Charitable Institutions Templates

Charitable Institutions

Discover the Benefits of Charitable Institutions

Are you a part of a religious or charitable institution and looking for tax exemption options? Look no further! Charitable institutions, also known as charitable organizations, play a vital role in society by promoting social welfare and providing support to those in need.

At our organization, we understand the importance of serving the community and making a positive impact. That's why we offer comprehensive information and resources on tax exemptions for charitable institutions in various states across the USA, including Utah, Louisiana, and Maine.

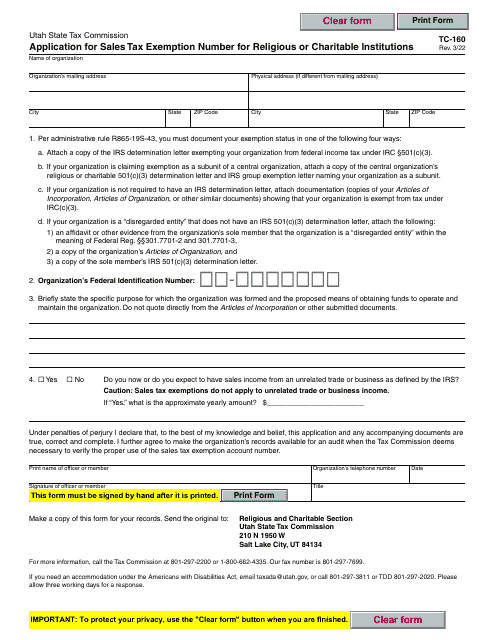

Our website provides valuable resources such as application forms specifically tailored to each state's requirements. For instance, if you are in Utah, you can find the Form TC-160 Application for Sales Tax Exemption Number for Religious or Charitable Institutions

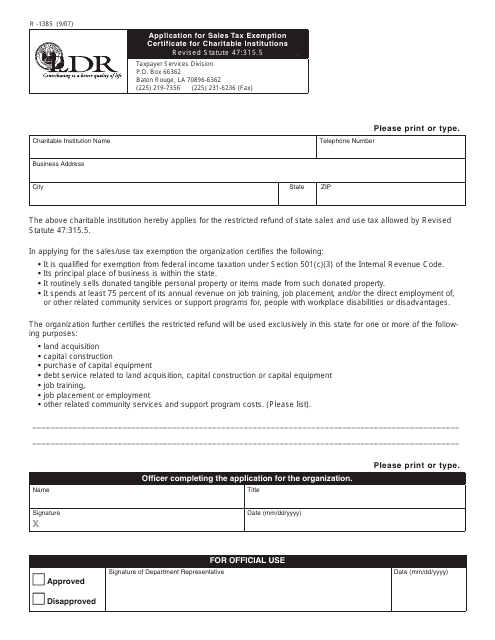

. Similarly, Louisiana residents can access the Form R-1385 Application for Sales Tax Exemption Certificate for Charitable Institutions.Tax exemptions can significantly benefit your charitable institution by allowing you to allocate more resources towards your philanthropic goals. By understanding and utilizing these exemptions, you can make a greater impact on the communities you serve.

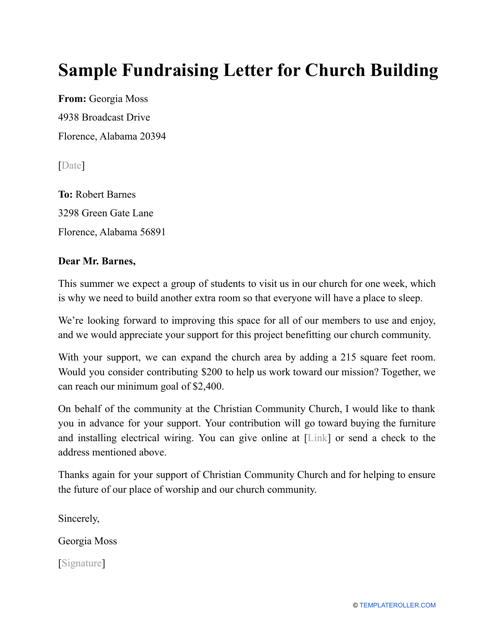

Additionally, our website offers sample fundraising letters for church buildings and other charitable initiatives. These letters can be customized and used to reach out to potential donors, encouraging them to contribute to your noble cause.

So, whether you are seeking tax exemptions, fundraising ideas, or simply want to learn more about charitable institutions, our website is the go-to resource for all your needs. Explore our comprehensive collection of information today to maximize the benefits for your organization.

Take advantage of the tax exemptions available to religious and charitable institutions and make a difference in the lives of those who need it most. Start navigating our website now to unlock the potential of your organization.

Documents:

5

This Form is used for applying for a sales tax exemption certificate in Louisiana for charitable institutions.

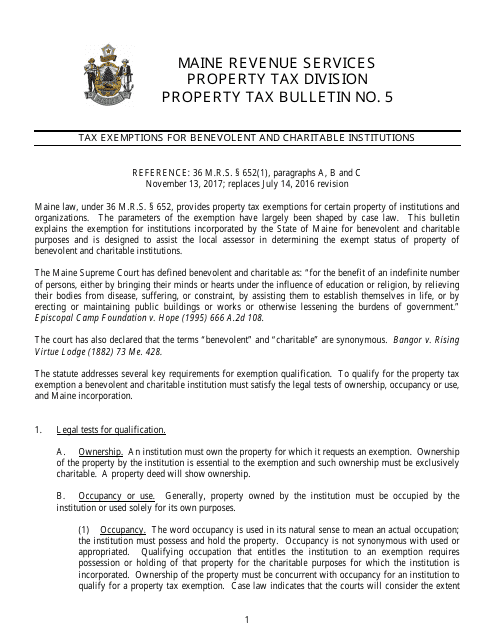

This document provides information about tax exemptions available to benevolent and charitable institutions in the state of Maine. It outlines the eligibility criteria and the process for obtaining these exemptions.

Individuals may use this type of letter when they would like to ask for contributions on behalf of their church to help in the maintenance or improvement of an existing church building.