Passive Income Templates

Are you tired of trading your time for money? Are you looking for a way to generate income while you sleep? Look no further than the world of passive income. Passive income, also known as residual income, is a wonderful way to earn money without constantly putting in hours of work.

Passive income can come in many forms, such as investments, real estate, or online businesses. By investing your money wisely, you can generate a steady stream of income that requires minimal effort on your part. Imagine waking up each morning to find that your bank account has grown while you were sleeping. This is the power of passive income.

One popular method of earning passive income is through investments. By carefully selecting stocks, bonds, or mutual funds, you can put your money to work for you. Whether it's dividends or capital gains, these investments can provide you with a regular income stream that requires little to no active involvement.

Another avenue for earning passive income is through real estate. By purchasing rental properties, you can earn monthly rental income without having to actively manage the property. Investing in real estate can be a lucrative long-term strategy for building wealth and creating a passive income stream.

In addition, starting an online business can be a great way to generate passive income. Whether it's through affiliate marketing, creating digital products, or running a membership site, there are countless opportunities to earn money online. With the right systems and automation in place, you can earn money while you focus on other aspects of your life.

If you're ready to break free from the traditional work model and start earning money passively, explore the world of passive income. Whether you're interested in investments, real estate, or online businesses, there's a passive income opportunity out there for you. Don't waste another minute trading your time for money. Start building your passive income empire today.

Documents:

23

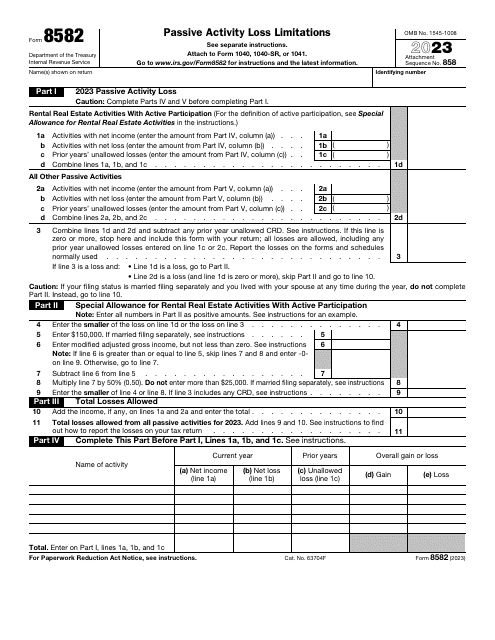

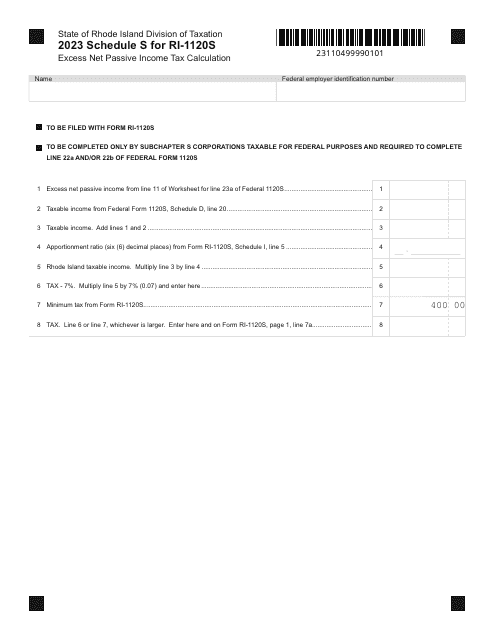

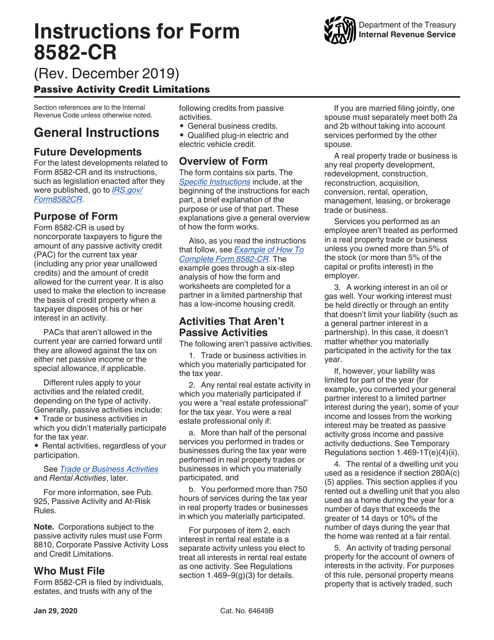

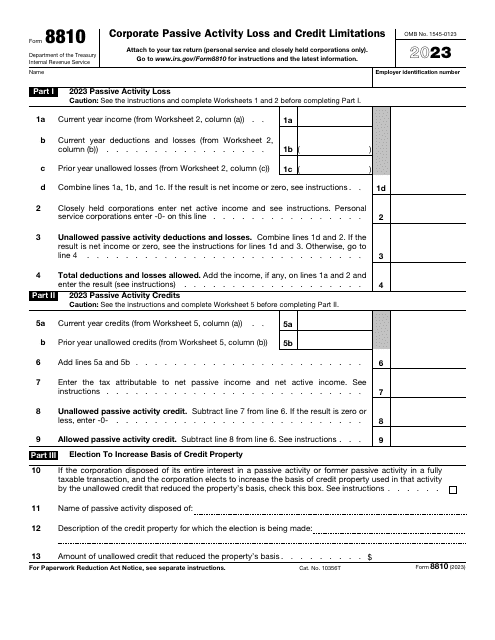

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

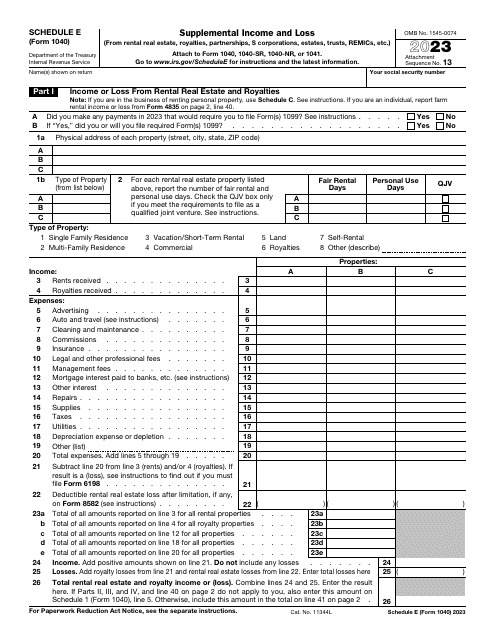

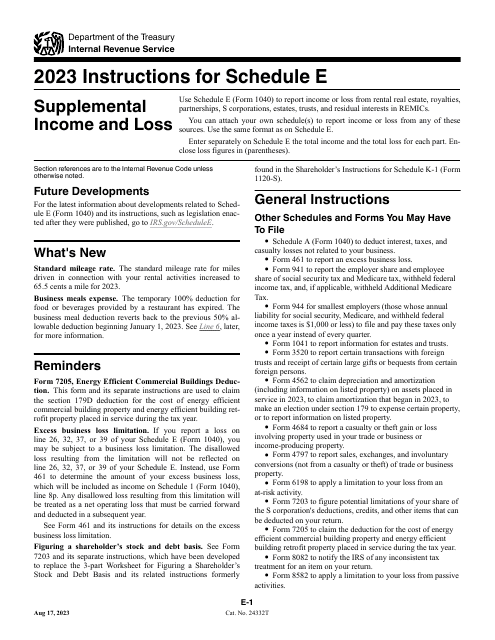

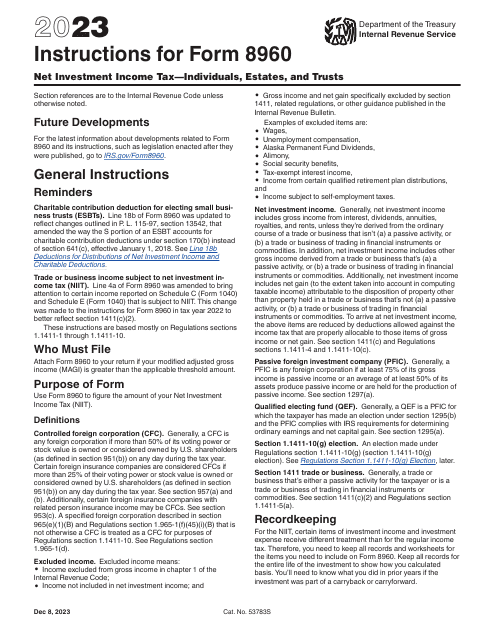

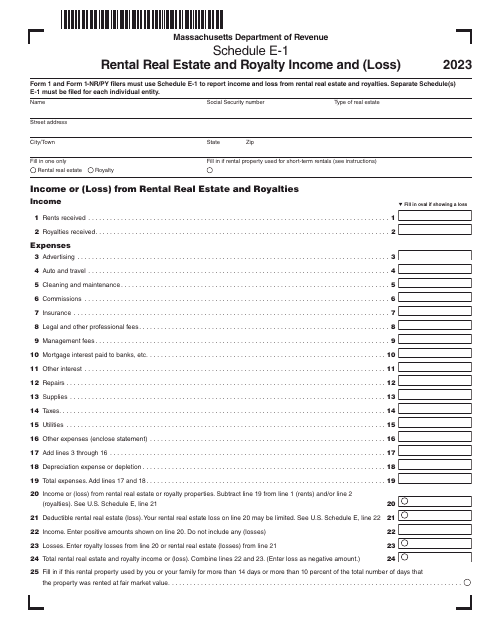

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

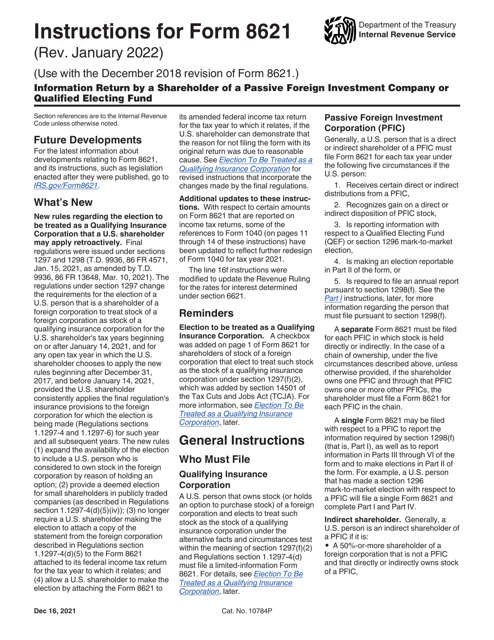

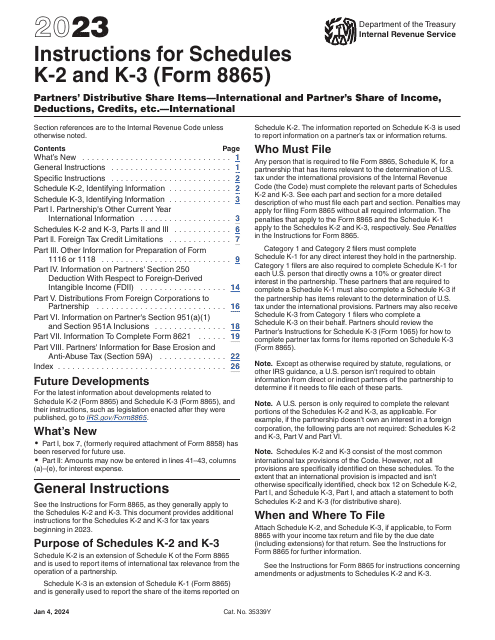

This document provides instructions for completing IRS Form 8621-A, which is used by shareholders who are making certain late elections to end their treatment as a Passive Foreign Investment Company.

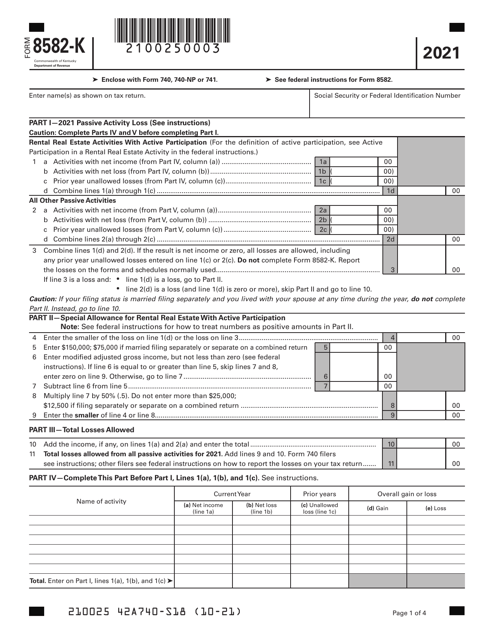

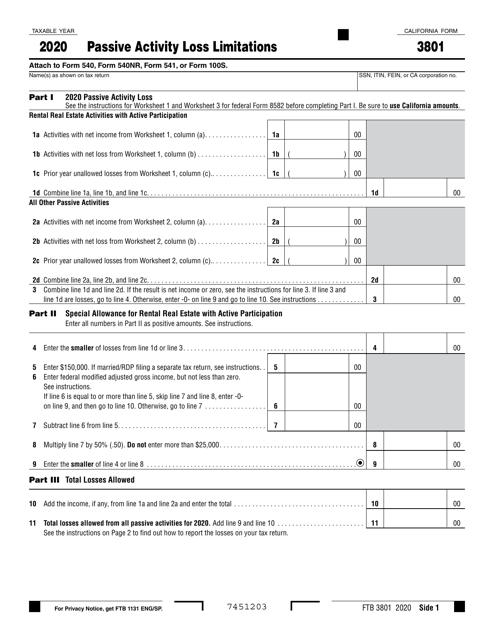

This form is used for reporting passive activity loss limitations in California.