Small Business Deductions Templates

Are you a small business owner looking to maximize your tax savings? Look no further than our comprehensive collection of documents centered around small business deductions. These documents provide valuable information and guidance on how small businesses can legally reduce their taxable income, ultimately saving you money.

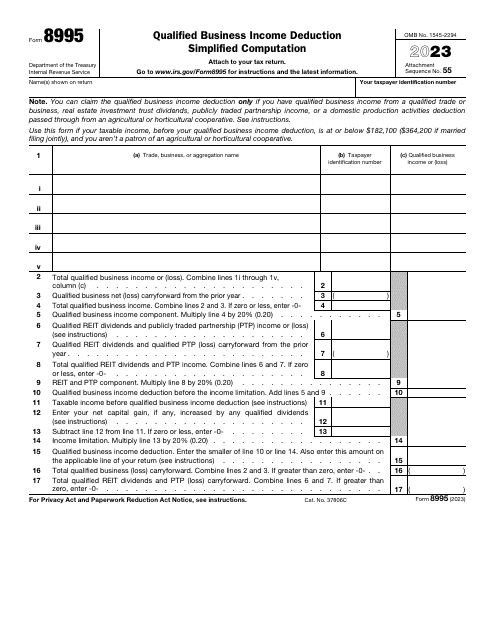

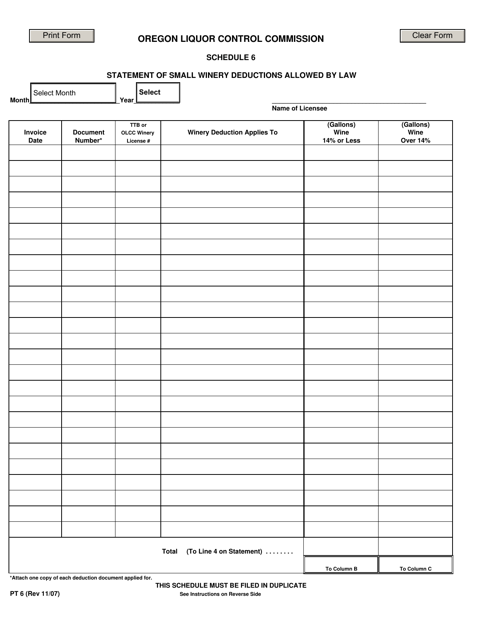

Our collection includes resources such as the IRS Form 8995 – Qualified BusinessIncome Deduction Simplified Computation. This form is designed to help small business owners calculate and claim their qualified business income deduction, taking advantage of potential tax benefits. Additionally, our library offers resources like Form PT6 Schedule 6 – Statement of Small Winery Deductions Allowed by Law in Oregon, catering to the unique deductions available to wineries in the state.

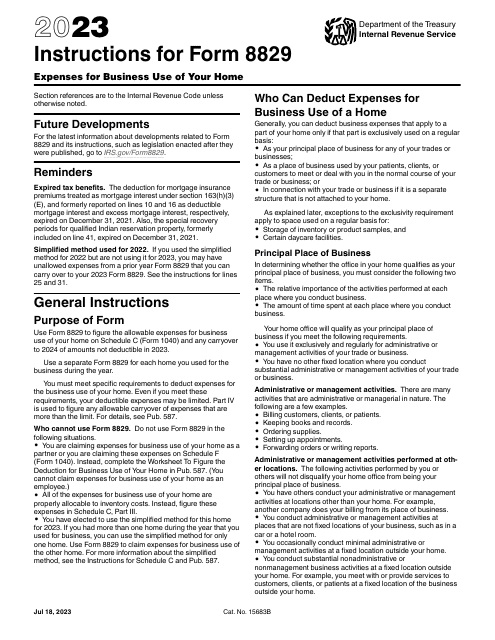

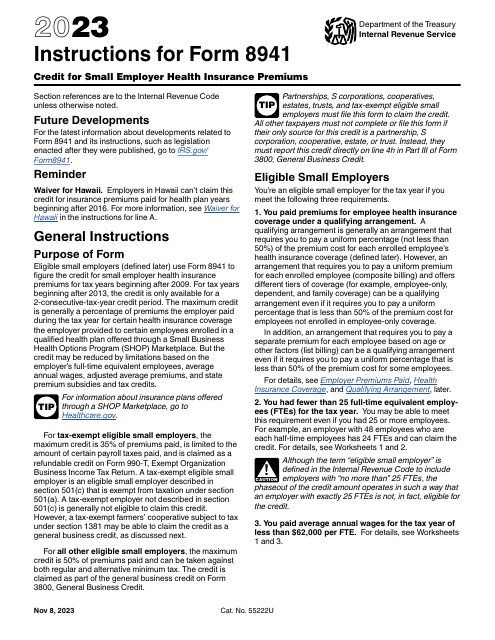

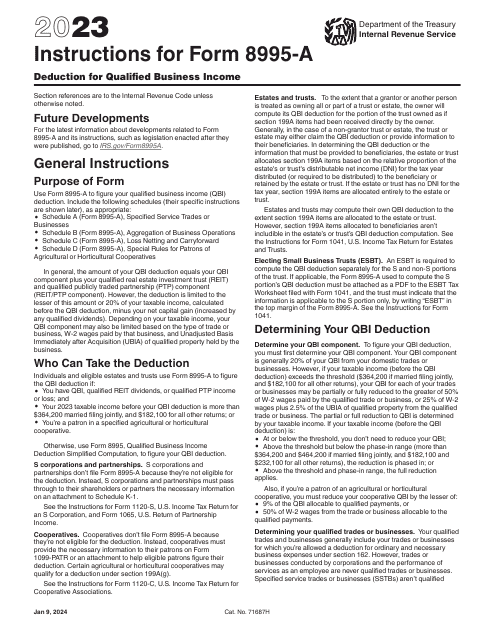

Navigating the complexities of small business deductions can be overwhelming, which is why we also provide detailed instructions for IRS Form 8995-A – Deduction for Qualified Business Income. These instructions offer step-by-step guidance on how to complete the form accurately and maximize your deduction.

Whether you refer to it as small business deductions, small business deduction or any other term, our collection of documents is your one-stop resource for understanding and utilizing deductions to benefit your small business. Don't miss out on potential savings – explore our collection today and take full advantage of the deductions available to you.

Documents:

11

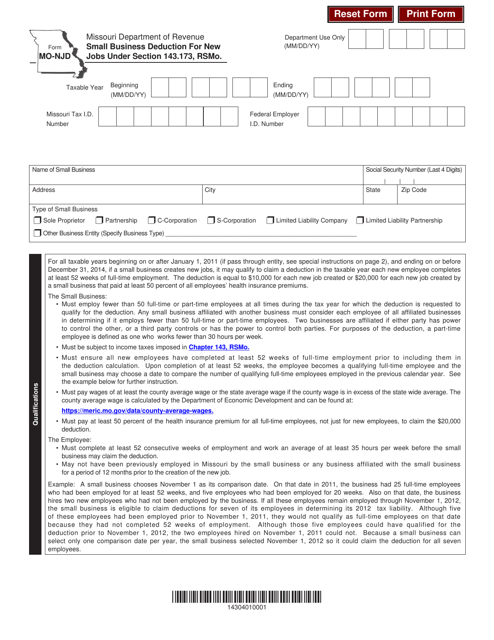

This form is used for claiming the small business deduction for creating new jobs in Missouri under Section 143.173 of the Revised Statutes of Missouri.

This form is used for reporting the deductions allowed by law for small wineries in Oregon.