Direct Pay Templates

Are you looking for a convenient and hassle-free method of making payments? Look no further than our Direct Pay service. With Direct Pay, you can pay your bills directly, without the need for intermediaries or additional steps. Say goodbye to the inconvenience of mailing checks or relying on third-party providers.

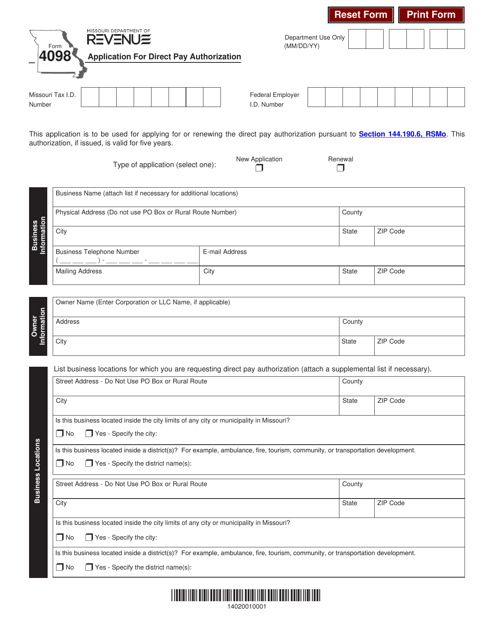

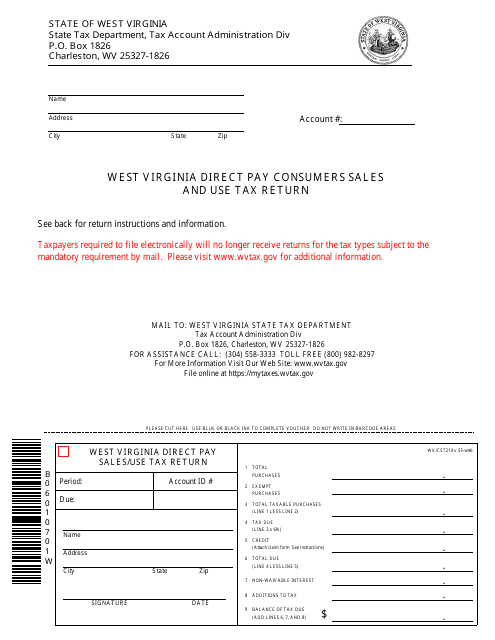

Our Direct Pay service offers a seamless experience for making payments. Whether you need to pay your taxes, utility bills, or any other expenses, Direct Pay simplifies the process. You can easily authorize direct payments through our user-friendly forms, such as the Form 4098 Application for Direct Pay Authorization in Missouri or the Form WV/CST-210 West Virginia Direct Pay Consumers Sales and Use Tax Return in West Virginia. Our forms are designed to streamline the process and make it easy for you to set up Direct Pay.

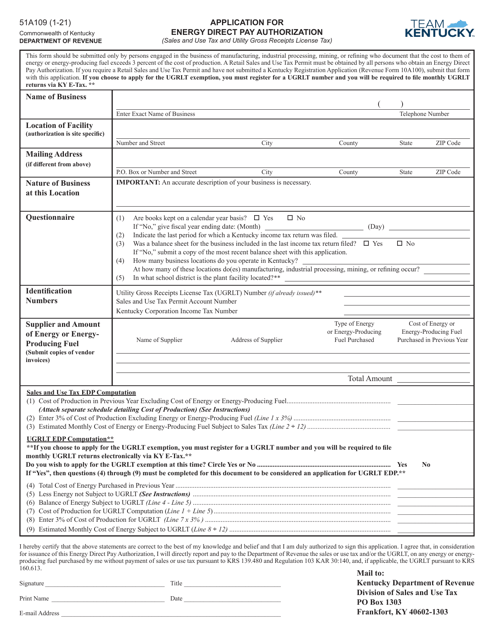

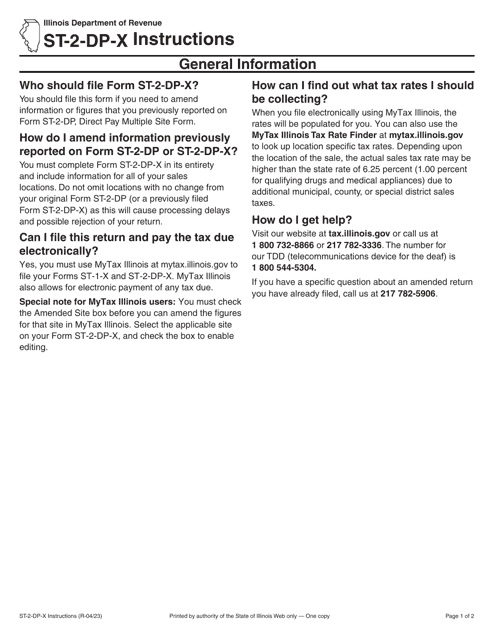

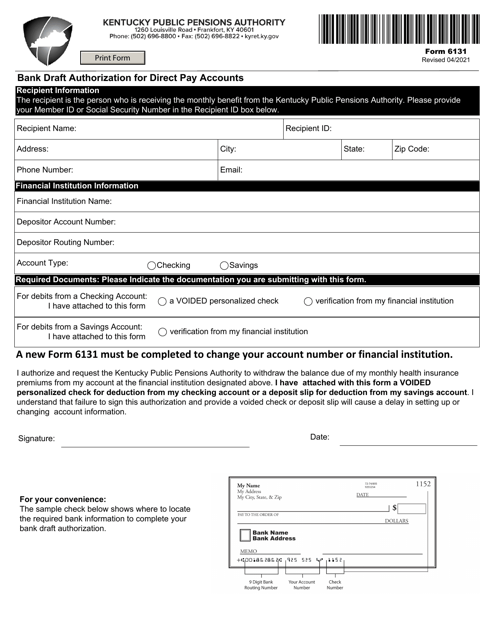

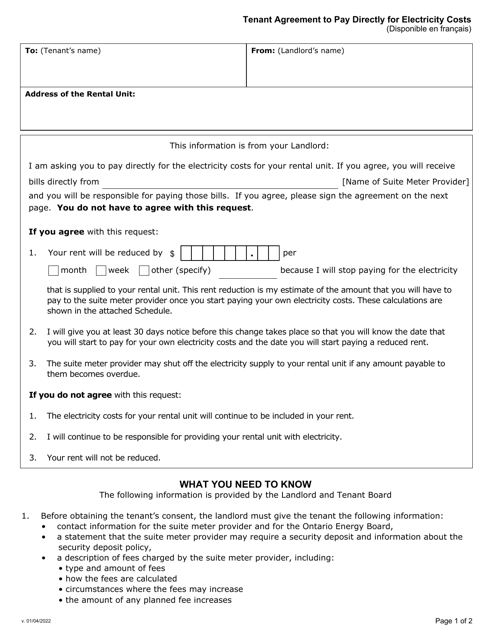

If you're looking to amend multiple direct pay sites, our Instructions for Form ST-2-DP-X Amended Direct Pay Multiple Site Form in Illinois provide clear guidelines to ensure a smooth transition. We understand that every state and province may have different requirements, which is why we have forms tailored to specific regions, like the Form 51A109 Application for Energy Direct Pay Authorization in Kentucky or the Tenant Agreement to Pay Directly for Electricity Costs in Ontario, Canada.

Say goodbye to the hassle of traditional payment methods and embrace the simplicity of Direct Pay. Our service eliminates the need for paper checks, reduces the risk of misplaced payments, and provides you with the convenience of paying bills directly. Explore our range of direct pay forms and take control of your financial transactions with ease.

Documents:

14

This document is used for filing the West Virginia Direct Pay Consumer Sales and Use Tax Return in the state of West Virginia. It is a form for individuals or businesses who have been granted direct payment authority to report and remit sales and use tax directly to the state. It allows for the reporting of taxable purchases and the calculation of tax due.

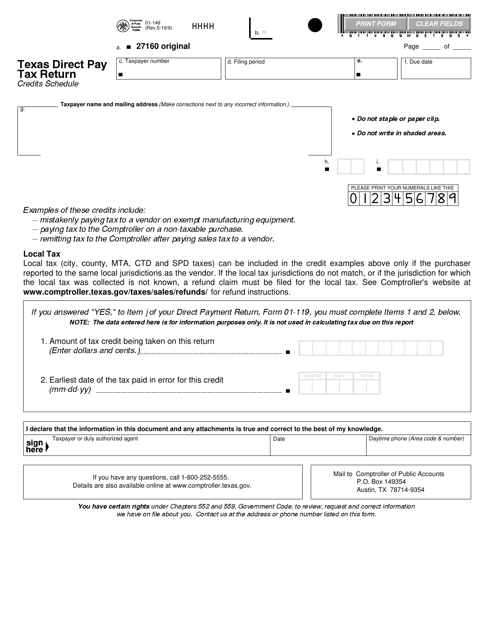

This form is used for reporting and claiming tax credits on the Texas Direct Pay Tax Return.

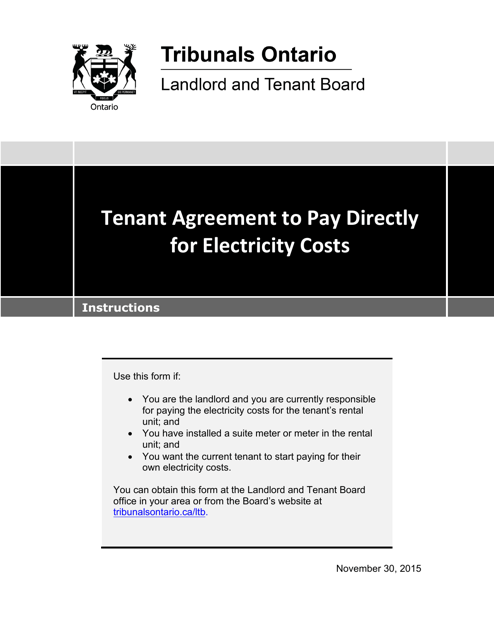

This document is for tenants in Ontario, Canada who will be responsible for paying their own electricity costs. It provides instructions on how to set up and manage the electricity account, as well as the obligations and responsibilities of the tenant regarding electricity usage and payments.

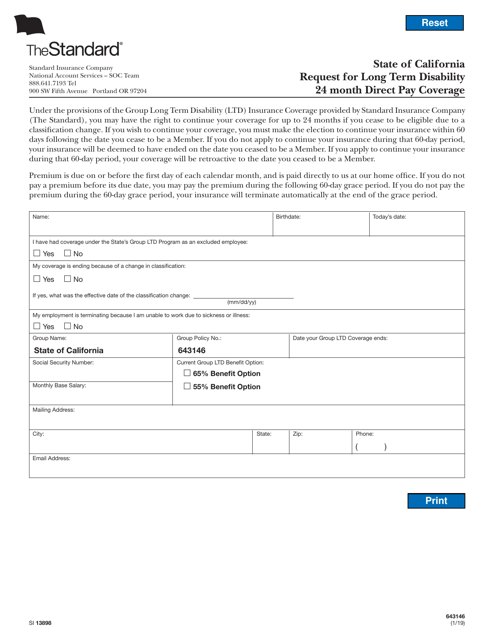

This form is used for requesting long-term disability coverage for a period of 24 months, with direct payment option, in California.

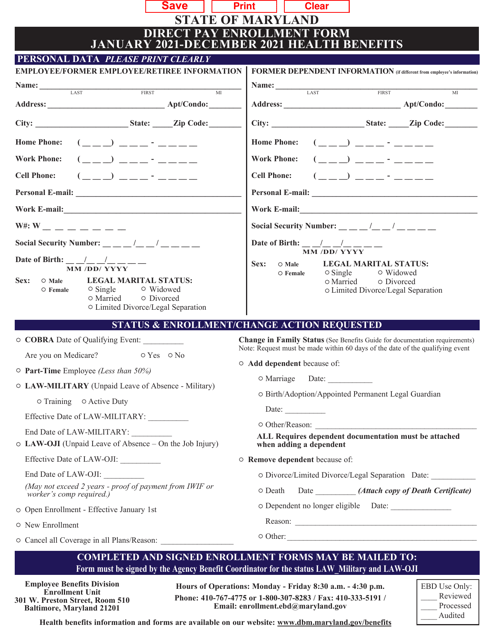

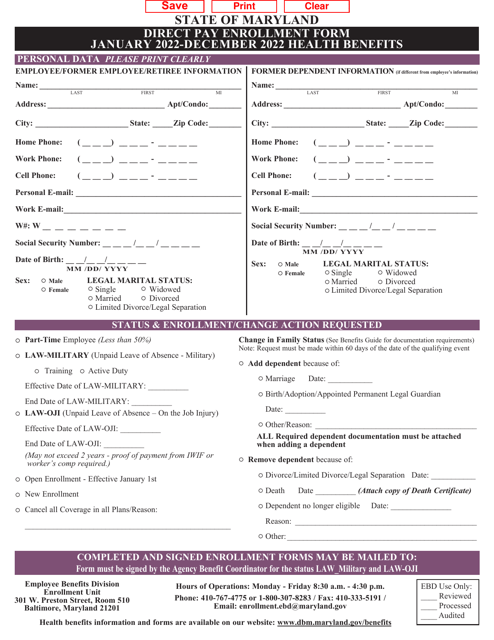

This Form is used for enrolling in the Direct Pay program for health benefits in Maryland.

This document is a Tenant Agreement specific to the province of Ontario, Canada. It allows tenants to pay directly for their electricity costs instead of having them included in their rent.