Distribution to Shareholders Templates

Are you looking for information on how to distribute profits or assets to shareholders in the United States, Canada, and other countries? Look no further. Our comprehensive collection of documents on distribution to shareholders provides all the information you need to ensure a smooth and proper distribution process.

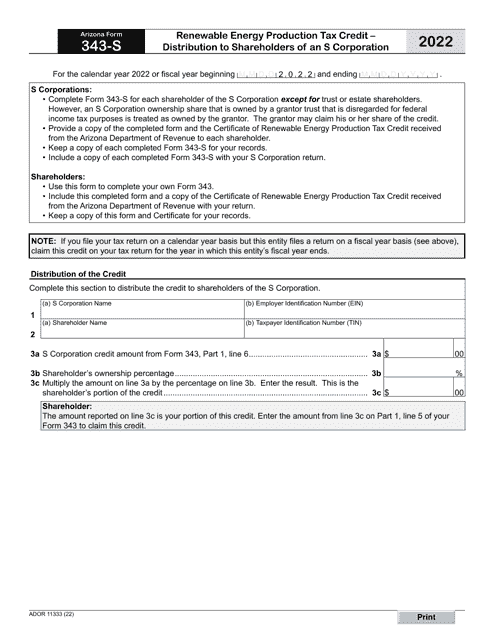

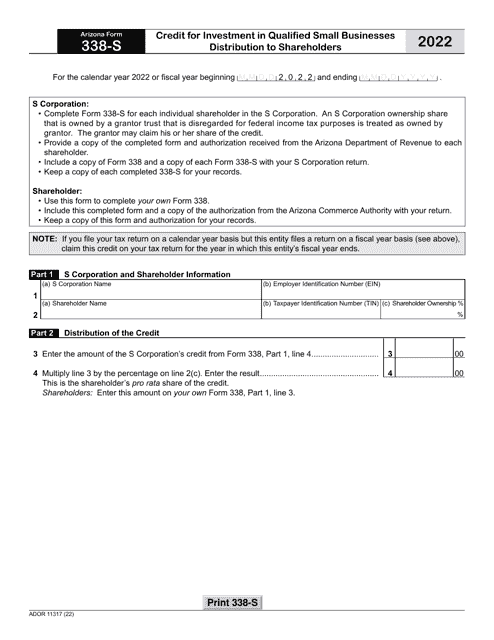

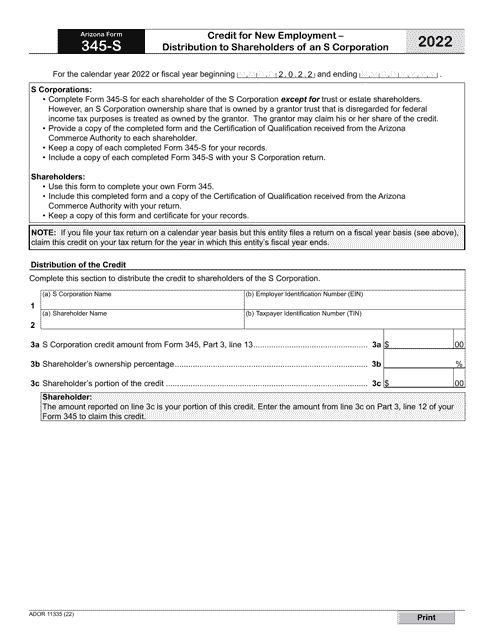

These documents cover a variety of topics related to distributing funds and assets to shareholders, including tax credits, investments in qualified small businesses, employment incentives, and more. Whether you are an S Corporation in Arizona or a multinational corporation, our collection of distribution to shareholders documents has got you covered.

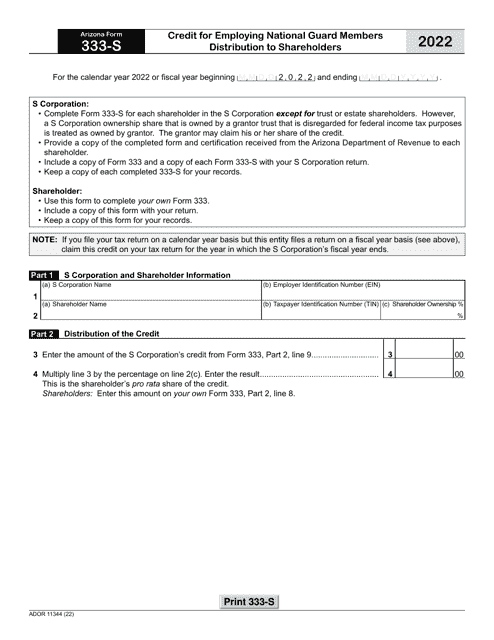

From Arizona Form 349-S (ADOR11298) that provides information on the credit for qualified facilities distribution to shareholders of an S Corporation in Arizona, to Arizona Form 333-S (ADOR11344) that covers the credit for employing National Guard members distribution to shareholders, our documents cover a wide range of scenarios and regulations.

Also known as distribution to shareholders, our collection includes various alternate names such as profit distribution, shareholder payout, and dividend distribution. No matter what term you use, our documents are designed to help you navigate the complexities of distributing funds and assets to your shareholders.

So, whether you need assistance with fulfilling legal requirements or want to optimize your tax obligations while distributing profits or assets to shareholders, our collection of distribution to shareholders documents is your one-stop destination. Take advantage of our comprehensive resources to ensure a seamless and compliant distribution process for your organization.

Documents:

9

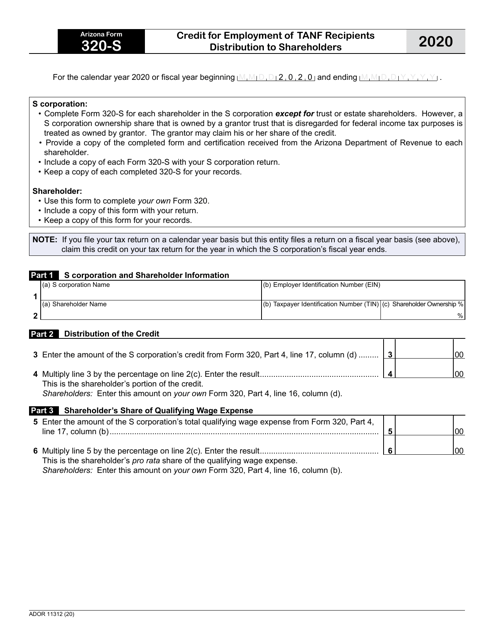

This Form is used for distributing credits for the employment of TANF recipients to shareholders in Arizona.

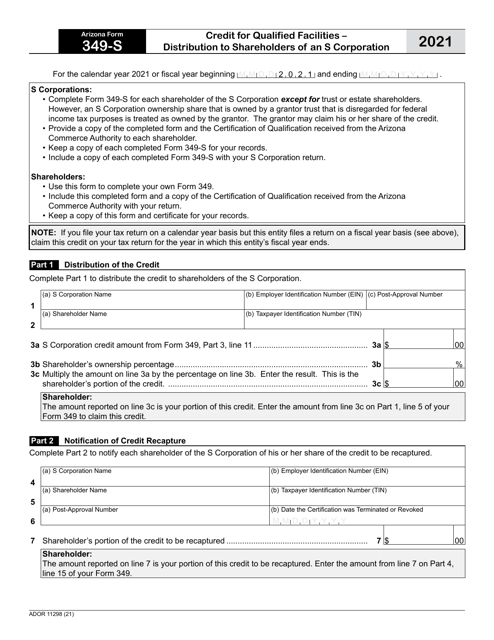

This Form is used for claiming a credit for qualified facilities and distributing it to the shareholders of an S Corporation in Arizona.