Tax Guidelines Templates

Looking for reliable and up-to-date tax information? Look no further than our extensive collection of tax guidelines. Whether you're a taxpayer, business owner, or tax professional, our tax guidelines provide essential guidance on various tax forms and requirements.

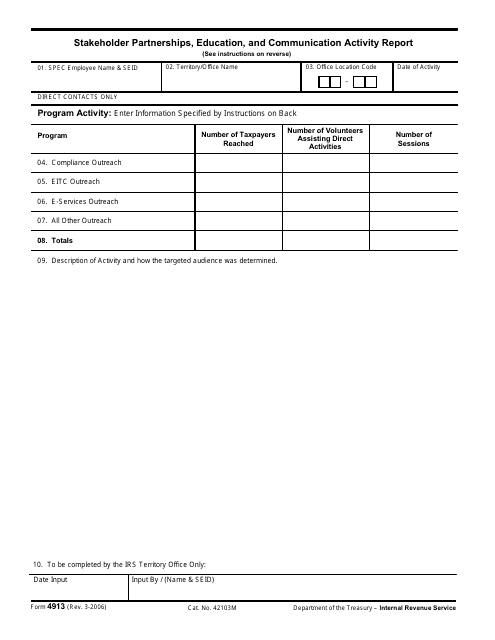

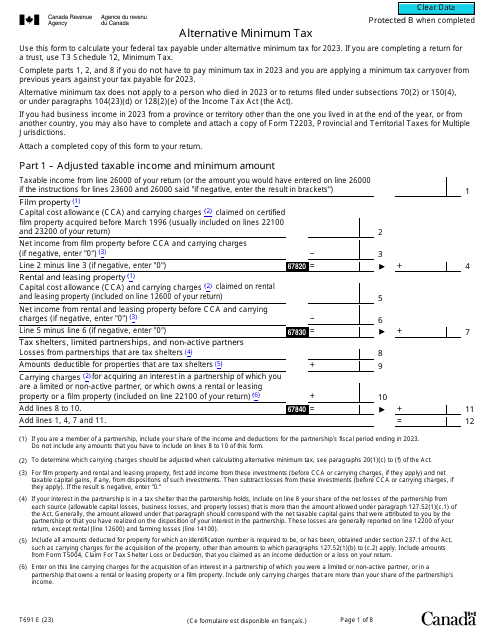

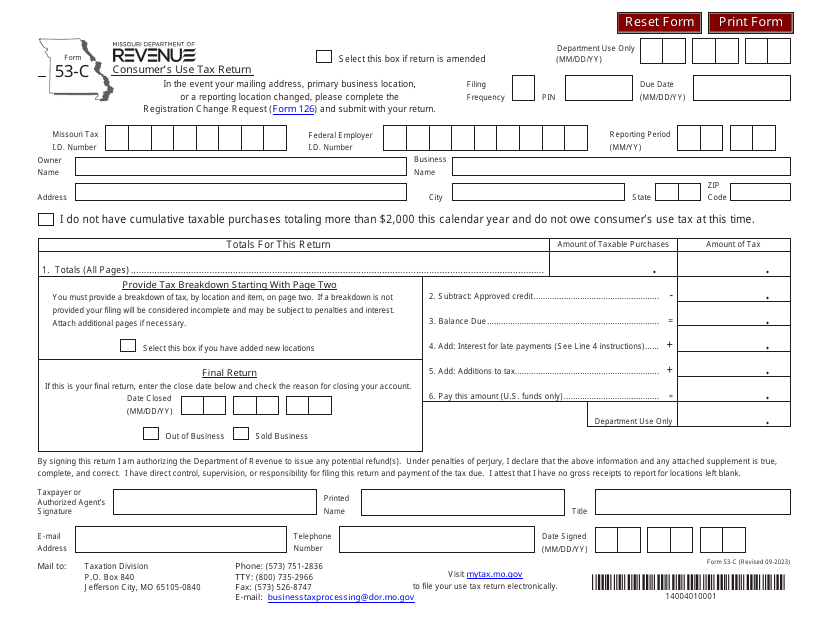

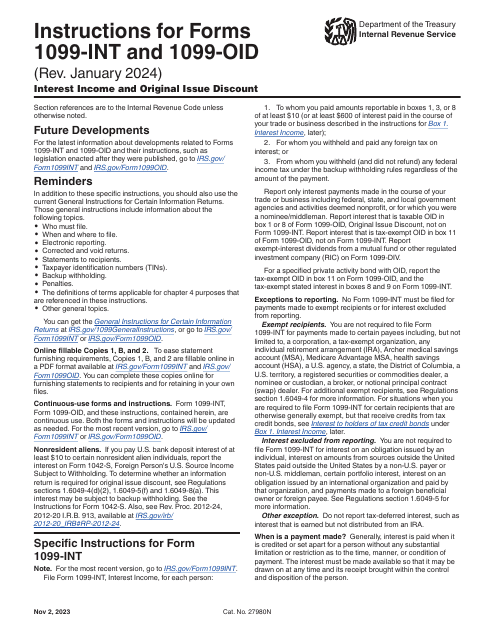

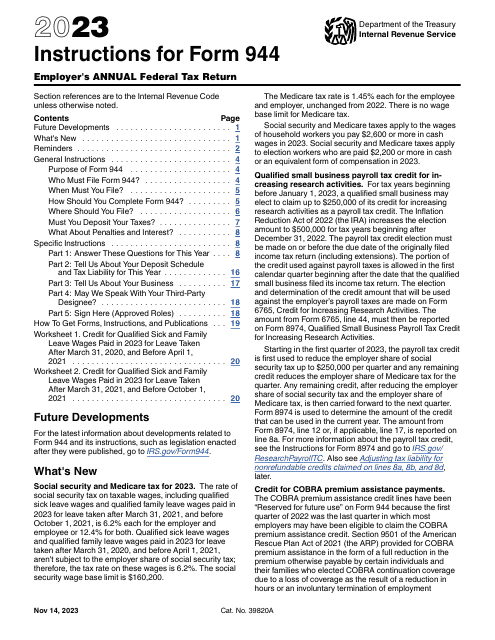

Our tax guidelines cover a wide range of topics and forms, ensuring that you have all the information you need to navigate the complex world of taxes. From IRS Form 4913 Taxpayer Education Statistical Report to Form 53-C Consumer's Use Tax Return in Missouri, we have you covered.

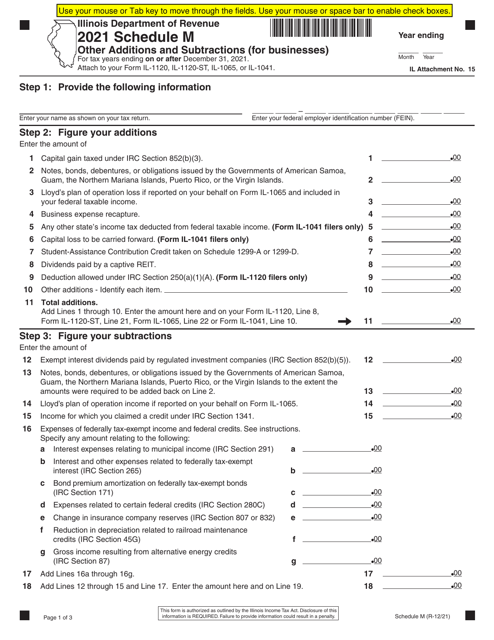

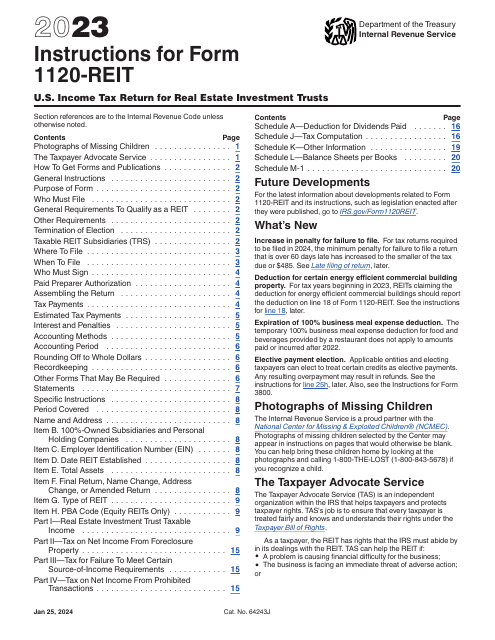

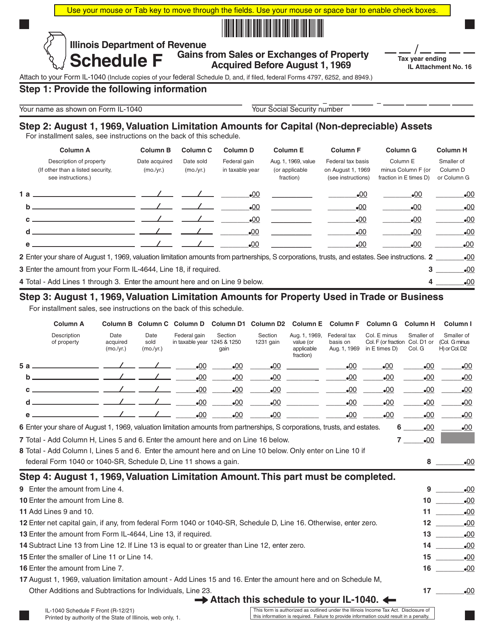

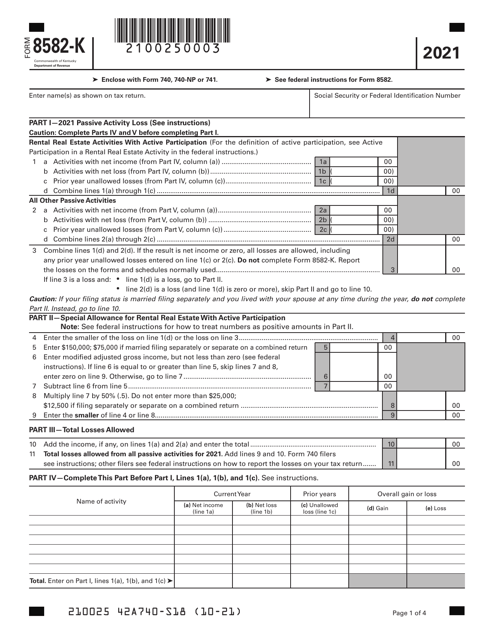

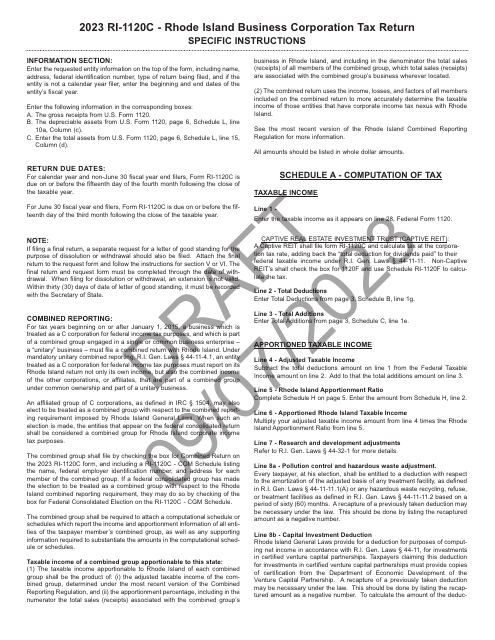

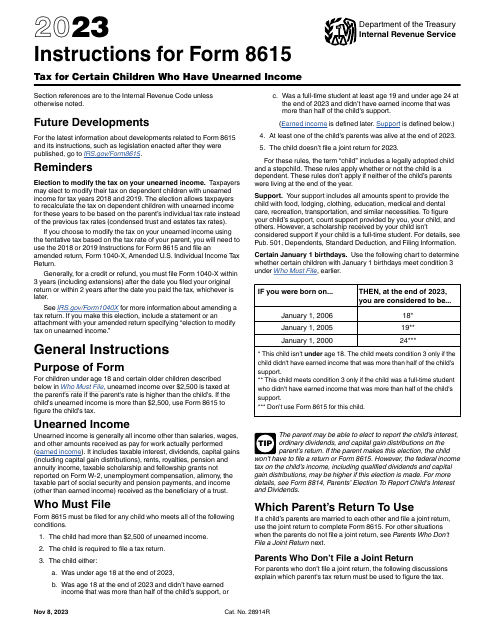

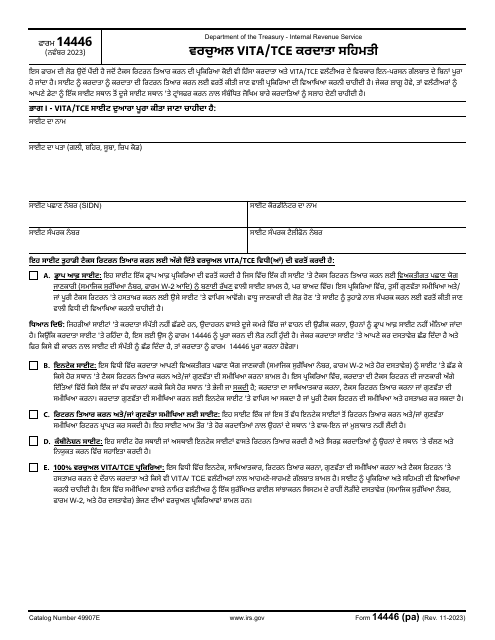

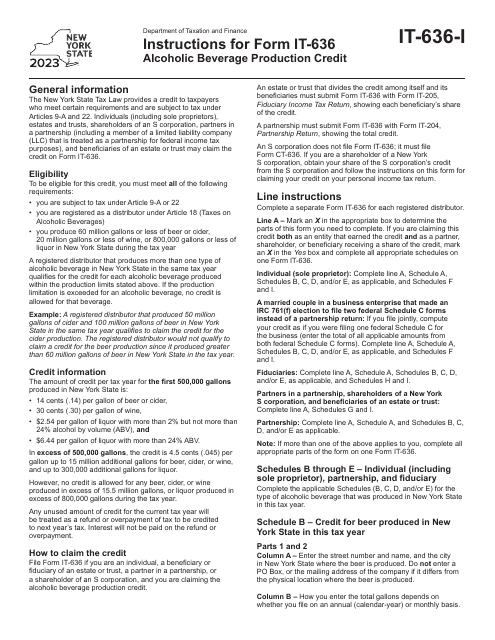

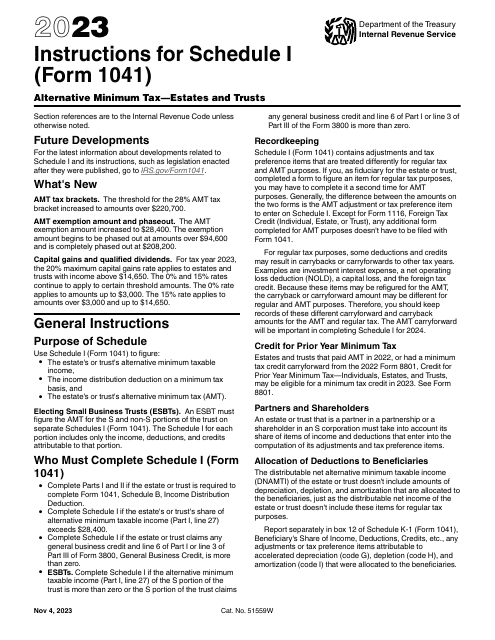

These tax guidelines offer step-by-step instructions, eligibility criteria, and explanations to help you accurately complete your tax forms. We understand that each state may have its own specific requirements, which is why our collection includes Instructions for Form RI-1120C Business Corporation Tax Return in Rhode Island and Instructions for Form I-053I Schedule M Additions to and Subtractions From Income in Wisconsin.

Whether you're dealing with personal taxes, business taxes, or full fee distance guidelines in Idaho with Form ITD3034, our tax guidelines will provide the clarity and guidance you need. Say goodbye to confusion and uncertainty and rely on our comprehensive tax guidelines for accurate and reliable information.

So, whether you're a taxpayer looking for guidance on filling out tax forms or a tax professional seeking the latest updates, our tax guidelines are your go-to resource. Stay informed and maximize your tax benefits with our tax guidelines.

Documents:

47

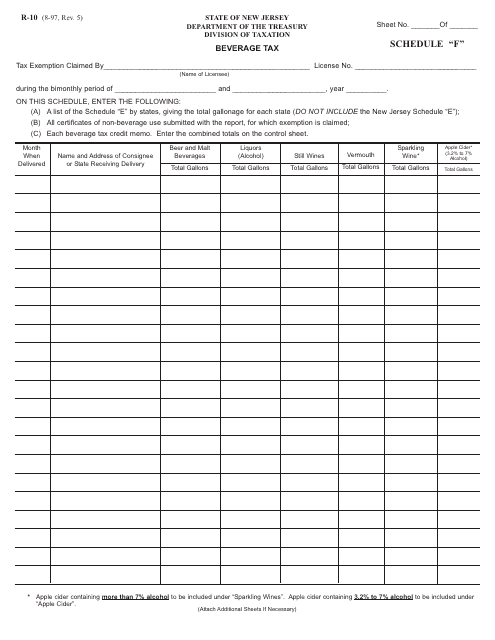

This form is used for reporting beverage taxes in New Jersey

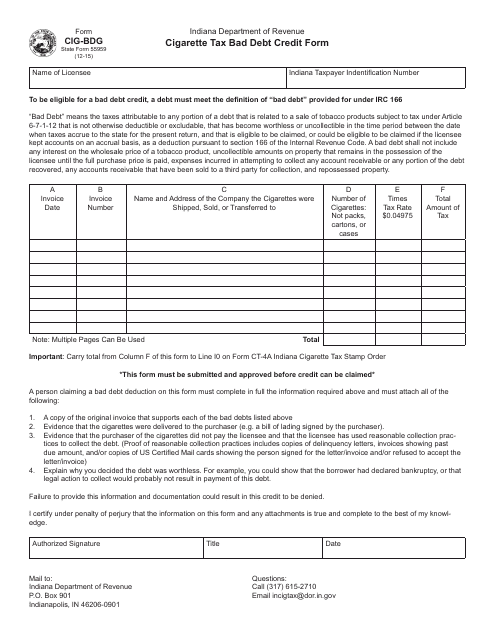

This form is used for claiming a bad debt credit related to cigarette taxes in Indiana.

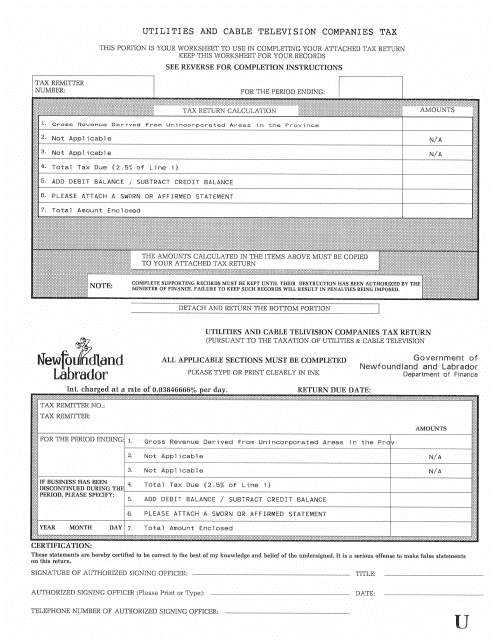

This document is for the tax regulations related to utilities and cable television companies in Newfoundland and Labrador, Canada. It provides information on the taxes applicable to these industries in the province.

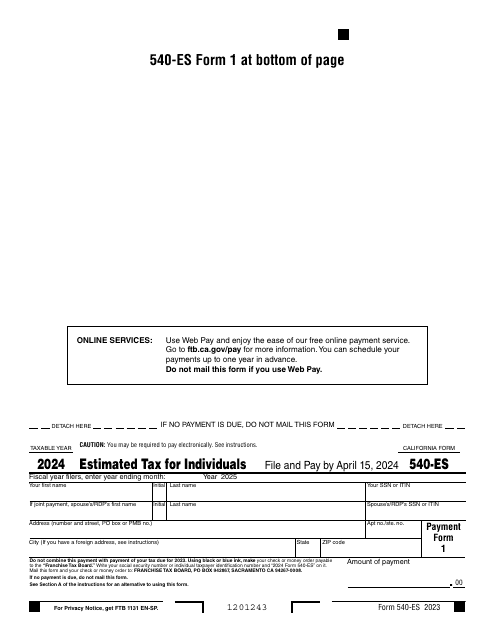

Fill out this form over the course of a year to pay your taxes in the state of California.

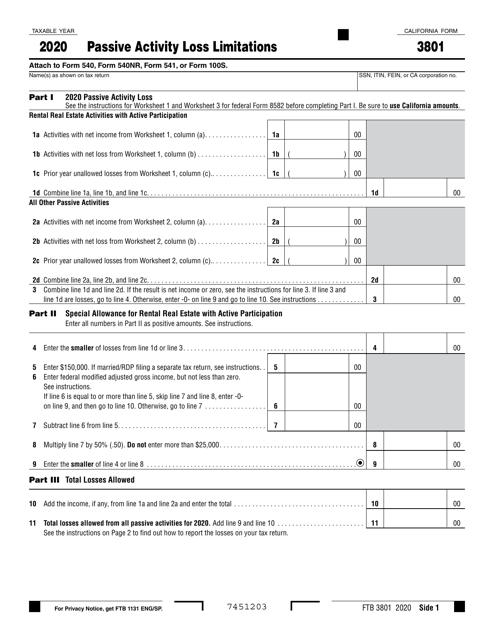

This form is used for reporting passive activity loss limitations in California.

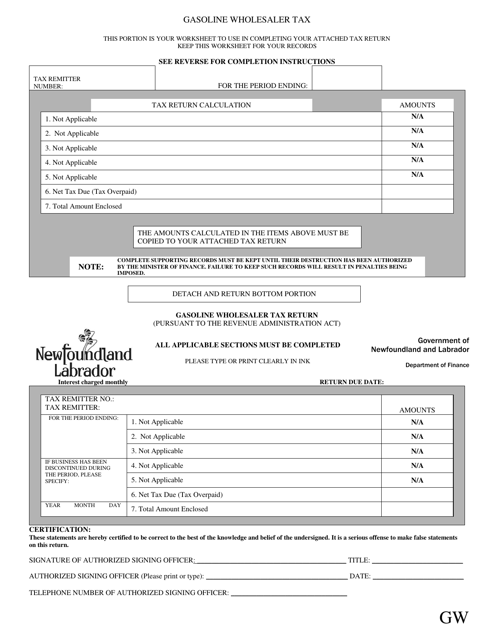

This document is for the Gasoline Wholesaler Tax in Newfoundland and Labrador, Canada. It explains the tax regulations for wholesalers who sell gasoline in the province.

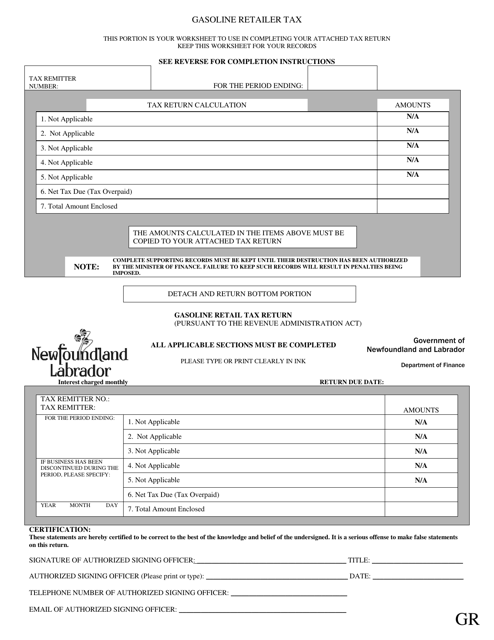

This document is used to schedule and pay the gasoline retailer tax in Newfoundland and Labrador, Canada.