Children Tax Templates

Children Tax, also referred to as Childrens Tax, is a collection of documents that provide valuable information and guidelines regarding taxes for children who have unearned income.

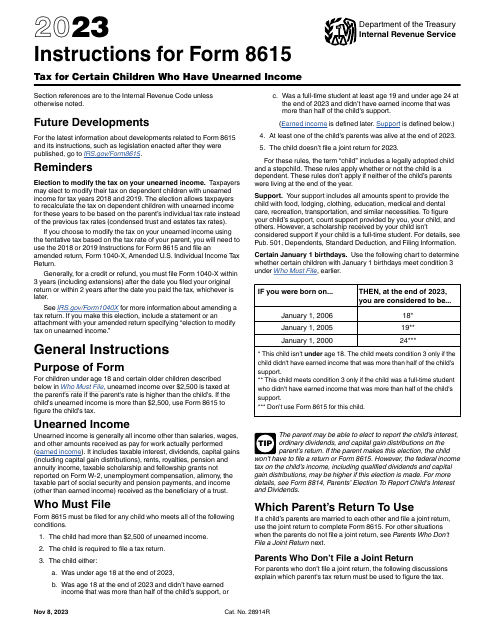

These documents are essential for parents and guardians who want to ensure they are compliant with tax regulations and maximize tax benefits for their children.One of the key documents in this collection is the Instructions for IRS Form 8615 Tax for Certain Children Who Have Unearned Income.

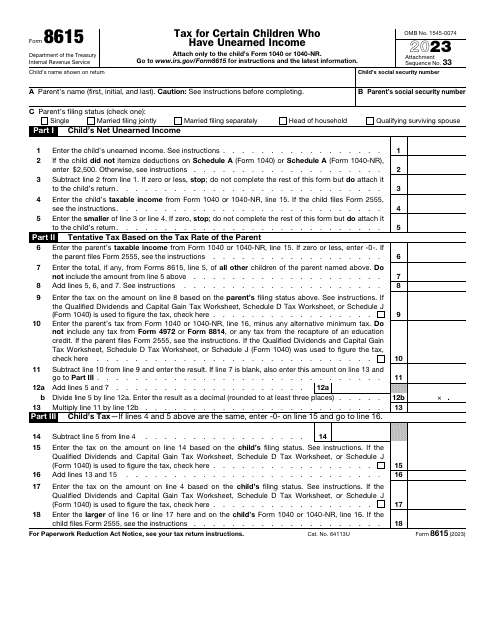

This comprehensive guide walks you through the process of calculating and reporting taxes for children with unearned income. It provides step-by-step instructions, detailed explanations, and examples to help you navigate through the complexities of children's tax.Another significant document in the Children Tax collection is the IRS Form 8615 Tax for Certain Children Who Have Unearned Income.

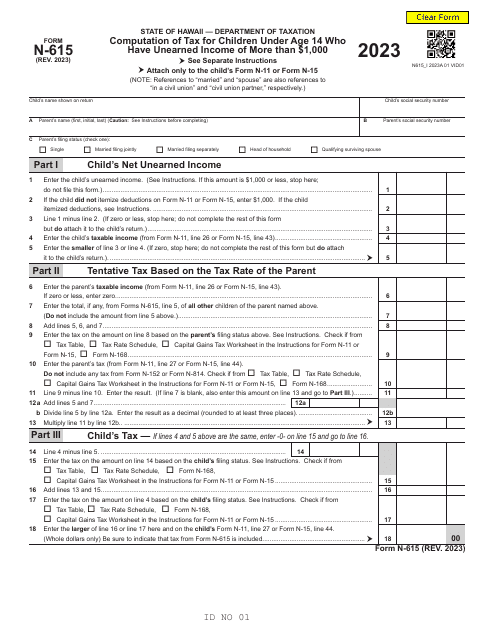

This form is used to report the child's unearned income and calculate the tax liability. It includes sections for reporting various types of income, such as dividends, interest, and capital gains. By accurately completing this form, you can ensure compliance with the IRS and avoid potential penalties.Additionally, the collection may include state-specific documents, such as Form N-615 Computation of Tax for Children Under Age 14 Who Have Investment Income of More Than $1,000 in Hawaii.

These state-specific documents provide additional guidance tailored to the tax regulations of a particular state.Understanding the intricacies of children's taxes can be challenging, but the Children Tax collection is an invaluable resource that simplifies the process.

Whether you are a parent, guardian, or tax professional, these documents will equip you with the information and tools needed to accurately report and pay taxes on unearned income for children..

Documents:

6