Commuter Benefits Templates

Commuter benefits, also known as commuting benefits, are a valuable employee perk offered by many organizations. These benefits aim to ease the financial burden of commuting to work and promote sustainable transportation options. By providing incentives and resources, employers can assist their employees in accessing affordable and efficient modes of transportation.

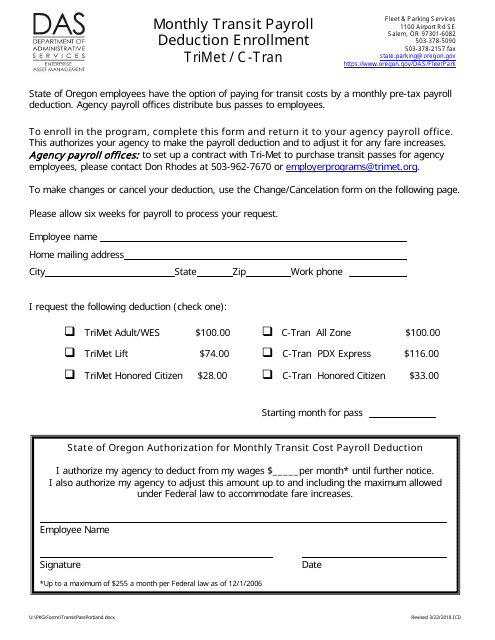

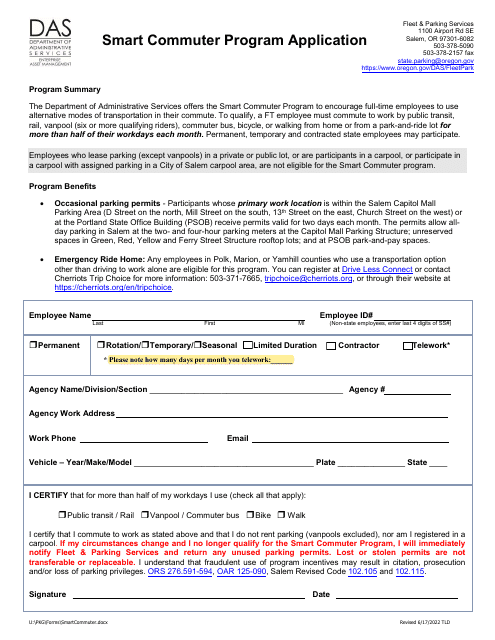

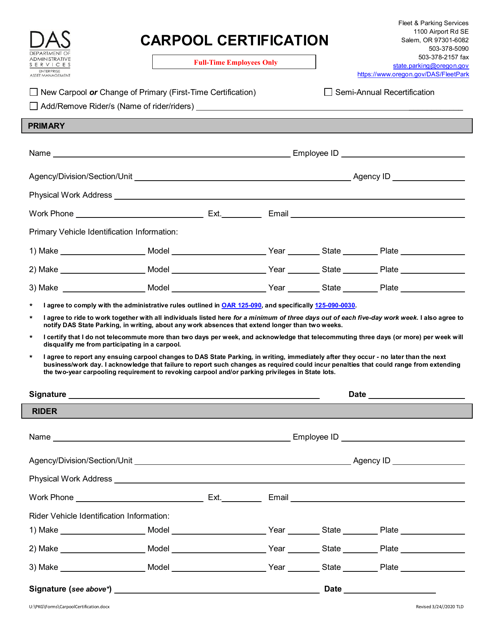

Commuter benefits programs vary based on location and employer preferences, but they typically include options such as transit payroll deductions, smart commuter programs, and participation forms. For instance, employees in Oregon can benefit from the Monthly Transit Payroll Deduction Enrollment, which allows them to deduct transit expenses from their paychecks. Similarly, the Smart Commuter Program Application supports Oregon residents in finding alternative means of transportation.

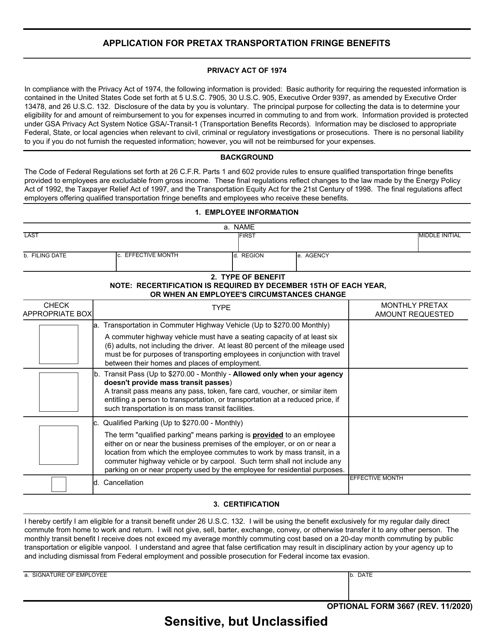

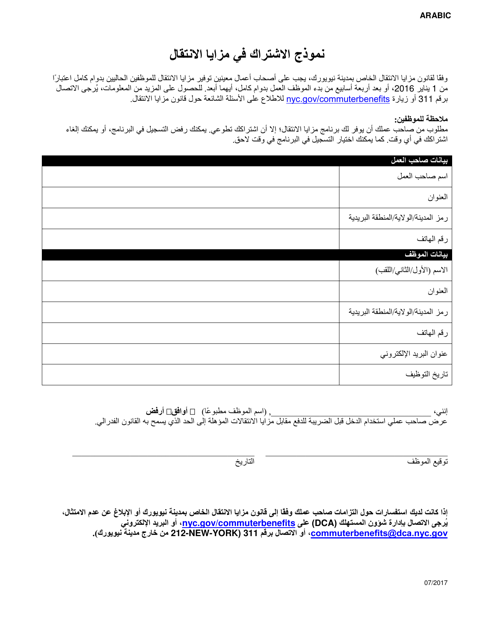

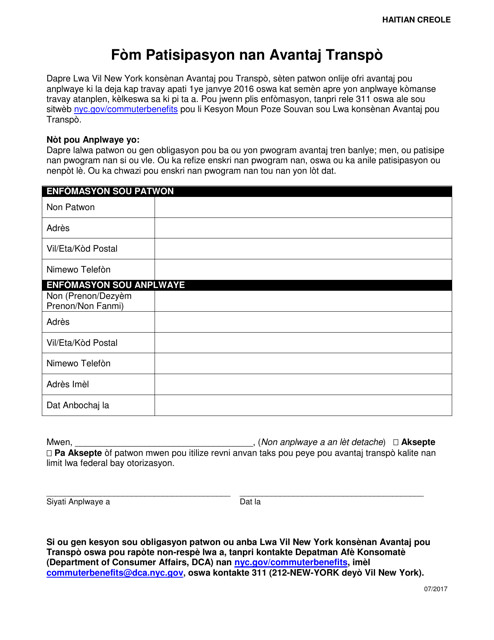

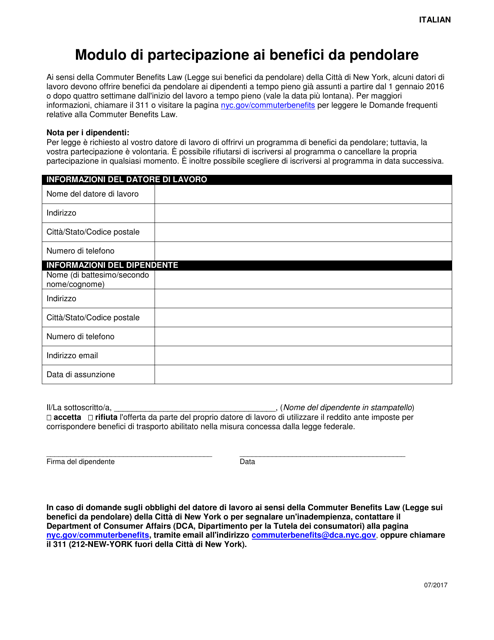

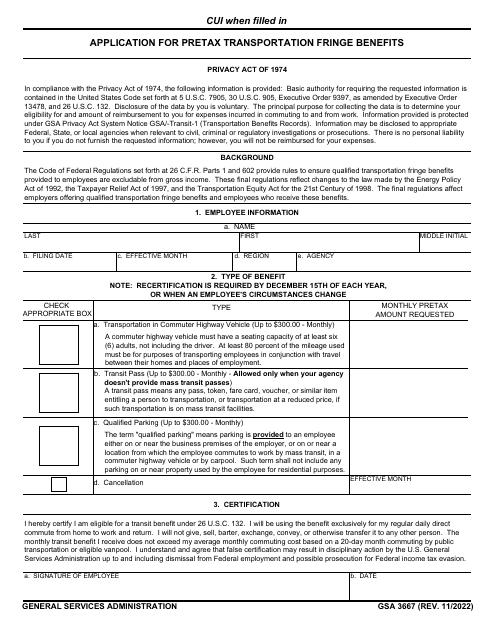

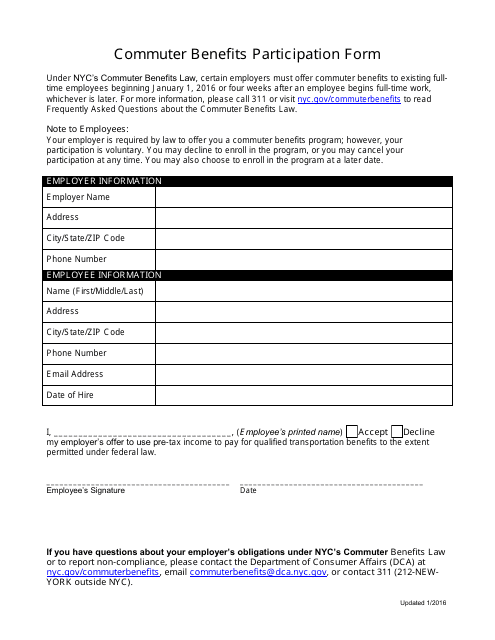

In New York City, the Commuter Benefits Participation Form is available in multiple languages, including Arabic and Italian. This inclusive approach ensures that employees from diverse backgrounds can easily access and enroll in commuter benefits. Additionally, the GSA Form 3667 Application for Pretax Transportation Fringe Benefits provides employees with the opportunity to save on taxes by using pretax income for commuting expenses.

Commuter benefits play a crucial role in reducing traffic congestion, promoting sustainable transportation options, and improving the overall well-being of employees. By offering these benefits, employers demonstrate their commitment to their workforce's financial stability and environmental responsibility. Whether employees choose to take advantage of public transportation, carpooling, biking, or other commuting methods, commuter benefits provide the necessary support to make their daily travels more affordable and convenient.

With the ever-increasing costs associated with commuting, it is essential for employers to offer commuter benefits as part of their employee benefit package. These programs not only help employees save money on transportation expenses but also contribute to a greener and more sustainable future. To learn more about commuter benefits and how they can benefit both employers and employees, explore the options available in your area.

Documents:

11

This document is for enrolling in monthly transit payroll deductions for the Trimet or C-Tran transit systems in Oregon. It allows employees to have their transit fares automatically deducted from their paychecks.

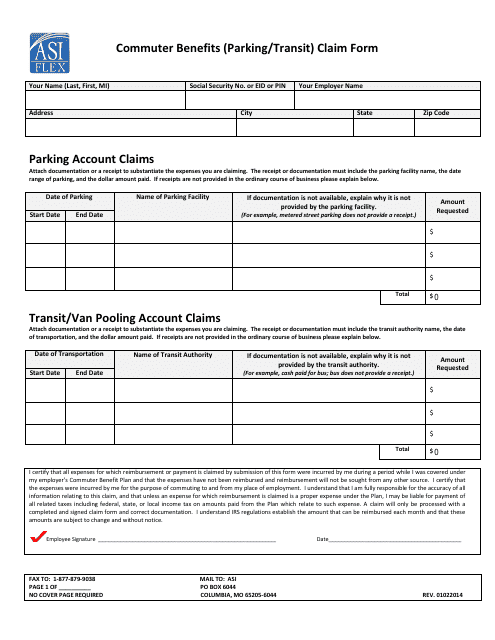

This form is used for claiming commuter benefits for parking and public transit expenses through the Asi Flex program.

This document is a form that allows participants in New York City to apply for commuter benefits. It is available in Arabic language.

This form is used for participating in commuter benefits program in New York City. It is available in Haitian Creole language.

This document is for New York City residents who want to participate in the Commuter Benefits Program. It is in Italian.