Tobacco Products Templates

Are you a tobacco product manufacturer or distributor looking to understand the regulations and requirements for your industry? Our comprehensive collection of documents on tobacco products is the perfect resource for you.

From tax returns and refund applications to manufacturer certifications, our extensive collection covers all the necessary paperwork for tobacco product businesses.

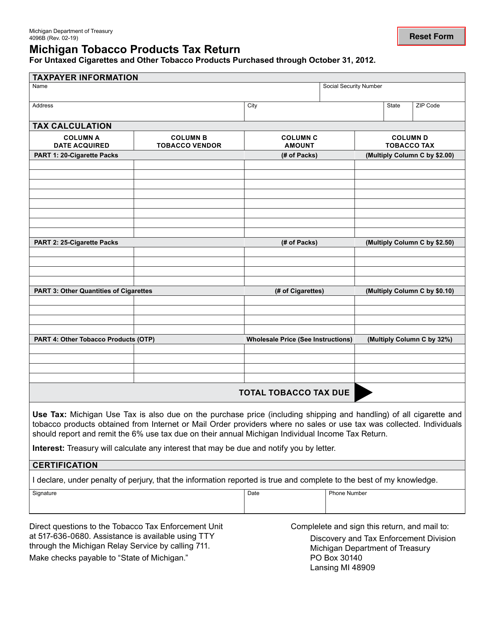

Browse through our forms to find what you need, whether you are importing, manufacturing, or exporting tobacco products. We've got you covered with documents like Form 56 Schedule I Tobacco Products Other Than Snuff Imported or Manufactured and Exported, Sample Form TT-100 Wisconsin Distributor's Tobacco and Vapor Products Tax Return, Form B-A-101R Application for Other Tobacco Products Excise Tax Refund, and many more.

Our repository also provides a wealth of information on tobacco production and the different forms of tobacco products available.

Don't waste time searching for individual forms and information scattered across the web. Instead, access everything you need in one place with our tobacco products documents collection. Trust us to keep you informed and up to date on the latest regulations and requirements in the industry.

Start exploring now to streamline your administrative processes and ensure compliance in the tobacco product sector.

Documents:

239

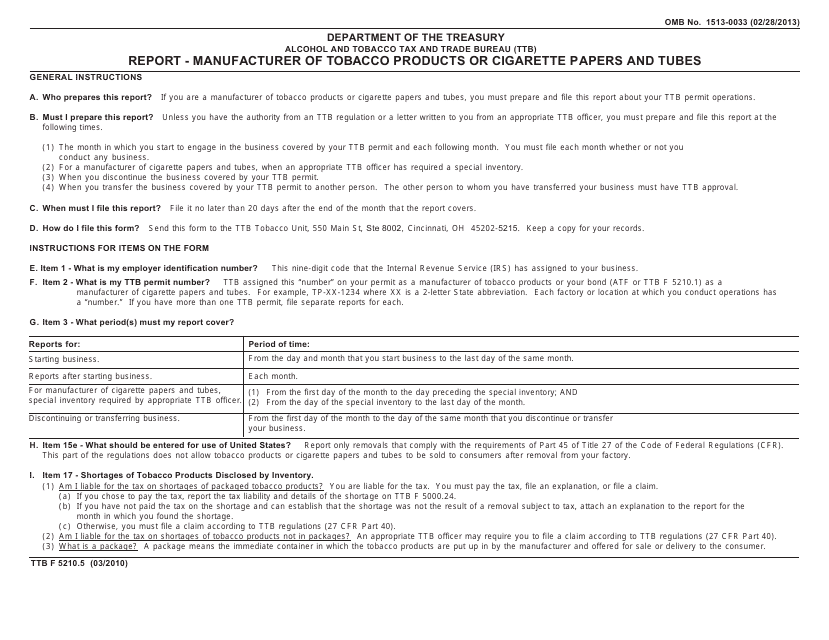

This document is used for reporting the information of manufacturers of tobacco products, cigarette papers, and tubes.

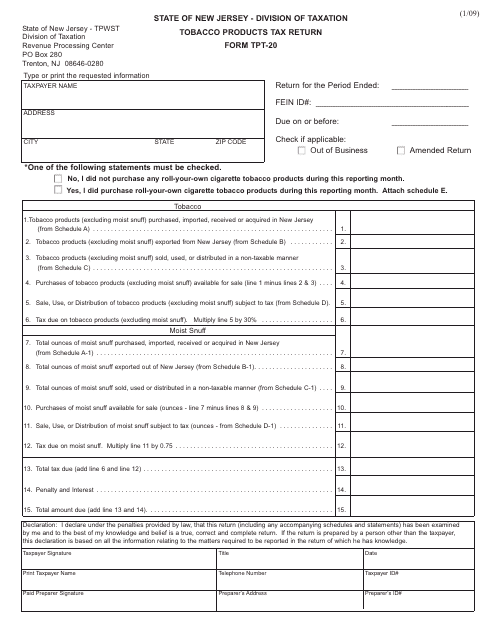

This Form is used for reporting and paying tobacco products tax in the state of New Jersey.

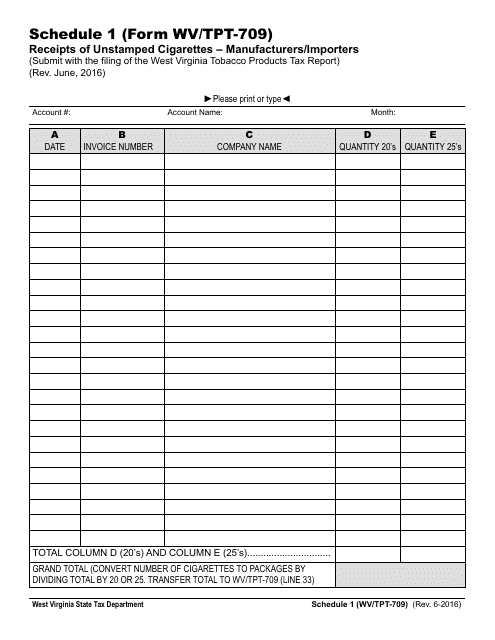

This form is used for reporting the receipts of unstamped cigarettes by manufacturers and importers in West Virginia.

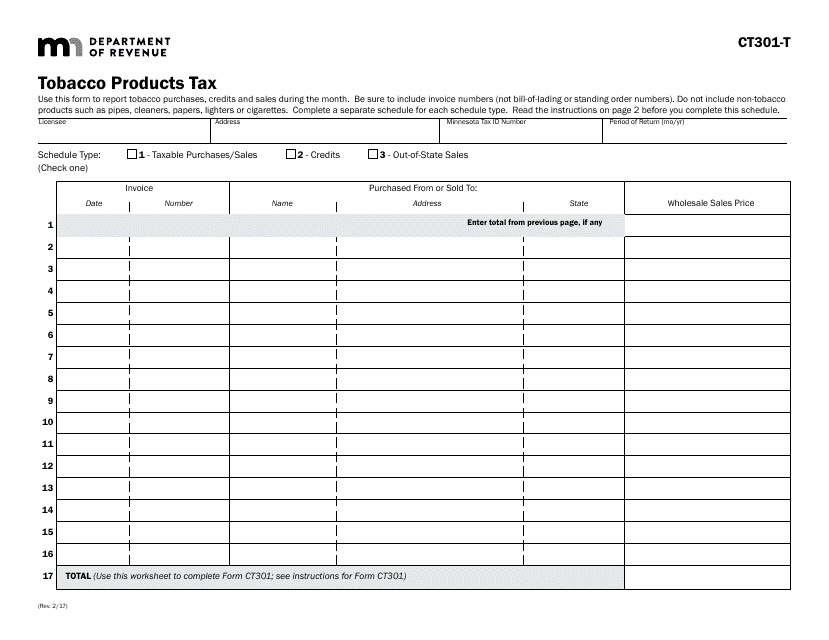

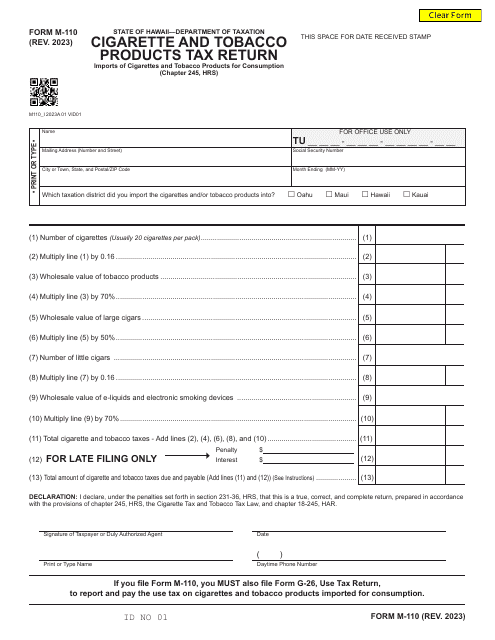

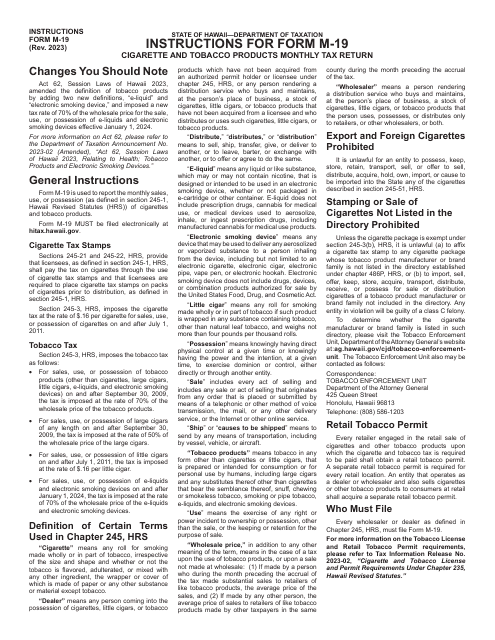

This document is used for reporting and paying tobacco products tax in the state of Minnesota.

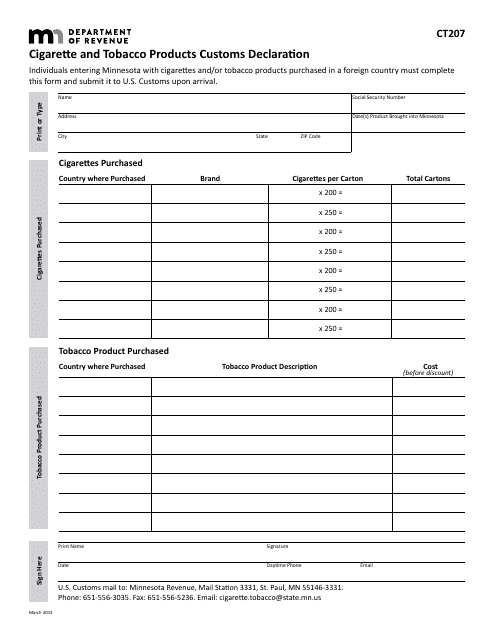

This document is used for declaring cigarette and tobacco products when entering Minnesota from another country.

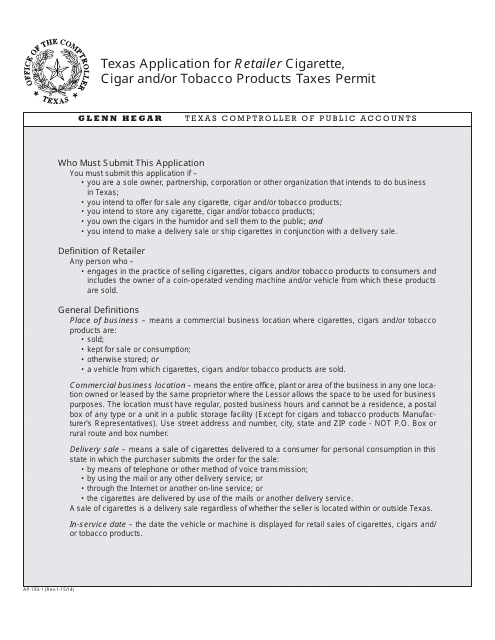

This Form is used for applying for a permit to sell cigarettes, cigars, and/or tobacco products in the state of Texas.

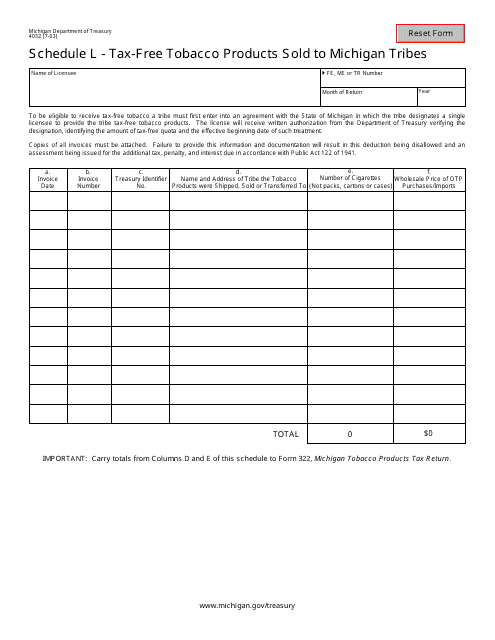

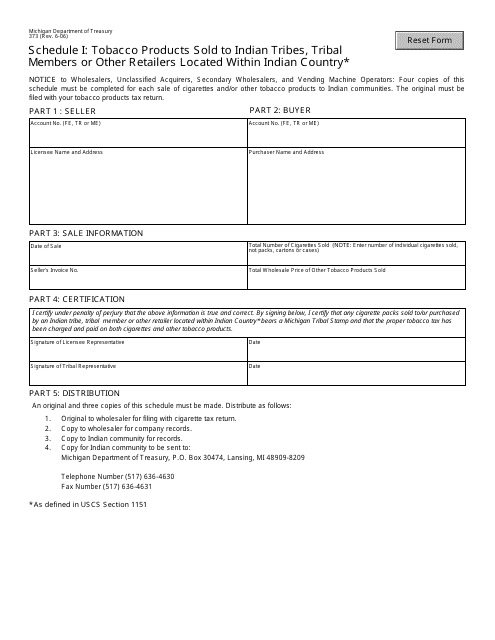

This document is used for reporting tax-free tobacco products sold to Michigan tribes within the state of Michigan.

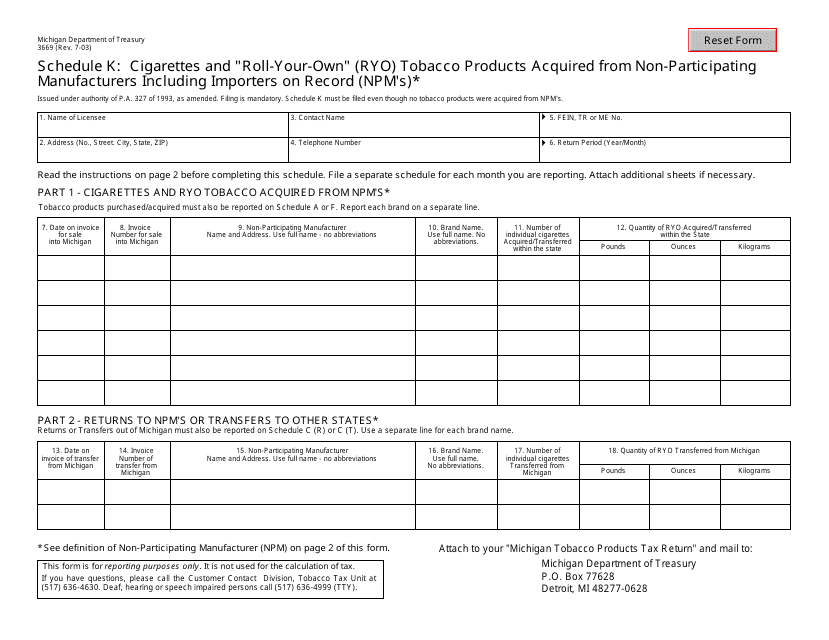

This form is used for reporting the acquisition of cigarettes and "roll-your-own" tobacco products from non-participating manufacturers and importers on record in the state of Michigan.

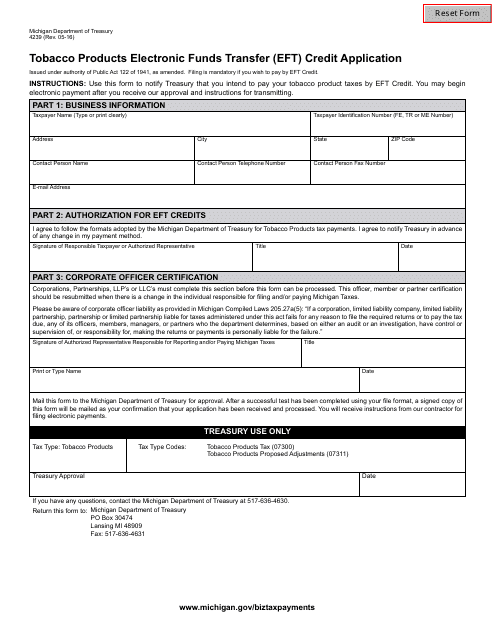

This form is used for applying for electronic funds transfer credit for tobacco products in the state of Michigan.

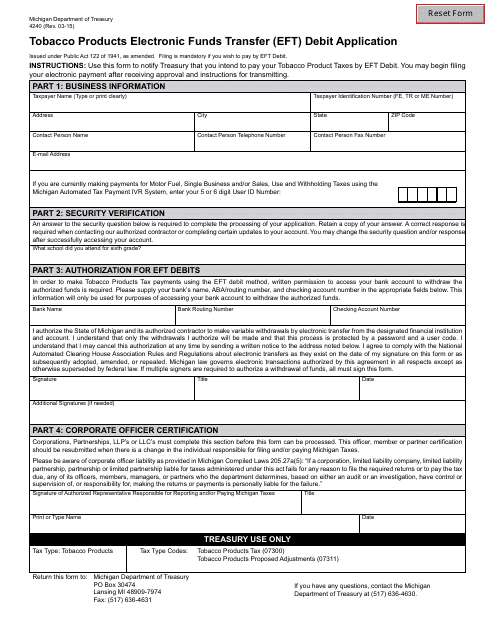

This form is used for applying for electronic funds transfer (EFT) debit authorization for tobacco products in Michigan.

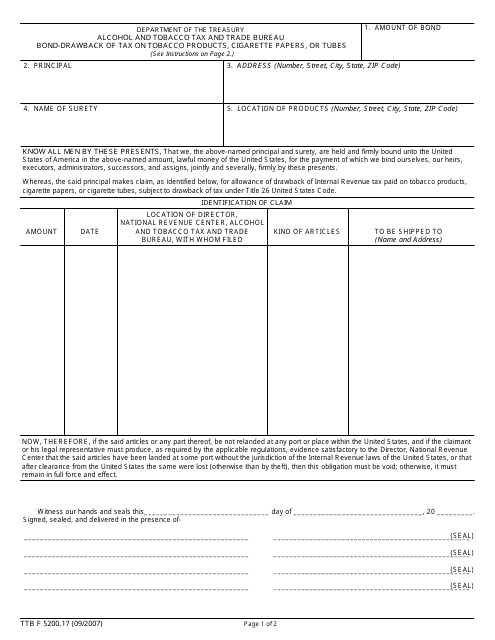

This form is used for claiming a refund of taxes paid on tobacco products, cigarette papers, or tubes that were exported or destroyed.

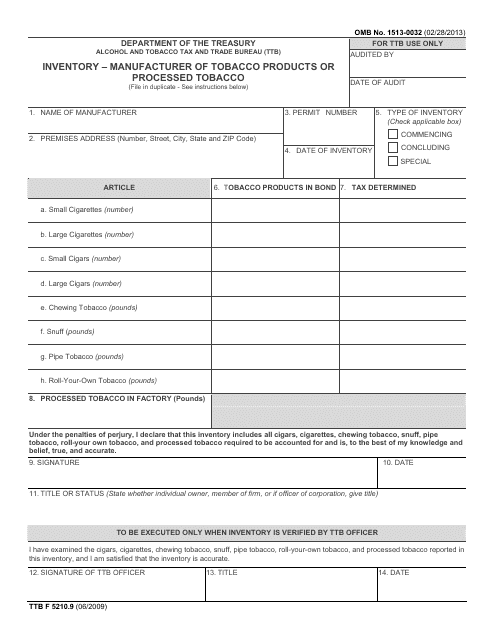

This form is used for inventory reporting by manufacturers of tobacco products or processed tobacco.

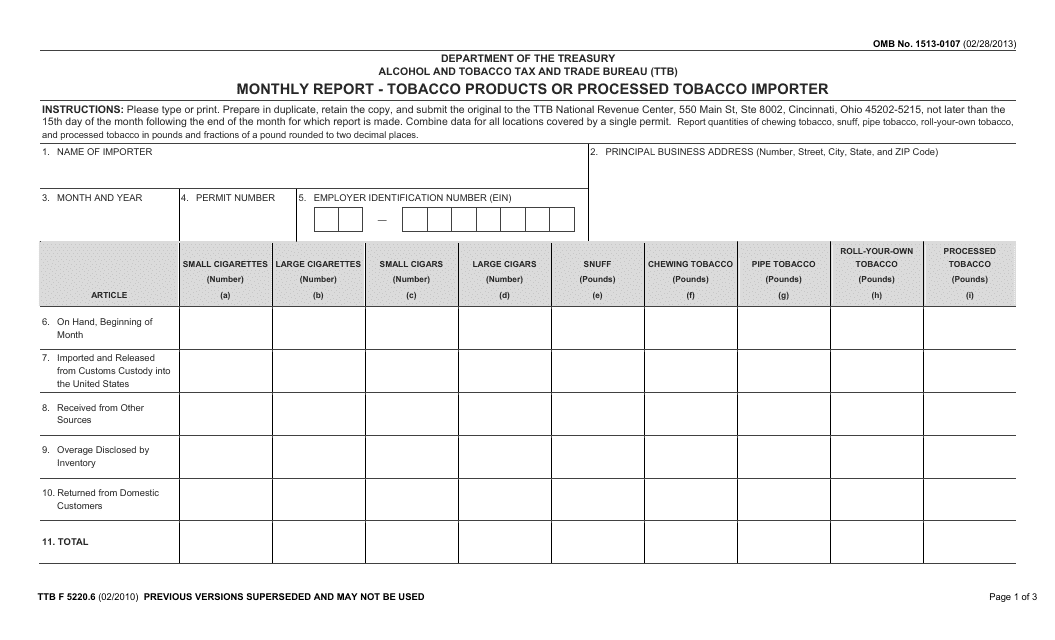

This Form is used for monthly reporting by importers of tobacco products or processed tobacco. It helps track import activities and compliance with regulations.

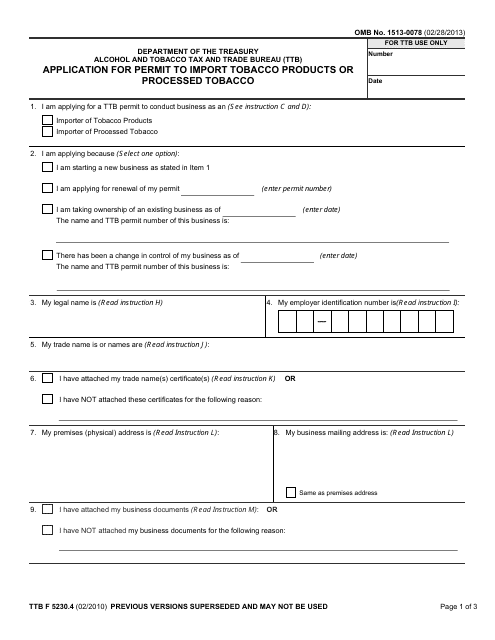

This Form is used for applying for a permit to import tobacco products or processed tobacco into the US.

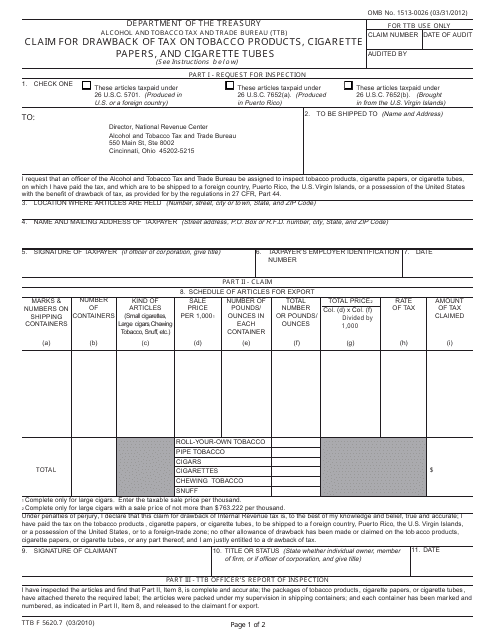

TTB Form 5620.7 Claim for Drawback of Tax on Tobacco Products, Cigarette Papers, and Cigarette Tubes

This form is used for claiming a refund of taxes paid on tobacco products such as cigarettes, cigarette papers, and cigarette tubes.

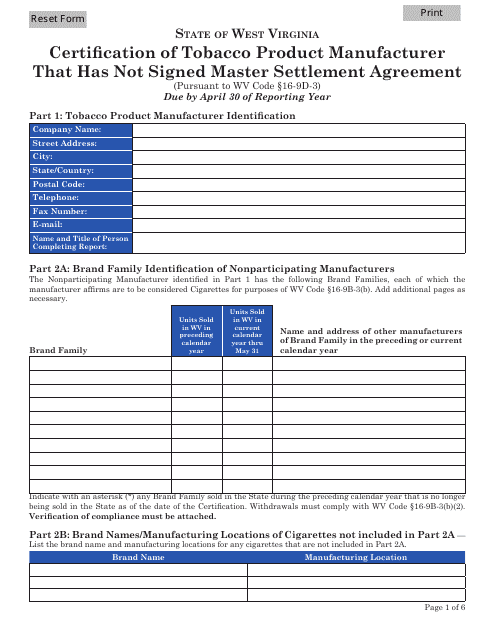

This document certifies a tobacco product manufacturer in West Virginia who has not signed the Master Settlement Agreement.

This Form is used for reporting tobacco products sold to Indian tribes, tribal members, or other retailers located within Indian Country in Michigan.

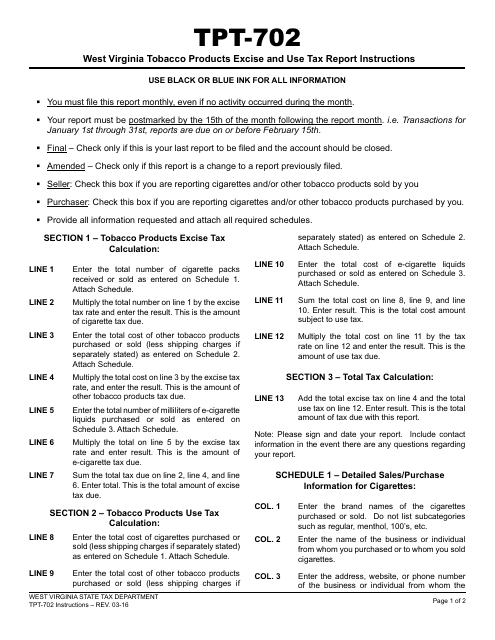

This document is used for reporting and paying tobacco products excise and use tax in West Virginia. It provides instructions on how to fill out Form WV/TPT-702. The form is used by businesses that sell tobacco products in the state.

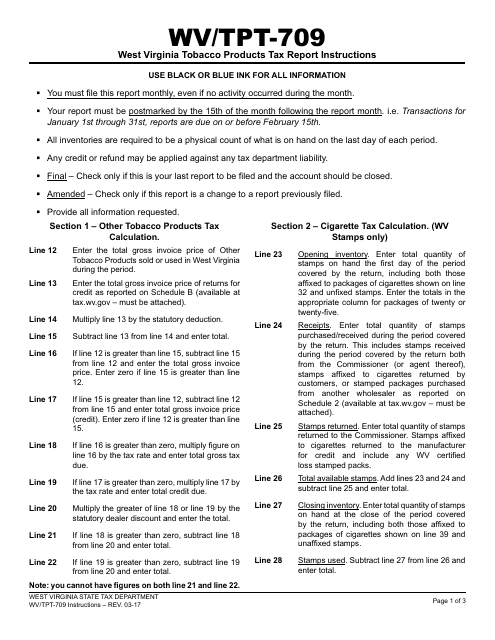

This Form is used for reporting tobacco products tax in West Virginia. It provides instructions on how to fill out and submit the WV/TPT-709 West Virginia Tobacco Products Tax Report.

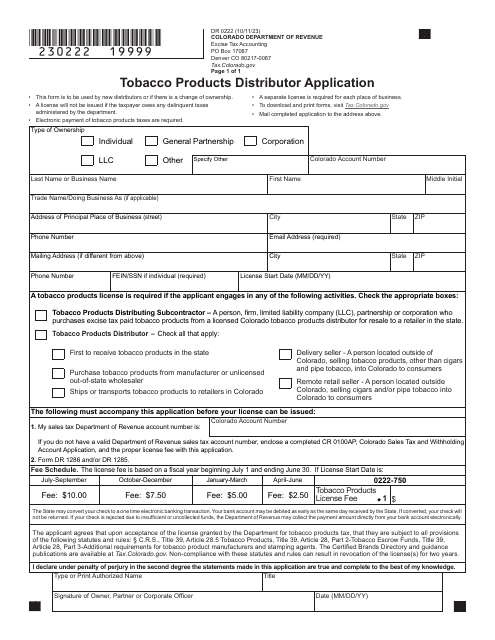

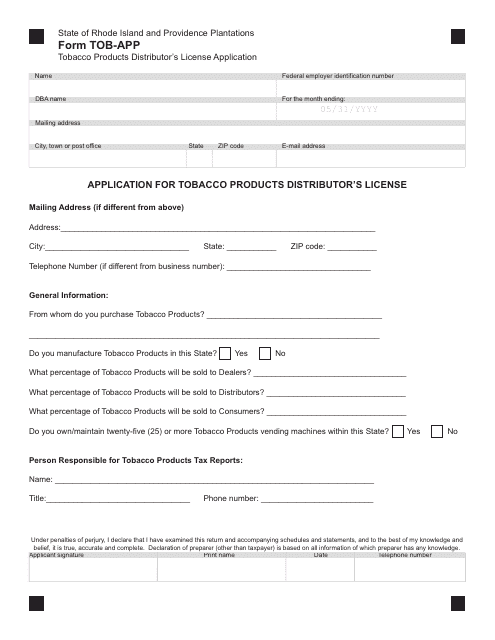

This document is used for applying for a tobacco products distributor's license in Rhode Island.

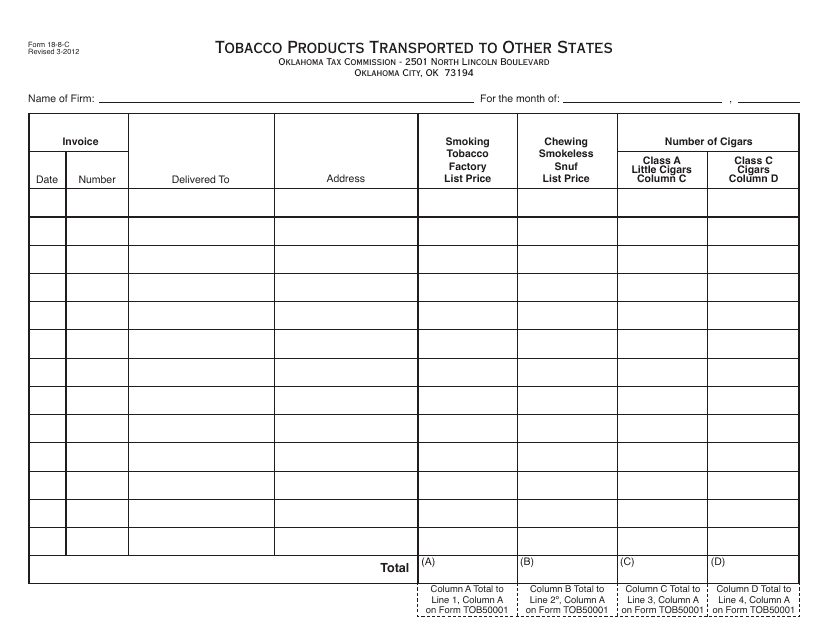

This form is used for reporting the transportation of tobacco products from Oklahoma to other states.

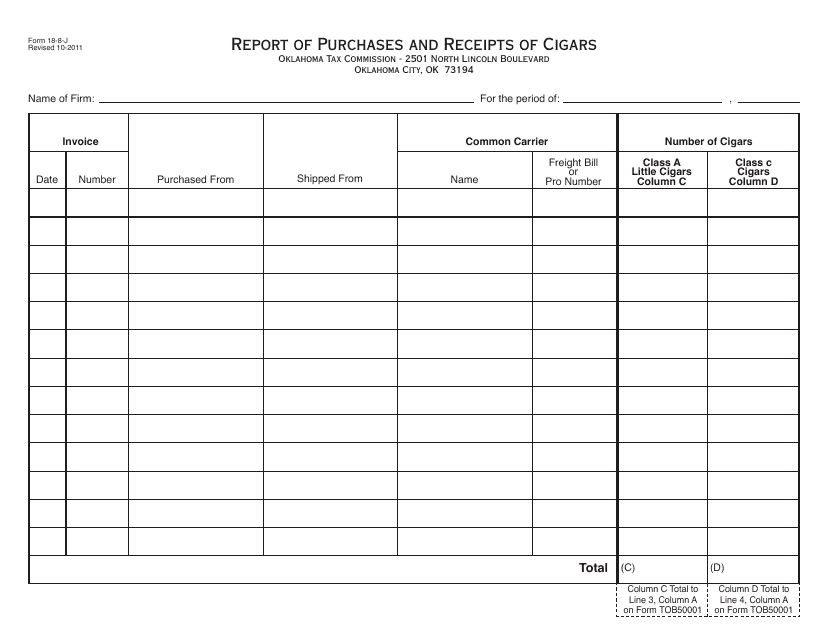

This form is used for reporting purchases and receipts of cigars in the state of Oklahoma.

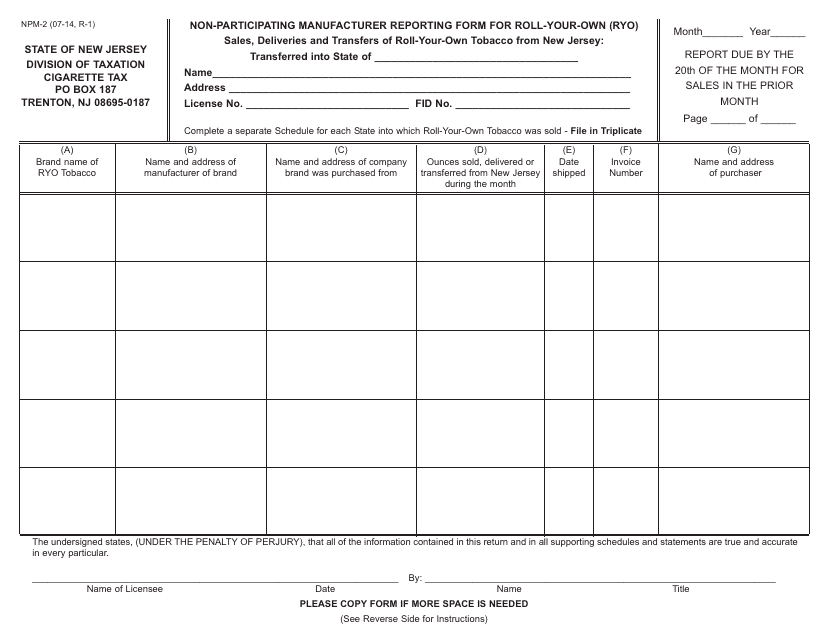

This form is used for non-participating manufacturers to report information related to the roll-your-own tobacco products in New Jersey.

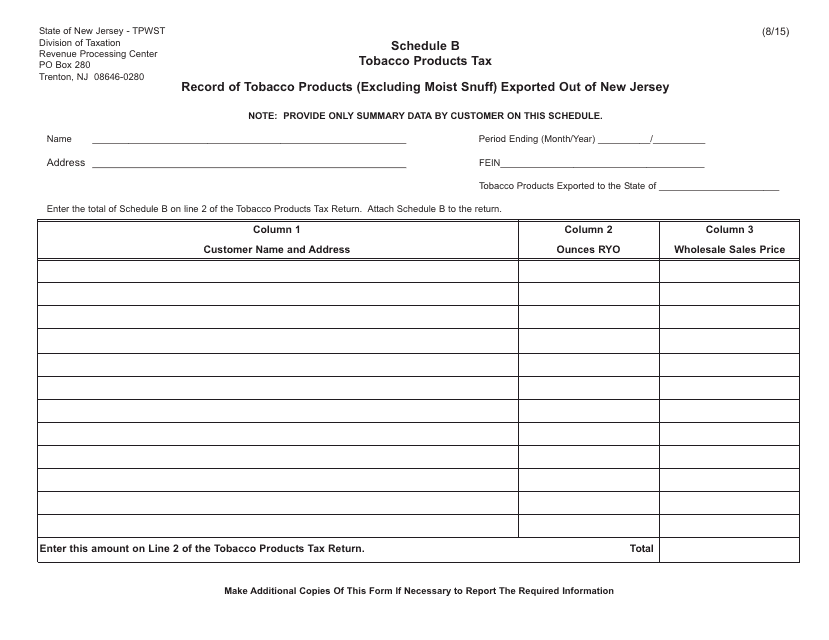

This document is used for keeping a record of tobacco products (excluding moist snuff) that are exported out of New Jersey.

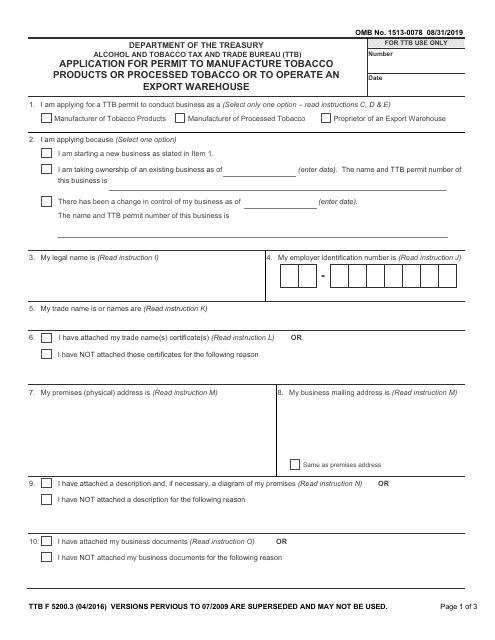

This form is used for applying for a permit to manufacture tobacco products or processed tobacco or to operate an export warehouse.

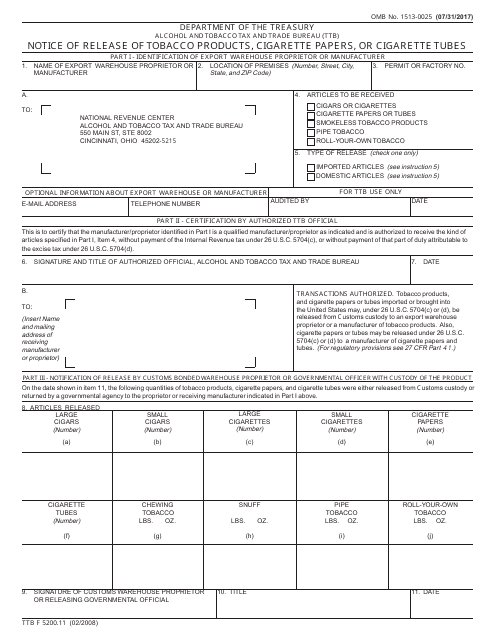

This Form is used for notifying the release of tobacco products, cigarette papers, or cigarette tubes to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

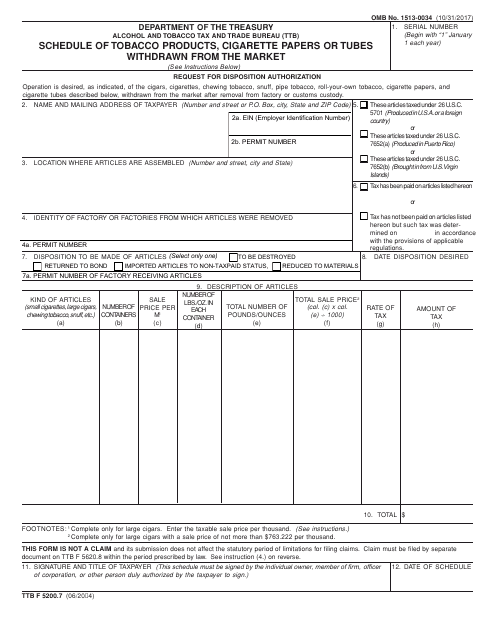

This form is used for reporting the schedule of tobacco products, cigarette papers or tubes that have been withdrawn from the market.

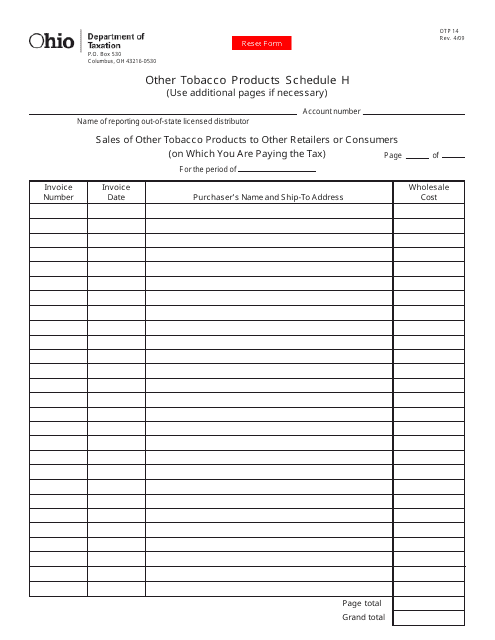

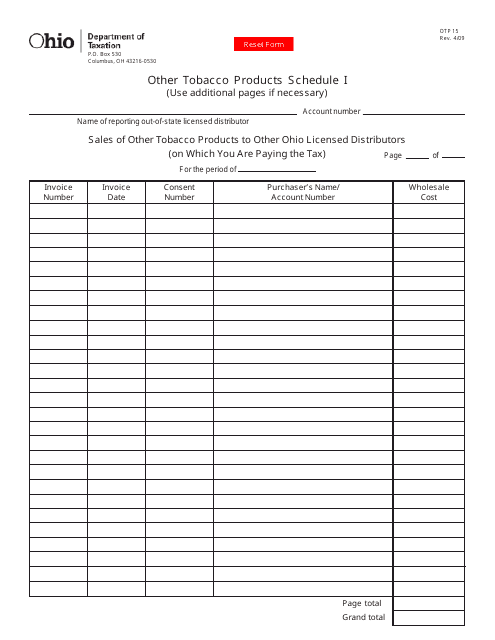

This document form is used for reporting sales of other tobacco products to other retailers or consumers in Ohio, on which you are paying the tax.

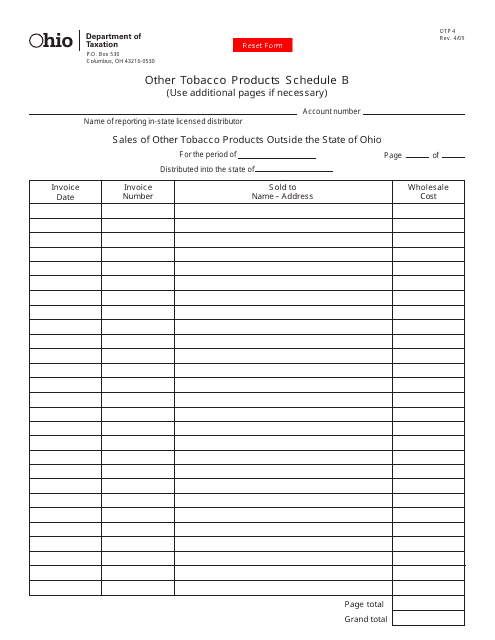

This form is used for reporting the sales of other tobacco products outside the state of Ohio. It is specifically designed for businesses located in Ohio.

This form is used for reporting and scheduling other tobacco products in Ohio, as required by law. It is part of the state's efforts to regulate the sale and distribution of tobacco products.

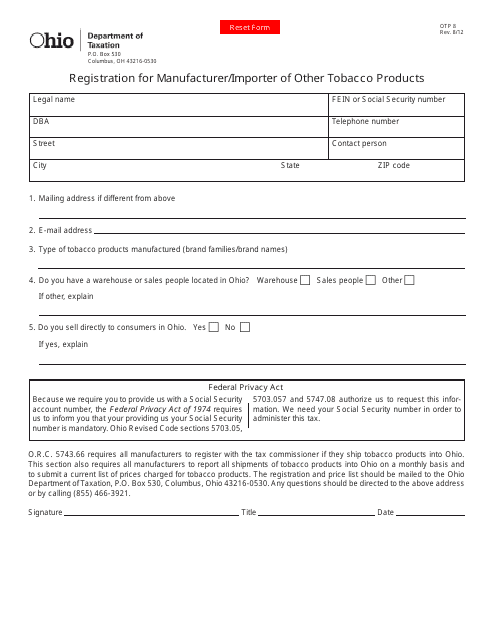

This form is used for registering as a manufacturer or importer of other tobacco products in Ohio.

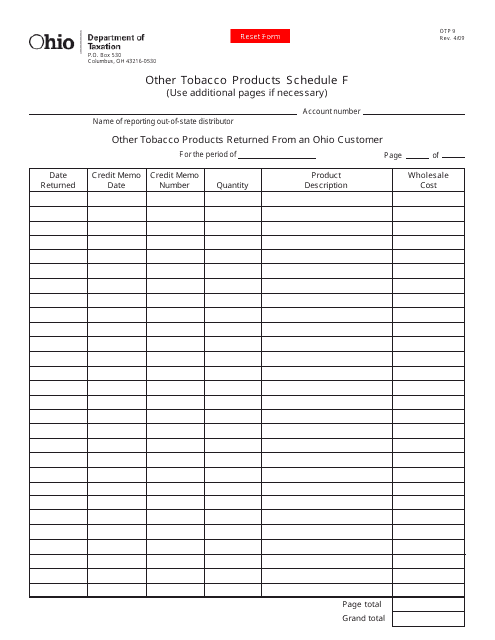

This form is used for reporting other tobacco products that have been returned by an Ohio customer in the state of Ohio.