Payroll Deduction Agreement Templates

A payroll deduction agreement, also known as a payroll deduction agreement form, is an essential document that outlines the terms and conditions for deducting a portion of an employee's wages or salary. This agreement enables employers to subtract various deductions such as taxes, healthcare premiums, retirement contributions, and loan repayments directly from their employees' paychecks.

Payroll deduction agreements provide clarity and transparency for both the employer and the employee. They ensure that deductions are accurately calculated and consistently applied, eliminating any confusion or disputes that may arise.

By completing a payroll deduction agreement form, employees authorize their employers to withhold specific amounts from their earnings. This document serves as a legally binding contract that protects the rights of both parties and establishes a clear understanding of the agreed deductions.

Whether you work for a federal agency, credit union, or local government, a payroll deduction agreement is a critical tool in managing your finances. It allows you to automate your financial obligations and ensures that payments are made on time and in an organized manner.

At its core, a payroll deduction agreement provides a streamlined process for employers and employees to manage deductions efficiently. It allows employees to take advantage of various benefits and services, such as healthcare plans or 401(k) contributions, without having to worry about manually making payments.

To summarize, a payroll deduction agreement, also referred to as a payroll deduction agreement form, is an essential document that establishes a legally binding contract between employers and employees regarding wage deductions. This agreement streamlines the payment process, ensures accuracy, and provides peace of mind for both parties involved.

Documents:

5

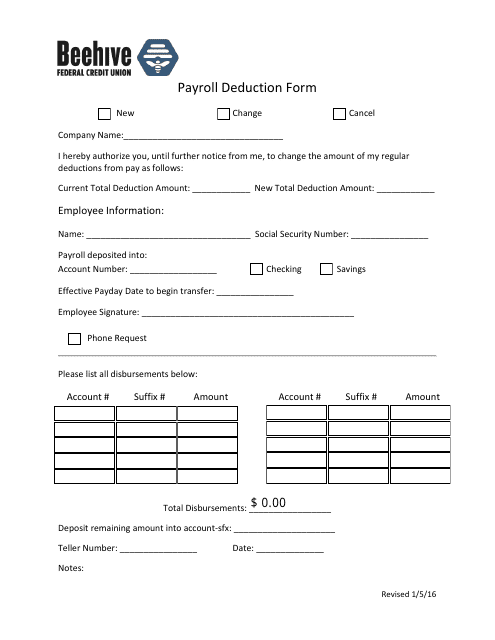

This form is used for authorizing payroll deductions for Beehive Federal Credit Union.

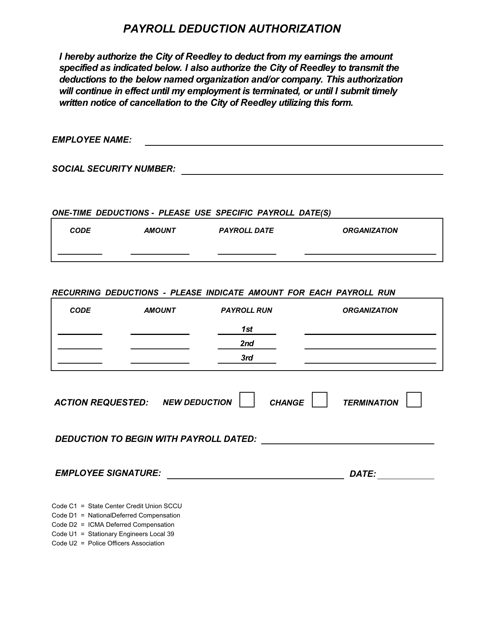

This Form is used for authorizing payroll deductions for employees of the City of Reedley, California.

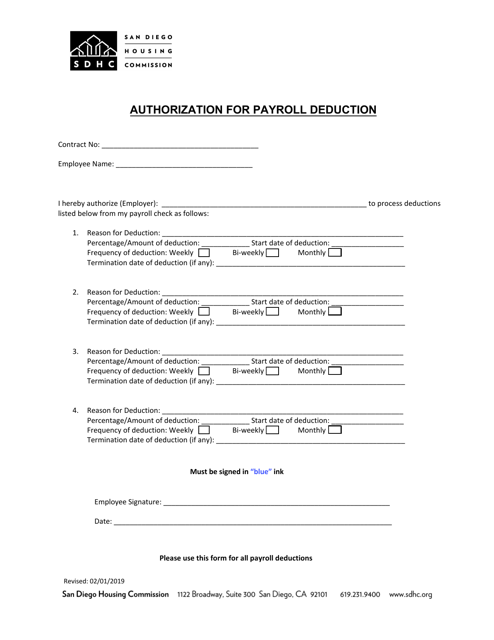

This document is used by employees of the City of San Diego, California to authorize payroll deductions for various purposes such as taxes, retirement contributions, or other authorized deductions.