Collateral Loan Templates

A collateral loan, also known as a loan collateral or loan secured by collateral, is a type of loan that requires the borrower to provide valuable assets as security. These assets, which can include real estate, vehicles, or other valuable possessions, act as collateral in case the borrower fails to repay the loan.

Collateral loans offer several advantages for both borrowers and lenders. For borrowers, these loans often come with lower interest rates and more flexible repayment terms compared to unsecured loans. Lenders, on the other hand, benefit from reduced risks since they have a tangible asset they can seize and sell if the borrower defaults.

At Templateroller.com, we understand the importance of collateral loans and offer a comprehensive range of documents and resources to facilitate this lending process. Whether you're a financial institution, a lender, or a borrower, our collection of collateral loan documents can assist you in navigating the complexities of these transactions.

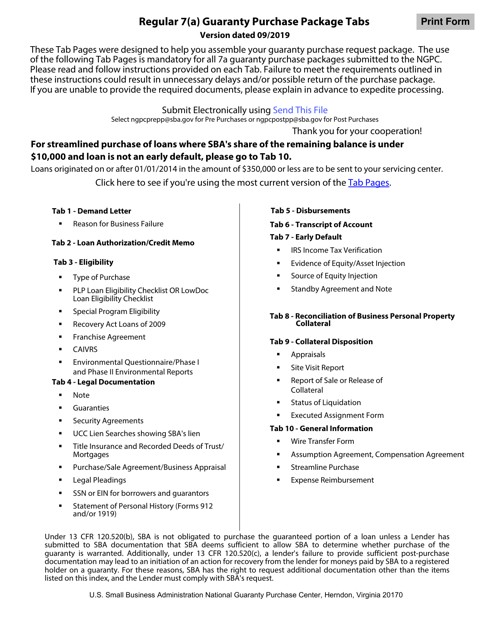

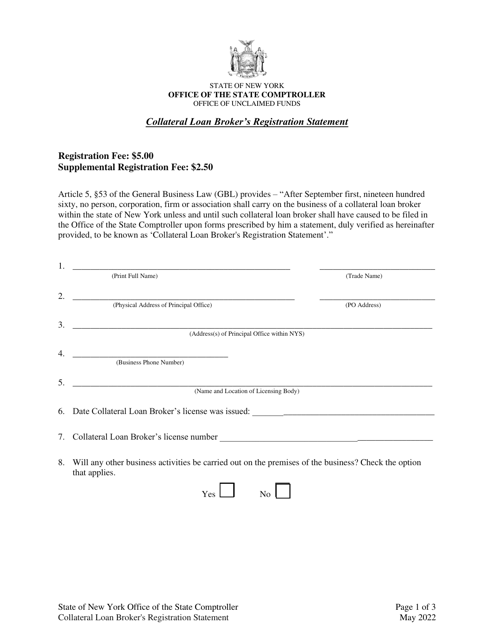

From government forms such as SBA Form 1059 Security Agreement and SBA Form 3507 CARES Act Section 1102 Lender Agreement to state-specific documents like the Security Agreement for Certificate of Deposit - Louisiana and the Collateral Loan Broker's Registration Statement - New York, our collection covers various aspects of collateral loans.

With our collateral loan documents, lenders can ensure their legal rights are protected and clearly established, while borrowers can have a comprehensive understanding of their obligations and rights regarding the collateral provided. These documents provide the necessary framework to safeguard both parties' interests and ensure a smooth and transparent lending process.

Whether you need to draft a security agreement, establish loan terms and conditions, or register as a collateral loan broker, our collateral loan documents collection has got you covered. With our user-friendly resources, you can easily customize these documents to suit your specific needs, saving you time and effort.

At Templateroller.com, we strive to provide reliable and comprehensive resources for all your collateral loan needs. Discover the benefits of collateral loans and maximize the potential of your assets with our extensive library of documents. Browse through our collection today and take a step towards securing your financial future.

Documents:

5

This form is used for creating a legally binding agreement between a borrower and a lender to secure a loan or credit with specified collateral.

This document is used for securing a certificate of deposit in the state of Louisiana. It outlines the terms and conditions of the agreement between the depositor and the financial institution.