State Tax Refund Templates

Are you looking to claim a state tax refund? Look no further! Our website is your one-stop destination for all things related to state tax refunds, also known as state tax refunds. We understand that navigating the complex world of state tax laws can be overwhelming, which is why we have compiled a comprehensive collection of resources to guide you through the process.

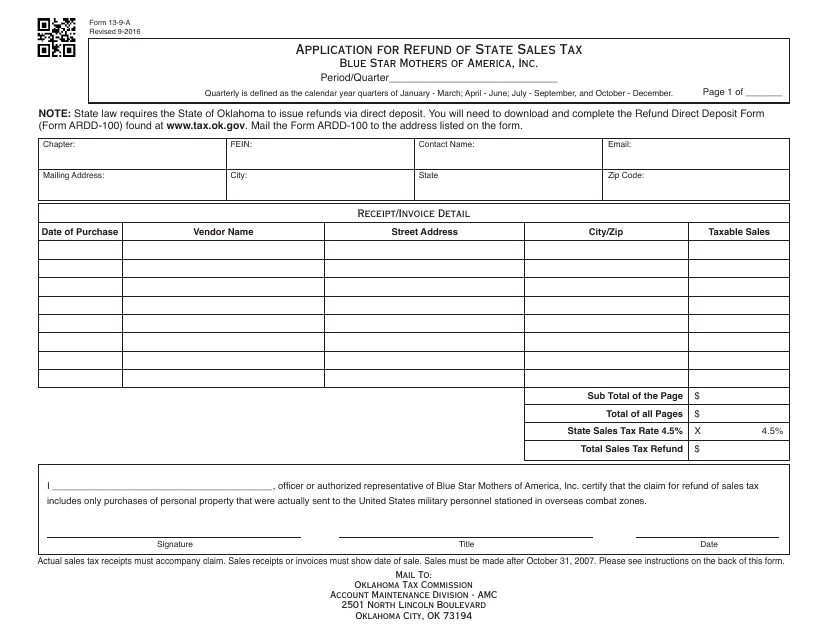

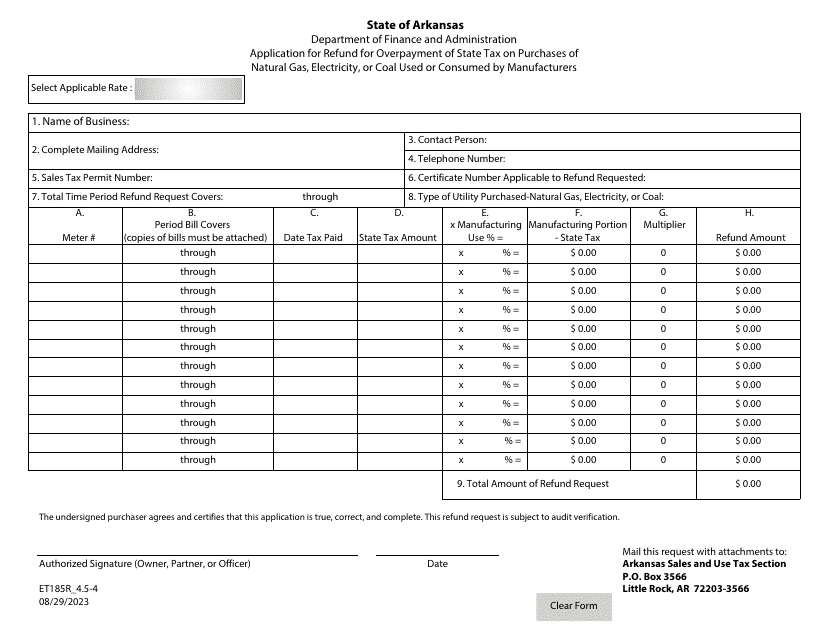

Whether you're an individual taxpayer or a business owner, our diverse range of state tax refund documents will cater to your specific needs. From the OTC Form 13-9-A Application for Refund of State Sales Tax in Oklahoma, to the Form ET185R_4.5-4 Application for Refund for Overpayment of State Tax on Purchases of Natural Gas or Electricity Used or Consumed by Manufacturers in Arkansas, we have you covered.

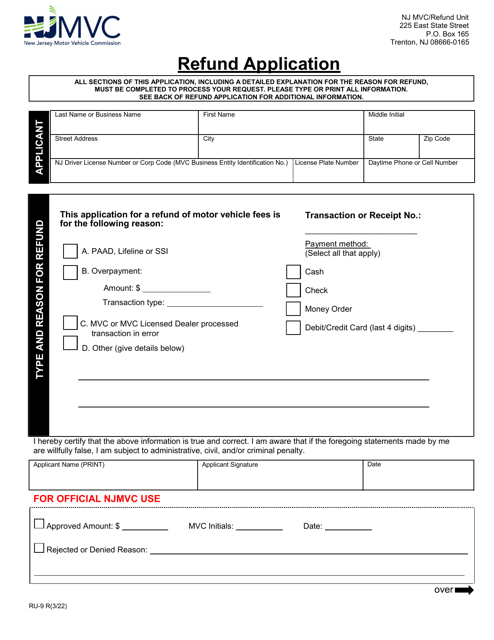

For residents of New Jersey, we have detailed instructions on how to complete the Form NJ-1040X, the New Jersey Amended Resident Income Tax Return. And if you have received certain government payments, such as unemployment compensation or a state income tax refund, you may even need to fill out the IRS Form 1099-G.

Not only do we provide access to these crucial documents, but we also offer valuable insights and guidance on how to maximize your state tax refund. Our team of experts regularly updates our collection to ensure that you have the latest information at your fingertips. So why wait? Start exploring our state tax refund resources now and take control of your finances.

Documents:

11

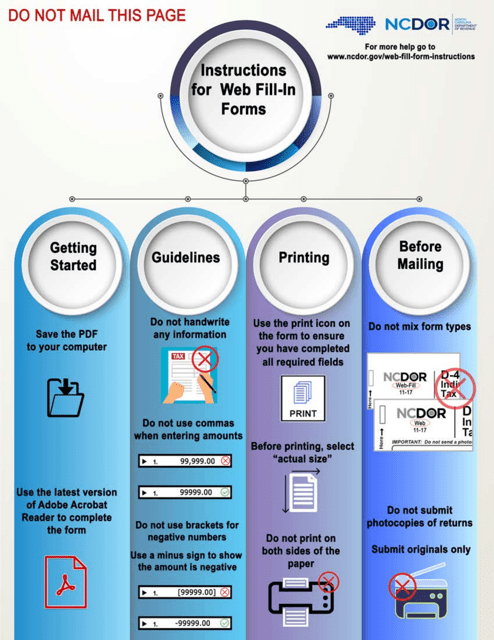

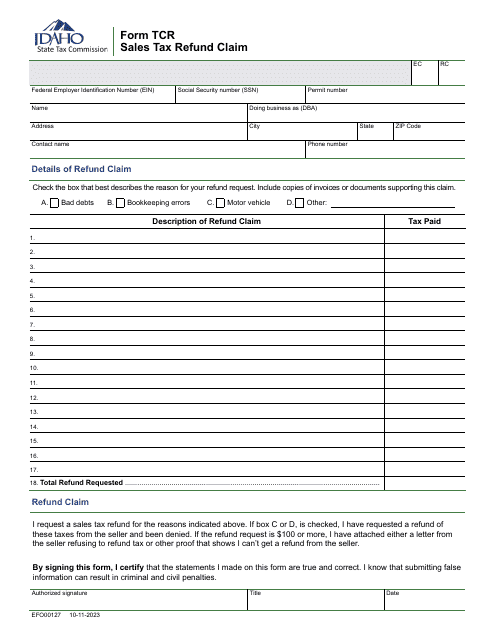

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

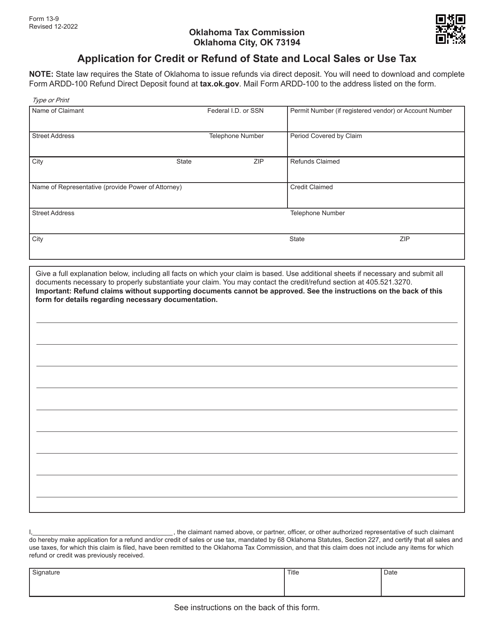

This form is used for applying for a refund of state sales tax in Oklahoma.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.