Tax Filing Status Templates

Tax Filing Status

Looking for information on tax filing status? You've come to the right place. Whether you're a resident or a nonresident, understanding your tax filing status is crucial when it comes to fulfilling your obligations and ensuring compliance with the tax laws of your jurisdiction.

Tax filing status refers to the classification that determines how you are required to file your tax return and the deductions and exemptions you may be eligible for. The tax filing status can vary depending on factors such as your marital status, residency status, and whether you have dependents.

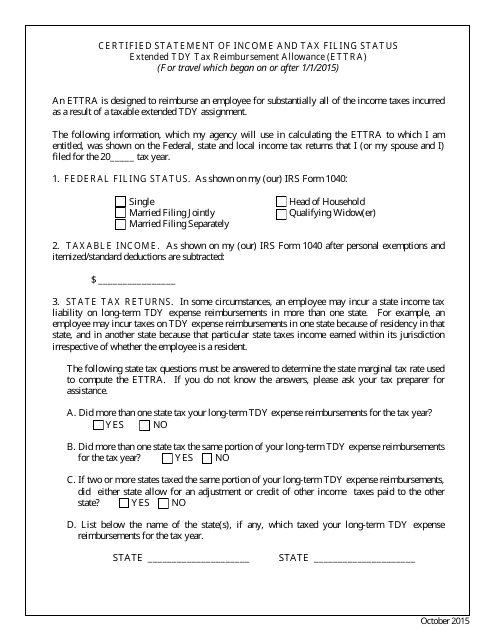

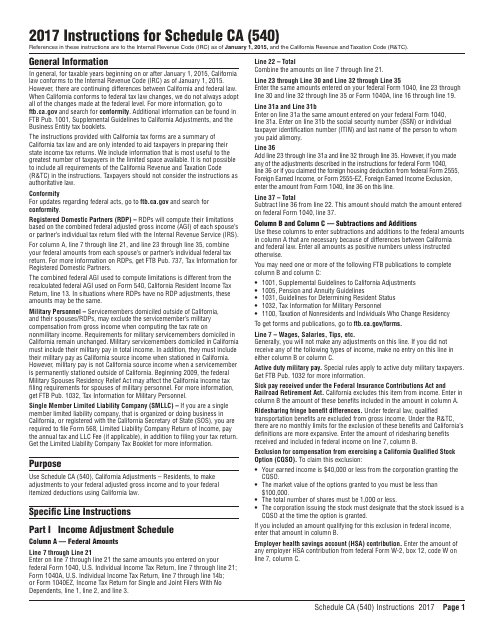

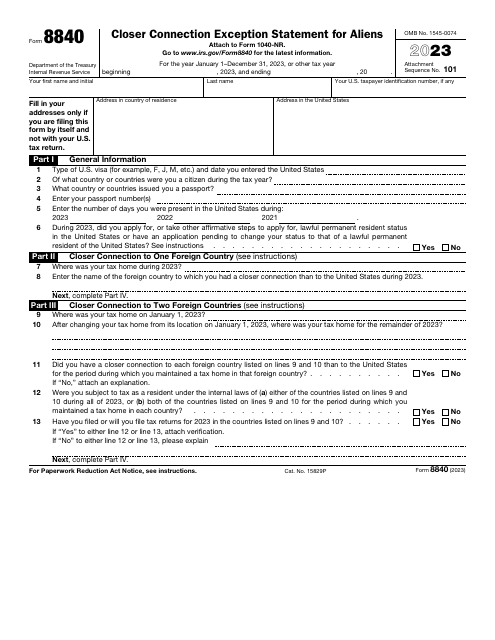

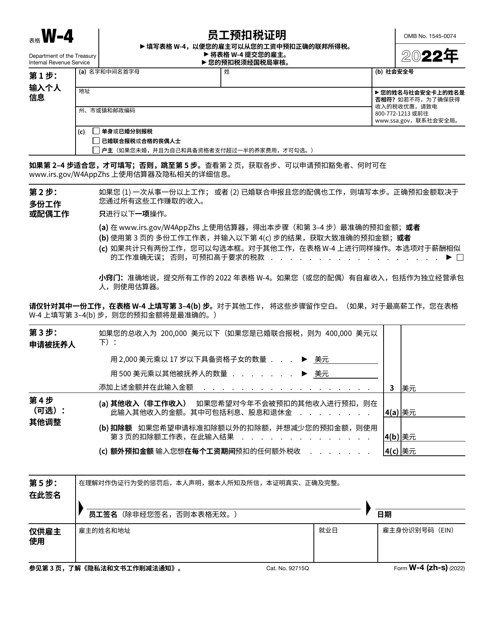

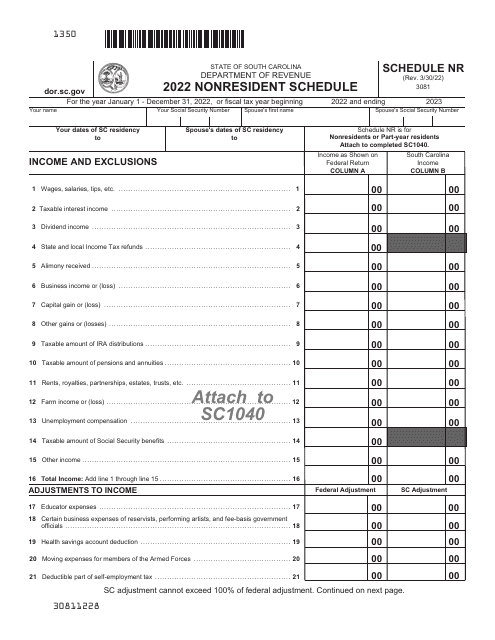

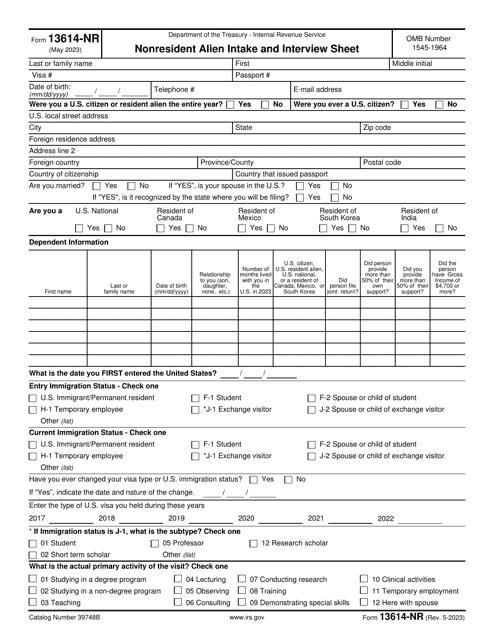

At our website, we provide a comprehensive collection of documents related to tax filing status. These documents include income tax return forms specific to different cities, certified statements of income and tax filing status for extended TDY tax reimbursement allowances, forms for aliens claiming closer connection exceptions, nonresident schedules for specific states, and intake and interview sheets for nonresident aliens.

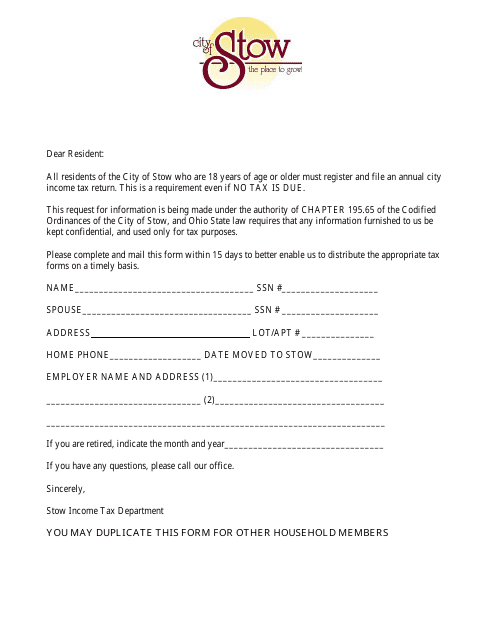

Our wide range of document resources ensures that you can easily find the information you need to accurately determine your tax filing status. Whether you're a resident of Stow, Ohio, or a nonresident alien residing elsewhere in the United States, we've got you covered.

We understand that tax filing can be complex, and determining your filing status is an important step in the process. That's why our website provides clear and concise explanations of each tax form, along with any additional instructions or guidelines that may be necessary.

Don't let the intricacies of tax filing status confuse you. Visit our website today to access our extensive collection of documents and gain a better understanding of tax filing status. With our resources at your fingertips, you'll be well-equipped to navigate the tax system and ensure compliance with the applicable tax laws.

Documents:

8

This Form is used for filing your income tax return in the City of Stow, Ohio.

This Form is used for individuals who are on extended temporary duty (TDY) and need to claim tax reimbursement allowance (ETTRA). It certifies their income and tax filing status.

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

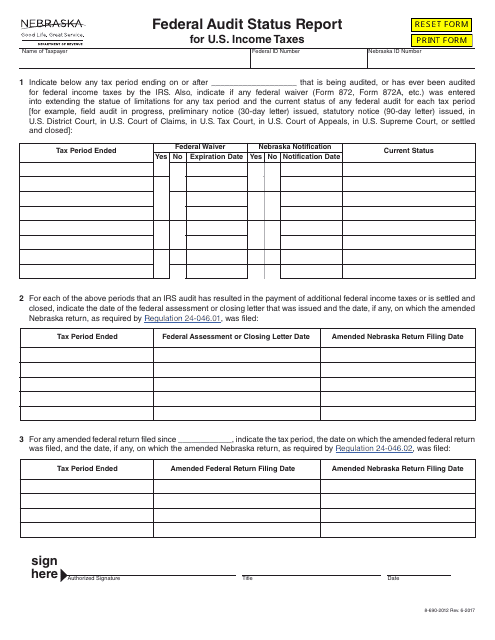

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.