Tax Payment Agreement Templates

Are you struggling to pay your taxes in a timely manner? Don't worry, we've got you covered. Our tax payment agreement service can help you ease the financial burden and avoid any potential penalties or interest charges. Whether you're an individual taxpayer or a business owner, we provide step-by-step instructions and assistance to help you navigate through the process.

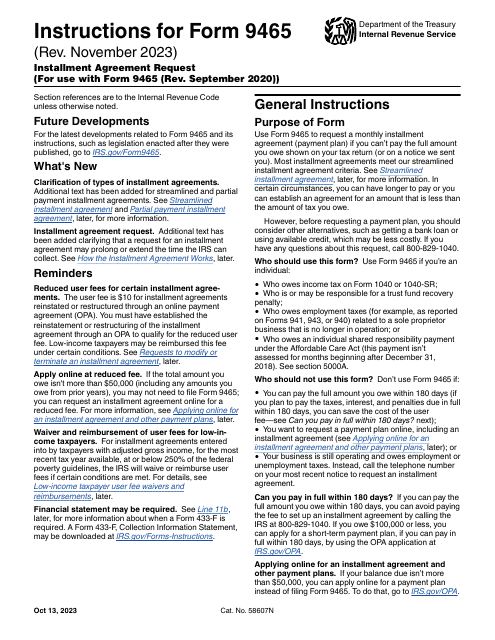

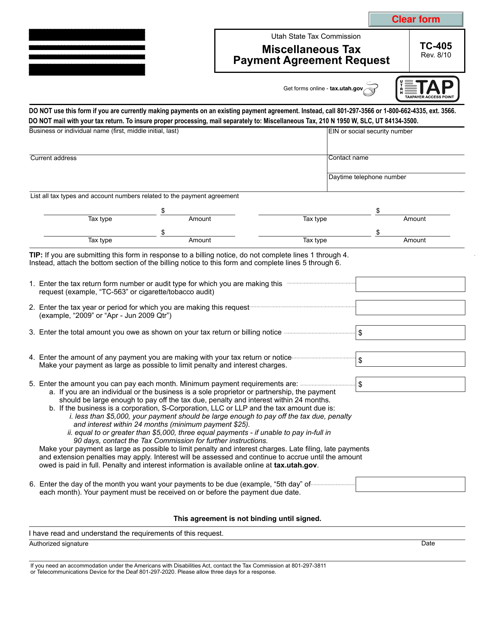

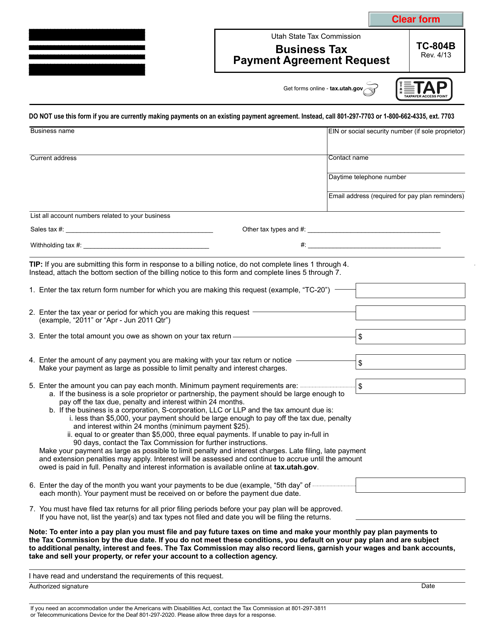

Our tax payment agreement service offers a variety of options that cater to your specific needs. With our easy-to-use forms and instructions, you can request an installment agreement with the IRS, or if you're a resident of Utah, you can utilize the TC-405 or TC-804B forms to request a miscellaneous tax payment agreement or a business tax payment agreement respectively.

By entering into a tax payment agreement, you can spread out your tax payments over a designated period of time, making it more manageable for you. This alternative solution allows you to fulfill your tax obligations without experiencing unnecessary financial strain. It's a win-win situation!

Our goal is to simplify the tax payment agreement process, ensuring that you have a stress-free experience. Let us take care of the paperwork and guide you every step of the way. With our extensive knowledge and expertise, you can rest assured that your tax payment agreement will be handled with utmost professionalism.

Take control of your tax payments today and explore the various options available to you. Don't let financial constraints hold you back from meeting your tax obligations. Trust our tax payment agreement service to provide you with the necessary resources and support you need. Say goodbye to tax payment worries and hello to financial peace of mind!

Documents:

5

This Form is used for taxpayers in Utah to request a miscellaneous tax payment agreement.

This Form is used for requesting a tax payment agreement for businesses in Utah. It allows businesses to set up a plan to pay their taxes over time.