after leaving a group plan.

This document is used for enrolling in the Retiree Group Legal Services Insurance Plan in California.

This Form is used for making changes to a Group Term Life insurance policy in the state of Utah.

This Form is used for Virginia small group employers to apply for coverage for their employees.