Capital Improvement Templates

Are you looking to make capital improvements to your property or facility? Look no further than our comprehensive collection of documents related to capital improvement projects. Our capital improvement documents provide all the necessary paperwork and forms needed to streamline the process and ensure that your project is completed efficiently and in compliance with regulations.

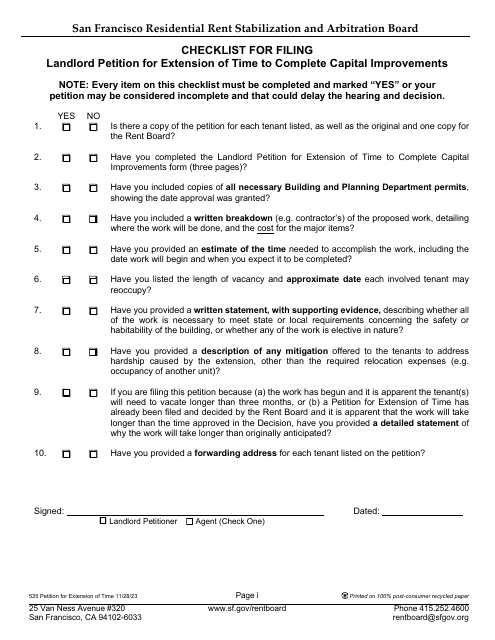

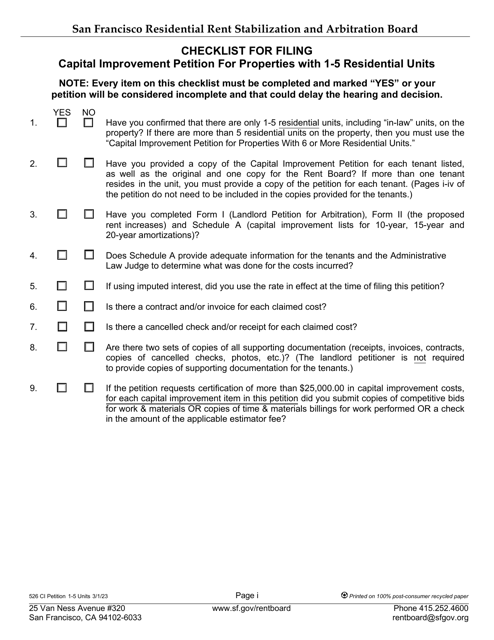

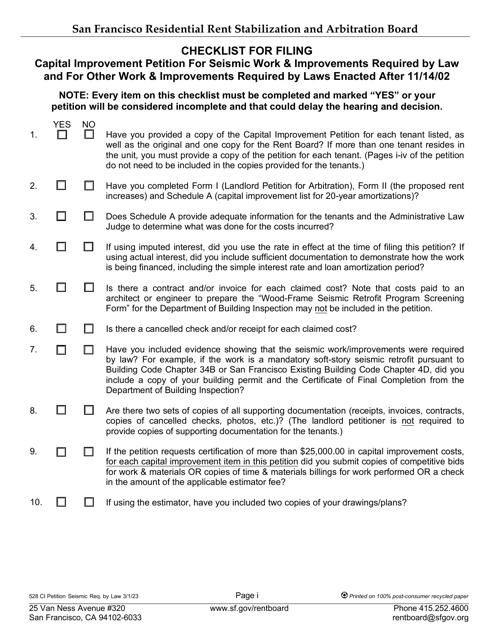

Whether you are a homeowner in Buffalo, New York, seeking a real property tax exemption for capital improvements to your multiple dwelling building or a landlord in San Francisco, California, petitioning for seismic and other work required by law, our collection of capital improvement documents has you covered. With forms like the Application for Real Property Tax Exemption, Capital Improvement/Facilities/Maintenance Project Request Form, and Landlord Capital Improvement Petition, you'll find everything you need to get started on your project.

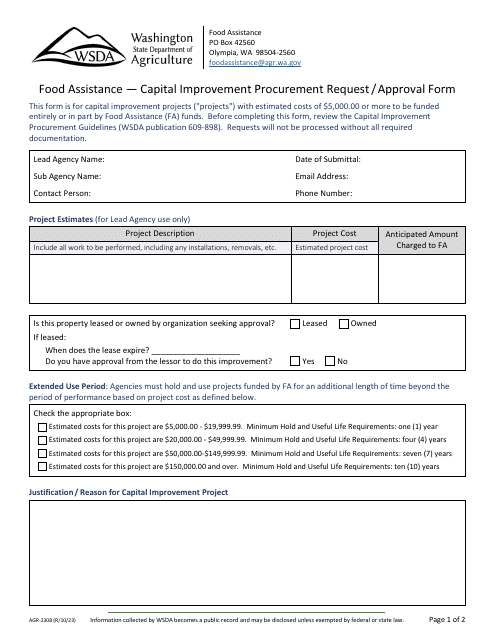

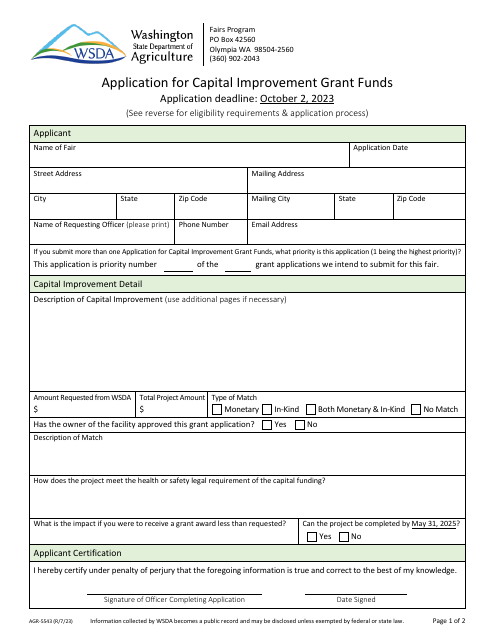

We also offer capital improvement grant application forms for those in Washington looking to secure funding for their projects. Our Application for Capital Improvement Grant Funds form will help you navigate the application process and increase your chances of receiving financial assistance.

No matter where you are located or the type of capital improvement project you are undertaking, our documents collection has the resources you need to successfully complete your project. Don't let the paperwork and administrative tasks overwhelm you - let our capital improvement documents simplify the process and save you time and effort.

Alternate names: capital improvement forms, capital improvements paperwork, documents for capital improvement projects

Documents:

35

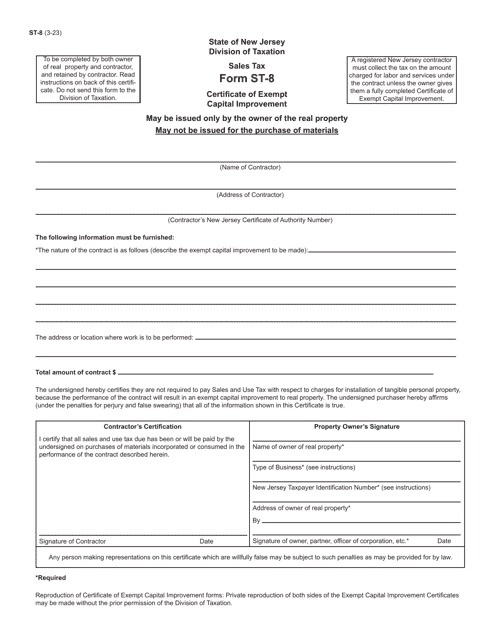

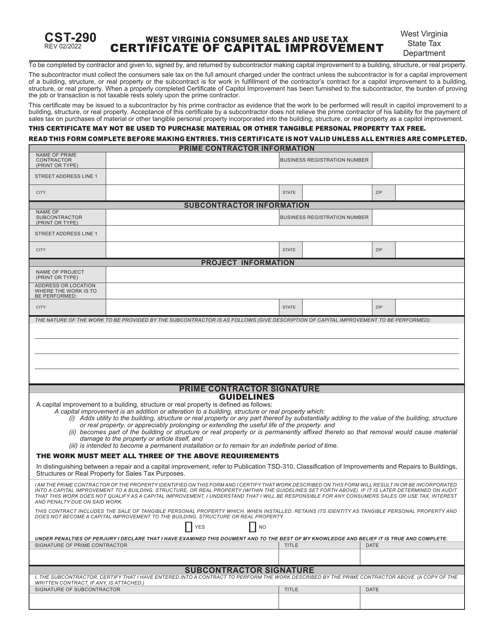

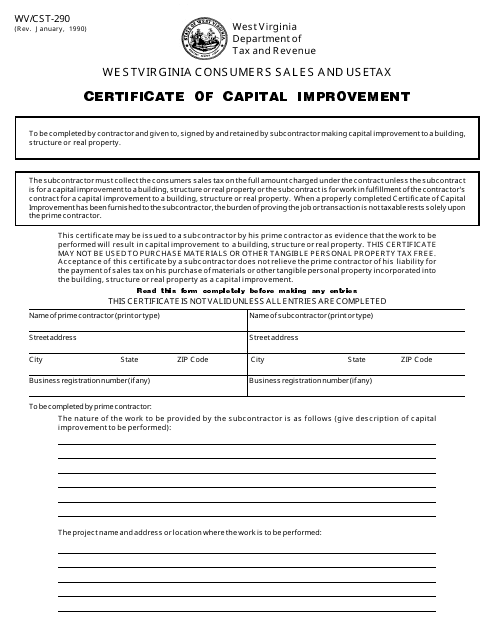

This Form is used for obtaining a certificate of capital improvement in West Virginia. It is used to document and report any capital improvements made to a property.

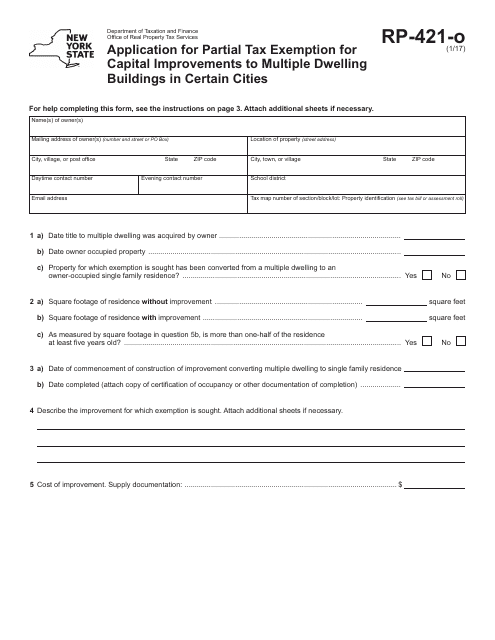

This form is used for applying for a tax exemption for capital improvements made to multiple dwelling buildings in certain cities in New York. It allows property owners to save on their taxes when making qualifying improvements to their buildings.

This Form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings within the City of Oneonta, New York. The form provides instructions on how to complete the application process.

This Form is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings within the City of Oneonta, New York.

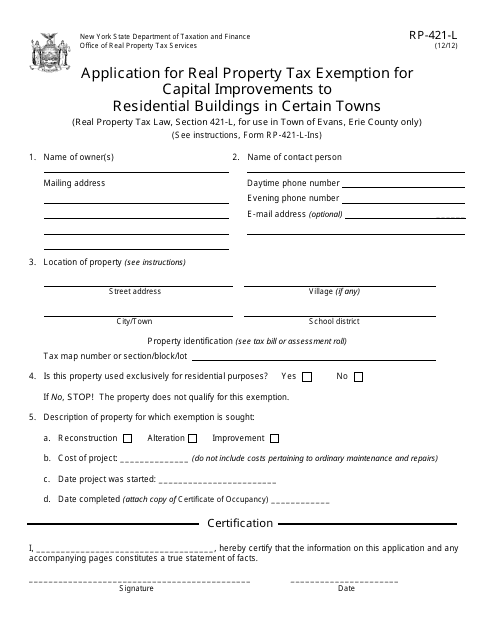

This form is used for applying for a real property tax exemption for capital improvements made to residential buildings in certain towns, specifically the Town of Evans, New York.

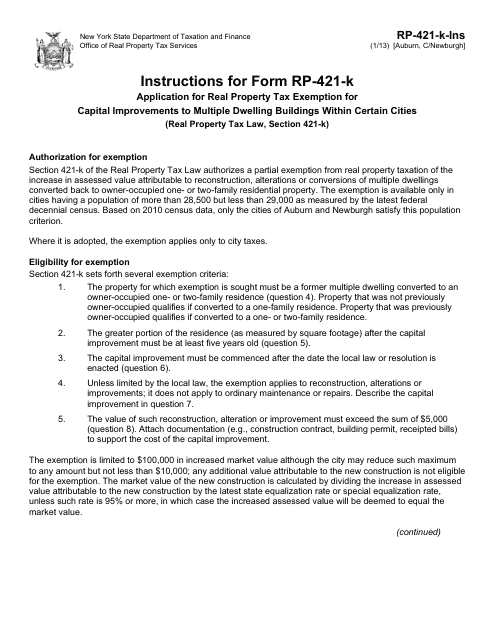

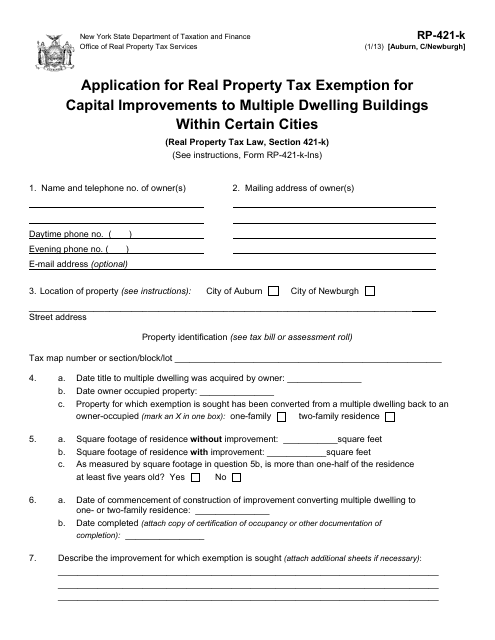

This document is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings in certain cities in New York, including Auburn and Newburgh. It provides instructions on how to fill out Form RP-421-K.

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings in certain cities in New York, specifically Auburn and Newburgh.

This Form is used for applying for a real property tax exemption in the City of Cohoes, New York, for capital improvements made to multiple dwelling buildings in certain cities.

This form is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings in the City of Cohoes, New York.

This Form is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings within certain cities, specifically the City of Buffalo, New York. It provides instructions on how to fill out the application and includes important information regarding eligibility requirements and documentation needed.

This form is used to apply for a real property tax exemption for capital improvements made to multiple dwelling buildings within certain cities, specifically the City of Buffalo, located in New York.

This document provides instructions for completing Form RP-421-I, which is used to apply for a real property tax exemption for capital improvements made to multiple dwelling buildings within certain cities, specifically the City of Albany, New York.

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings in certain cities, specifically Albany, New York.

This Form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings in specific cities in New York.

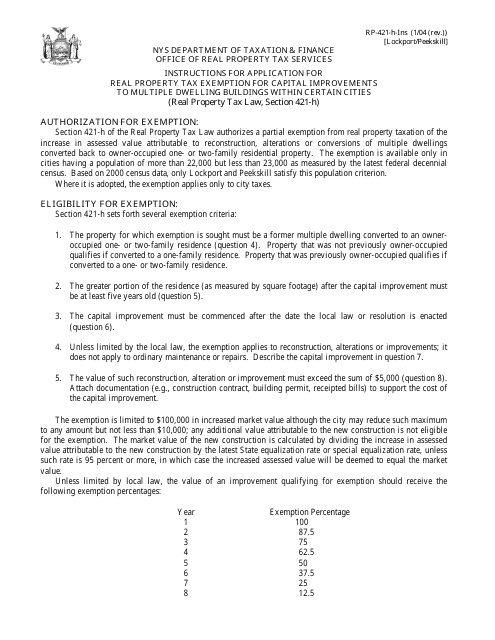

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings within the cities of Lockport and Peekskill in New York.

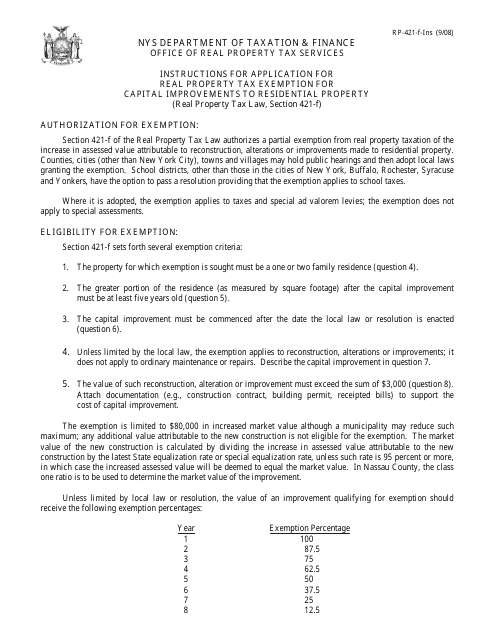

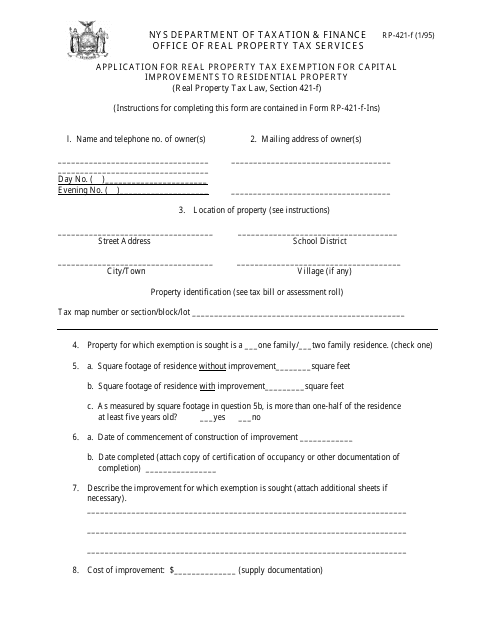

This Form is used for applying for a real property tax exemption for capital improvements made to residential property in New York. It provides instructions on how to complete the application and what documents are required.

This Form is used for applying for a real property tax exemption in New York for capital improvements made to residential property.

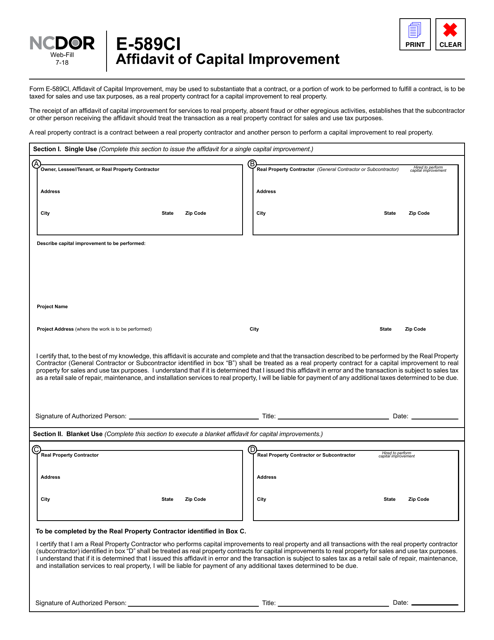

This form is used for filing an Affidavit of Capital Improvement in North Carolina. It is used to certify that certain construction or improvements have been made to a property in order to claim an exclusion or deferment from property taxes.

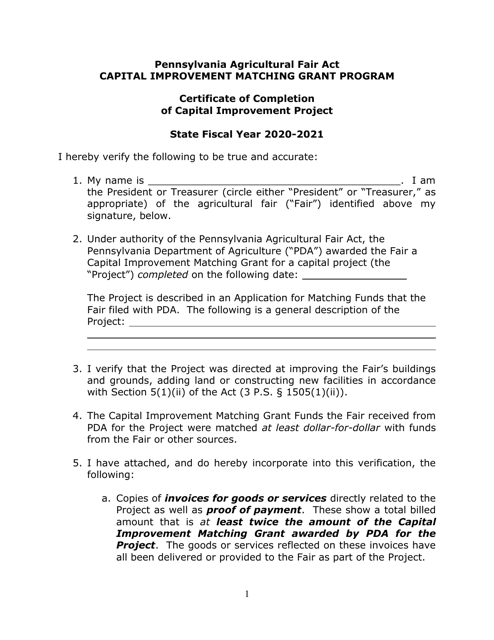

This document certifies the completion of a capital improvement project in the state of Pennsylvania. It is given to acknowledge the successful completion of the project.

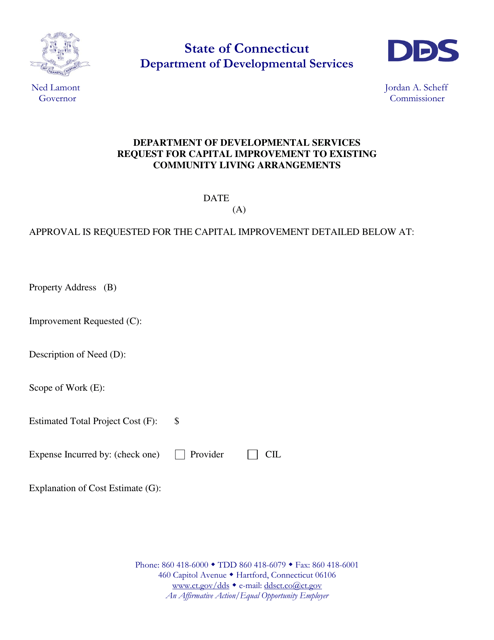

This document is used for requesting capital improvement to existing community living arrangements in Connecticut. It is a formal request to make improvements or renovations to a community living facility in the state.

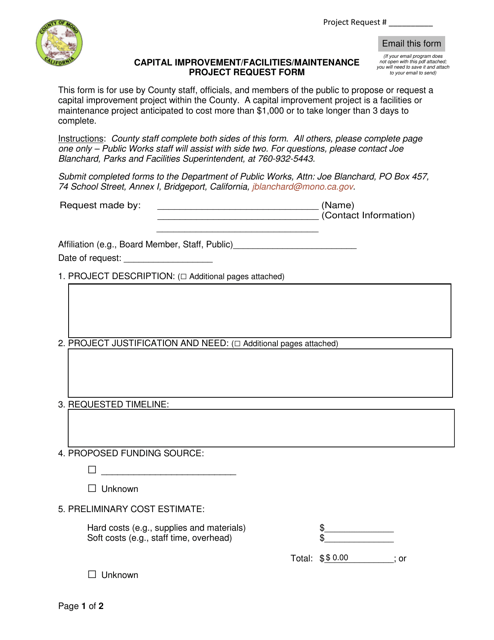

This Form is used for submitting project requests related to capital improvement, facilities, and maintenance in Mono County, California.

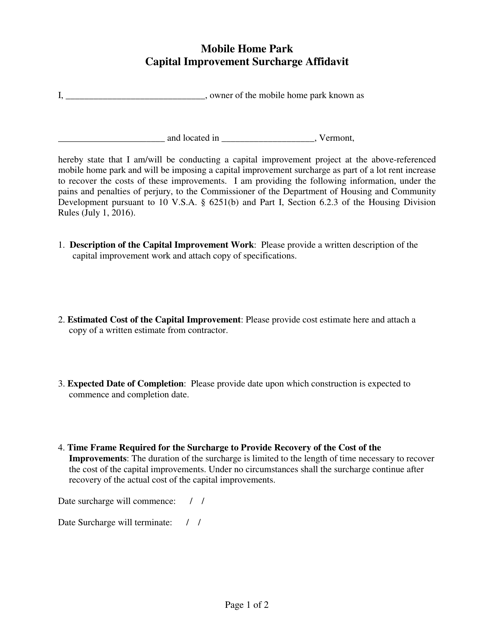

This document is for residents of mobile home parks in Vermont to file a capital improvement surcharge affidavit. It is used to report any capital improvements made to the park and to calculate the surcharge amount.

This form is used for obtaining a Consumer Sales and Use Tax Certificate of Capital Improvement in West Virginia. The certificate is required for businesses engaged in capital improvement projects to exempt certain purchases from sales and use tax.

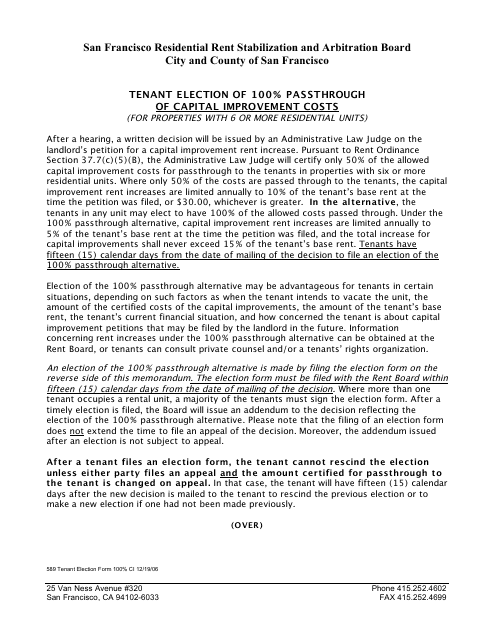

This Form is used for tenants to participate in the election process for 100% capital improvement passthrough alternative in San Francisco, California.

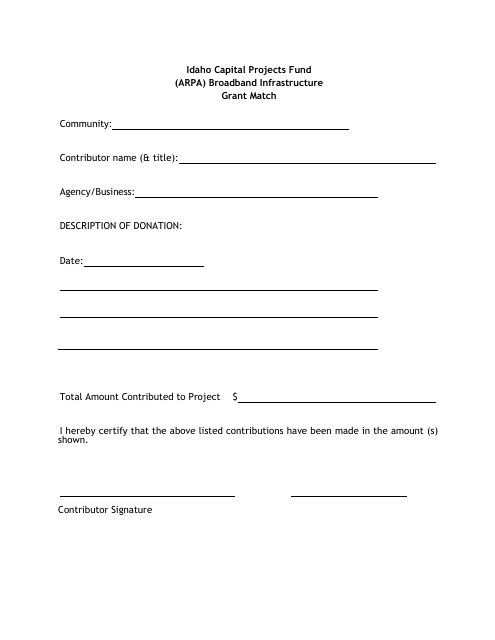

This document is a template for a Capital Projects Fund Match Letter in Idaho. It is used for requesting funds to match a capital project in the state.

![Instructions for Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349853/instruction-for-form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york_big.png)

![Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york_big.png)

![Instructions for Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349862/instruction-for-form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york_big.png)

![Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york_big.png)

![Instructions for Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349864/instruction-for-form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york_big.png)

![Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york_big.png)

![Instructions for Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349866/instructions-for-form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-albany-new-york_big.png)

![Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york_big.png)

![Form RP-421-H [LOCKPORT/PEEKSKILL] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Cities of Lockport/Peekskiill, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349869/form-rp-421-h-lockport-peekskill-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-cities-of-lockport-peekskiill-new-york_big.png)