Tax Residency Templates

Tax Residency

Are you unsure about your tax residency? Do you need to determine if you are considered a resident for tax purposes? Look no further! Our tax residency documents collection has got you covered.

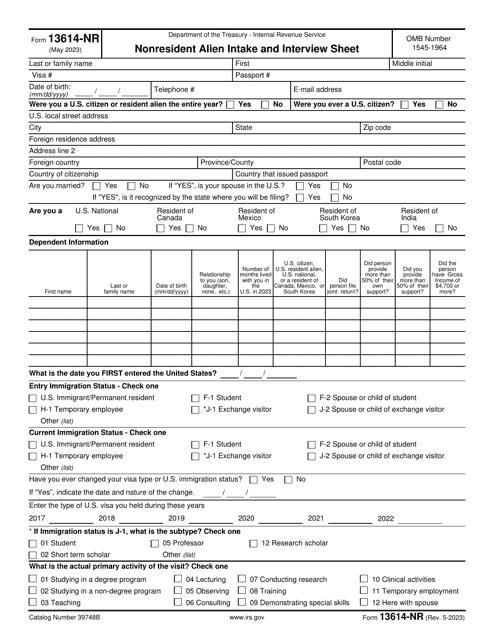

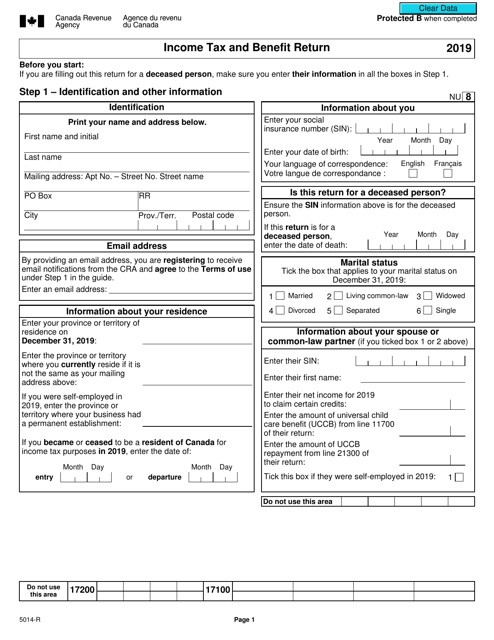

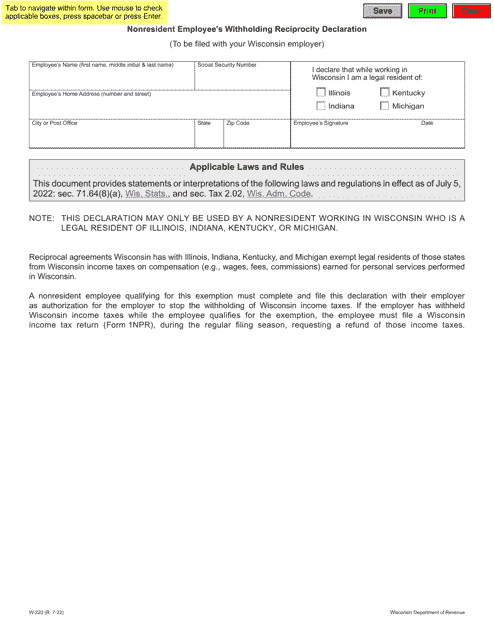

Tax residency, also known as tax residence or resident tax, refers to the legal designation of an individual's status as a resident for tax purposes. Different countries have their own criteria for determining tax residency, and our collection includes various forms and instructions to help you navigate through the process.

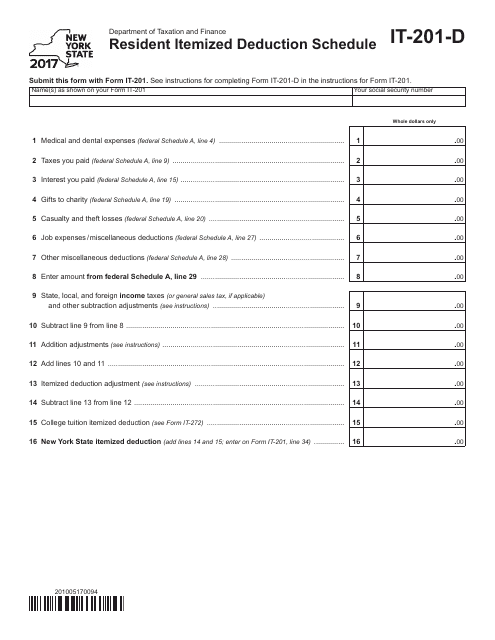

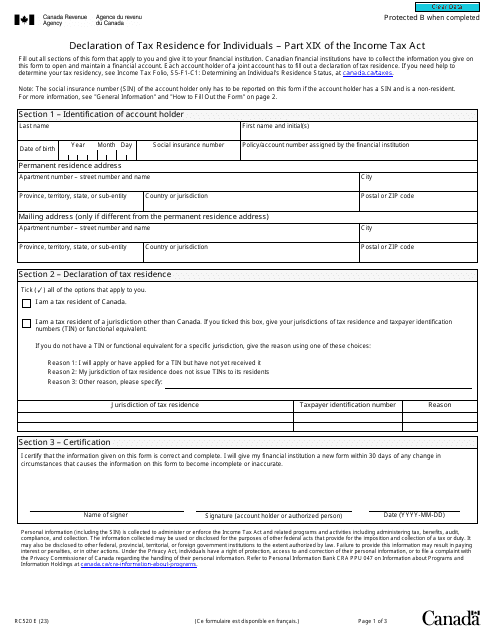

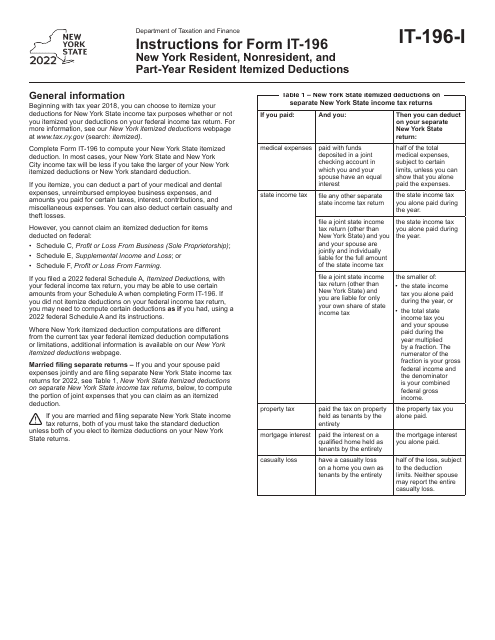

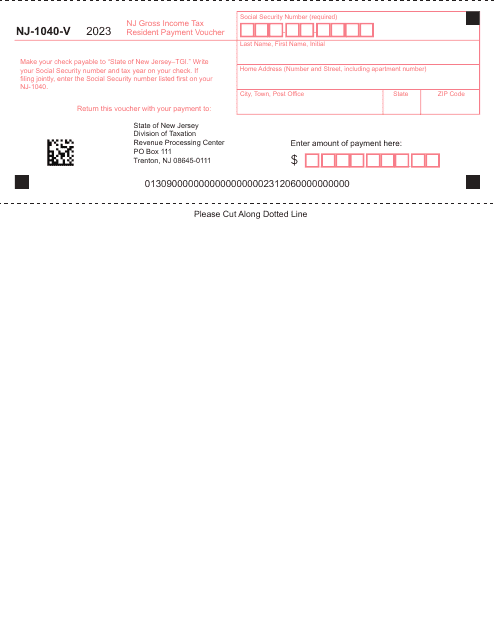

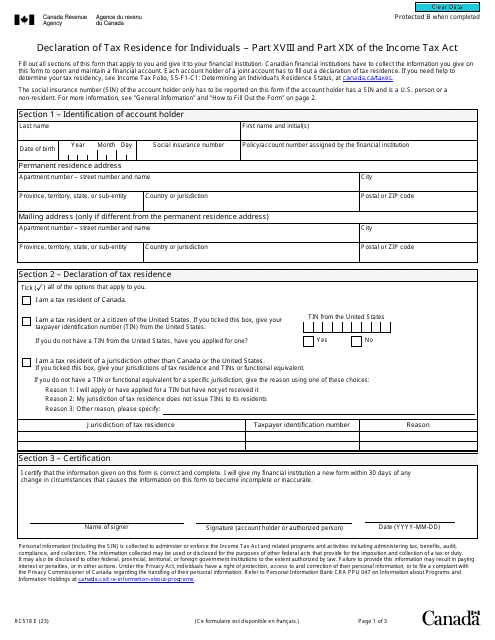

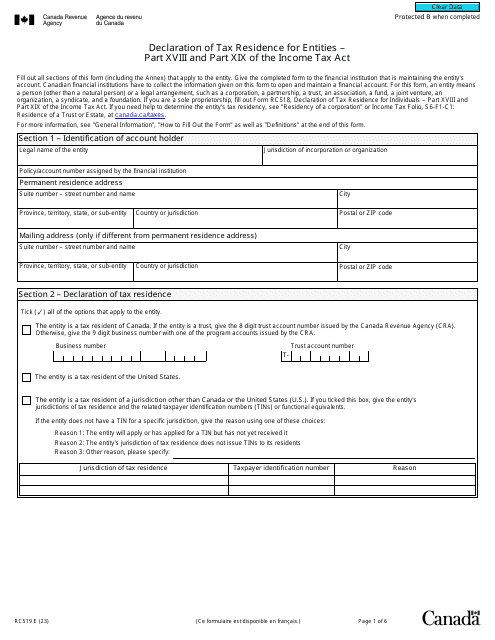

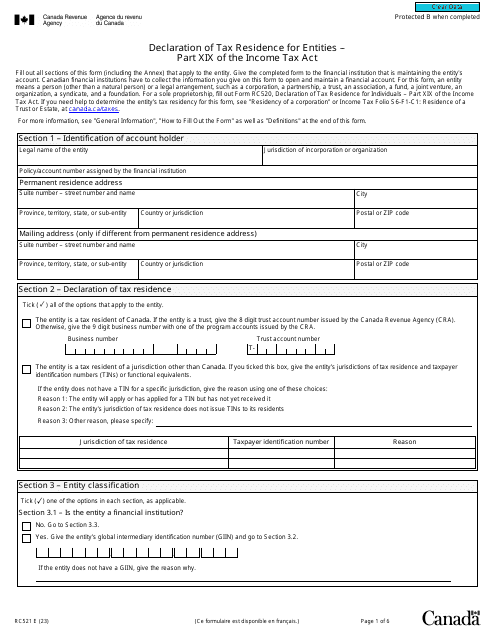

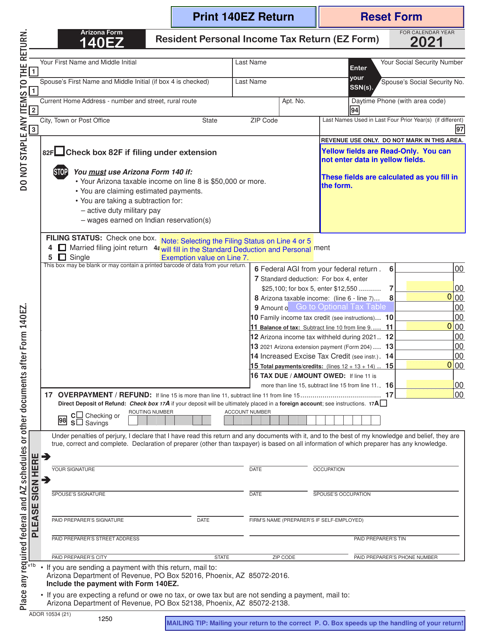

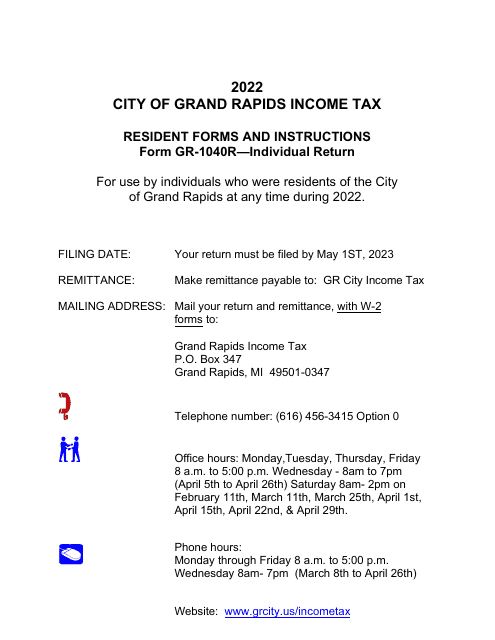

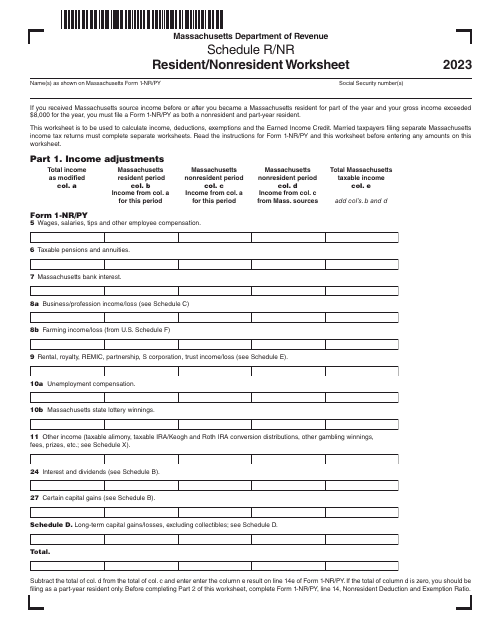

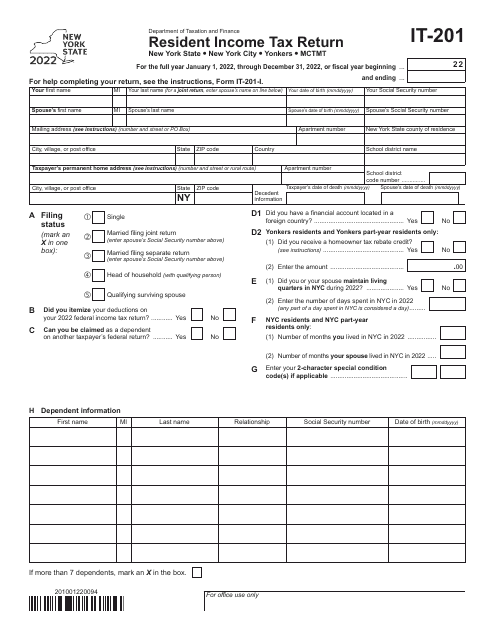

For example, in Canada, you can find Form RC520 Declaration of Tax Residence for Individuals, which is a crucial document for proving your residency status. Similarly, in the United States, there's Form IT-196 for New York residents and Form NJ-1040-V for New Jersey residents.

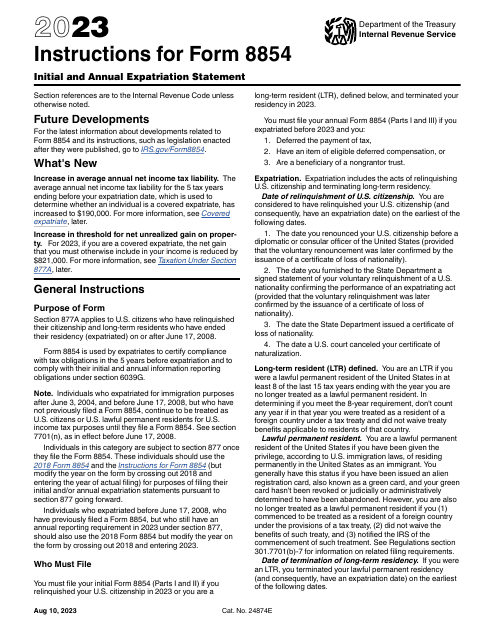

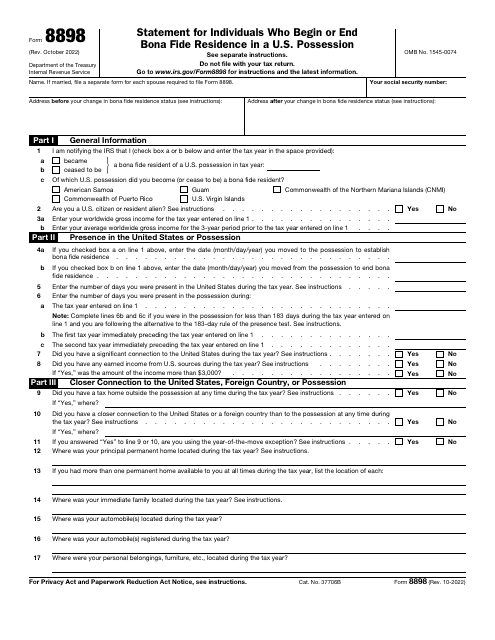

If you are a U.S. citizen residing in a U.S. possession, we also have IRS Form 8898, specifically designed for individuals who begin or end bona fide residence in a U.S. possession.

Our tax residency documents collection provides the necessary resources to understand and comply with tax residency requirements in different jurisdictions. Whether you are a Canadian resident, a U.S. resident, or a resident of any other country, we have the forms and information you need to ensure proper tax reporting.

Don't let tax residency confusion slow you down. Access our comprehensive tax residency documents collection, also known as resident tax forms, and make sure you accurately declare your tax residency to avoid any potential issues with tax authorities.

Documents:

32

This form is used for reporting itemized deductions for residents of New York on their state tax return.

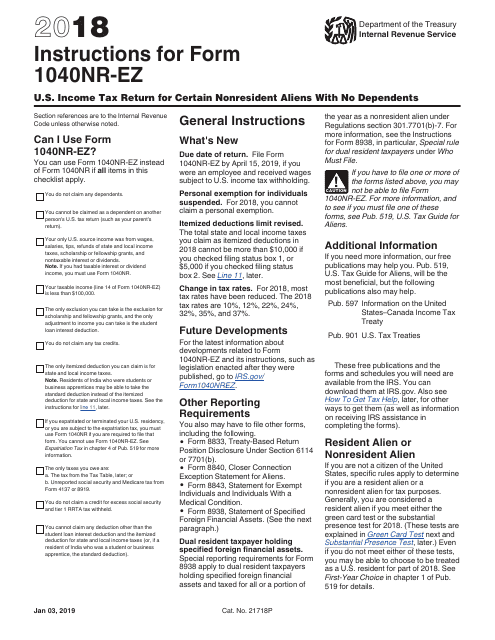

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

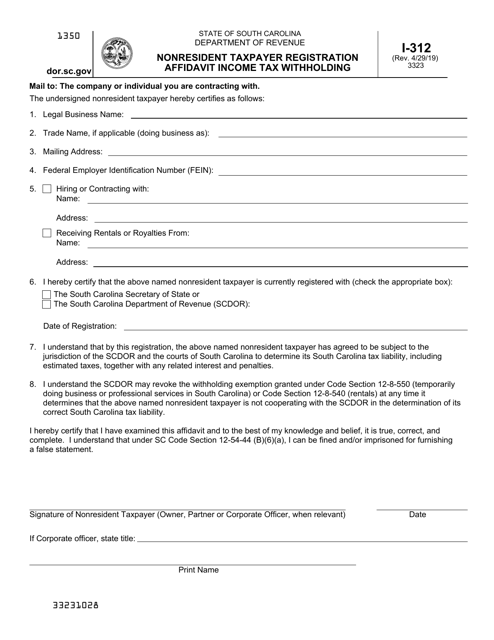

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

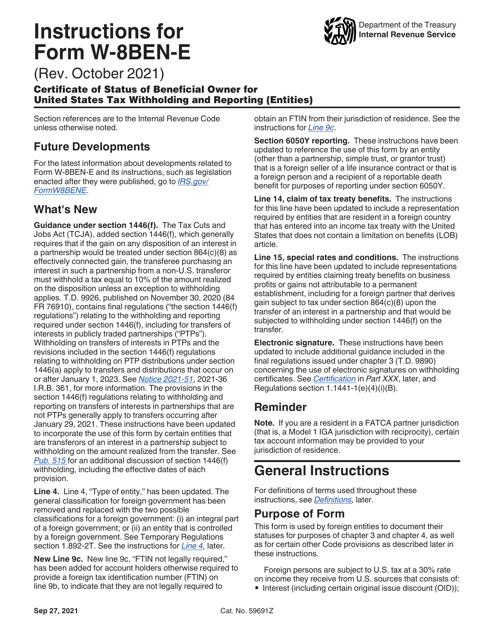

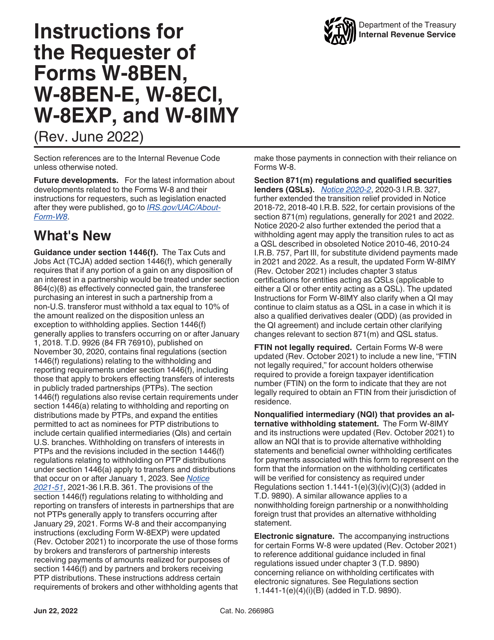

This document provides instructions for individuals or entities requesting Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. It explains how to complete these forms necessary for tax purposes.

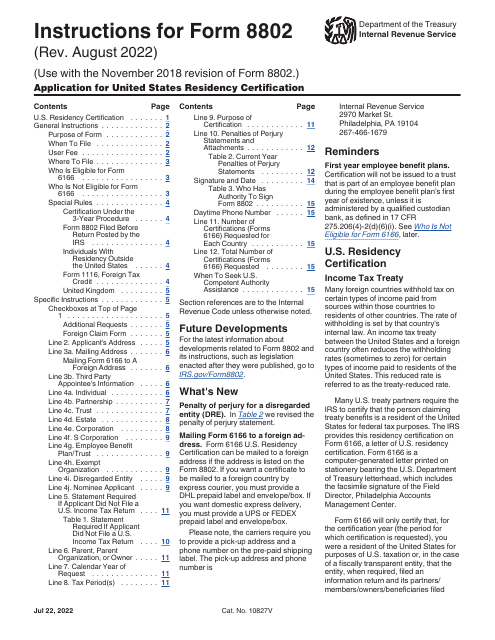

These are the official instructions for IRS Form 8802 and is used to help certify an applicant's United States residency.

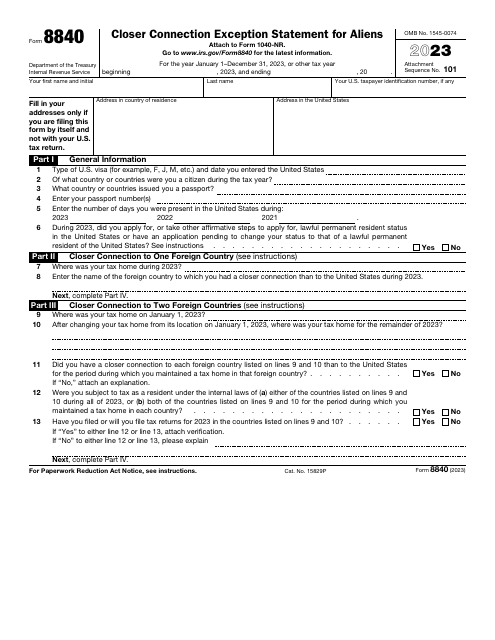

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.