Intercompany Transactions Templates

Are you looking for a way to efficiently handle intercompany transactions within your organization? Look no further! Our comprehensive collection of documents related to intercompany transactions is designed to streamline your processes and ensure accuracy in your financial reporting.

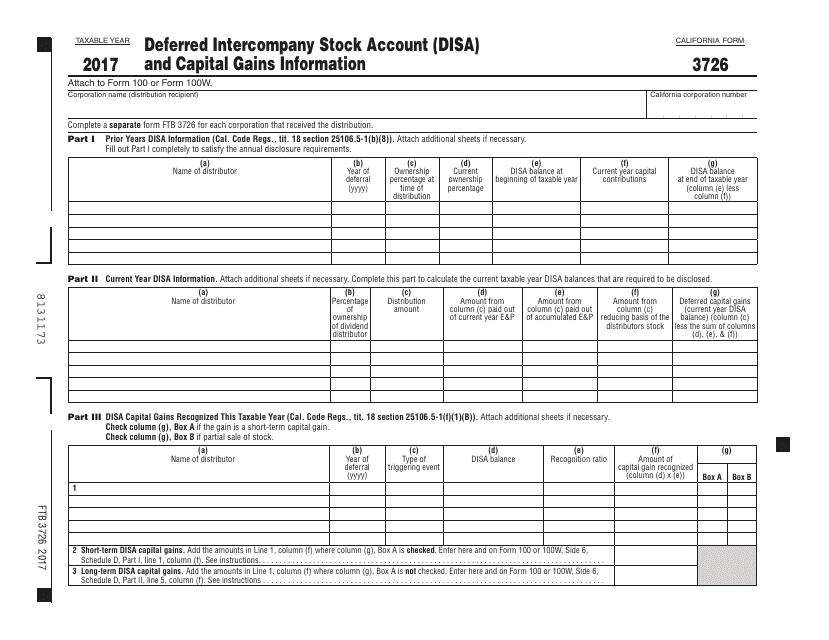

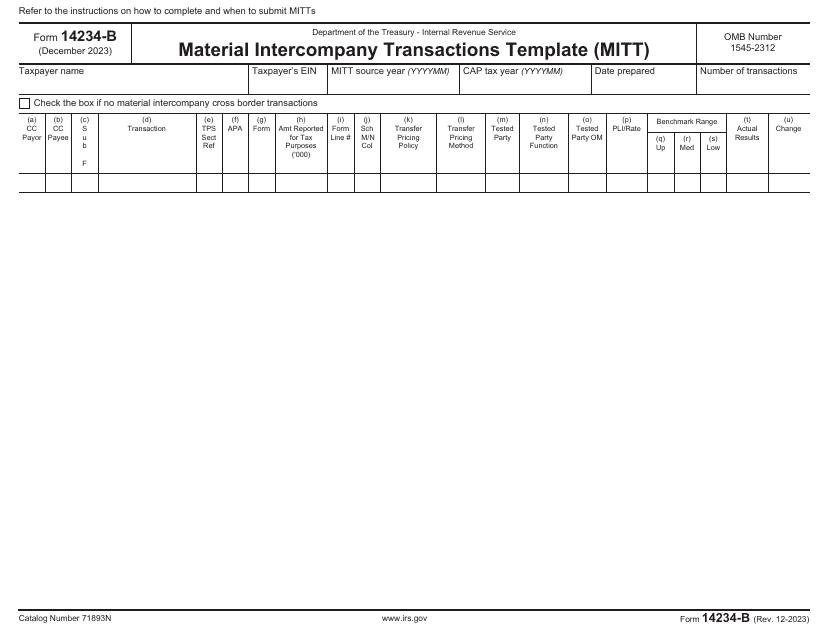

Whether you need to document deferred intercompany stock accounts, report capital gains information, or track material intercompany transactions, we have you covered. Our extensive library includes templates such as the IRS Form 14234-B Material Intercompany Transactions Template (Mitt) and the Form FTB3726 Deferred Intercompany Stock Account (Disa) and Capital Gains Information - California. These documents provide a standardized framework for capturing and analyzing intercompany transactions, making it easier for you to manage your financial operations.

Our intercompany transactions documents collection is an invaluable resource for businesses operating in multiple jurisdictions or those with complex organizational structures. By implementing the best practices identified in these documents, you can ensure compliance with regulatory requirements and minimize the risk of errors or fraud.

So, whether you need a template to track intercompany transactions or guidance on reporting capital gains, our intercompany transactions documents collection has what you need. Take advantage of this valuable resource to streamline your processes and improve the accuracy of your financial reporting. Invest in your organization's success by accessing our intercompany transactions documents collection today!

Documents:

5

This form is used for reporting deferred intercompany stock account and capital gains information in California.