Excise Tax Act Templates

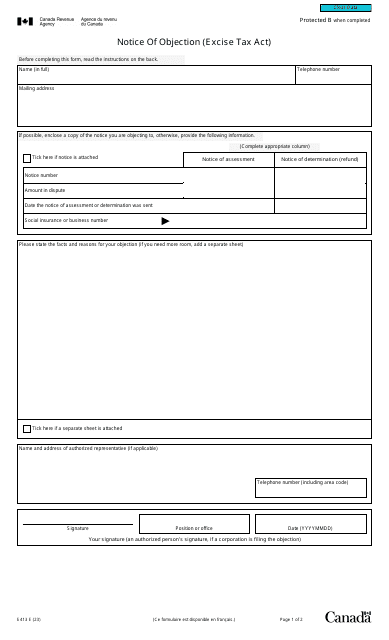

The Excise Tax Act, also known as the excise tax legislation, is a collection of documents that outline the regulations and requirements for the taxation of certain goods and services. These documents provide guidance and information on the application, calculation, and collection of excise tax.

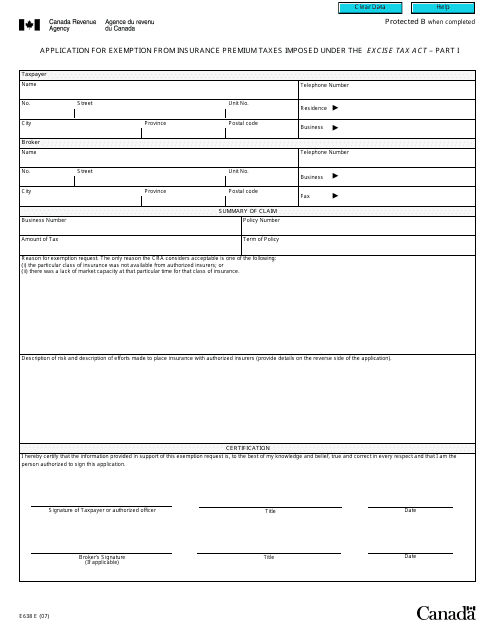

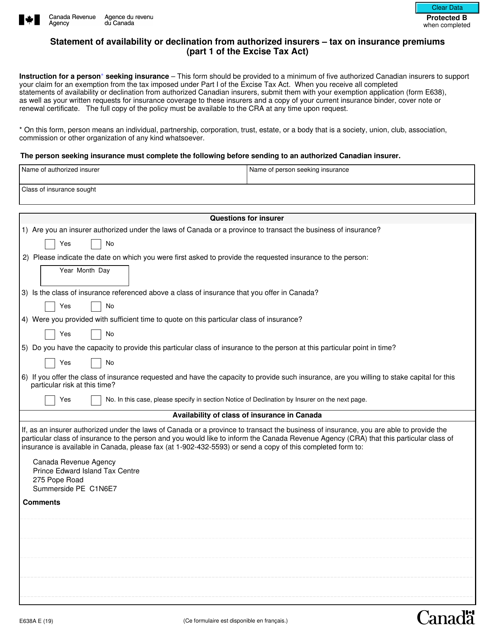

One example document is the Form E638A, which is a statement used to indicate the availability or declination from authorized insurers regarding the tax on insurance premiums. This form is just one example of the various forms and notices that fall under the Excise Tax Act.

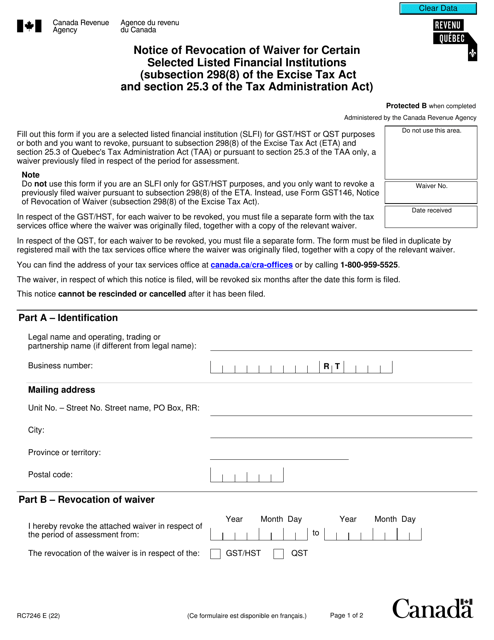

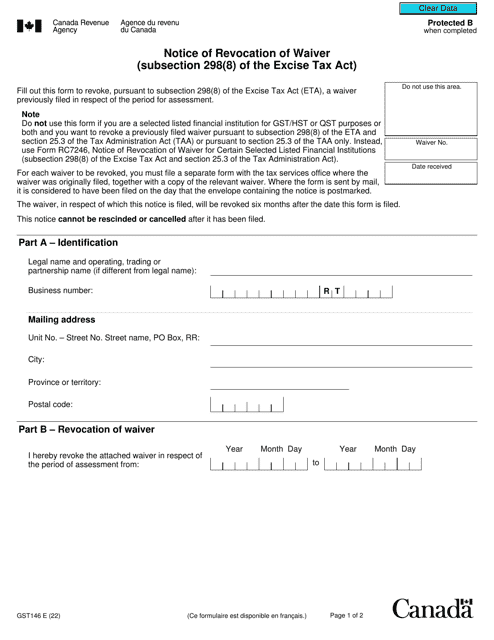

Another document is the Form GST146, which is a notice of revocation of a waiver under subsection 298(8) of the Excise Tax Act. This form is used to inform individuals or businesses that a previously granted waiver for certain tax obligations has been revoked.

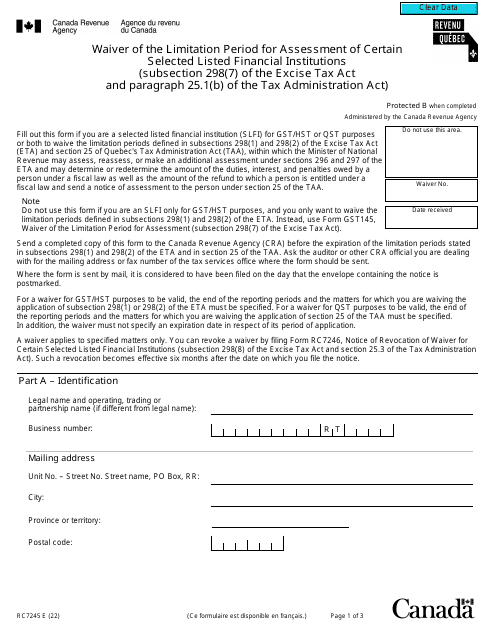

The Form RC7246 is yet another document that relates to the Excise Tax Act. It is a notice of revocation of a waiver specifically for selected listed financial institutions. This form is used to inform these institutions that their waiver has been revoked and they are now subject to the excise tax requirements.

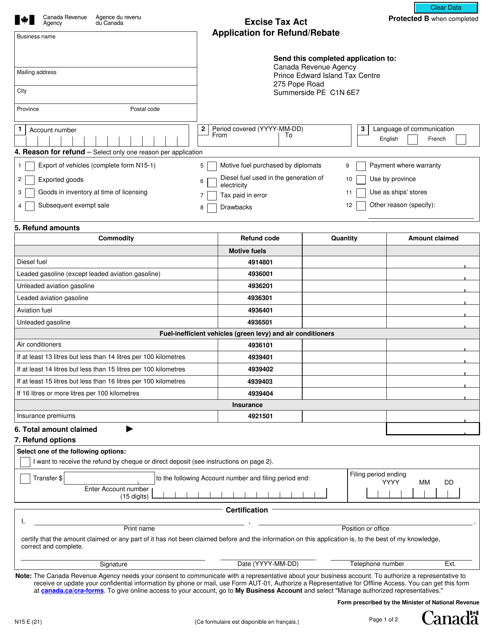

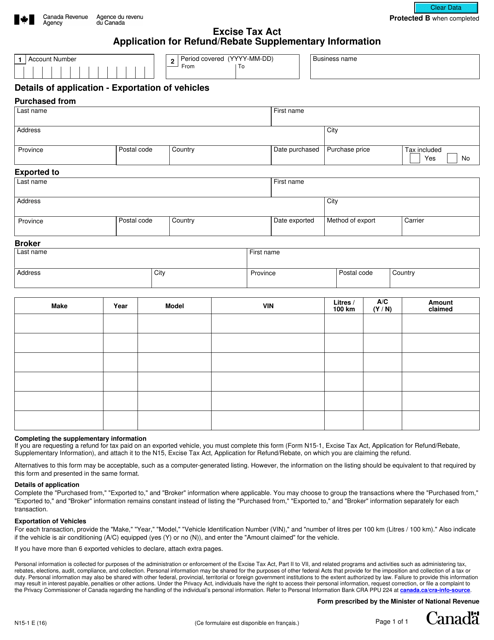

The Excise Tax Act also includes the Form N15, which is an application for refund or rebate under the Act. This form allows individuals or businesses to request a refund or rebate for overpaid excise tax.

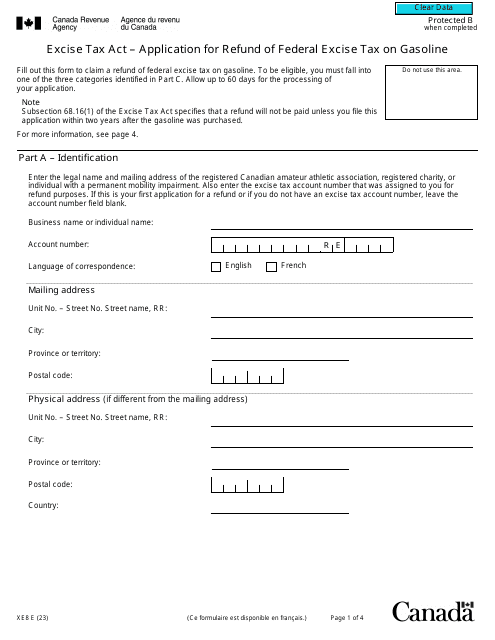

Lastly, the Form XE8 is an application for a refund of the federal excise tax on gasoline. This form is used specifically for claiming a refund of the excise tax paid on gasoline.

All these documents within the Excise Tax Act serve as essential resources for individuals and businesses to understand and comply with the excise tax regulations. They provide the necessary information and forms to ensure accurate reporting and payment of excise tax liabilities.

Documents:

18

This form is used for applying for an exemption from insurance premium taxes imposed under the Excise Tax Act in Canada.

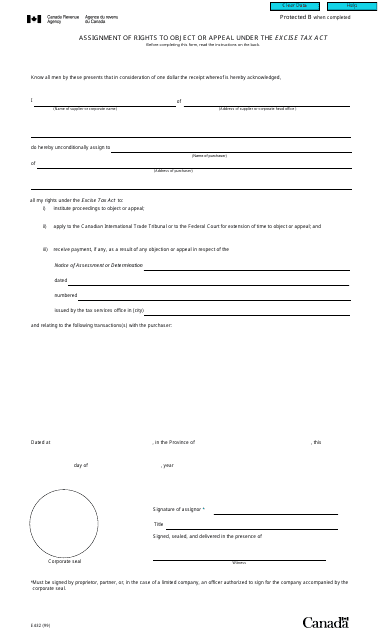

This form is used for assigning the rights to object or appeal under the Excise Tax Act in Canada.

This form is used for taxpayers in Canada to declare their availability or refusal to purchase insurance from authorized insurers for the purpose of the Tax on Insurance Premiums as per the Excise Tax Act.

This form is used for applying for a refund or rebate of excise tax in Canada. It is the supplementary information form for Form N15-1.