Inventory Tax Templates

Are you a business owner who deals with inventory? If so, you may be subject to an inventory tax. Also known as the inventory tax form or tax inventory, this tax is an important aspect of managing your business finances.

Understanding and complying with inventory tax regulations is crucial to avoid penalties and ensure accurate reporting. Our website provides a comprehensive resource for all your inventory tax needs.

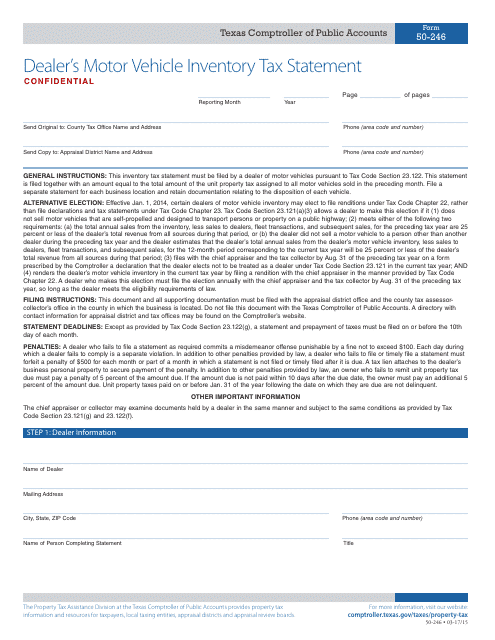

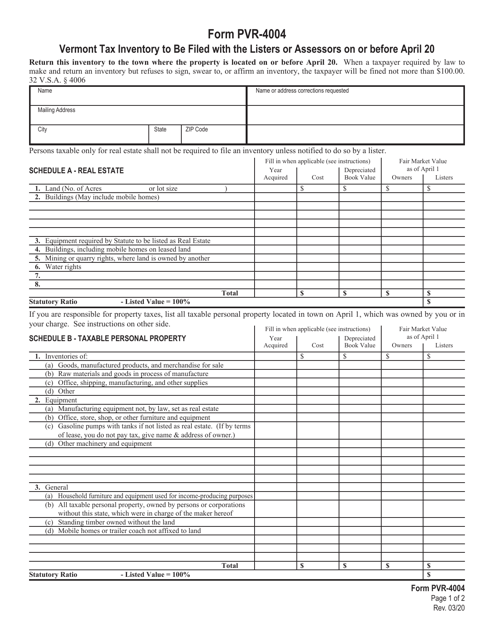

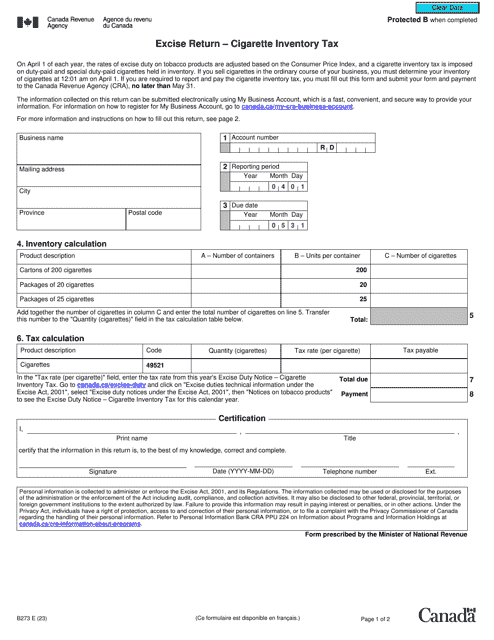

Whether you operate in Texas, Vermont, or even Canada, we have the information and forms you need to file your inventory tax correctly. For example, in Texas, you'll find Form 50-246 Dealer's Motor Vehicle InventoryTax Statement, while in Vermont, it's Form PVR-4004 Vermont Tax Inventory to Be Filed With the Listers or Assessors on or Before April 20.

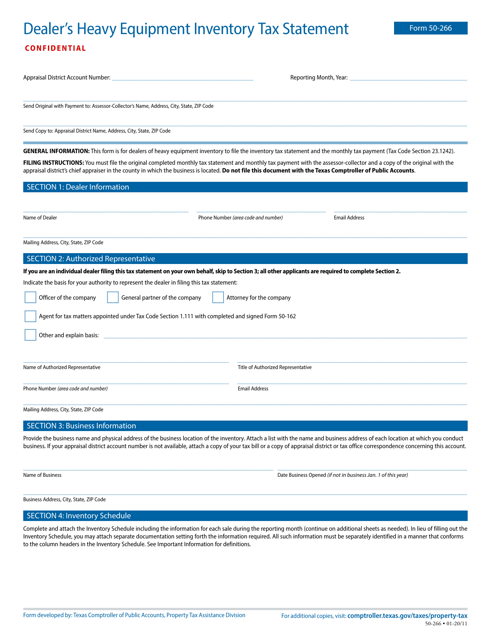

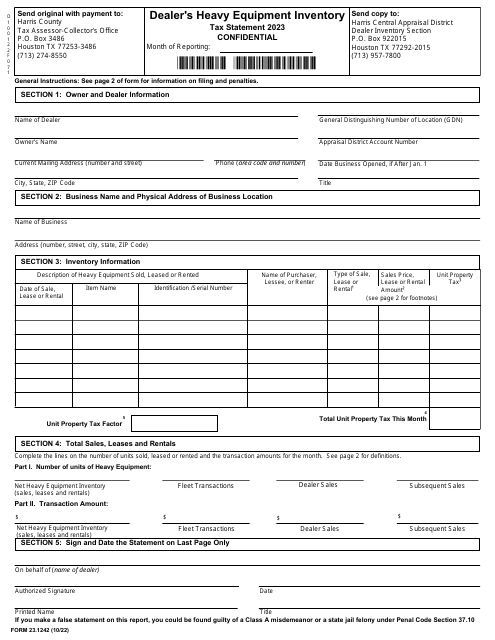

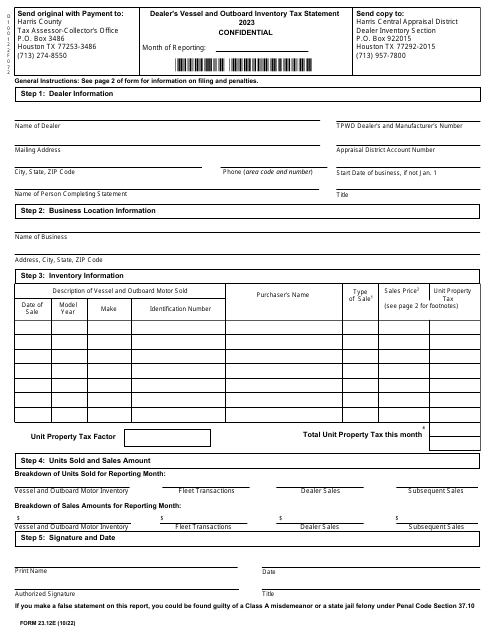

If you're in the heavy equipment or vessel industry in Harris County, Texas, you may need to complete Form 23.1242 Dealer's Heavy Equipment Inventory Tax Statement or Form 23.12E Dealer's Vessel and Outboard Inventory Tax Statement respectively.

We understand that inventory taxes can be complex, but our website aims to simplify the process for you. From providing detailed information on inventory tax regulations to supplying the necessary forms, we strive to make your inventory tax filing experience as seamless as possible.

With our help, you can ensure that you are in compliance with inventory tax laws and avoid any unnecessary financial burdens. Check out our website today to find the resources you need to manage your inventory tax efficiently.

Documents:

8

This Form is used for reporting the inventory of motor vehicles held by dealers in Texas for tax purposes.

This form is used for submitting the Vermont Tax Inventory to the Listers or Assessors by April 20. It is required for tax purposes in the state of Vermont.

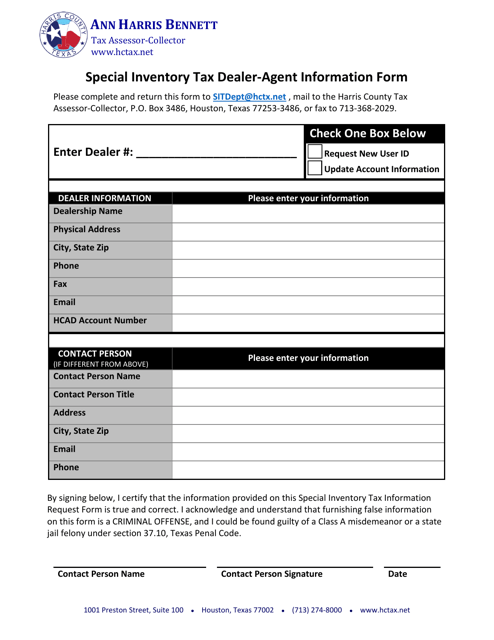

This form is used for providing dealer-agent information for the Special Inventory Tax in Harris County, Texas.