Fidelity Bond Coverage Templates

Fidelity bond coverage, also known as fidelity surety coverage or bond insurance, provides protection for businesses against losses resulting from fraudulent or dishonest acts committed by their employees. This type of insurance is crucial for organizations that handle large amounts of money or have access to sensitive financial information.

Fidelity bond coverage is designed to safeguard businesses from financial harm caused by employee theft, forgery, embezzlement, or other fraudulent activities. It not only covers financial losses but also helps to restore the trust and confidence of clients and stakeholders.

With fidelity bond coverage, businesses can rest assured that they are protected against the unforeseen actions of their employees. In the event of a claim, the insurance company will provide financial compensation to mitigate the damages caused by employee dishonesty.

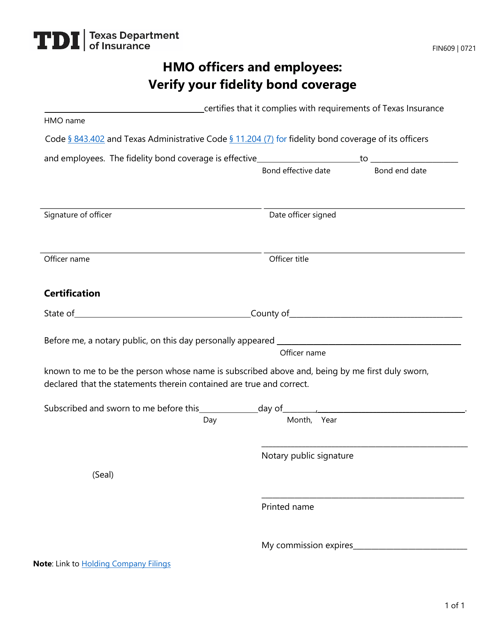

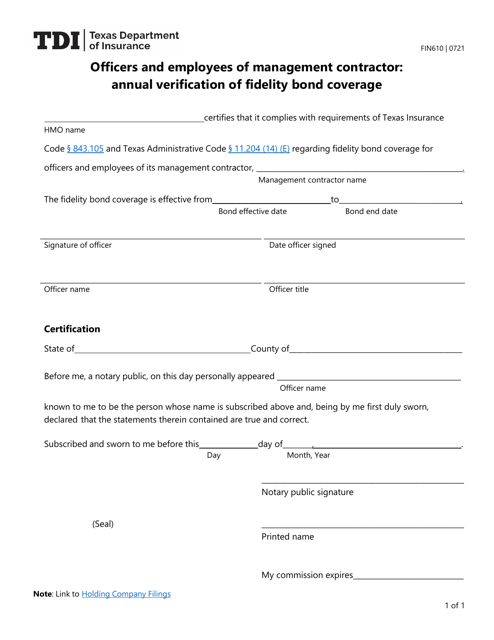

To ensure compliance and maintain coverage, businesses are required to submit annual verification forms such as Form FIN609 and Form FIN610. These forms, specific to the state of Texas, certify the ongoing fidelity bond coverage and confirm that the business has the necessary protection against employee dishonesty.

Fidelity bond coverage is essential for businesses across various industries, including finance, healthcare, retail, and more. It not only minimizes the financial impact of fraudulent activities but also serves as a deterrent, discouraging employees from engaging in dishonest behavior.

Protect your business from financial losses caused by employee dishonesty by investing in fidelity bond coverage. Don't leave your organization vulnerable to internal threats - secure the trust and confidence of your clients and stakeholders with comprehensive fidelity bond coverage.