Documento Fiscal Templates

Are you looking for information on fiscal documents or documentos fiscales? Welcome to our webpage dedicated to providing comprehensive information on various fiscal documents and their instructions.

Fiscal documents play a vital role in maintaining accurate financial records and fulfilling various legal obligations. Whether you are an individual taxpayer or a business entity, understanding the different types of fiscal documents and their requirements is crucial.

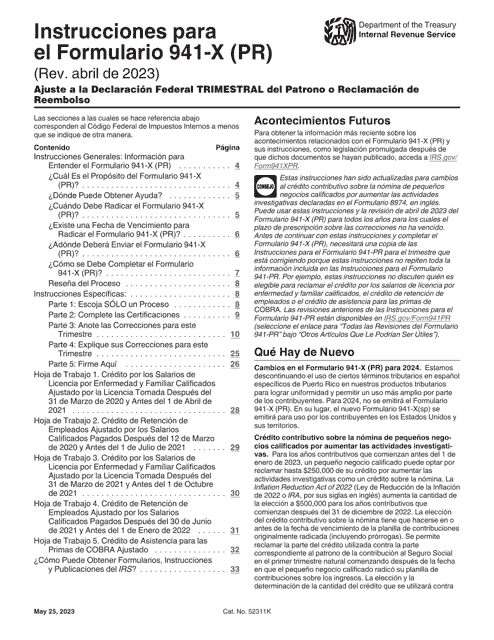

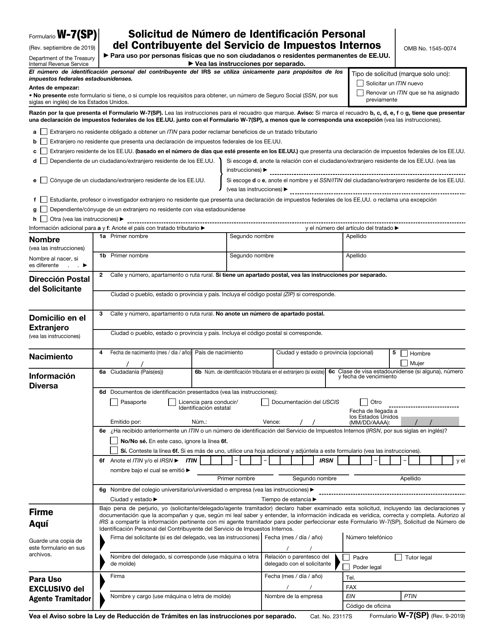

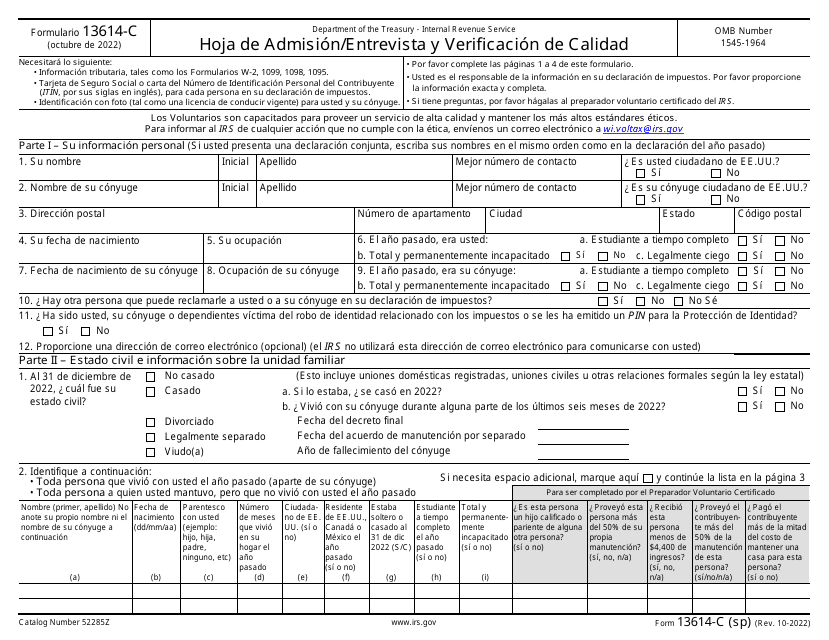

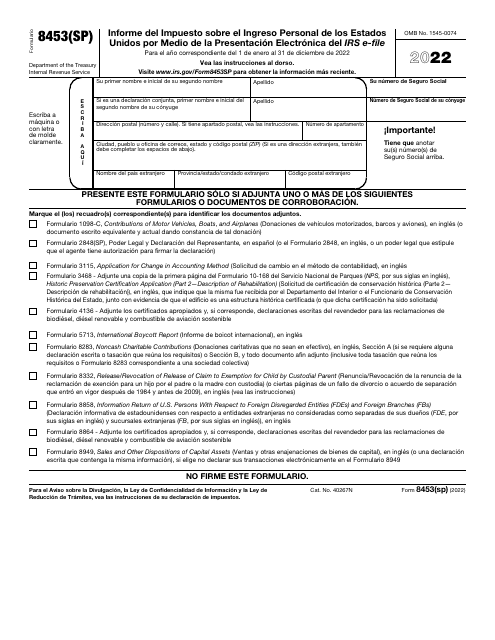

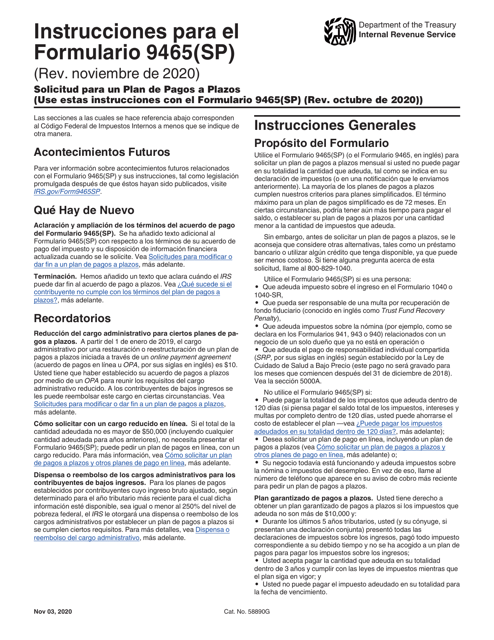

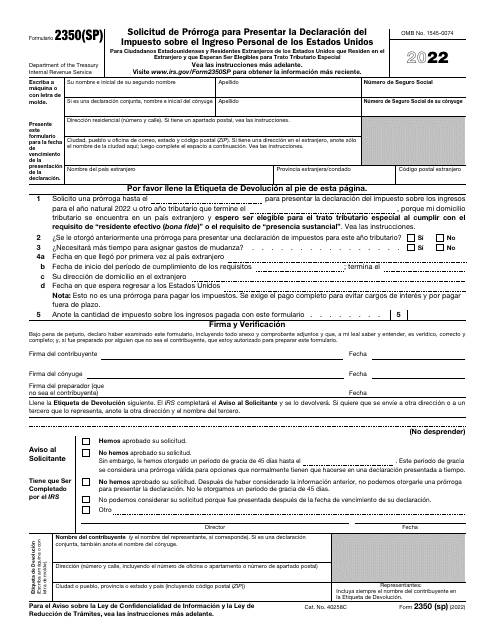

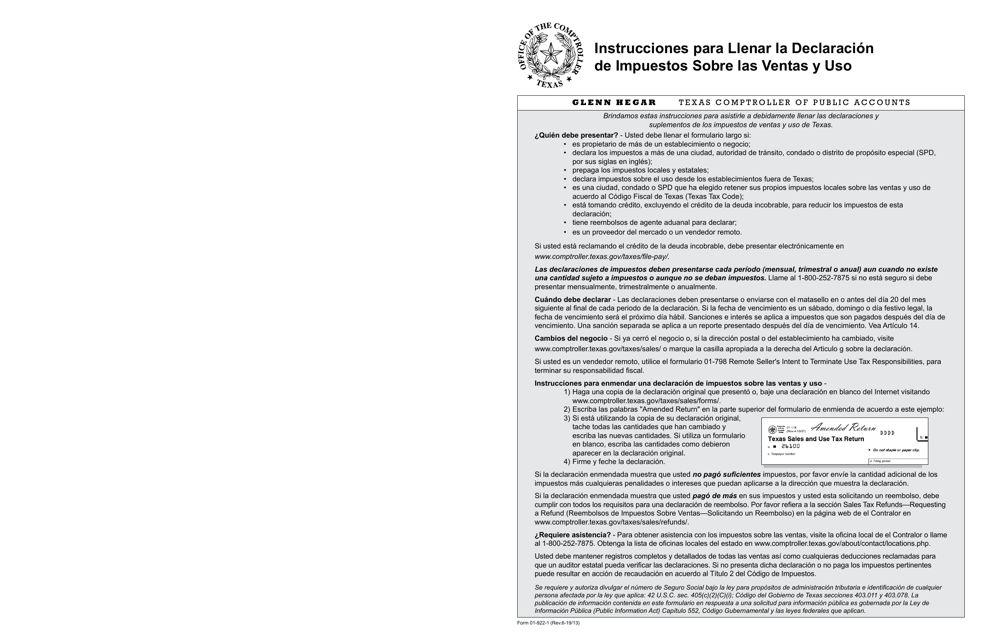

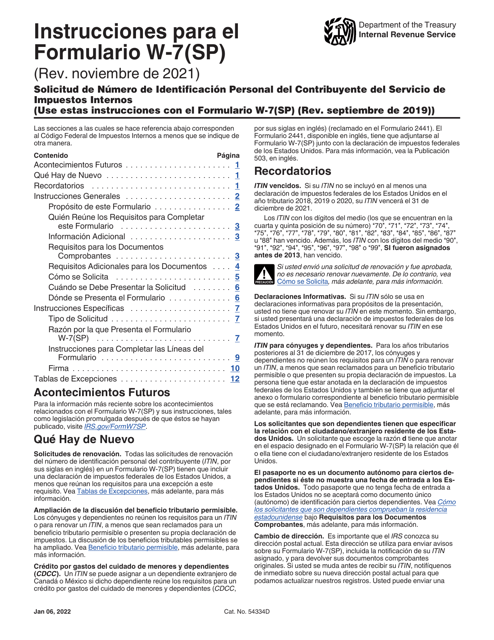

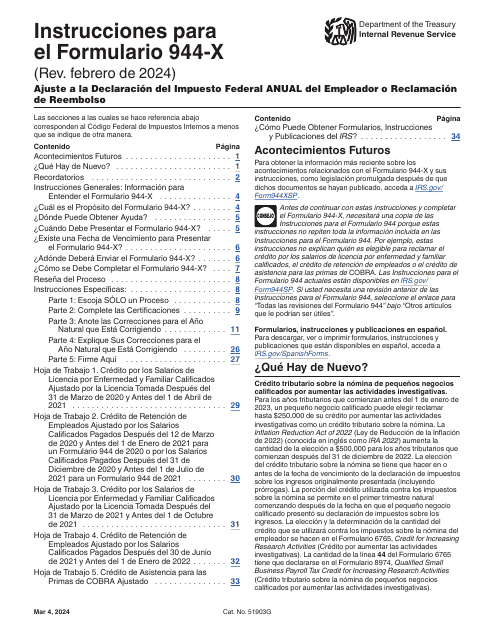

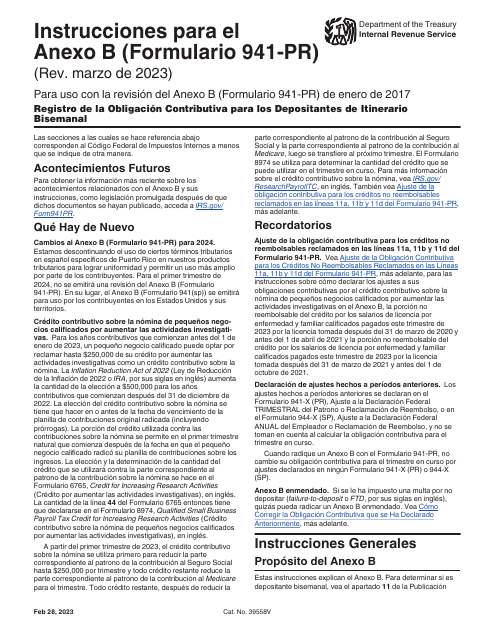

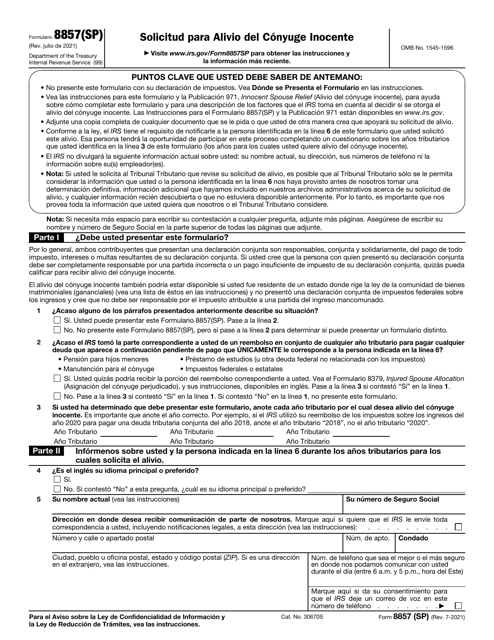

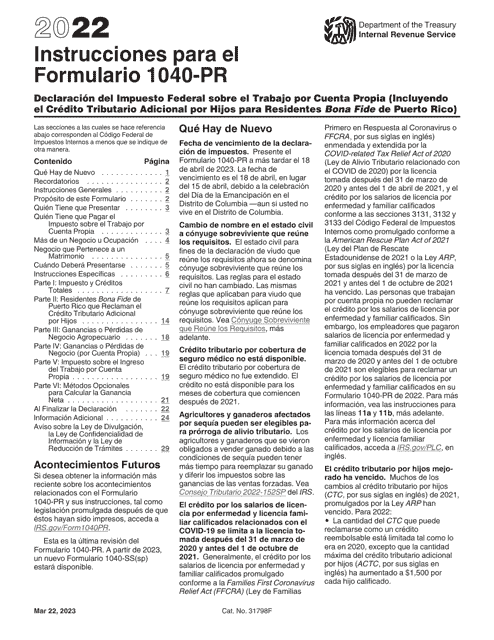

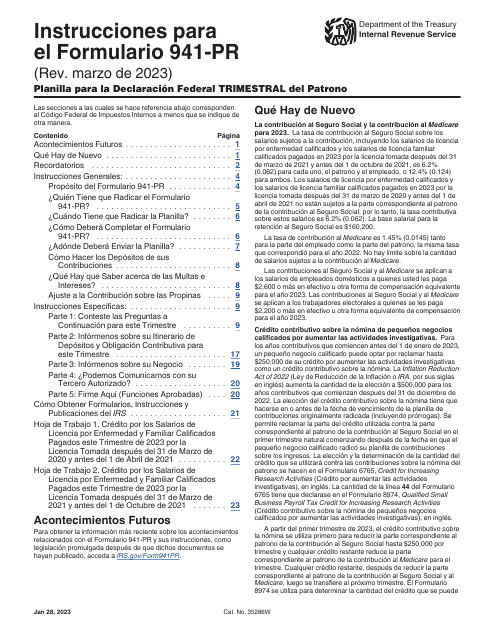

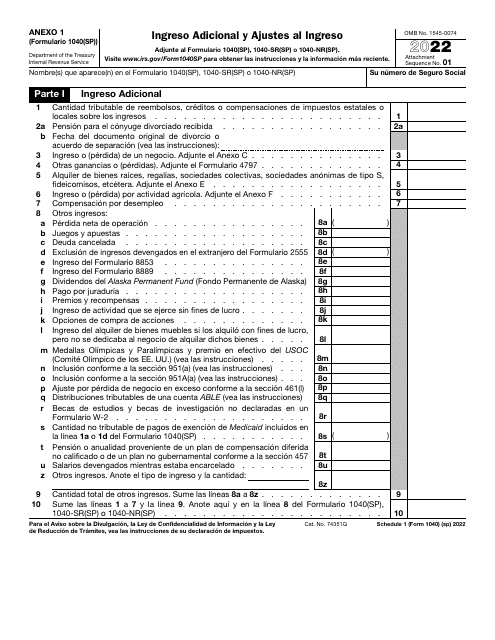

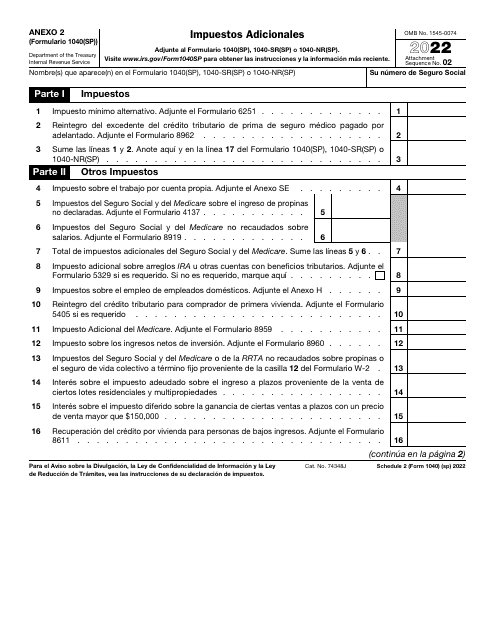

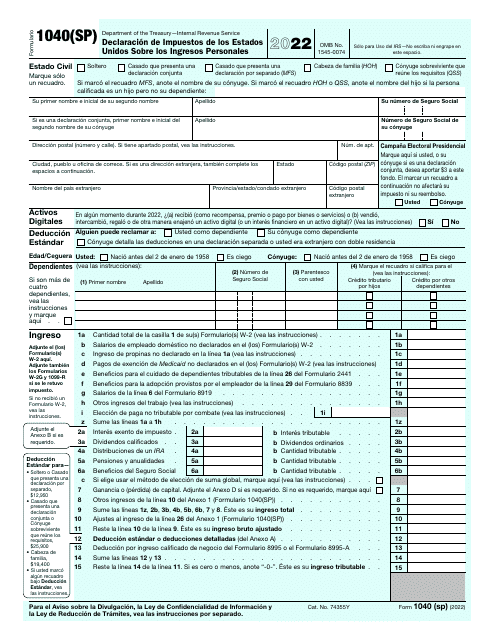

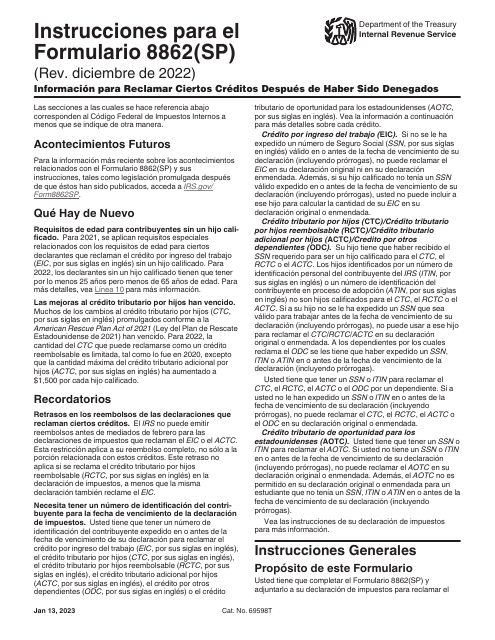

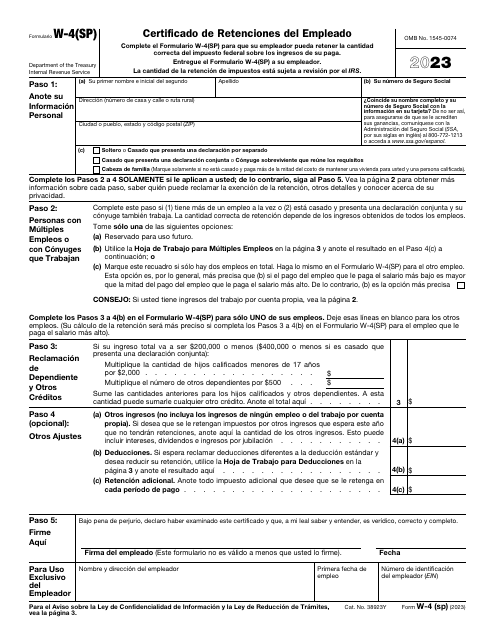

At our online resource, we offer guidance on a wide range of fiscal document forms, including IRS Formulario 941-X (PR), IRS Formulario 1040-PR, IRS Formulario 1040(SP), Formulario 3063-S, and Formulario WAGES-EMP. These documents cater to specific tax-related needs and reporting obligations for different individuals and businesses.

Our webpage is designed to provide detailed instructions, explanations, and support for filling out these forms accurately. We understand that tax regulations can be complex, and our aim is to simplify the process for you. By providing step-by-step instructions, helpful tips, and important insights, we ensure that you have all the necessary information at your fingertips.

Whether you need assistance with reporting your self-employment income, claiming tax credits, or reporting employee earnings, our webpage has all the resources you need. Our goal is to empower individuals and businesses to fulfill their fiscal duties effectively, while also maximizing applicable deductions and credits.

Browse through our webpage to find the information you are seeking. In addition to detailed instructions, we also provide answers to frequently asked questions and helpful links for further assistance. Our webpage is user-friendly and organized, making it easy to navigate and find the information you need.

Whether you are a taxpayer in need of guidance or a business owner responsible for maintaining accurate fiscal records, our webpage on fiscal documents is your go-to resource. Stay compliant, maximize your tax benefits, and have peace of mind knowing that you are fulfilling your fiscal obligations accurately and efficiently.

Documents:

45

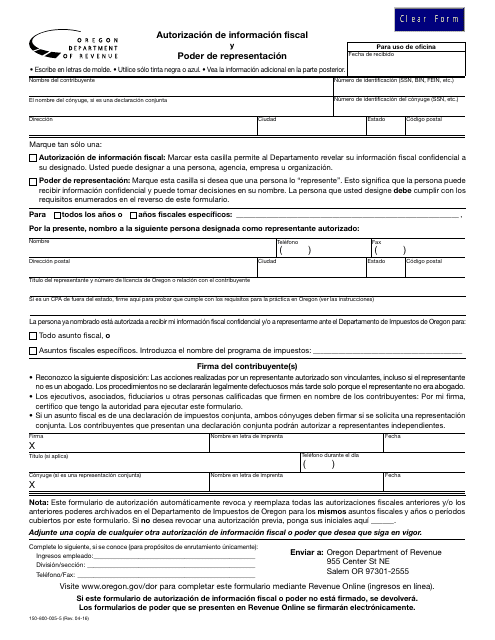

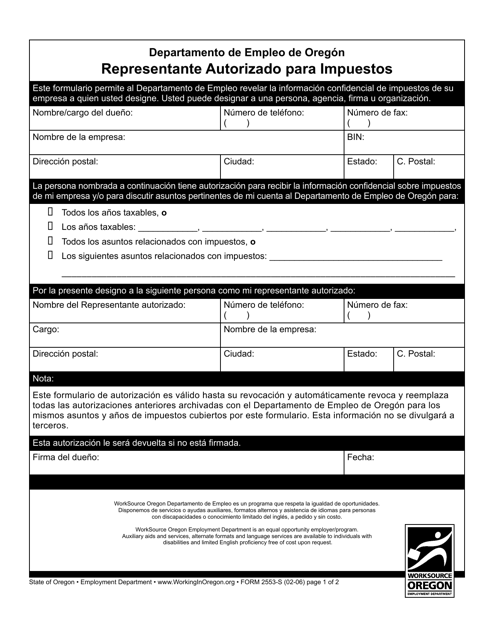

This type of document is an Authorization of Fiscal Information and Power of Representation form in Oregon, used to grant someone the authority to access and represent your tax information.

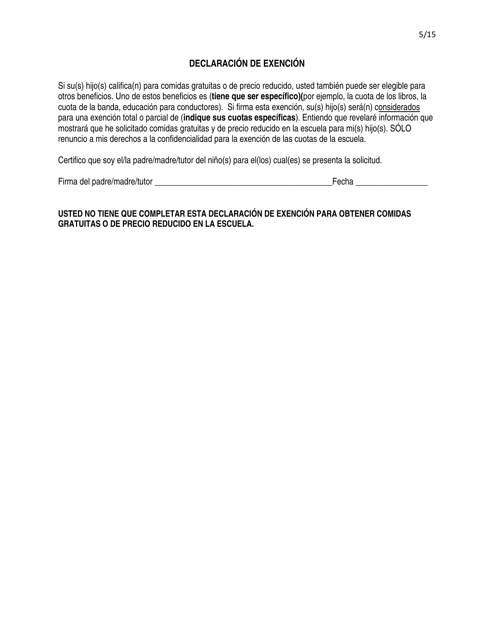

This type of document is a Spanish version of the Iowa Exemption Declaration form. It is used to declare exemptions for certain taxes in the state of Iowa.

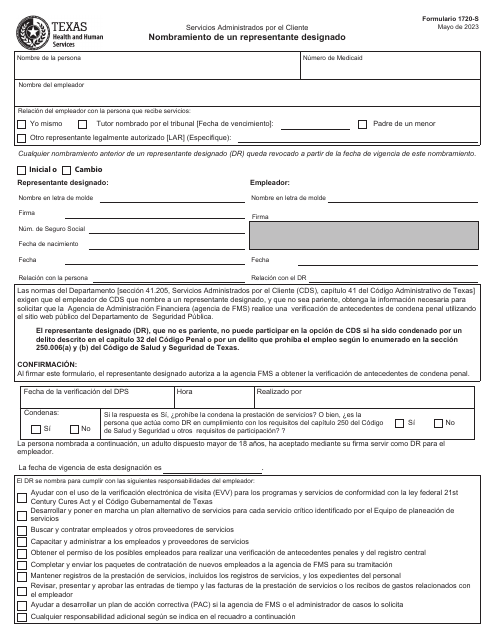

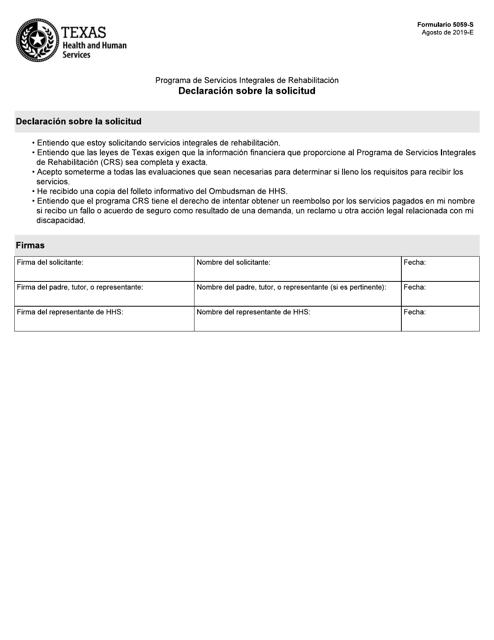

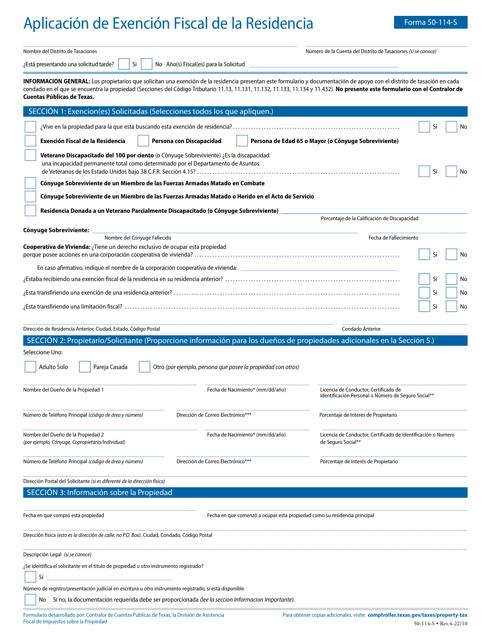

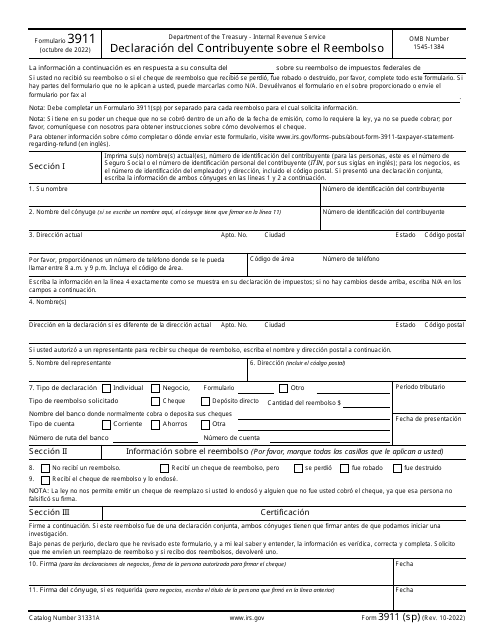

This Form is used for making a declaration regarding a request in Texas. (Spanish version)

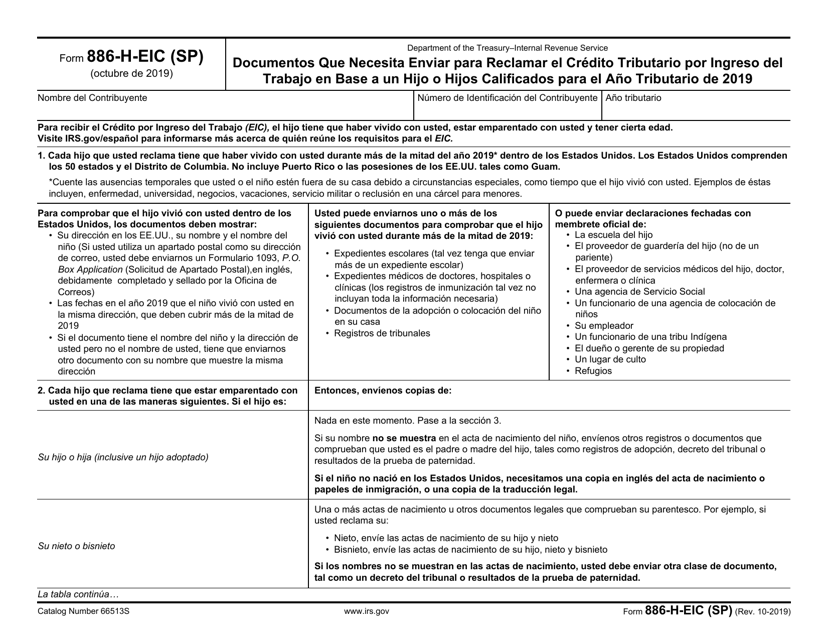

This document is for Spanish-speaking individuals who need to submit documents to claim the Earned Income Tax Credit based on a qualified child or children.

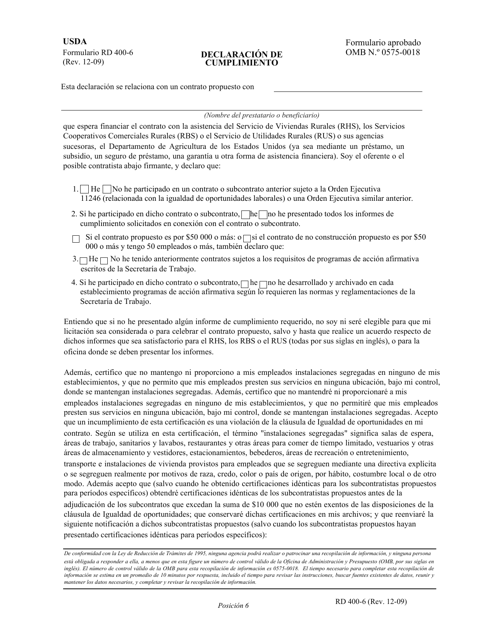

This document is used for submitting a Declaration of Compliance in Spanish.

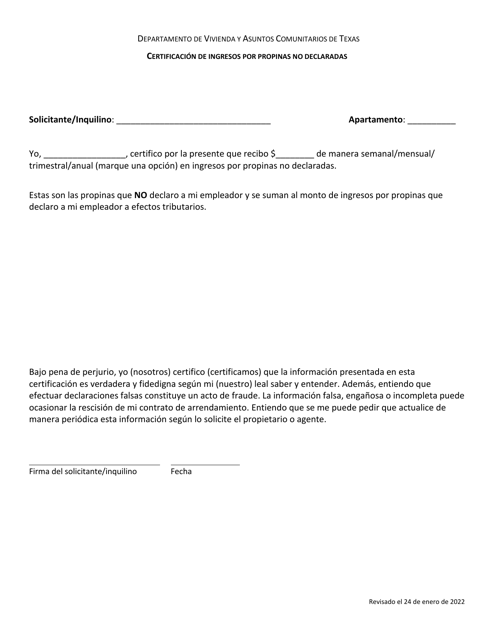

This document certifies income from undeclared tips in Texas.