Married Filing Jointly Templates

Are you and your spouse filing taxes together? If so, you'll want to learn more about the married filing jointly documents. These documents are essential for couples who are married and choose to file their tax returns jointly.

The married filing jointly documents group, also known as the joint tax documents or the married couple tax forms, includes a variety of forms and schedules that are necessary to accurately report your income and deductions as a married couple. These documents ensure that both you and your spouse are accounted for and that you take advantage of any applicable tax benefits or credits.

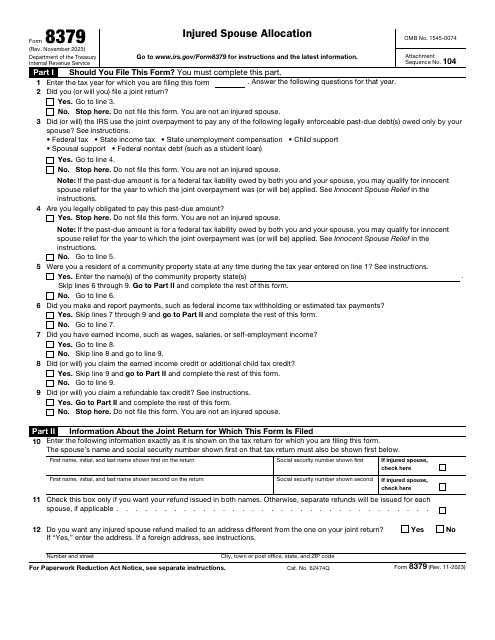

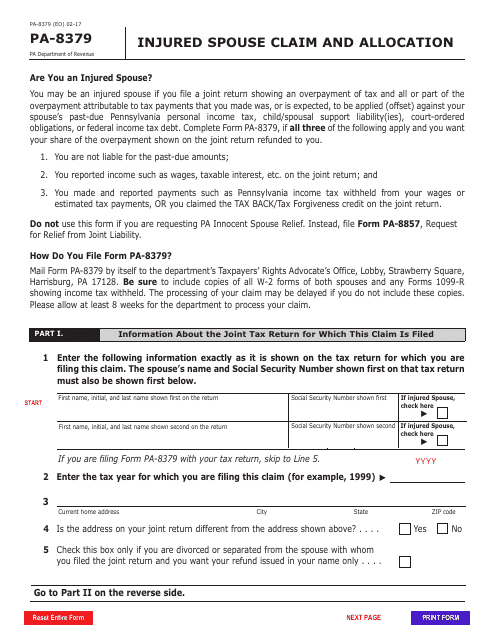

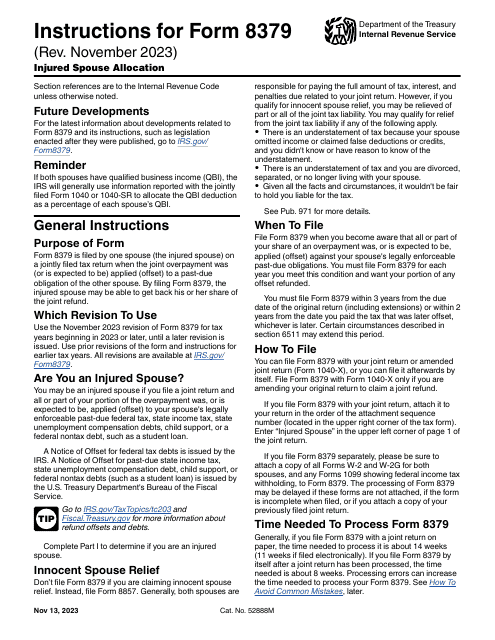

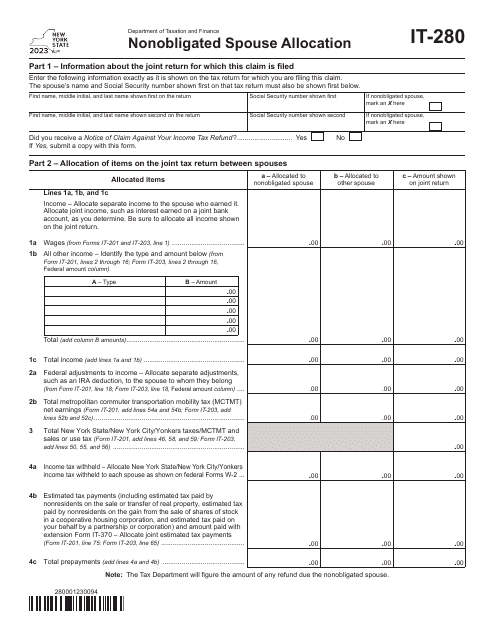

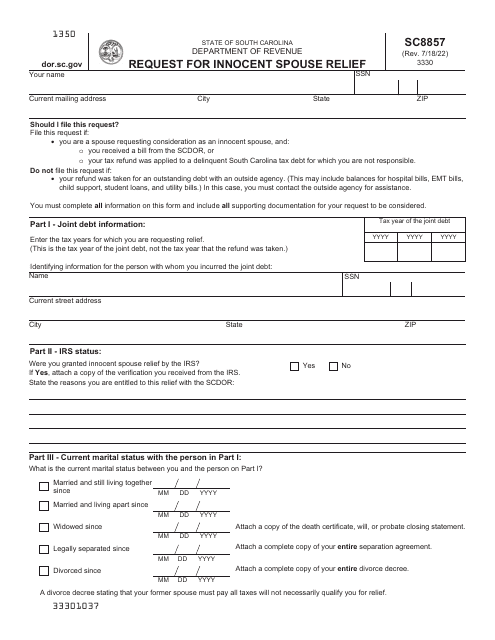

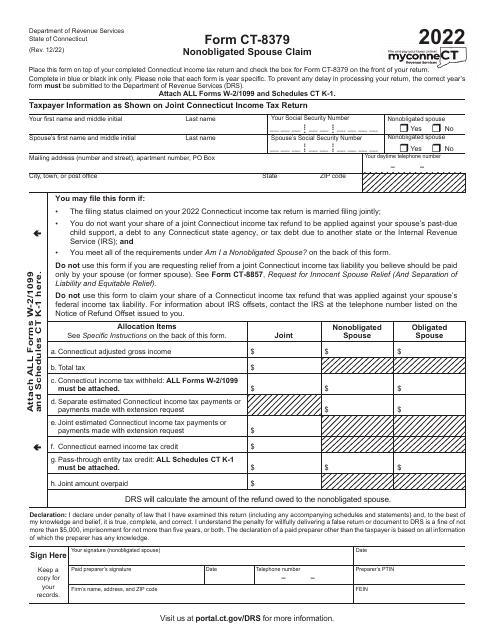

Some examples of documents within the married filing jointly group include the IRS Form 8379 Injured Spouse Allocation, which allows a couple to allocate the tax refund or liability between both spouses if one spouse has outstanding debts or obligations. Another example is the Form PA-8379 Injured Spouse Claim and Allocation, specific to the state of Pennsylvania. Similar forms exist for other states like New York and South Carolina, such as the Form IT-280 Nonobligated Spouse Allocation in New York and the Form SC8857 Request forInnocent Spouse Relief in South Carolina.

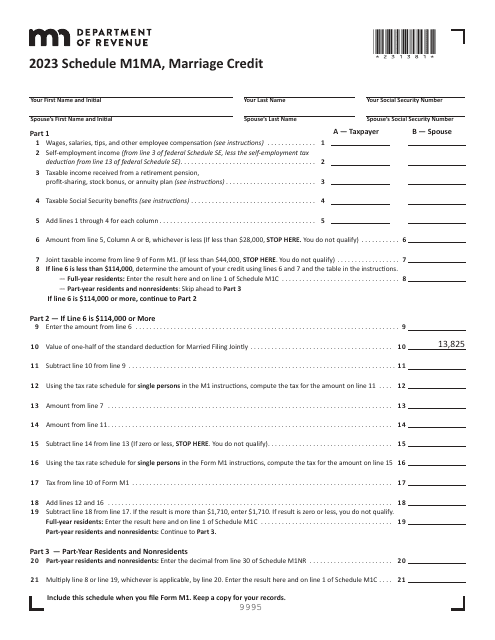

Additionally, there may be schedules or credits that are specific to certain states, like the Schedule M1MA Marriage Credit in Minnesota. These documents help ensure that married couples receive any applicable deductions or credits based on their state residency and marital status.

By understanding and correctly completing the married filing jointly documents, you can maximize your tax savings and avoid any potential issues or delays in processing your tax return. It's important to consult with a tax professional or use tax preparation software that can guide you through the specific requirements and forms related to married filing jointly.

So, whether you're looking to allocate tax refunds, claim credits, or ensure you're in compliance with state tax laws, the married filing jointly documents are crucial for married couples.

Documents:

8

This form is used for spouses in Pennsylvania to file a claim and allocate any refunds due to them when their tax refund is being offset for their partner's debts.