Debt Collection Agency Templates

Are you struggling to collect outstanding debts? Look no further than our debt collection agency services. We are your go-to solution for recovering unpaid debts and delinquent accounts. With extensive expertise and proven success, our debt collection agency helps businesses and individuals recoup the money they are owed.

Our team of skilled professionals works diligently to pursue overdue payments, utilizing effective strategies and industry-standard protocols. As a leading debt collection agency, we understand the importance of maintaining strict compliance with state and federal laws, ensuring ethical and lawful debt recovery.

We offer a wide range of services to meet your specific needs. From initiating collection efforts and conducting comprehensive investigations to negotiating settlements and pursuing legal actions when necessary, our debt collection agency is well-equipped to handle any debt recovery case.

With years of experience and a vast network of resources, we have established ourselves as a reliable and trustworthy debt collection agency. Our focus is on providing personalized solutions tailored to each client's unique situation. We understand that every debt collection case is different, and we approach each one with precision and personalized attention.

Don't let unpaid debts erode your financial stability. Contact our debt collection agency today to discuss your needs and find out how we can help you recover what you are owed. Our team is ready to assist you in navigating the complexities of debt collection, ensuring a swift and efficient resolution to your outstanding accounts.

Alternate names for this document group: debt collection agencies, debt recovery services, debt collectors, collections agencies, delinquent accounts recovery.

Documents:

11

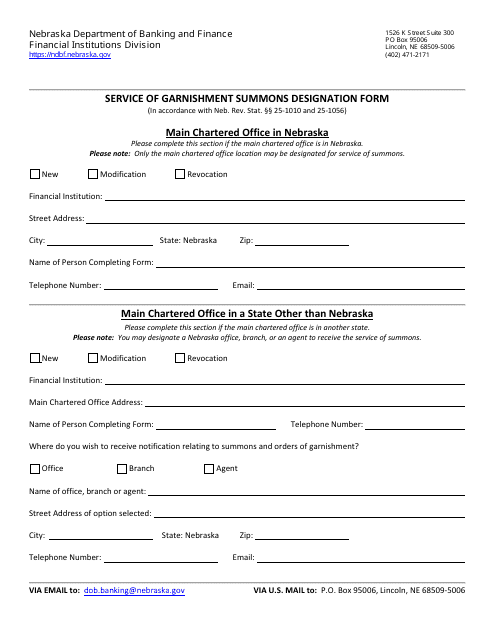

This document is used for designating the service of a garnishment summons in Nebraska.

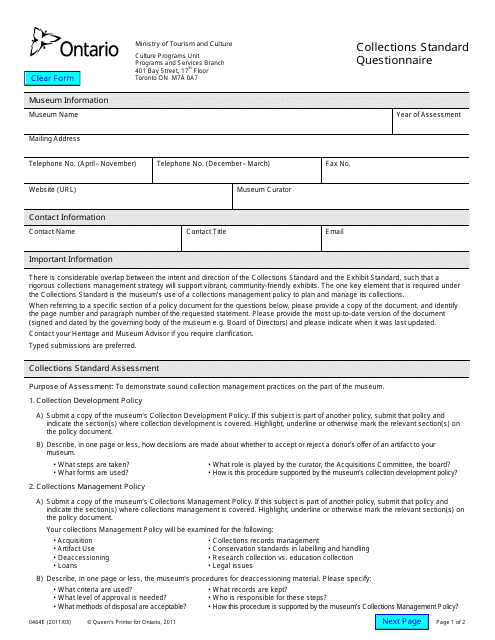

This Form is used for conducting collections standard questionnaires in Ontario, Canada. It is designed to gather information for assessing compliance with collections standards.

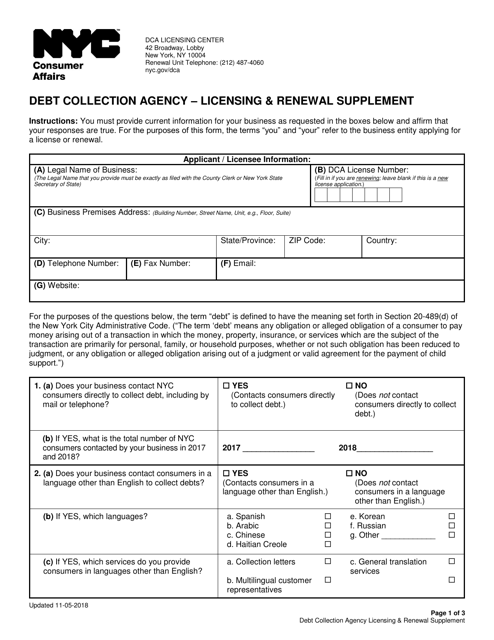

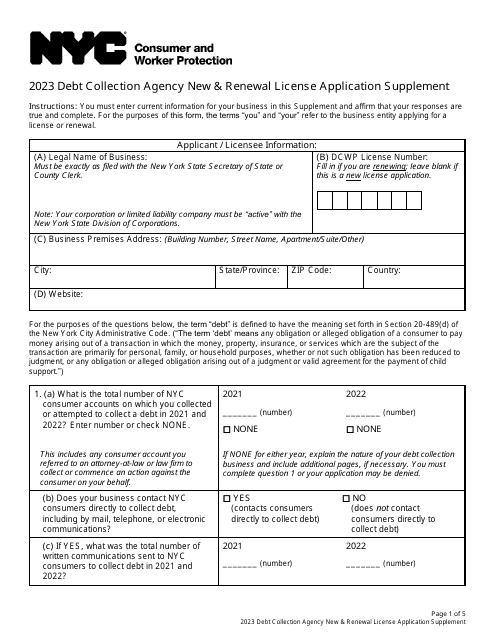

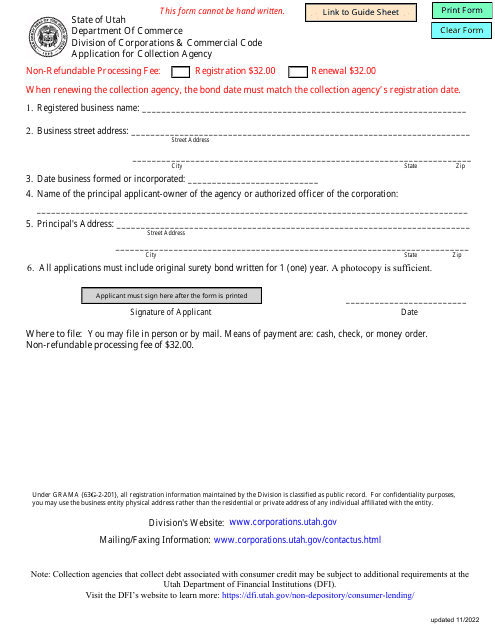

This document provides information on the licensing and renewal process for debt collection agencies operating in New York City. It includes the necessary forms and instructions for obtaining and renewing a license.

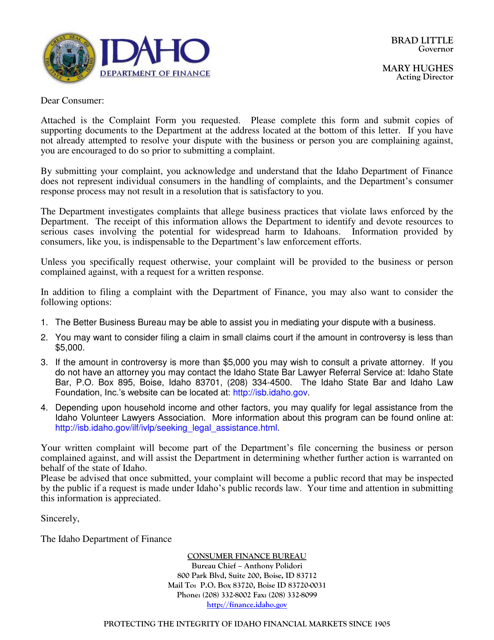

This Form is used for filing a complaint against a collection agency in Idaho.

Use this letter to request information about your credit history and any particular debts you may have.

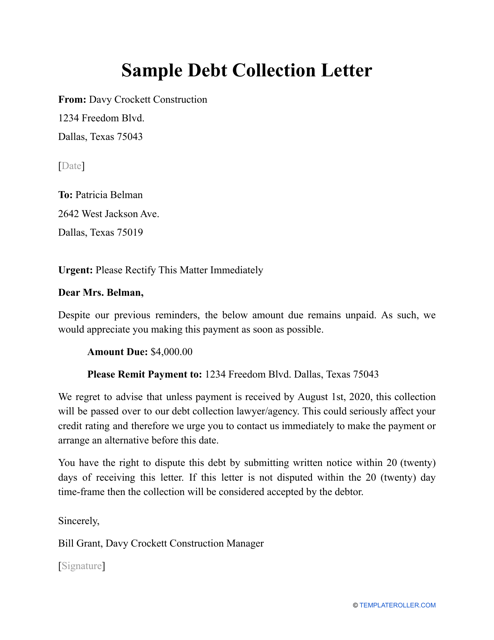

A lender can preparer this financial statement and send it to a borrower with the request for them to handle an unpaid debt.

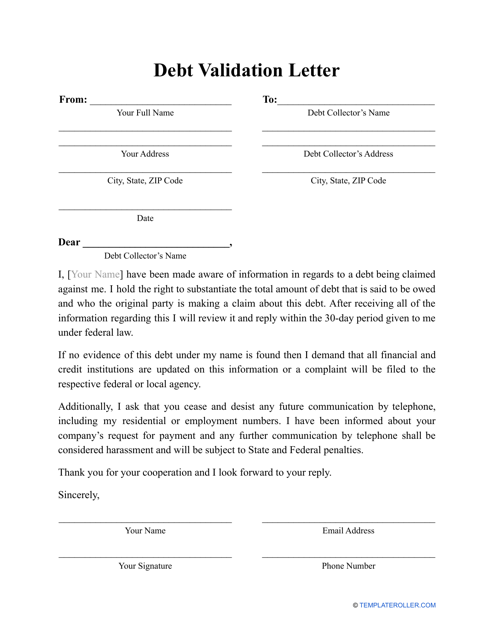

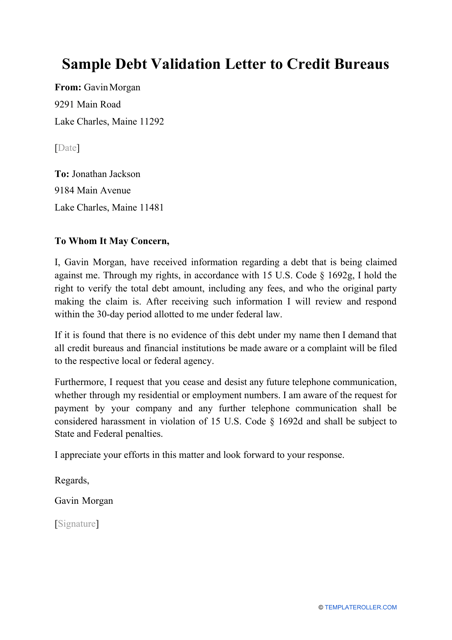

A debtor or their representative may prepare this letter with the intention of finding out whether their debt is real, to request information about an existing debt, and to warn the credit bureau that handles the debt to cease their harassing behavior if necessary.

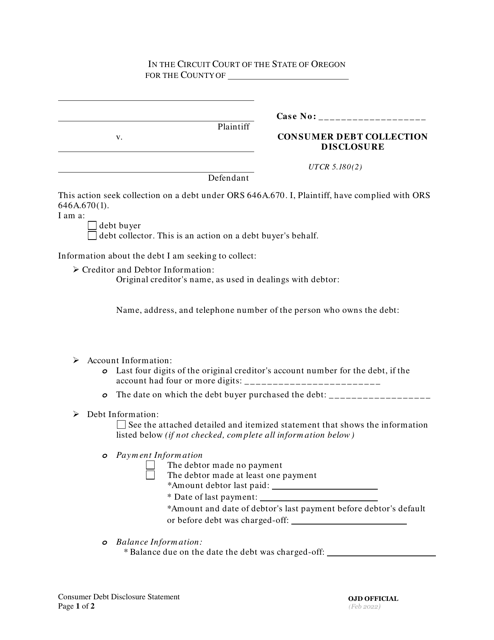

This document provides consumers in Oregon with important information regarding the debt collection process and their rights. It explains the disclosure requirements and protections afforded to consumers when dealing with debt collectors in the state.