Other States Templates

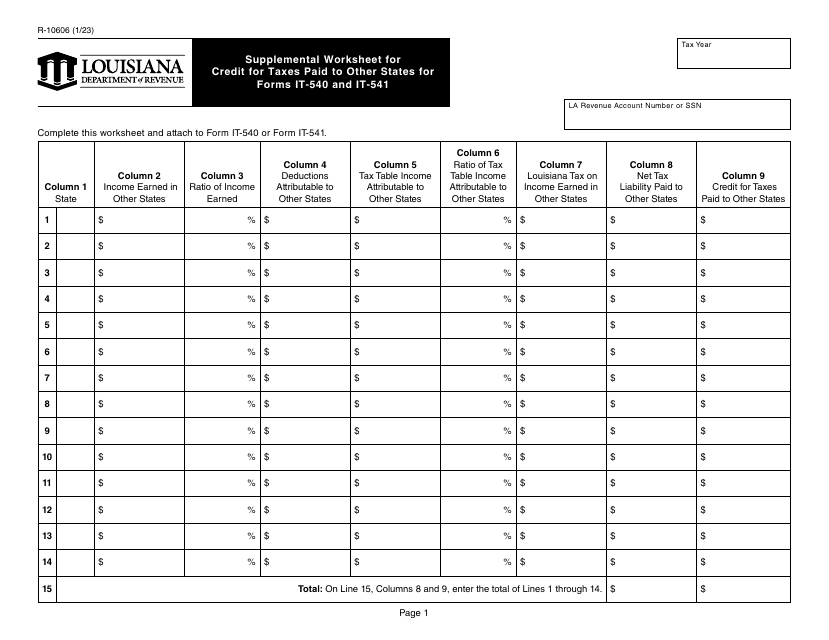

Looking for information on taxes paid to other states or provinces? Our website is your go-to resource for all things related to tax credits for income taxes paid to other states. Whether you are a resident of Mississippi, Vermont, Illinois, Missouri or any other state, we have the information you need.

Our extensive collection of documents provides detailed instructions on how to claim tax credits for income taxes paid to other states or Canadian provinces. No matter which state you reside in, we have you covered with our user-friendly forms and step-by-step guidance.

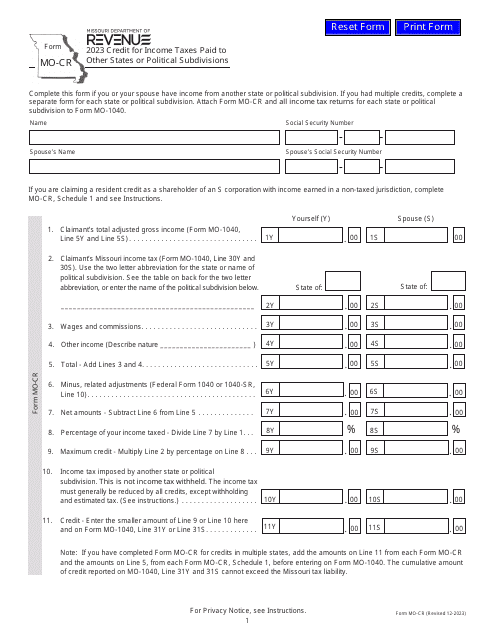

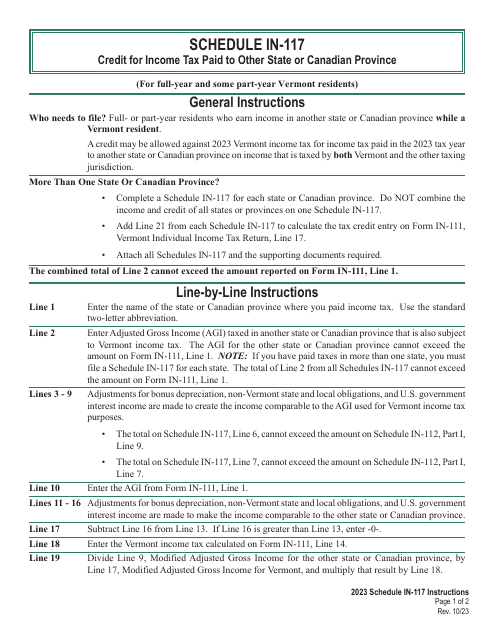

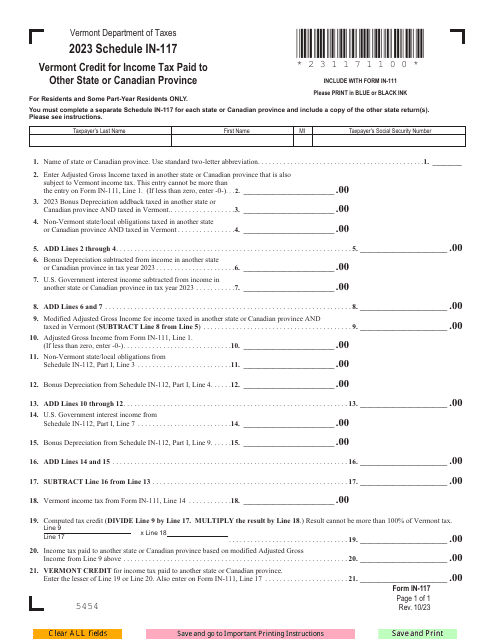

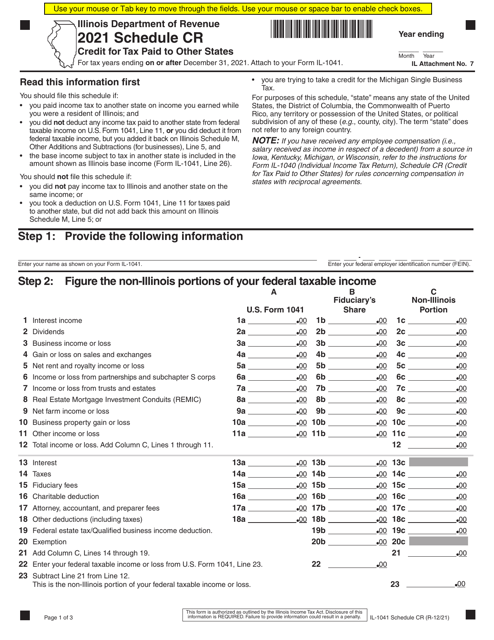

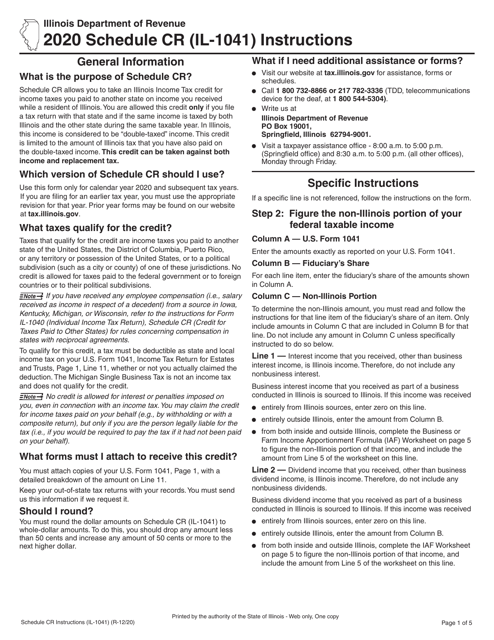

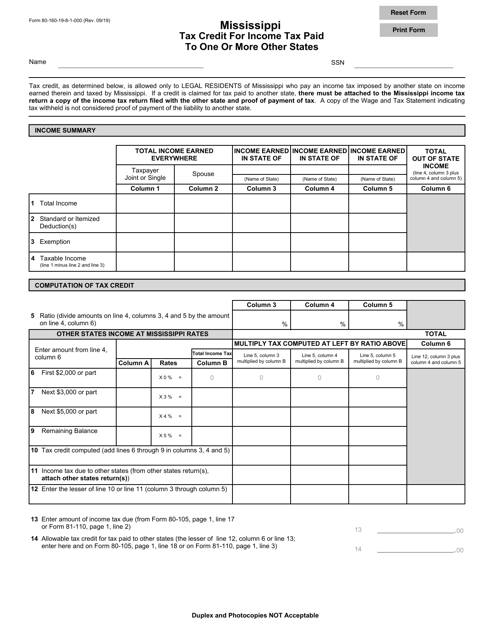

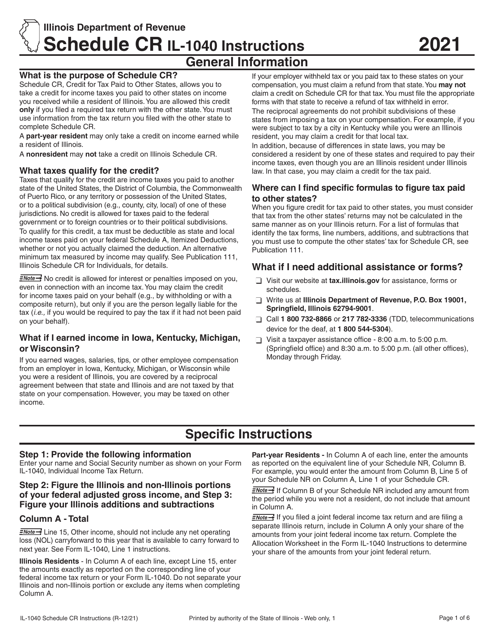

Our documents cover a wide range of topics including Form 80-160-14-8-1-000 Mississippi Tax Credit for Income Tax paid to one or more other states, Instructions for Schedule FIT-167 Vermont Credit for Tax Paid to Other State or Canadian Province for Fiduciaries, Form IL-1041 Schedule CR Credit for Tax Paid to Other States and many more. We have compiled the most relevant and up-to-date information to ensure you have all the necessary resources at your fingertips.

Don't waste time searching for information on tax credits for income taxes paid to other states. Visit our website today and access our comprehensive collection of documents. Simplify your tax filing process and ensure you maximize your tax savings with our easy-to-follow instructions and forms.

Disclaimer: This website is not affiliated with any specific state or province. of the given example documents titles were used in the above text.

Documents:

40

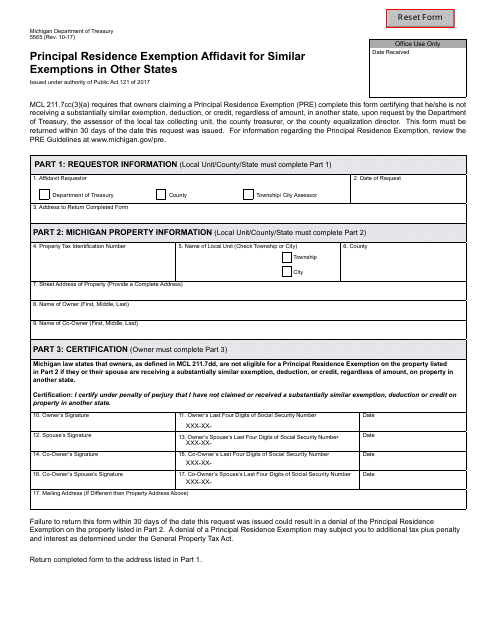

This document is used for claiming principal residence exemption in Michigan and exploring similar exemptions in other states.

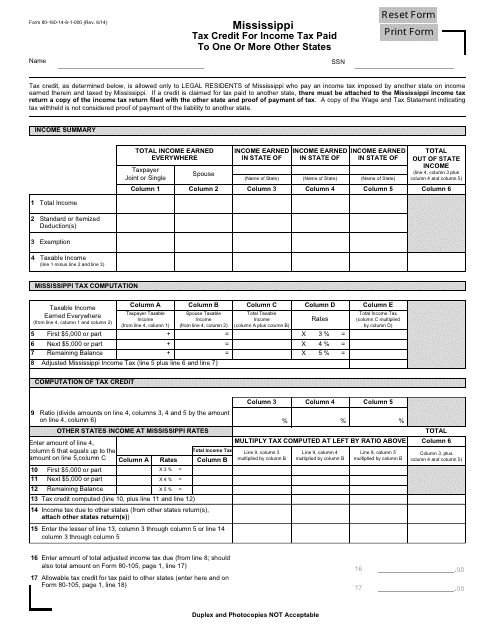

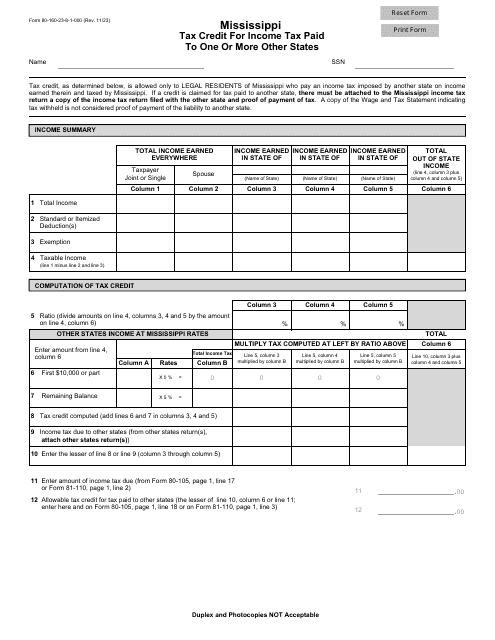

This Form is used for claiming a tax credit in Mississippi for income tax paid to other states.

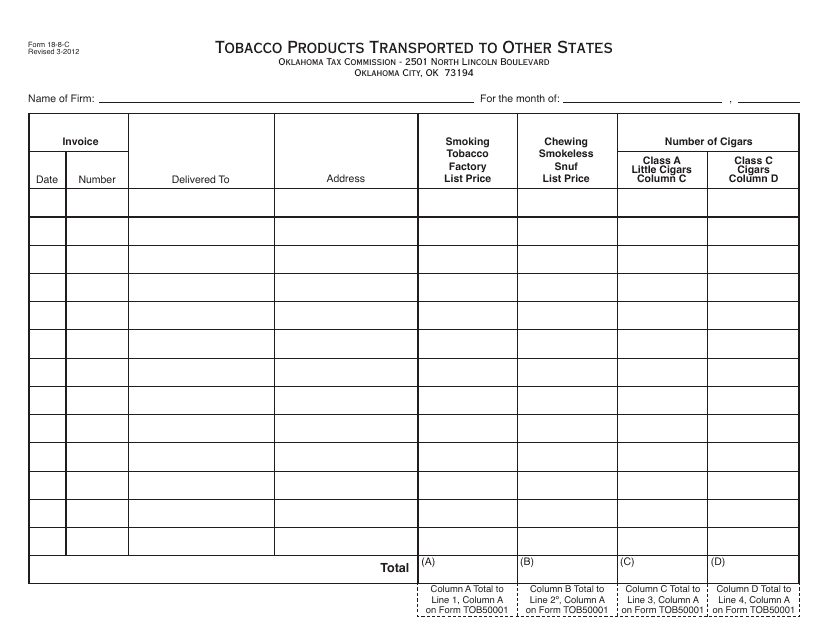

This form is used for reporting the transportation of tobacco products from Oklahoma to other states.

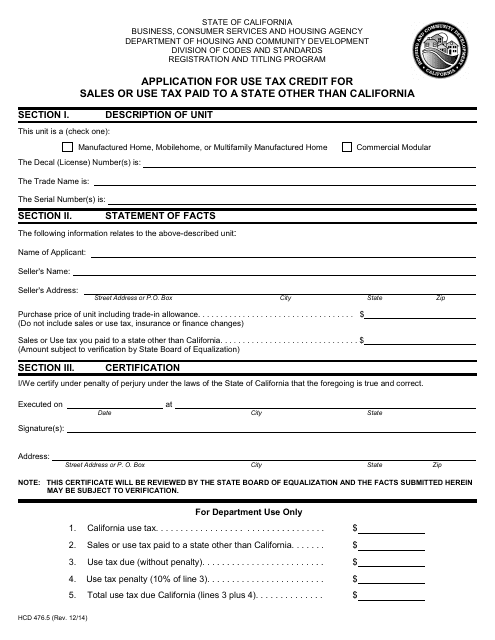

This Form is used for applying for a use tax credit in California when sales or use tax has been paid to a state other than California.

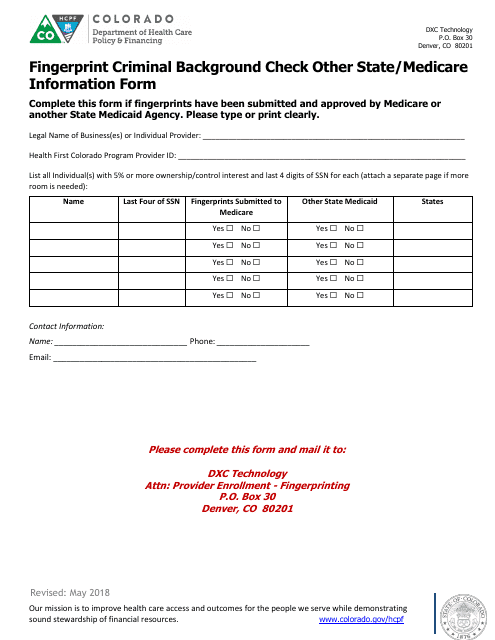

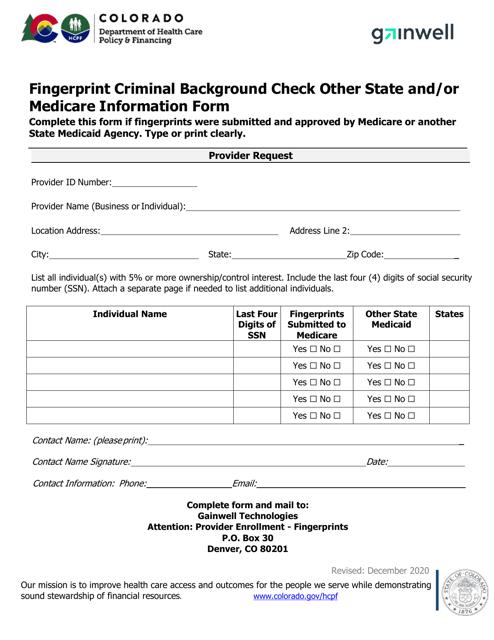

This document is used to perform a criminal background check on individuals in Colorado, and also contains information related to other state Medicare programs.

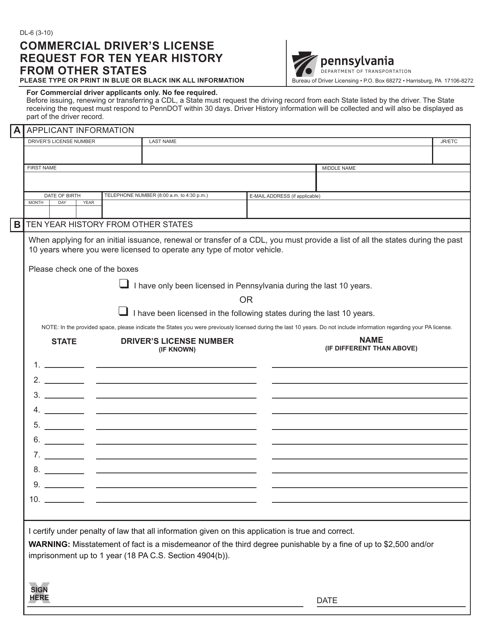

This form is used for requesting a ten-year driving history from other states for commercial driver's license (CDL) purposes in Pennsylvania.

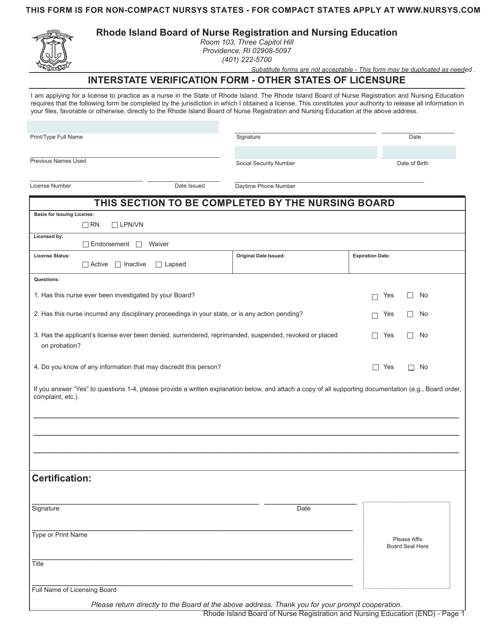

This Form is used for verifying licensure in other states for residents of Rhode Island.

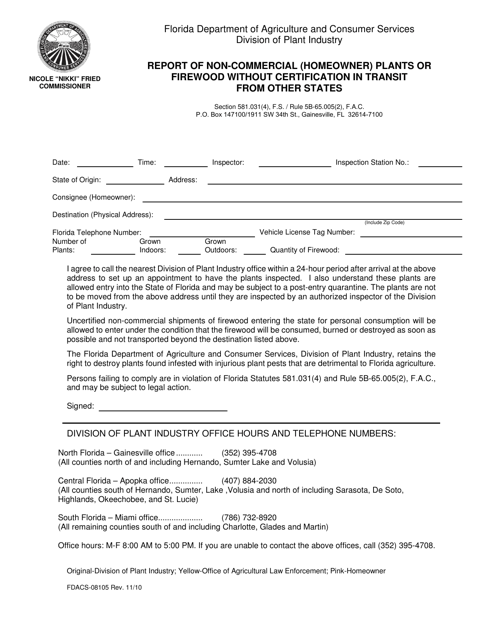

This type of document is used for reporting non-commercial plants or firewood without certification being transported from other states in Florida.

This document is a Mississippi tax form for claiming a tax credit for income tax paid to one or more other states.

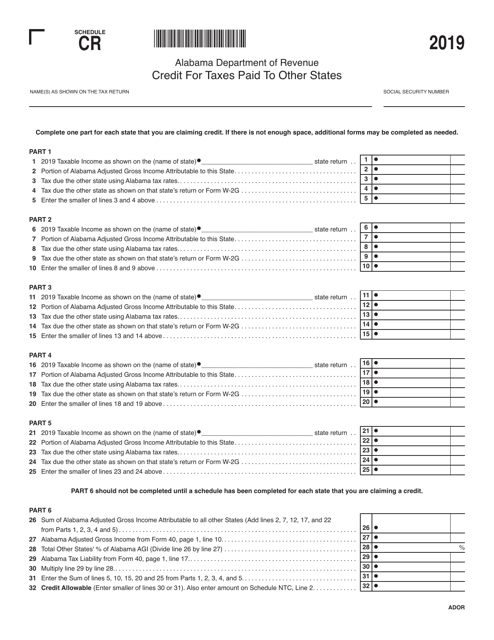

This form is used for claiming a credit for taxes paid to other states if you are a resident of Alabama.

This form is used for conducting a fingerprint criminal background check in Colorado to collect other state and/or Medicare information.

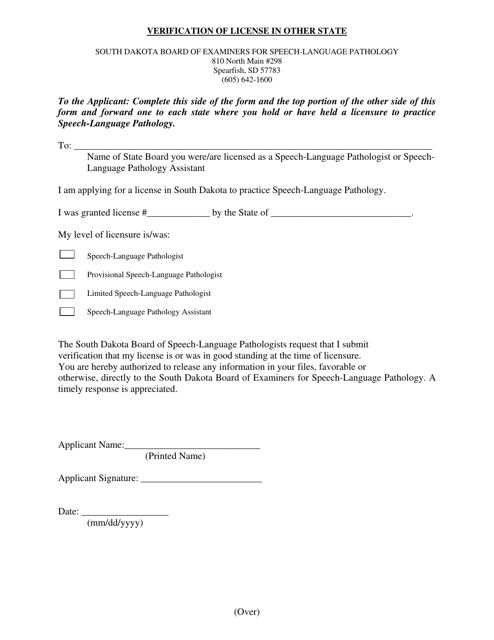

This form is used for verifying a license from another state in South Dakota.

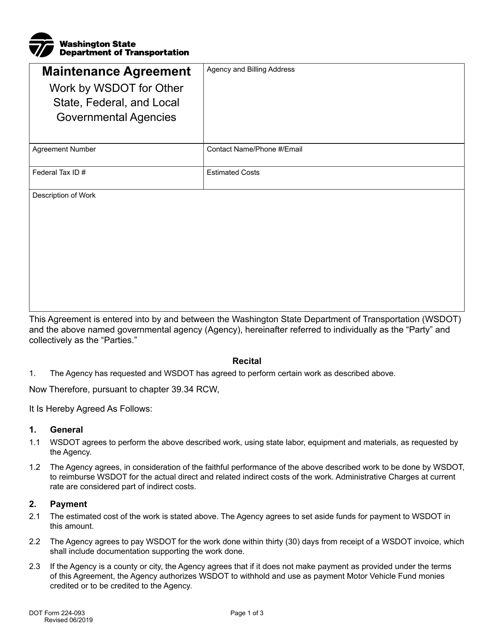

This form is used for a maintenance agreement between the Washington State Department of Transportation (WSDOT) and other state, federal, and local governmental agencies. It outlines the work that WSDOT will perform on behalf of these agencies.

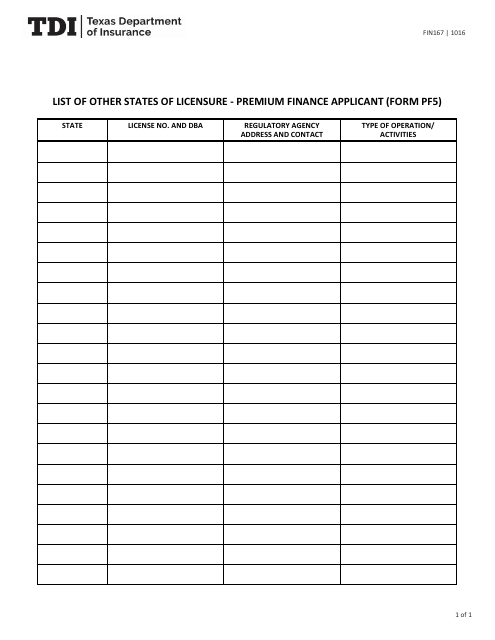

This Form is used for listing other states of licensure for premium finance applicants in Texas.