Real Property Transfer Templates

Are you planning to transfer or purchase a real property? The process of real property transfer can often be complex and time-consuming. However, with the help of real property transfer forms, you can streamline the process and ensure all legal requirements are met.

Real property transfer forms, also known as real property transfer documents or real property transfer disclosure statements, are essential paperwork used during the transfer of real estate. These documents are designed to disclose any relevant information about the property being transferred, ensuring transparency and protecting both the buyer and the seller.

Whether you're a homeowner looking to sell your property or a buyer interested in purchasing real estate, having the right real property transfer forms is crucial. These forms serve as a legal record of the transfer process, including details about the property, any encumbrances, and any disclosures required by law.

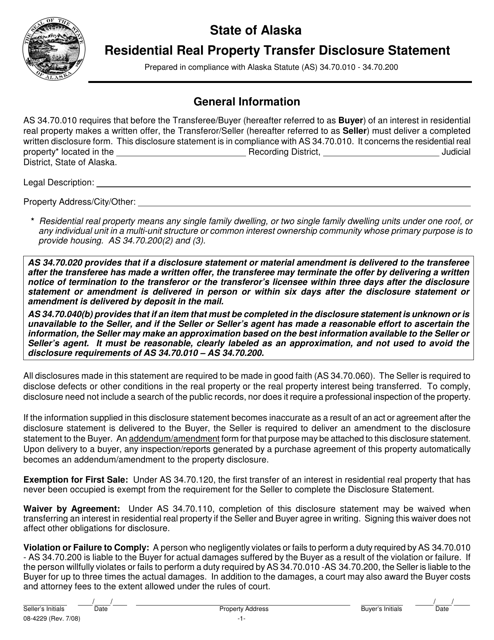

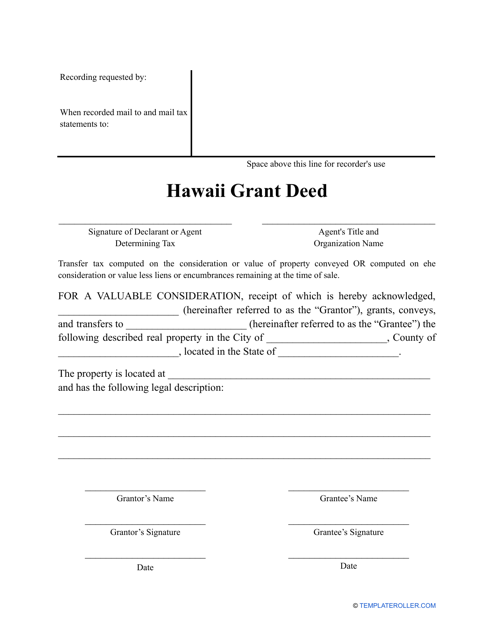

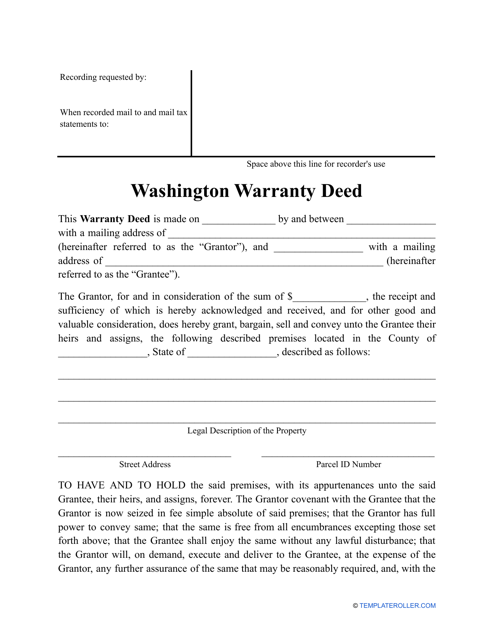

In Alaska, for example, you'll need to complete Form 08-4229 Residential Real Property Transfer Disclosure Statement. This form helps sellers disclose any known defects or issues with the property, ensuring transparency for the buyer. Similarly, in Hawaii, you'll need to use a Grant Deed Form, while in Washington, a Warranty Deed Form is required.

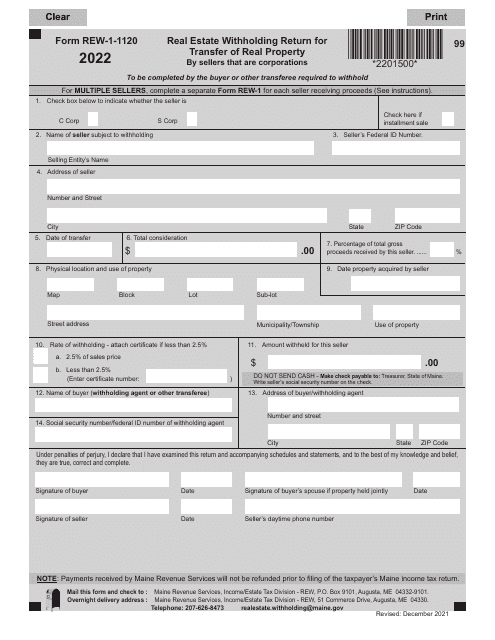

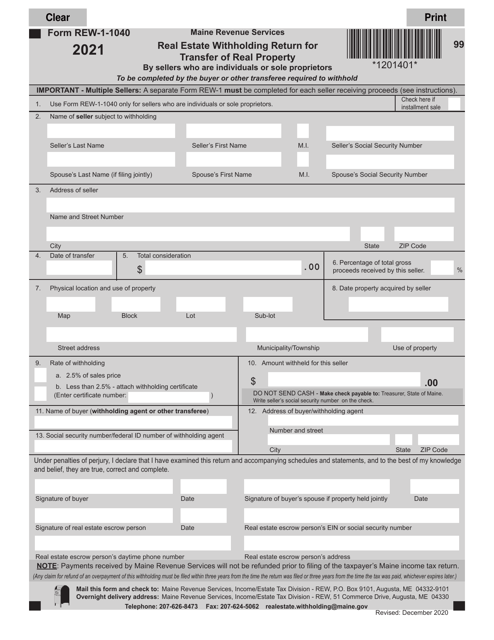

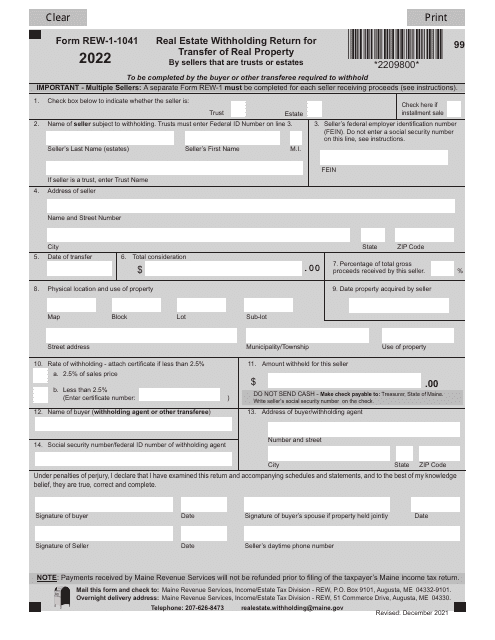

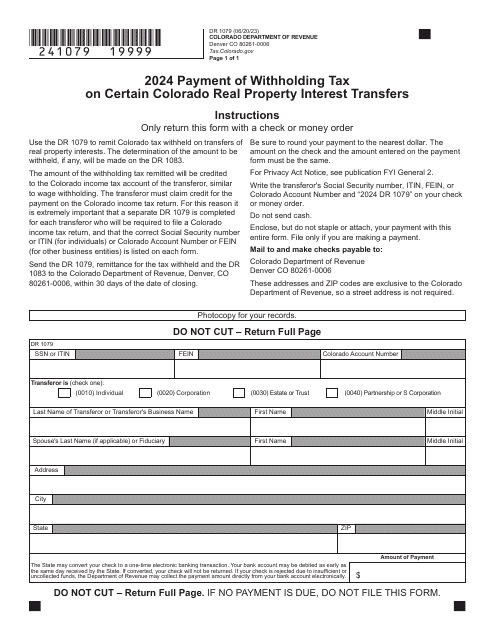

Different states may have their specific real property transfer forms, and it's essential to ensure compliance with local regulations. For instance, in Maine, you'll need to fill out Form REW-1-1041 Real Estate Withholding Return for Transfer of Real Property by Sellers That Are Trusts or Estates, while in Colorado, you'll need to submit Form DR1079 for the payment of withholding tax on certain real property interest transfers.

To navigate the real property transfer process smoothly, it's advisable to consult with a knowledgeable professional or attorney who can guide you through the required forms and legal obligations.

So, whether you're a seller, buyer, or trustee working with real estate, having the proper real property transfer forms is essential. These forms ensure compliance with legal requirements, provide transparency in the process, and protect all parties involved.

Documents:

11

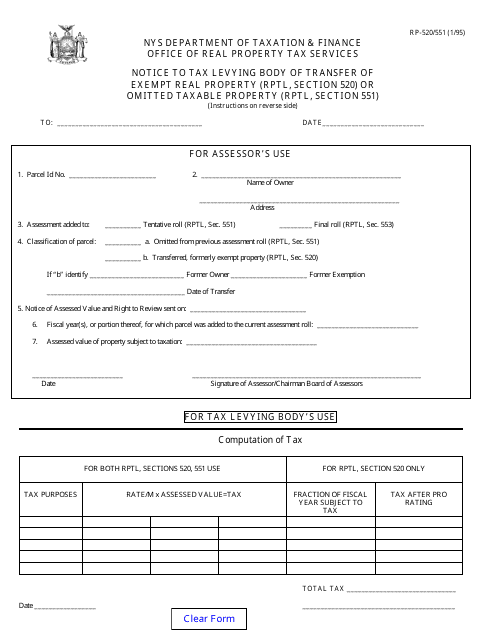

This form is used to notify the tax levying body in New York about the transfer of exempt real property or omitted taxable property in accordance with Rptl, Section 520 or Rptl, Section 551.

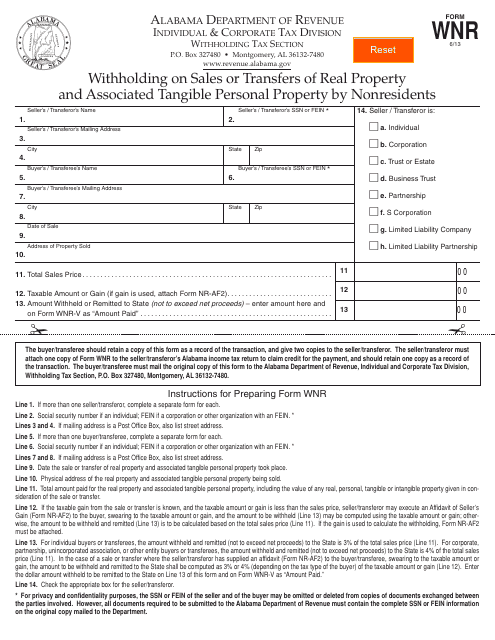

This form is used for reporting and withholding taxes on sales or transfers of real property and associated tangible personal property by nonresidents in the state of Alabama.

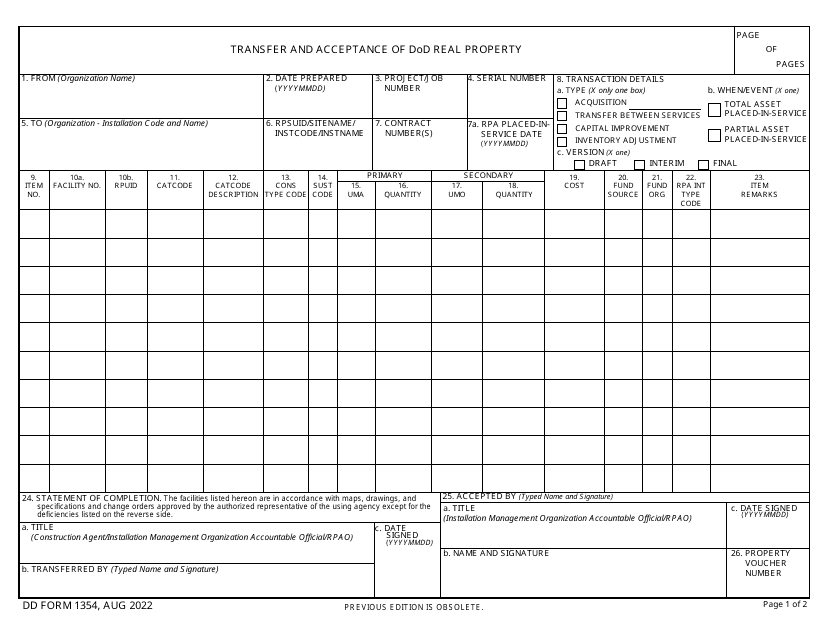

This document is used in transferring military real property to another military department or government agency.

This form is used for disclosing information about the transfer of residential real property in Alaska. It helps buyers make informed decisions about the property they are purchasing.

You may use this printable template when making your own Grant Deed in the state of Hawaii.

Use this printable template when making your own Warranty Deed in the state of Washington.

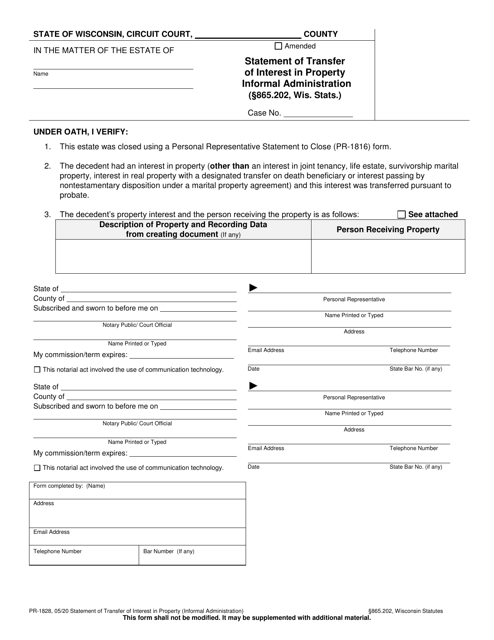

This form is used for individuals in Wisconsin to officially transfer their interest in a property through the informal administration process.