Loan Programs Templates

Looking for financial assistance? Look no further than our loan programs! Whether you need funding for a small business startup or environmental cleanup, our loan programs offer a variety of options to suit your needs. With our loan programs, you can access capital to help make your dreams a reality.

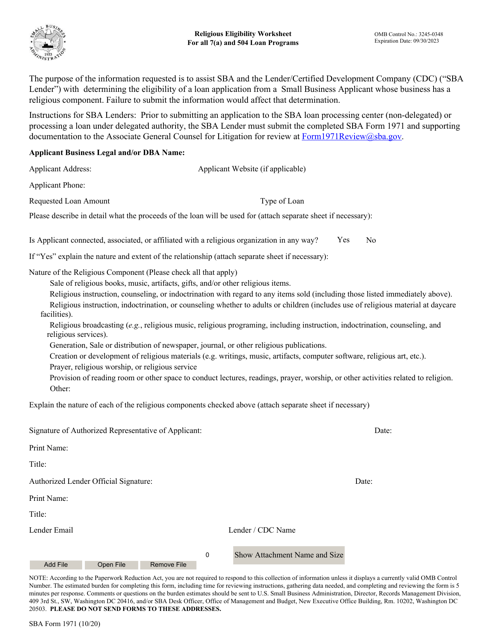

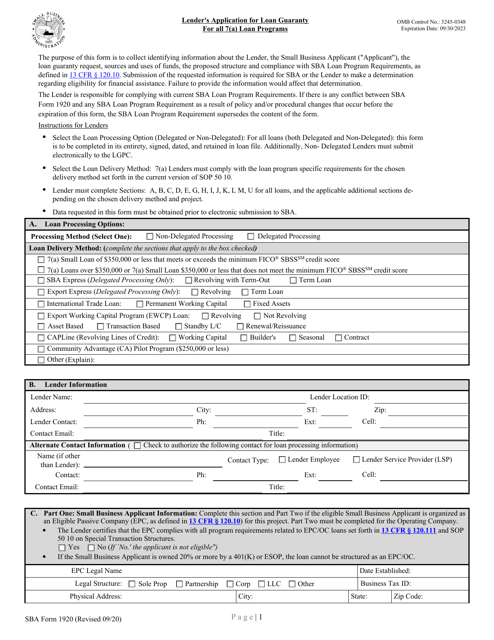

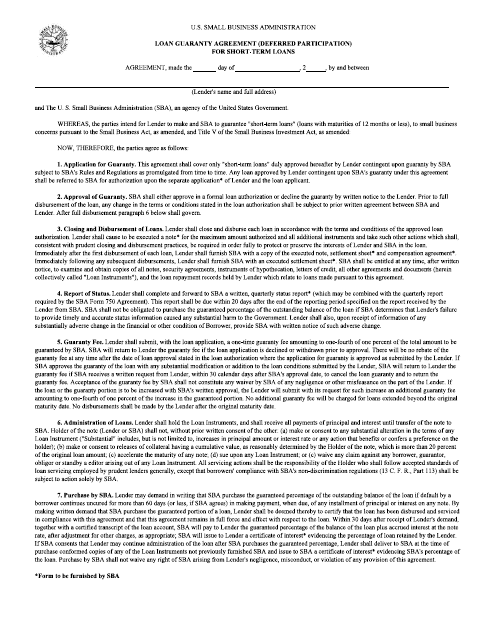

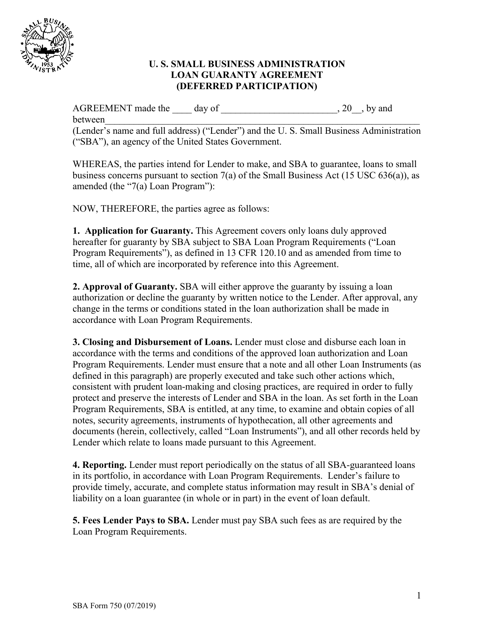

Our loan programs are designed to cater to different industries and purposes. For small businesses, we offer the SBA Form 750 Lender's Loan Guaranty Agreement (Deferred Participation), which provides a valuable guarantee for lenders. If you represent a religious organization, the SBA Form 1971 Religious Eligibility Worksheet for All 7(A) and 504 Loan Programs can help determine your eligibility for funding. For environmental projects, the Form WPC765 (IL532-3020) Federal Reporting Requirements - Water Pollution Control Loan Program in Illinois and ADEM Form 542 Pre-application Form - Brownfield Cleanup State Revolving Fund (BCSRF) Loan Program in Alabama are available.

Our loan programs are also known as loan programs or loan program, so you can easily find the assistance you need. We understand that sometimes traditional funding isn't enough, which is why we've developed a range of specialized loan programs to meet unique needs.

Whether you're looking to launch a new business or support a community project, our loan programs can provide the financial boost you require. Don't miss out on the opportunity to turn your goals into realities. Explore our loan programs today and see how we can help you succeed!

Documents:

91

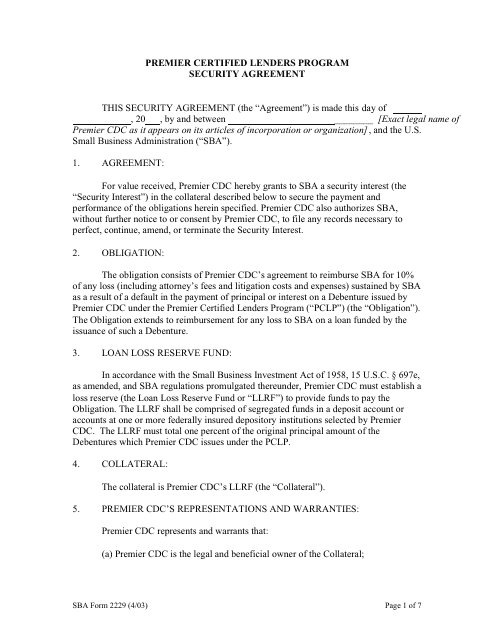

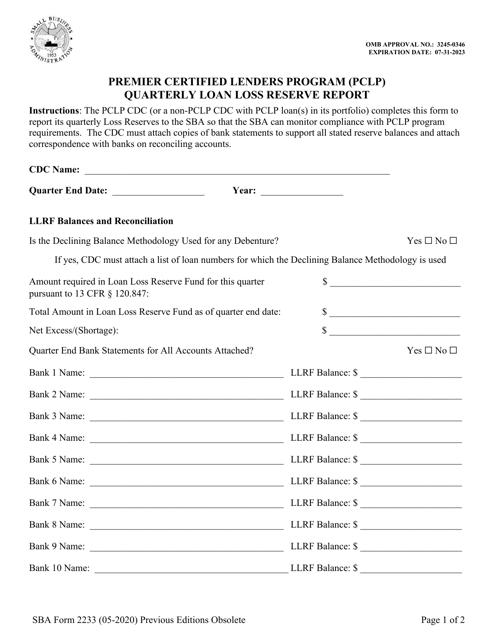

This type of document is a security agreement used in the Premier Certified Lenders Program of the Small Business Administration (SBA).

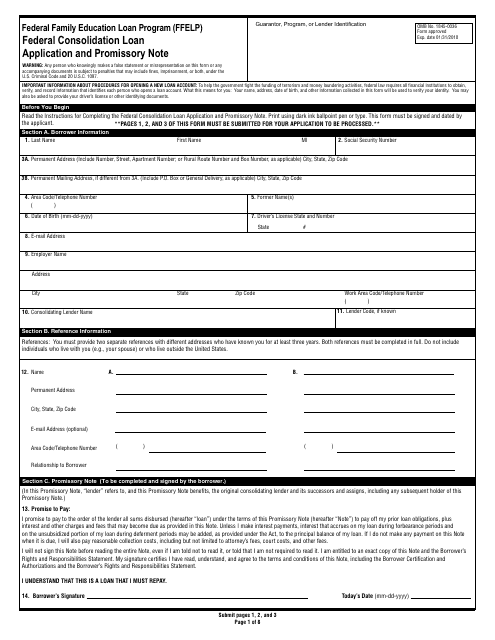

This type of document is used for applying for a Federal Consolidation Loan under the Federal Family Education Loan Program.

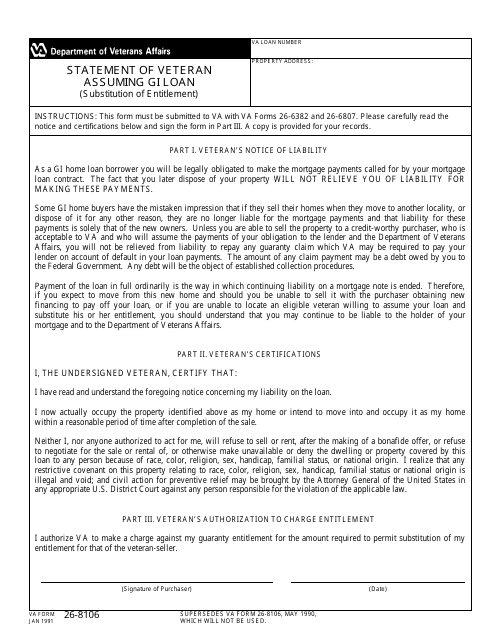

This Form is used for veterans assuming GI loans to provide a statement confirming their intention to assume the loan.

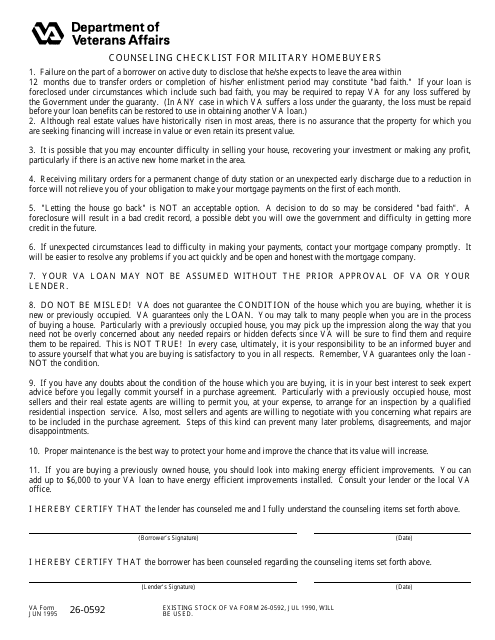

U.S. Servicemembers may use this VA checklist to obtain a loan with the help of the Federal Housing Administration.

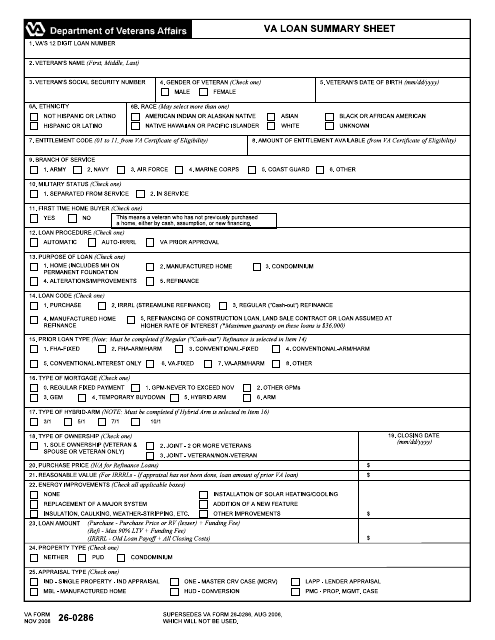

This document provides a summary of information related to a VA loan. It is used to summarize important details of a VA loan application.

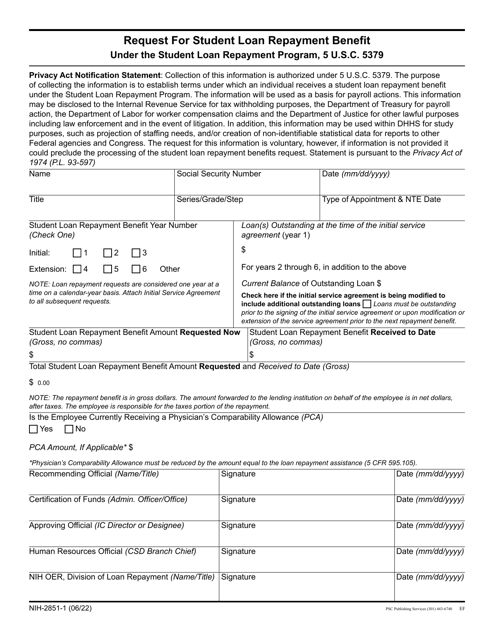

This document is a contract for the Loan Repayment Program of the National Institutes of Health (NIH). It is used to formalize the terms and conditions of the program between the applicant and NIH.

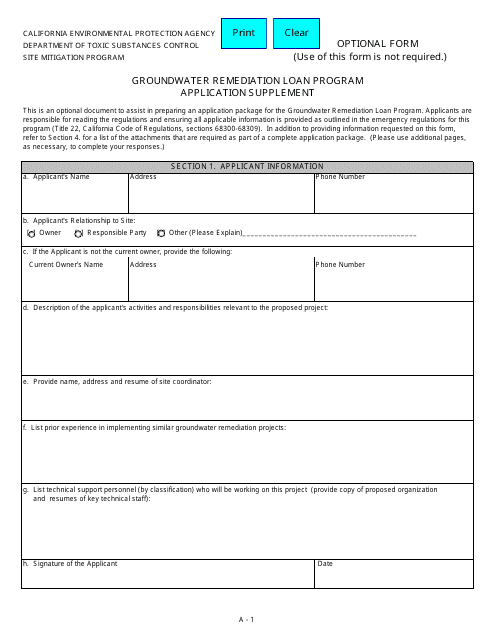

This form is used for applying for a groundwater remediation loan under the Groundwater Remediation Loan Program in California.

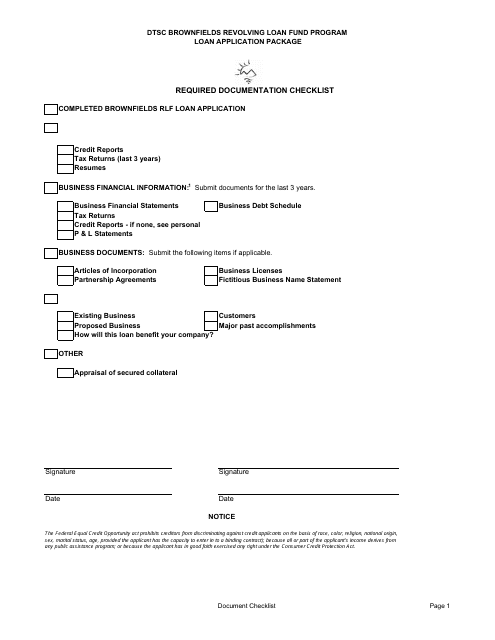

This document provides a checklist of the required documentation for the DTSC Brownfields Revolving Loan Fund Program in California. It outlines the necessary paperwork and forms that must be submitted as part of the program application process.

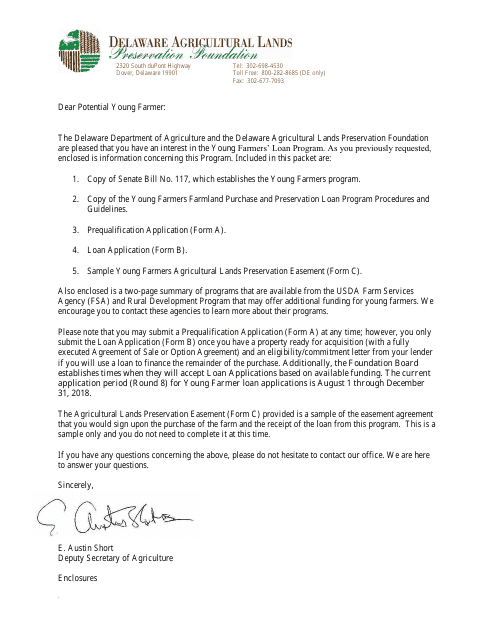

This document outlines the procedures and guidelines for Delaware's Farmland Purchase and Preservation Loan Program. It provides information on how to apply for loans to purchase and preserve farmland in the state.

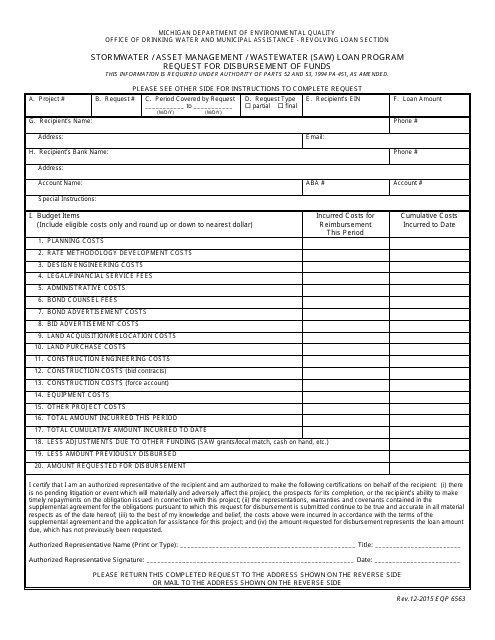

This form is used for requesting the disbursement of funds for the Stormwater / Asset Management / Wastewater (Saw) Loan Program in Michigan.

This Form is used for applying to the Michigan Rail Loan Assistance Program. The program provides financial assistance to individuals and organizations seeking to develop or improve rail infrastructure in Michigan.

This form is used for requesting an annual computed millage waiver for the School Bond Qualification and Loan Program in Michigan. It allows schools to request an exemption from certain millage requirements.

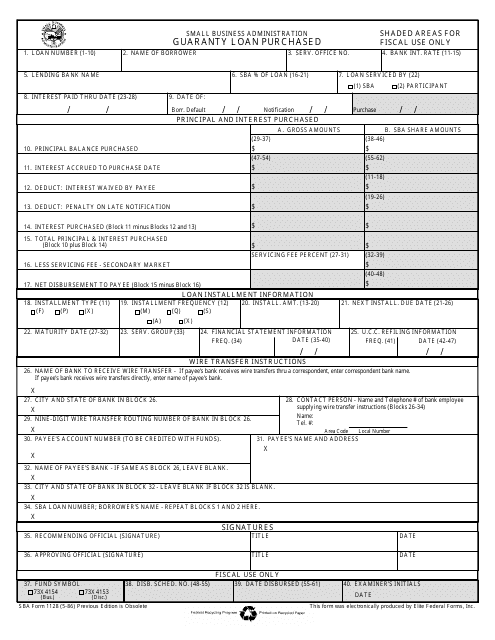

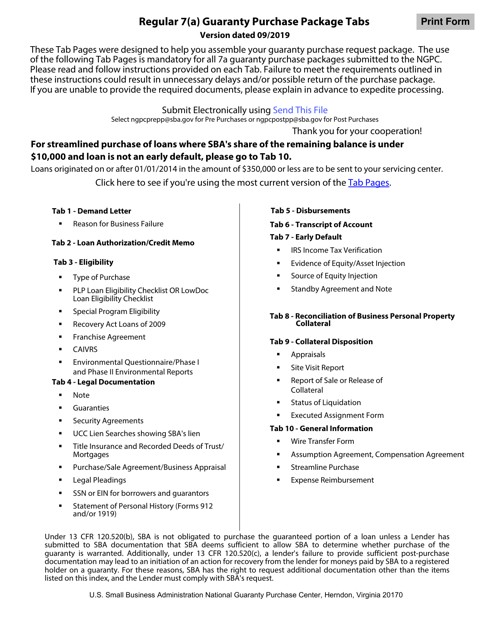

This Form is used for purchasing a guaranteed loan through the Small Business Administration (SBA).

This Form is used for applying to become a Loan Pool Originator for the First Mortgage Loan Pool (FMLP) Program administered by the Small Business Administration (SBA).

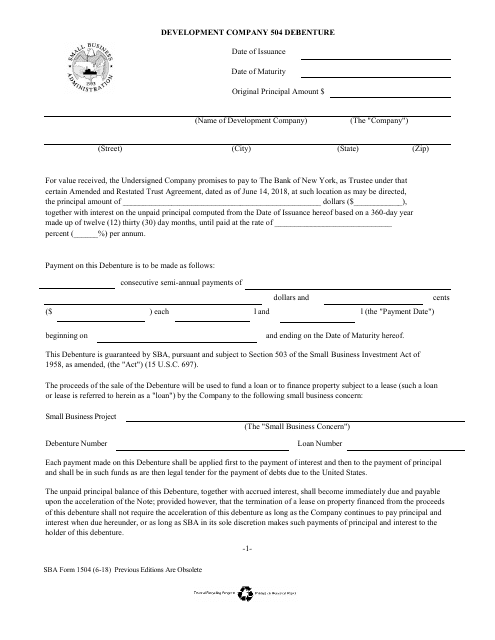

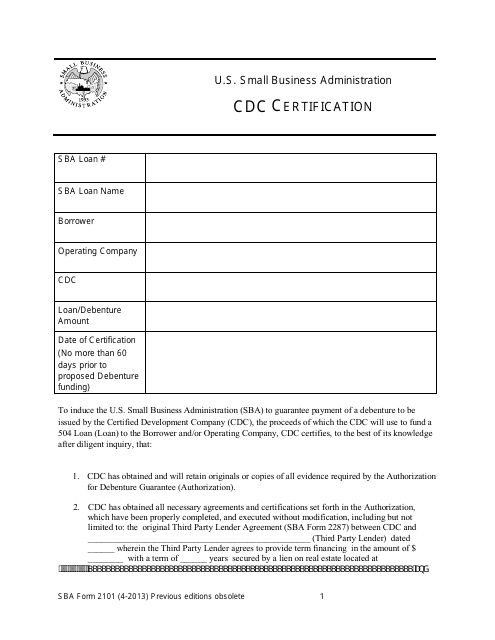

This form is required to be filled out by the Certified Development Company (CDC) to report the debenture payment schedule of development companies.

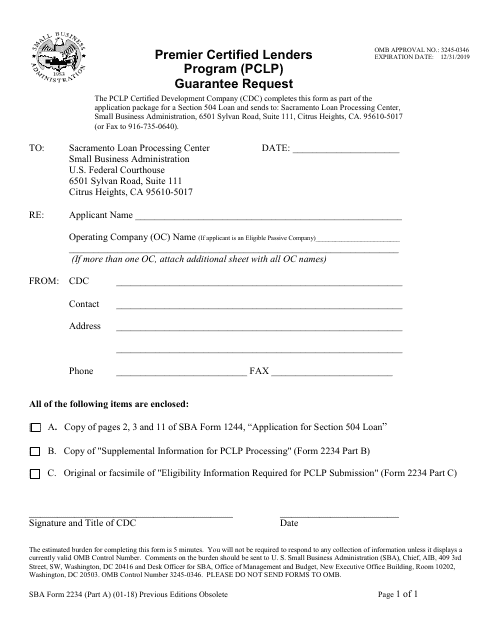

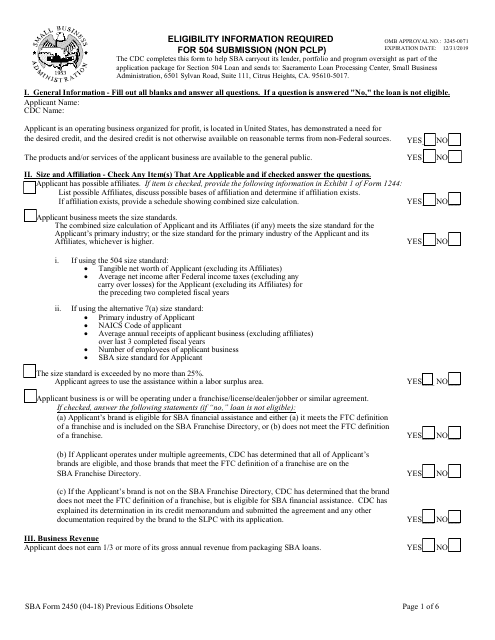

This form is used for requesting a guarantee through the Premier Certified Lenders Program (PCLP) offered by the Small Business Administration (SBA).

This form is used for the Small Business Administration (SBA) CDC (Certified Development Company) certification process. It verifies the qualifications of CDCs under the SBA's 504 loan program.

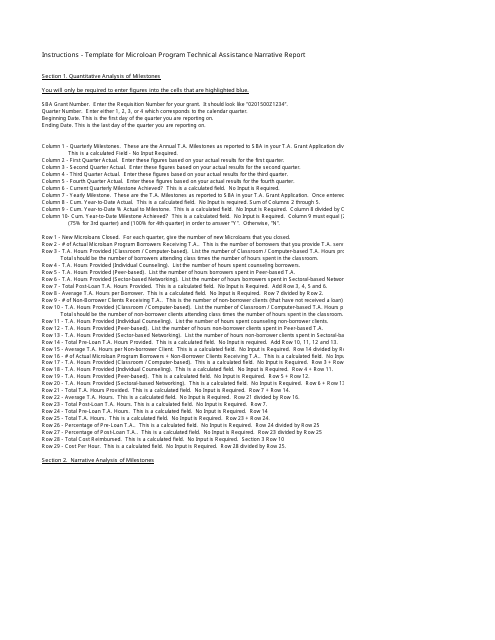

This document is a template for creating a narrative report for a technical assistance program associated with a microloan program. It helps in documenting the progress and outcomes of the technical assistance provided to support microloan programs.

This document is used for the Loan Guaranty Agreement (Deferred Participation) for Short-Term Loans under the Small Business Administration (SBA) program.

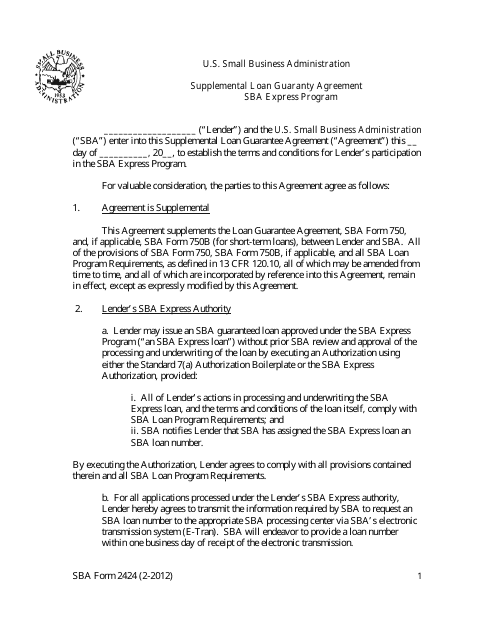

This form is used for a supplemental loan guaranty agreement in the SBA Express Program.

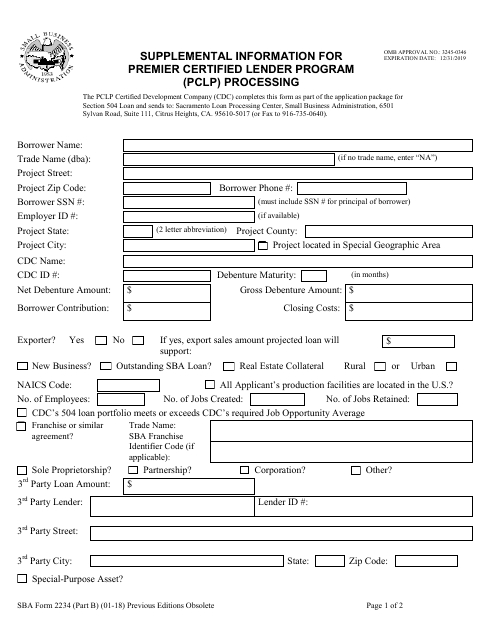

SBA Form 2234 Part B Supplemental Information for Premier Certified Lender Program (PCLP) Processing

This Form is used for providing supplemental information for the Premier Certified Lender Program (PCLP) processing in SBA Form 2234 Part B.

This document is completed by a Certified Development Company (CDC) to help the Small Business Administration (SBA) to apply for a Section 504 Loan.

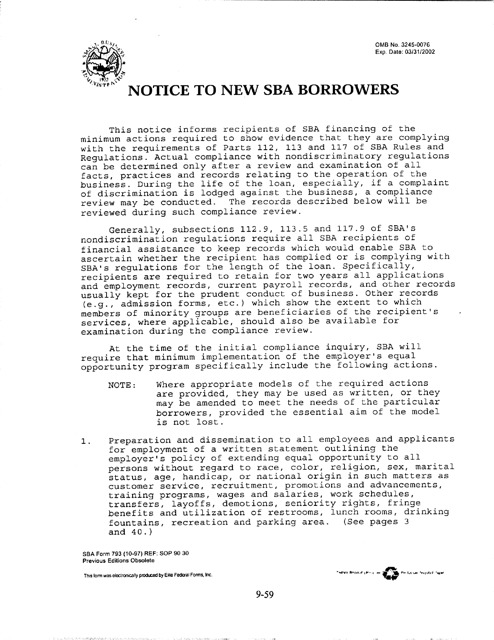

This form is used for notifying new borrowers about the Small Business Administration (SBA) requirements and terms for their loan.

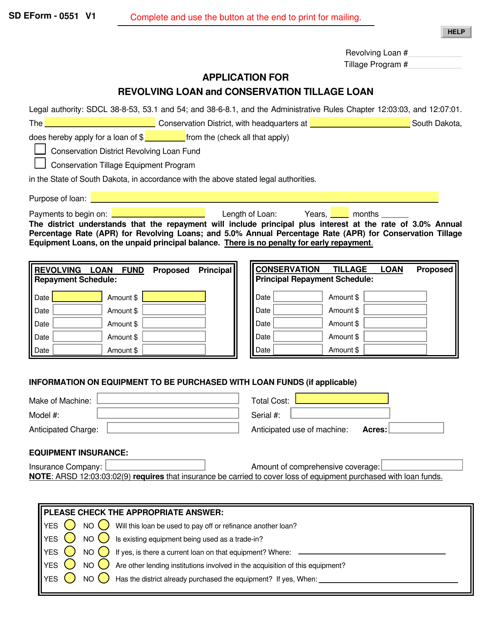

This form is used for applying for a revolving loan and conservation tillage loan in South Dakota.

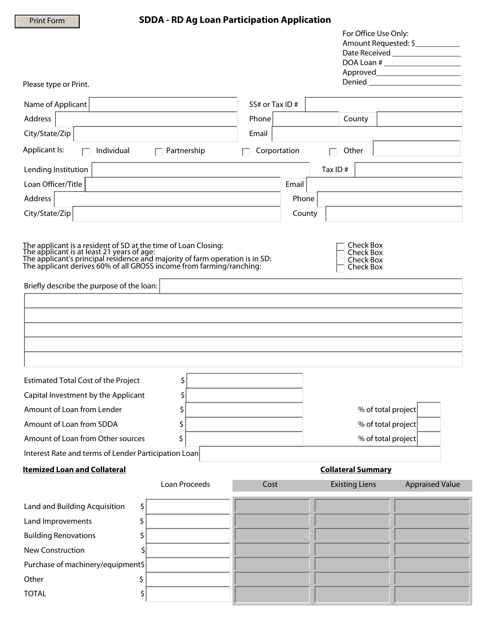

This form is used for applying for a loan participation program in South Dakota specifically for agricultural purposes.

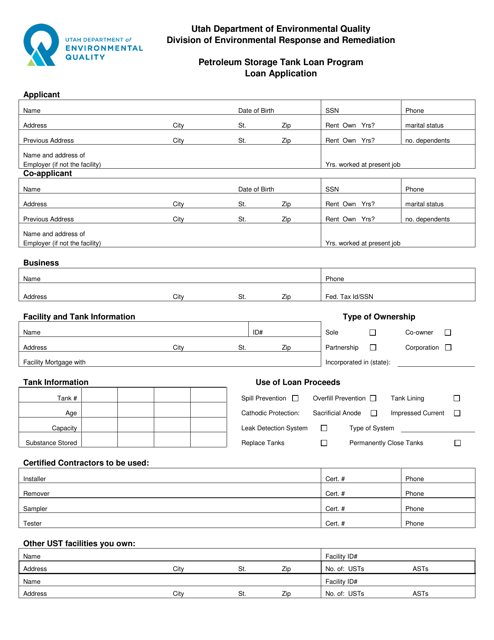

This document is a loan application for the Petroleum Storage Tank Loan Program in Utah. It allows individuals or businesses to apply for a loan to finance the installation or upgrade of petroleum storage tanks.

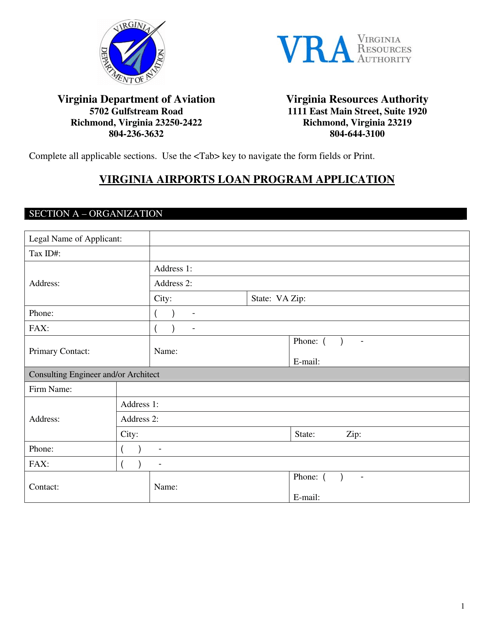

This form is used for applying for a loan through the Virginia Airports Loan Program. It is specifically designed for residents of Virginia who are looking for financial assistance for their airport projects.

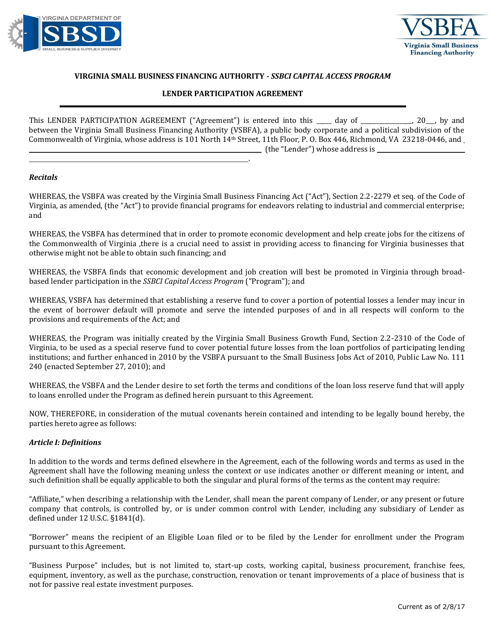

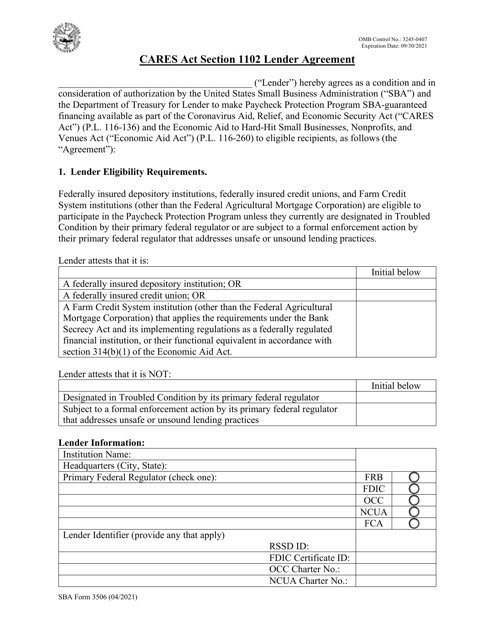

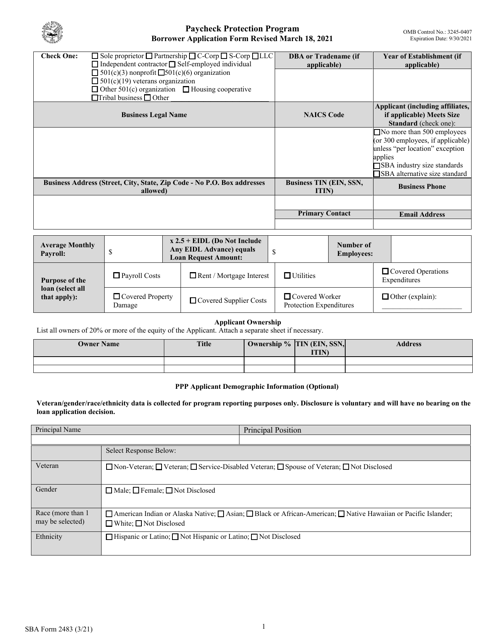

This document outlines the agreement between a lender and the state of Virginia for participation in the State Small Business Credit Initiative (SSBCI) Capital Access Program (CAP). It specifies the terms and conditions of the lender's participation.

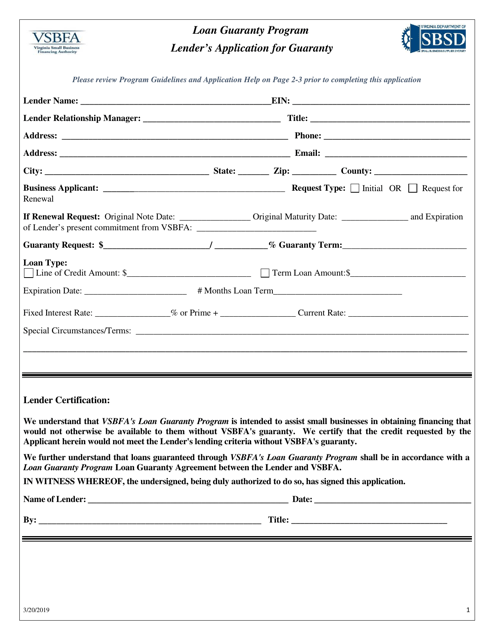

This document is for lenders in Virginia who want to apply for a loan guaranty through the Loan Guaranty Program.

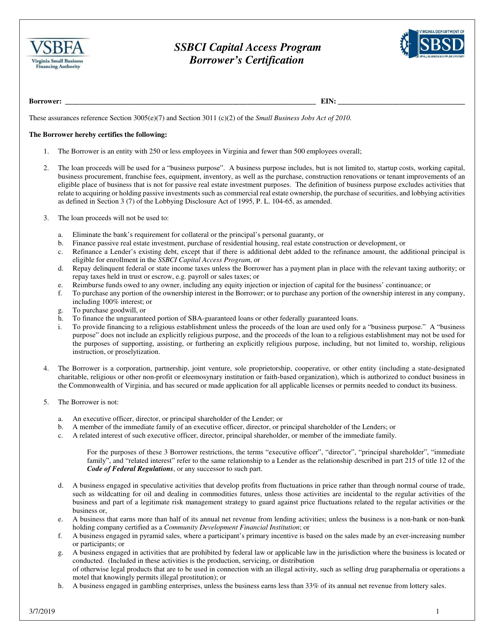

This document certifies borrowers participating in the SSBIC Capital Access Program in Virginia.

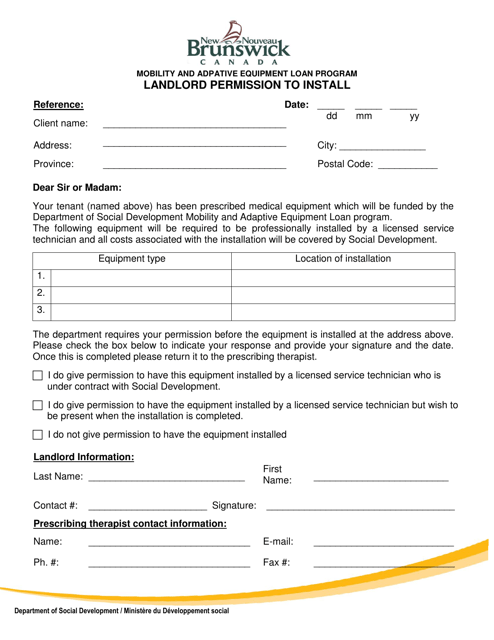

This document is for residents of New Brunswick, Canada who need to obtain permission from their landlord to install mobility and adaptive equipment in their rental property.