Charitable Contributions Templates

Are you looking to make a difference in your community? Consider making charitable contributions or donations. Charitable contributions are a way to support causes you care about while also potentially receiving tax benefits.

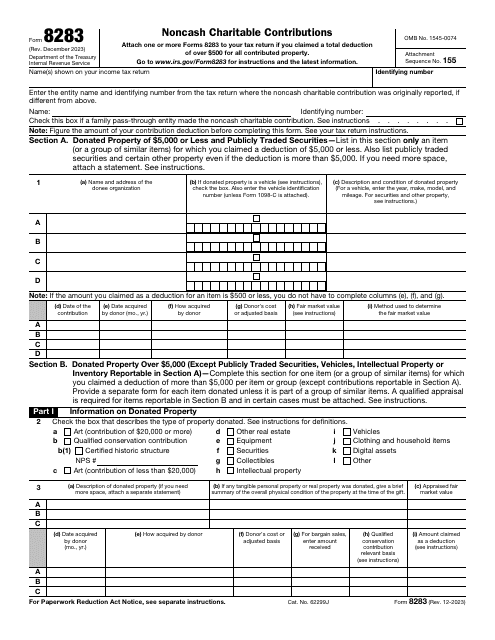

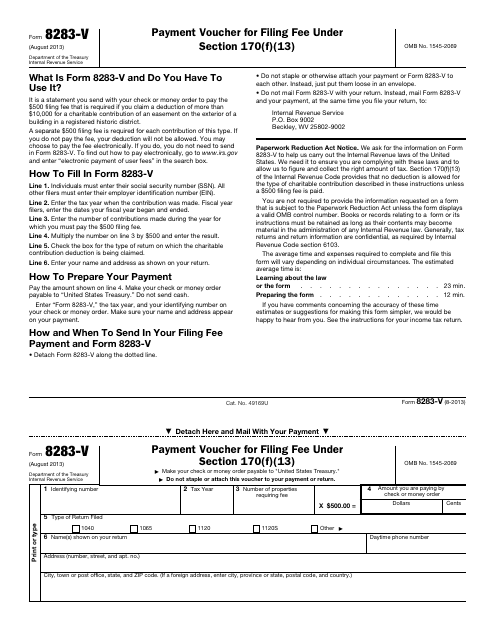

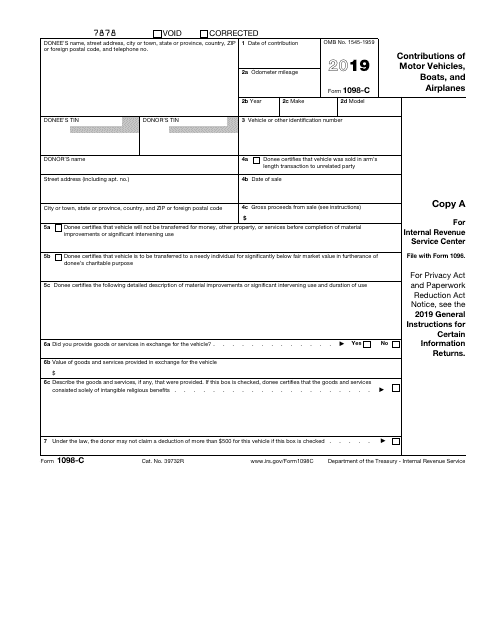

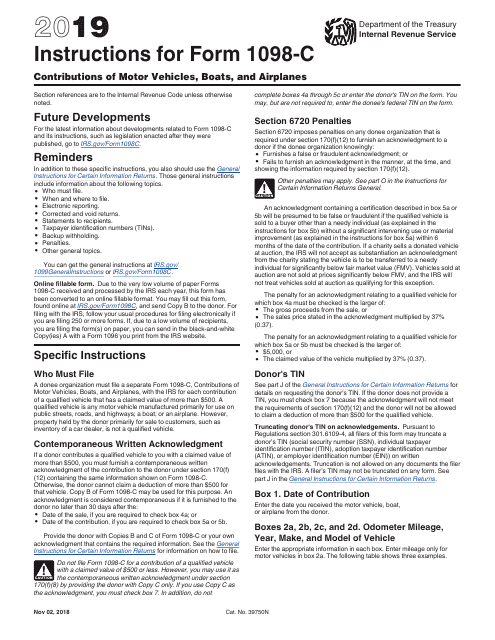

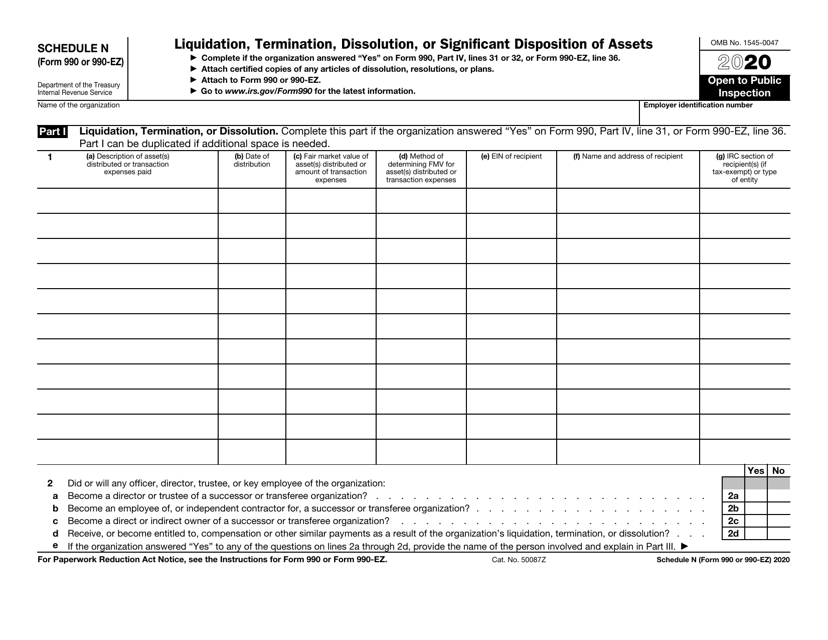

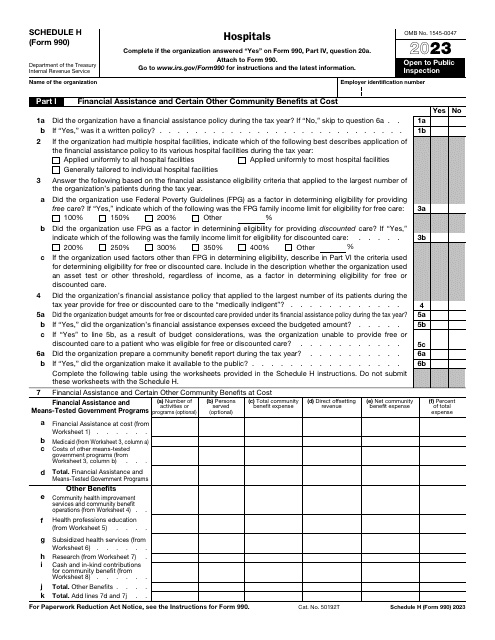

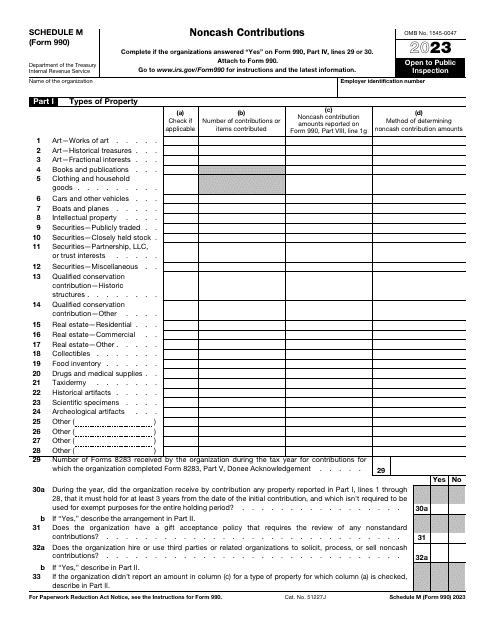

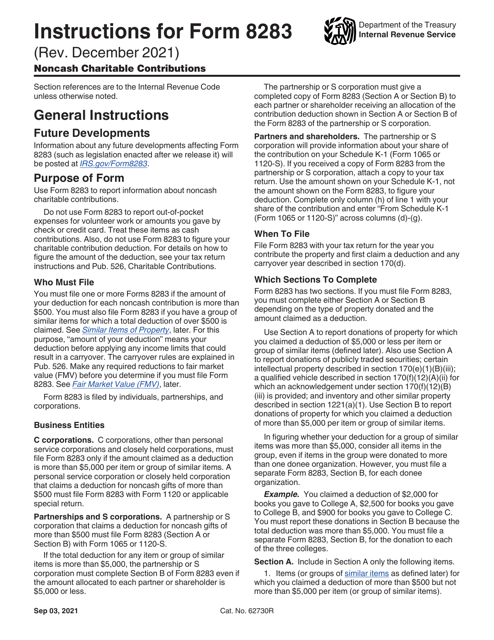

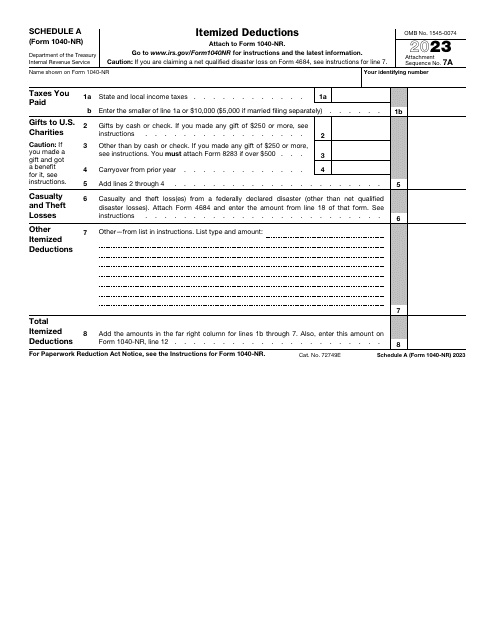

Whether you want to donate a motor vehicle, boat, or airplane, or give noncash items such as clothing, electronics, or furniture, there are forms and instructions available to help you navigate the process. For example, the IRS provides Form 1098-C and Form 8283 for reporting contributions of motor vehicles, boats, airplanes, and other noncash items. These forms ensure that your contributions are properly documented for tax purposes.

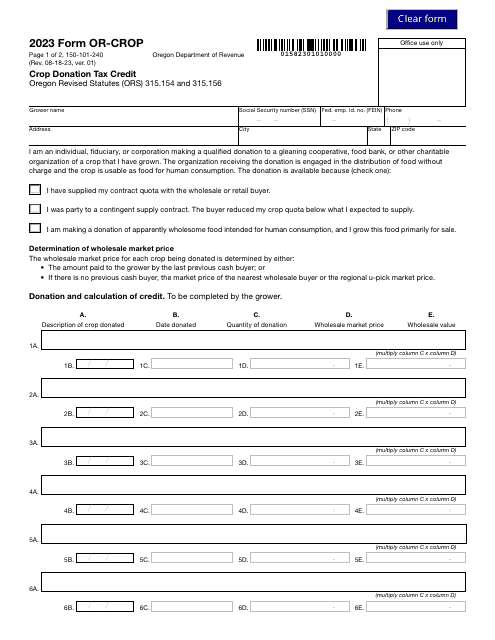

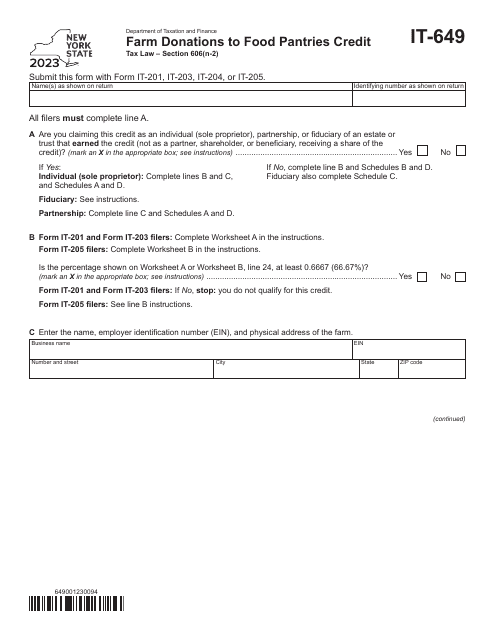

If you are a farmer in New York and want to donate food to food pantries, you may be eligible for the Form IT-649 Farm Donations to Food Pantries Credit. By contributing your excess produce or other farm-related products, you can help address hunger in your community while potentially receiving a tax credit.

Animal lovers in Miami-Dade County, Florida, can contribute to the Animal ServicesTrust Fund through automatic deductions. By setting up regular contributions, you can aid in the care and welfare of animals in need.

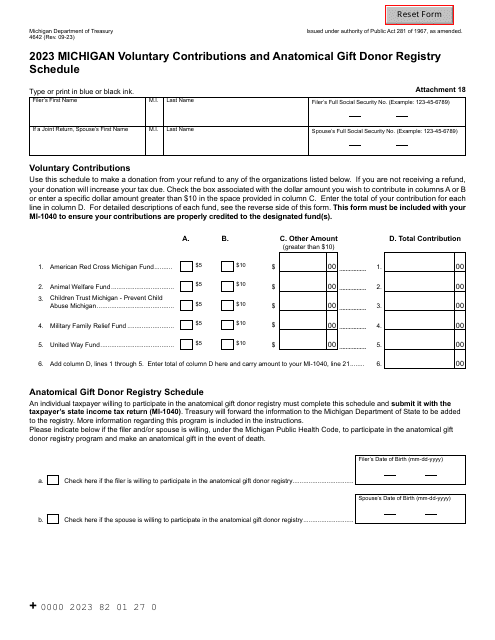

In Colorado, residents can make voluntary contributions to various causes through the Form DR0104CH Voluntary Contributions Schedule. This form allows individuals to support initiatives such as education, wildlife, parks, and forests, among others.

Whatever your philanthropic goals may be, there are resources available to assist you in making charitable contributions. By following the proper procedures and using the appropriate forms, you can make a positive impact in your community while potentially benefiting from tax incentives. Start making a difference today by exploring the various options for charitable contributions.

Documents:

54

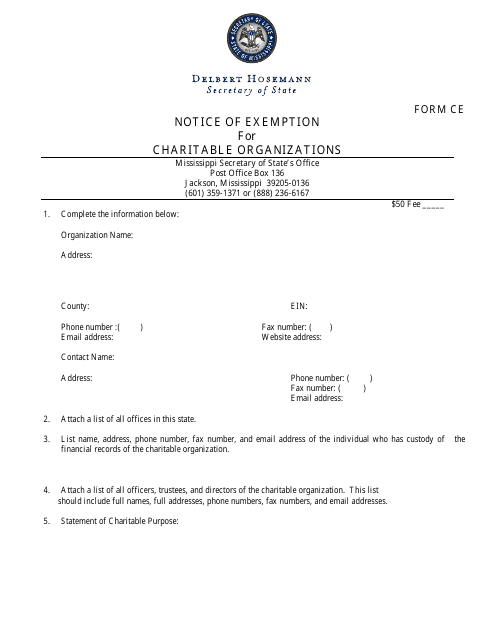

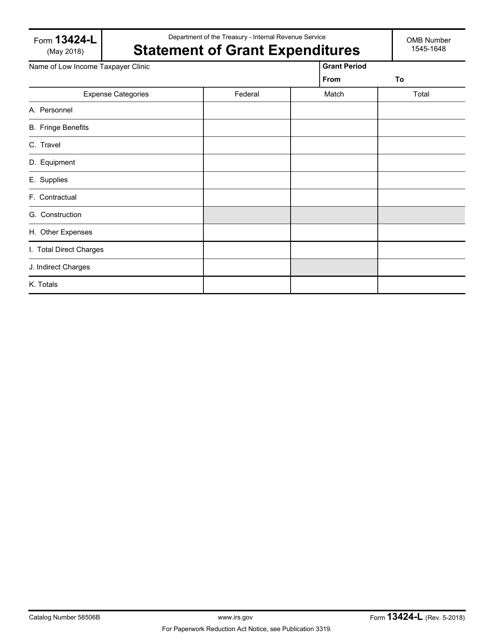

This form is used for charitable organizations in Mississippi to apply for an exemption from certain taxes.

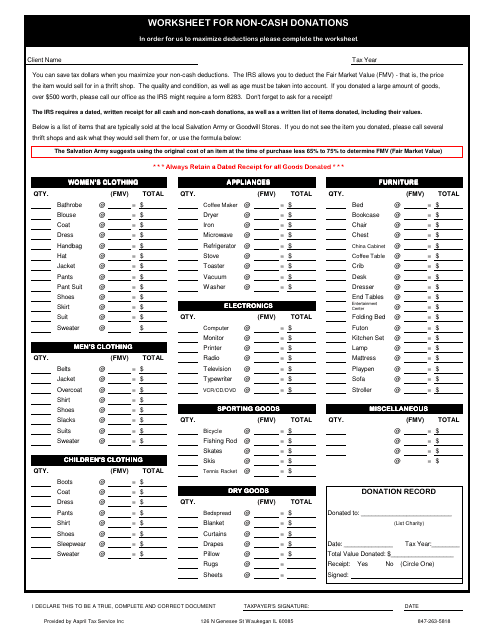

This document is a non-cash donations worksheet template provided by Aapril Tax Service Inc. It helps individuals track their non-cash donations for tax purposes.

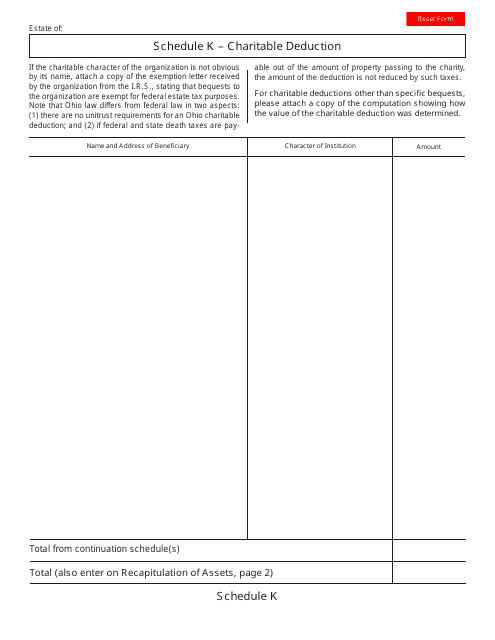

This document is used for reporting charitable deductions on Schedule K in Ohio. It is used to claim deductions for donations made to qualified charitable organizations.

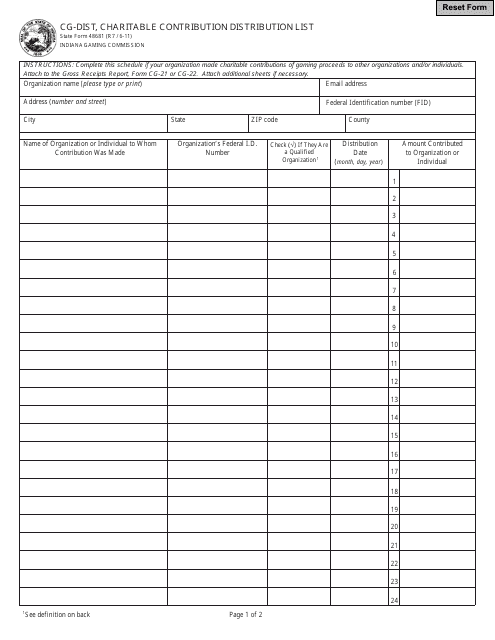

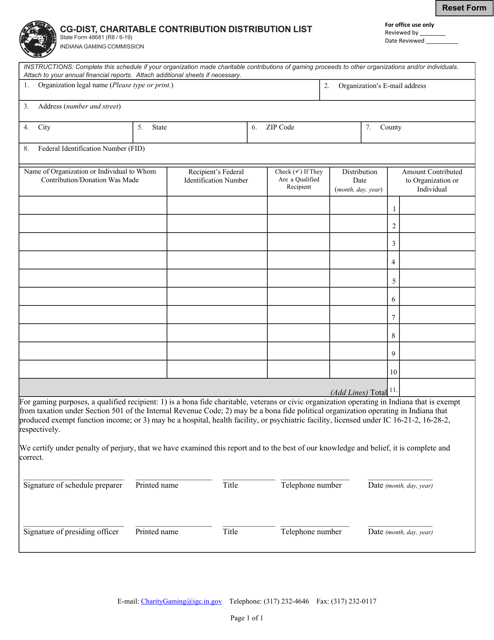

This form is used for reporting charitable contribution distributions in the state of Indiana.

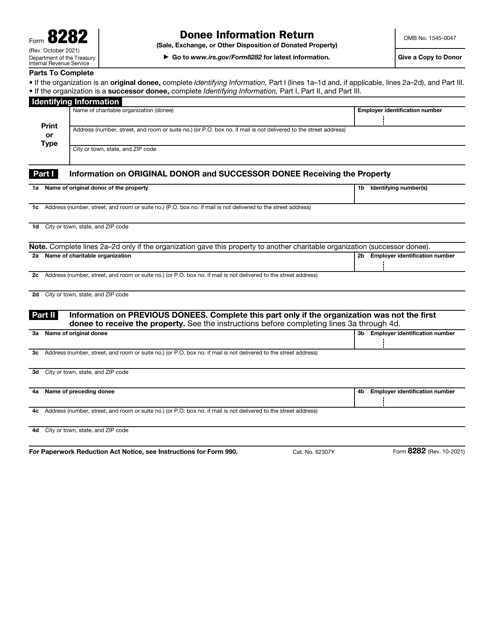

This form lists and details the donations of automobiles, boats, and airplanes made to charitable organizations. It is filed with the Internal Revenue Service (IRS) by the recipient organization.

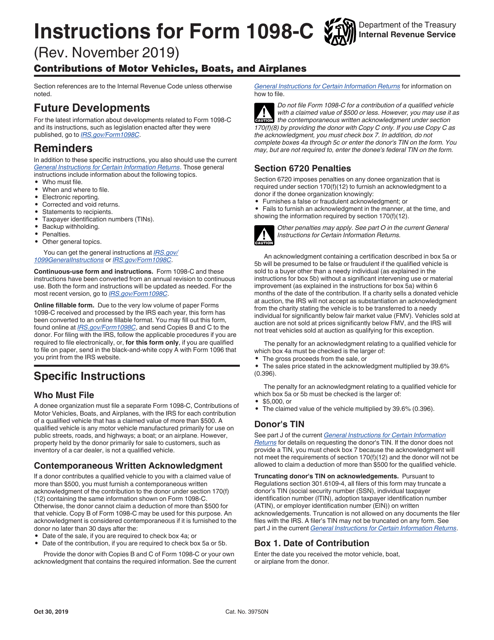

This document is used for reporting contributions of motor vehicles, boats, and airplanes to qualifying organizations.

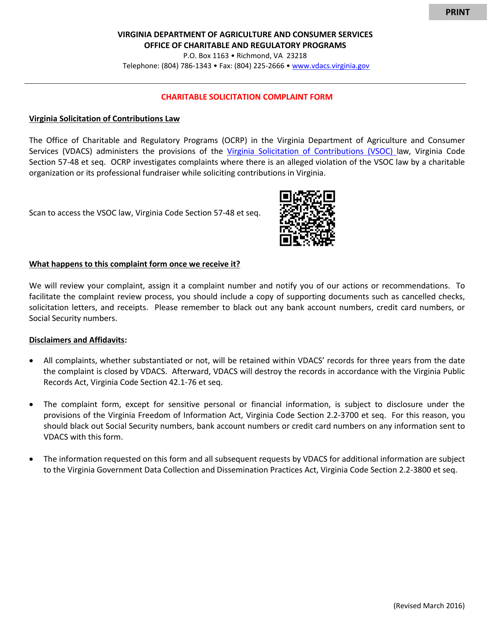

This Form is used for reporting charitable solicitation compliance in the state of Virginia. It ensures that organizations are following the necessary rules and regulations for soliciting donations.

This form is used for reporting a charitable contribution distribution list in the state of Indiana.

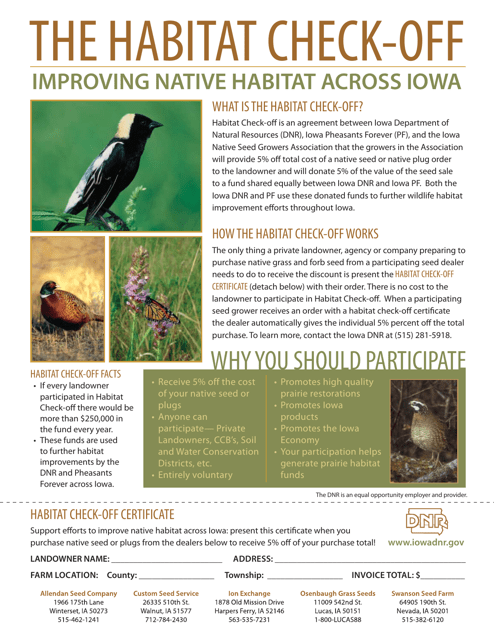

This document certifies that a habitat check-off contribution has been made in the state of Iowa. It helps support conservation efforts and protect wildlife habitats in Iowa.

This Form is used for reporting contributions of motor vehicles, boats, and airplanes to the IRS. It provides instructions on how to properly report the donation for tax purposes.

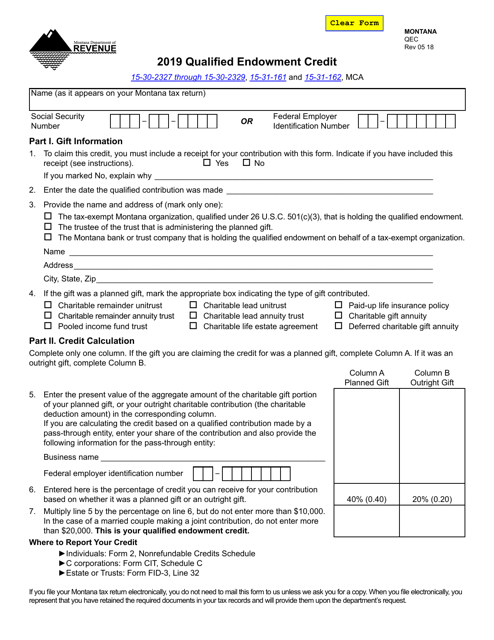

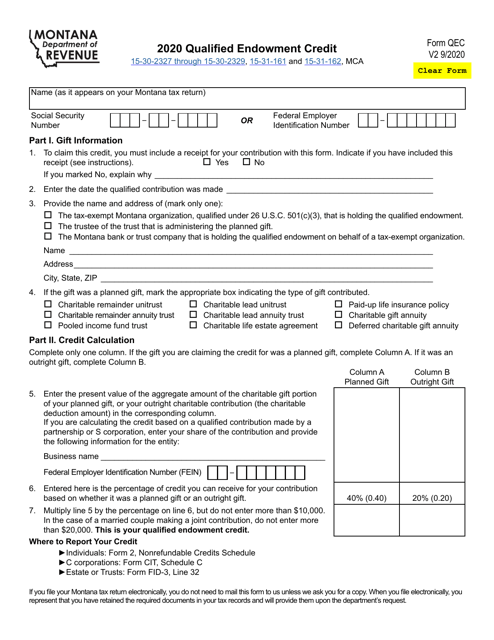

This Form is used for claiming the Qualified Endowment Credit in Montana. The credit is available to individuals and businesses contributing to qualified endowment funds.

This form is used for claiming the Qualified Endowment Credit in Montana.

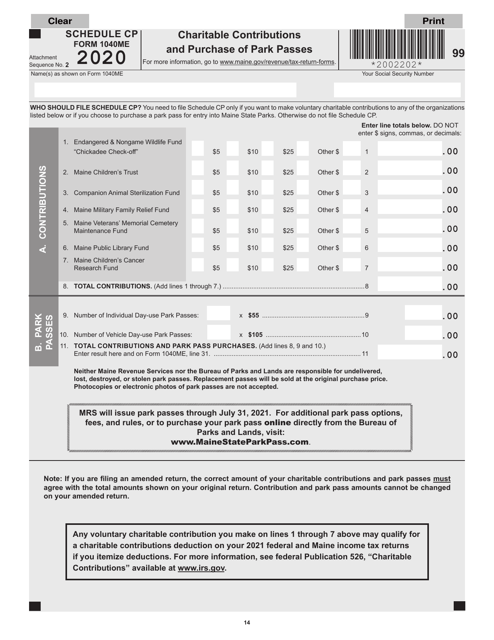

This form is used for reporting charitable contributions and the purchase of park passes in the state of Maine on the Maine tax return.

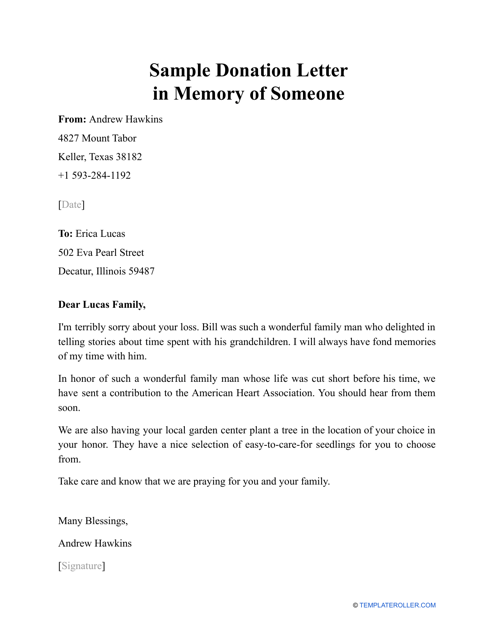

Individuals can use this type of letter as a reference when they would like to make a donation in memory of a deceased person.

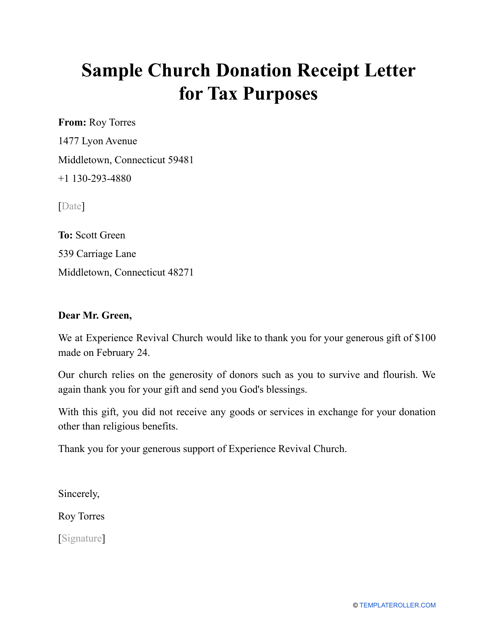

This is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax deduction on their tax return.

This Form is used for registering an institution as a purely public charity in the state of Pennsylvania.

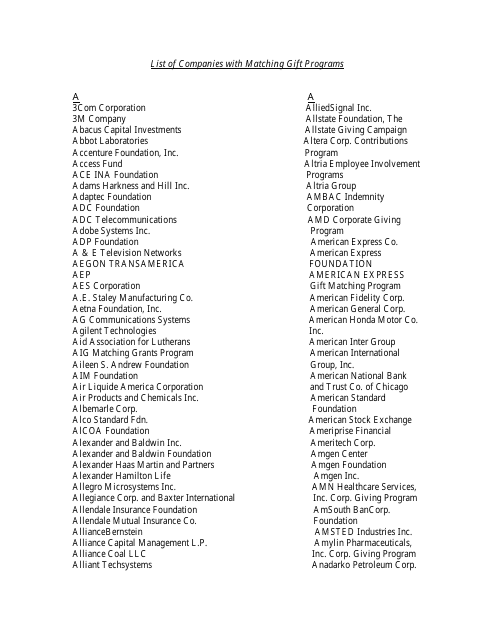

This document lists companies that have matching gift programs. Matching gift programs are where companies match the donations made by their employees to eligible nonprofit organizations.