Residential Investment Templates

Are you looking to invest in residential properties? Do you want to take advantage of tax exemptions and benefits available to residential property owners? Our residential investment documents collection has everything you need to get started.

Residential investment, also known as investing in residential properties, can be a lucrative venture. However, navigating the complex tax landscape and applying for exemptions can be daunting. That's where our collection of residential investment documents comes in handy.

Whether you're in Syracuse, New York, Utica, New York, or any other city, we have the appropriate application forms for you. Our Form RP-485-J [SYRACUSE] Application for Residential Investment Real Property Tax Exemption - City of Syracuse, New York, and Form RP-485-J [UTICA] Application for Residential Investment Real Property Tax Exemption - City of Utica, New York, forms will help you apply for tax exemptions specific to these cities.

But that's not all. We also offer Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York; Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York, and Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York. These forms are designed for specific school districts and cities, enabling you to maximize your tax savings.

Investing in residential properties can provide a steady stream of income and wealth accumulation. By leveraging our comprehensive collection of residential investment documents, you can ensure that you're taking advantage of all available tax benefits and exemptions. Don't miss out on the opportunity to optimize your residential investment. Access our collection today.

Documents:

9

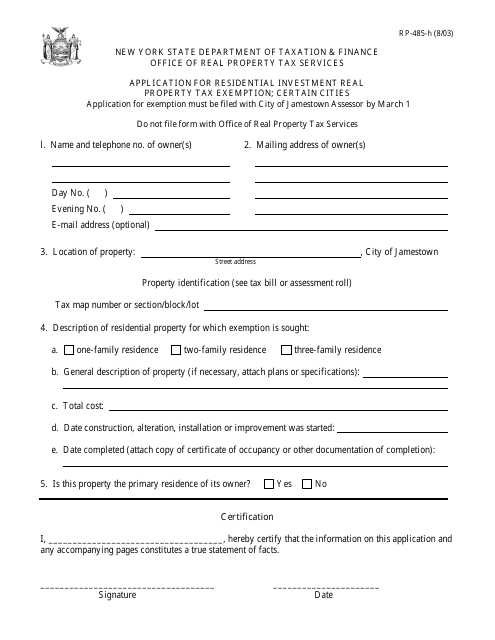

This form is used for applying for a residential investment real property tax exemption in certain cities in New York.

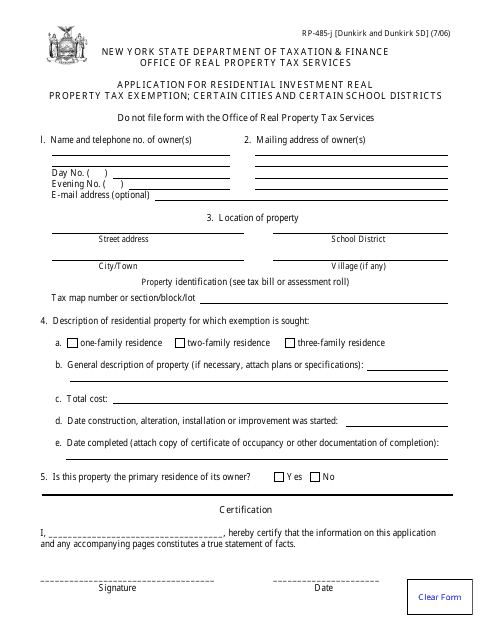

This form is used for applying for a residential investment real property tax exemption in the City of Dunkirk, New York.

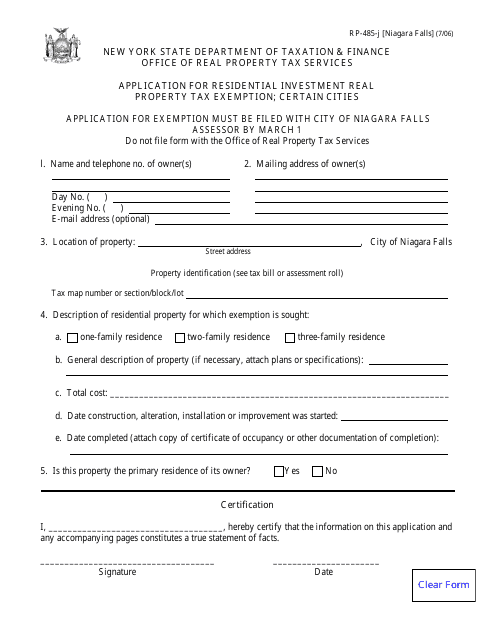

This Form is used for applying for a residential investment real property tax exemption in certain cities, specifically Niagara Falls, New York.

This document is used for applying for a residential investment real property tax exemption in the City of Amsterdam, New York.

This form is used for applying for a residential investment real property tax exemption in the city of Syracuse, New York.

This form is used for applying for a residential investment real property tax exemption in the City of Utica, New York. It is for property owners who are looking for tax relief for their residential investments.

This form is used for applying for a residential investment real property tax exemption in certain school districts within the City of Utica, New York.

This form is used for applying for a residential investment real property tax exemption in certain cities in New York.

This form is used for applying for a tax exemption on residential investment properties in certain school districts in New York.

![Form RP-485-J [AMSTERDAM] Application for Residential Investment Real Property Tax Exemption - City of Amsterdam, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578657/form-rp-485-j-amsterdam-application-for-residential-investment-real-property-tax-exemption-city-of-amsterdam-new-york_big.png)

![Form RP-485-J [SYRACUSE] Application for Residential Investment Real Property Tax Exemption - City of Syracuse, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578658/form-rp-485-j-syracuse-application-for-residential-investment-real-property-tax-exemption-city-of-syracuse-new-york_big.png)

![Form RP-485-J [UTICA] Application for Residential Investment Real Property Tax Exemption - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578659/form-rp-485-j-utica-application-for-residential-investment-real-property-tax-exemption-city-of-utica-new-york_big.png)

![Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york_big.png)

![Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york_big.png)

![Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)