Tax Relief Programs Templates

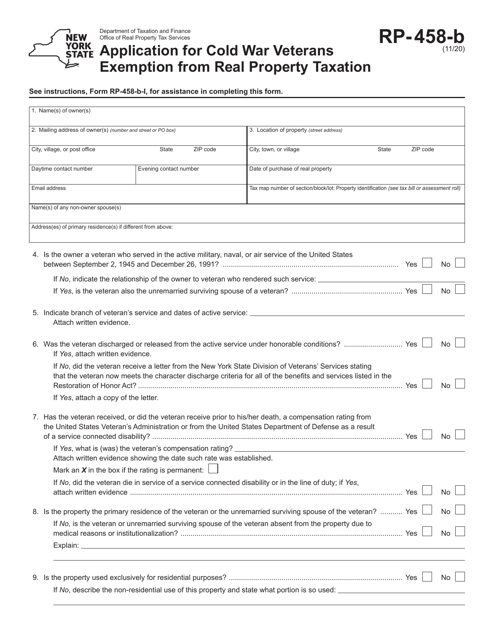

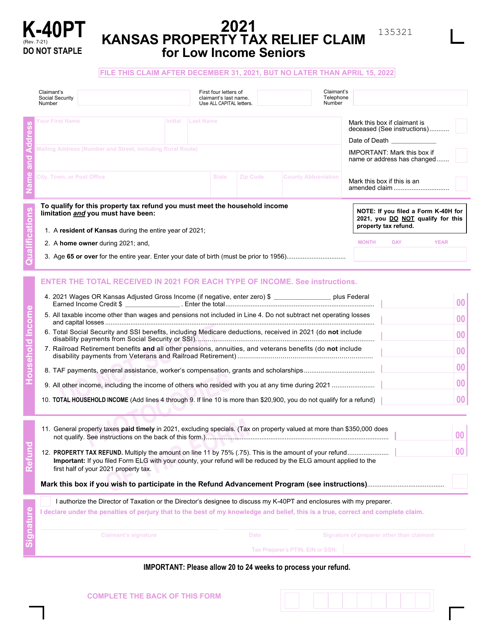

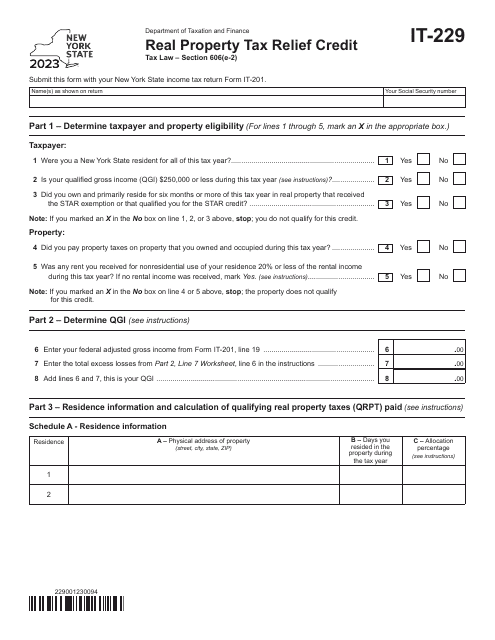

Are you struggling to manage your tax burden? Explore our comprehensive collection of tax relief programs designed to provide assistance to individuals and organizations seeking relief from their tax responsibilities. From state-specific programs like the Disabled Homeowners' Exemption Renewal Application in New York City to the Form RP-458-B Application for Cold War Veterans Exemption From Real Property Taxation, we have you covered. Our tax relief programs range from complaint forms such as Form 11017 to credits like Form IT-229 Real Property Tax Relief Credit. Don't let the complexities of taxes overwhelm you - take advantage of our tax relief programs and alleviate your financial stress. Whether you're an individual or a business owner, our alternate names like tax relief programs or tax relief program capture the essence of the comprehensive assistance we provide.

Documents:

16

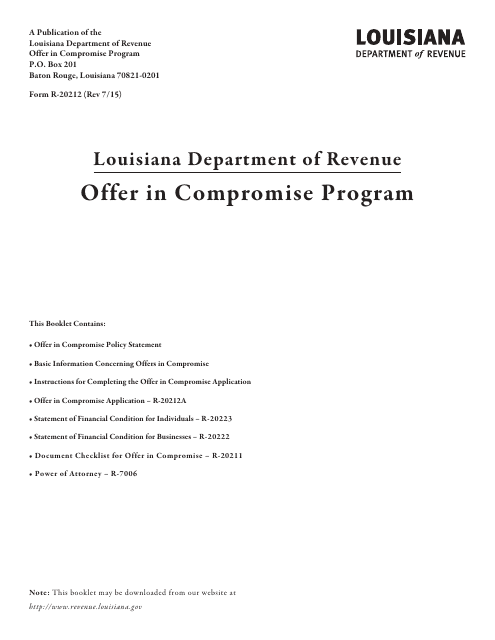

This form is used for the Offer in Compromise Program in the state of Louisiana. It allows taxpayers to settle their tax debts with the state for a reduced amount.

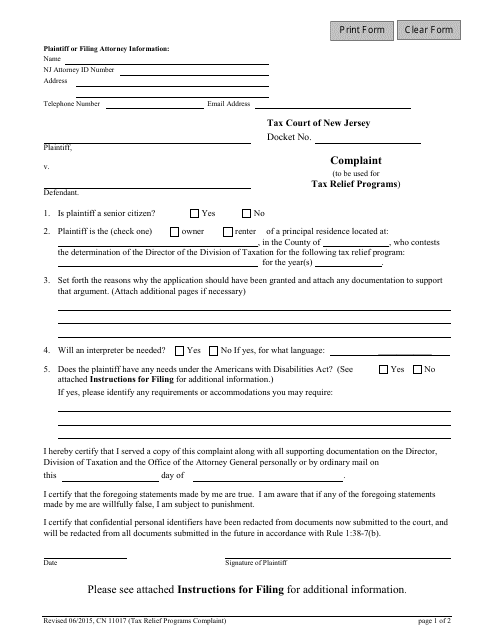

This form is used for filing complaints about tax relief programs in New Jersey.

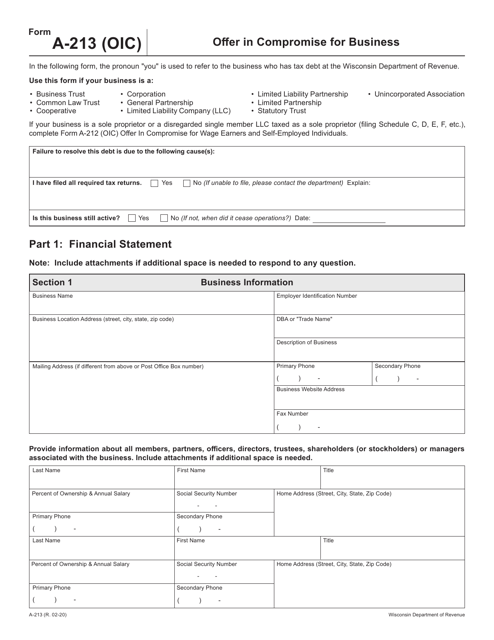

This form is used for making an offer in compromise for a business located in Wisconsin.

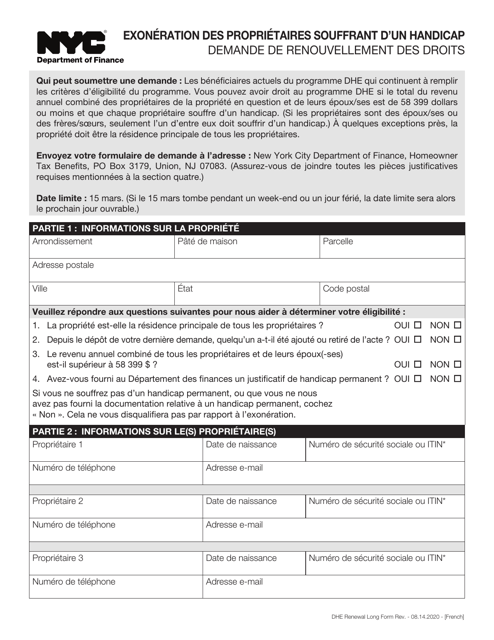

This Form is used for renewing the Disabled Homeowners' Exemption in New York City.

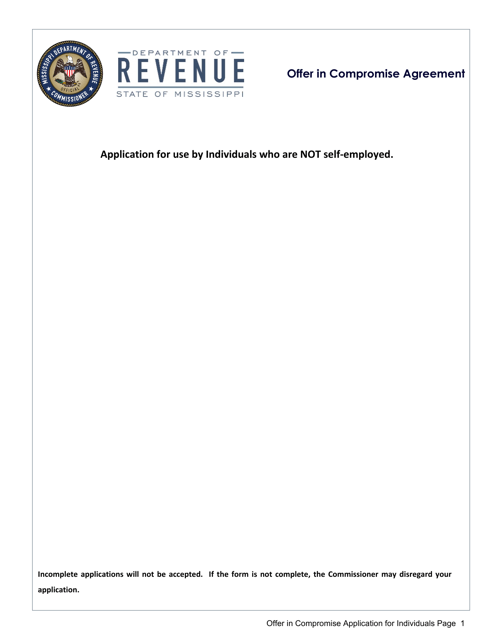

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

This Form is used for applying for a tax abatement on real property in Washington, D.C.

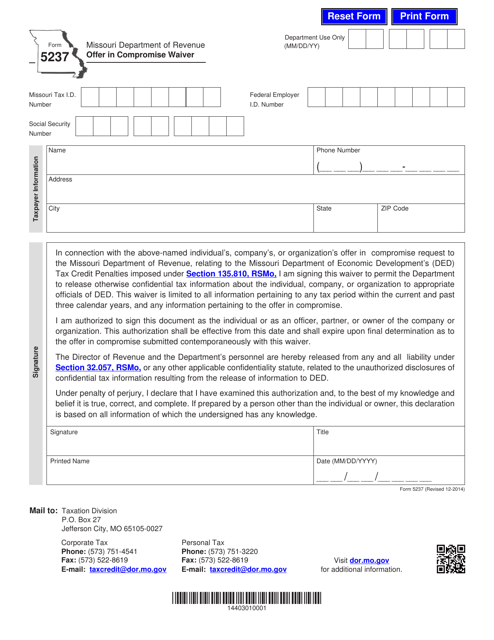

This form is used for applying for an offer in compromise waiver in the state of Missouri.

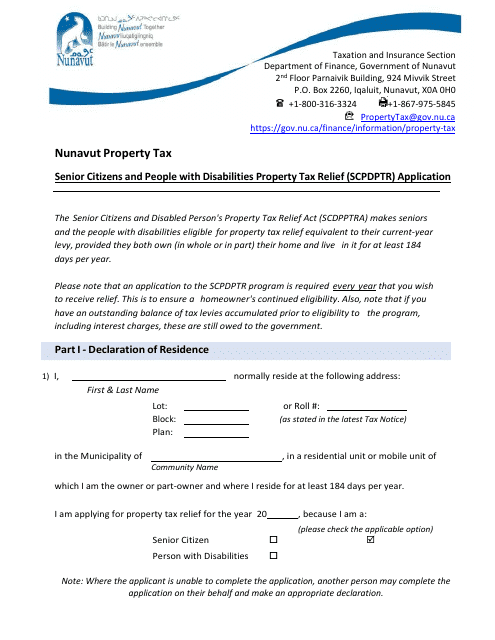

This document is for residents of Nunavut, Canada who are senior citizens or people with disabilities. It is an application for property tax relief.