Tax Compromise Templates

Are you facing difficulties in resolving your tax liabilities? Look no further than our comprehensive tax compromise solutions. Whether you are an individual or a business, our team of experts is here to guide you through the process of negotiation and settlement with the tax authorities.

Our tax compromise services offer a range of effective options that can help you reduce your tax burden and potentially eliminate some of the penalties and interest on your outstanding tax debt. We understand that every tax situation is unique, which is why we provide personalized assistance to find the best compromise solution for you.

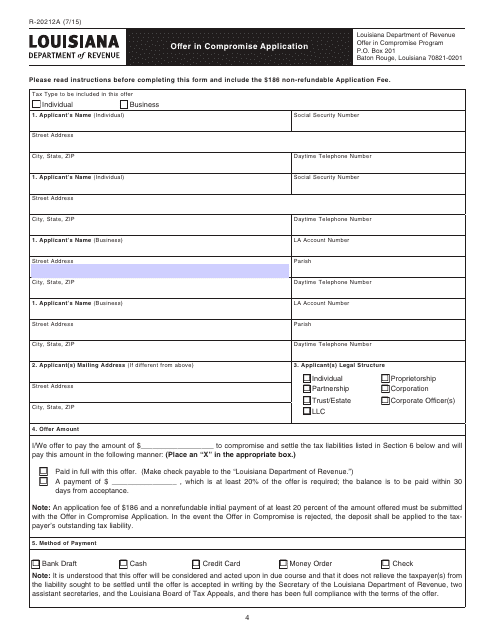

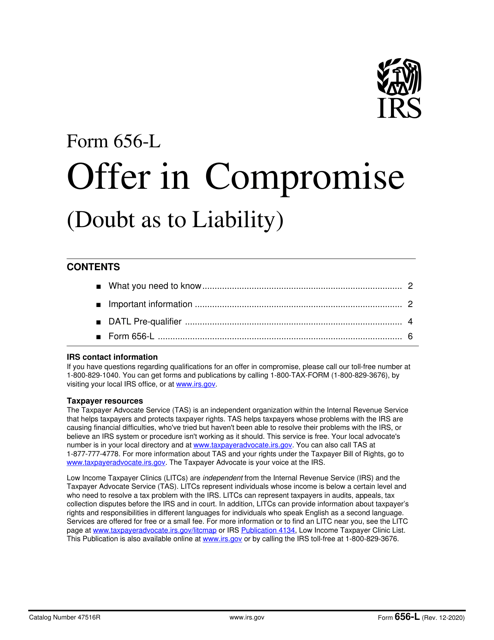

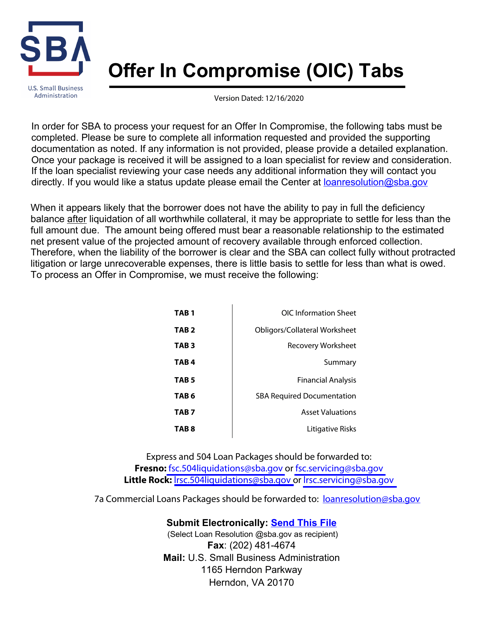

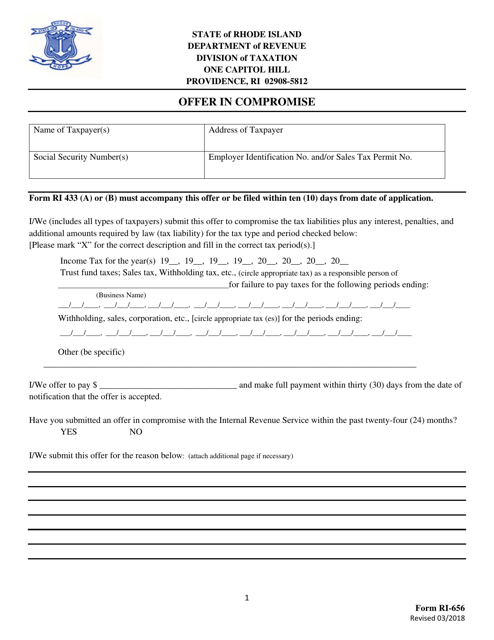

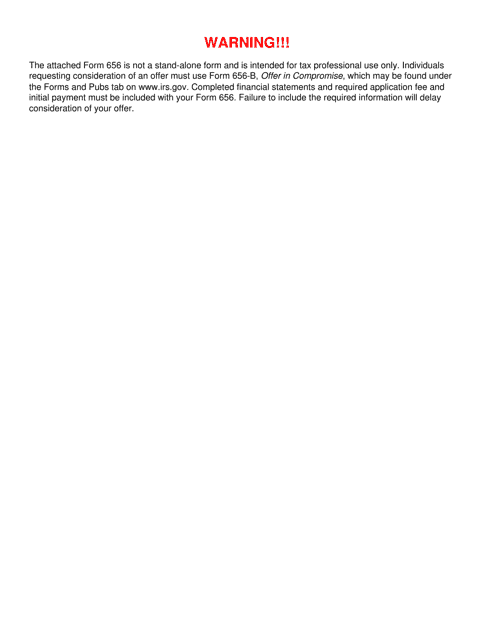

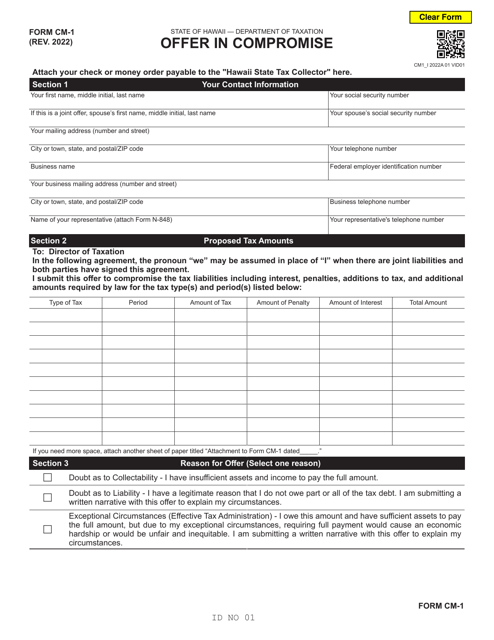

Our tax compromise package includes various forms and documents, such as the IRS Form 656-L Offer in Compromise (Doubt as to Liability), Form REV-567 Offer in Compromise - Pennsylvania, Offer in Compromise (OIC) Tabs, and the IRS Form 656 Offer in Compromise. These documents are meticulously prepared to ensure accurate and efficient communication with the tax authorities.

By utilizing our tax compromise services, you can navigate the complex tax landscape with confidence and peace of mind. Our experienced professionals will handle all the paperwork and negotiations on your behalf, providing you with the support and expertise needed to achieve the most favorable resolution possible.

Don't let your tax liabilities weigh you down any longer. Take advantage of our tax compromise solutions and give yourself the opportunity to start afresh. Contact us today to explore the various options available to you and take the first step towards a brighter financial future.

Documents:

17

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

This form is used for submitting an offer in compromise application to the California Department of Tax and Fee Administration.

This form is used for making an offer in compromise to the state of Rhode Island to settle a tax debt.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

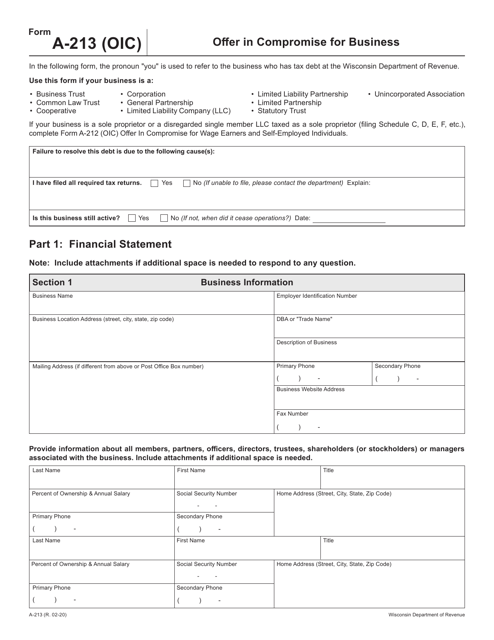

This form is used for making an offer in compromise for a business located in Wisconsin.

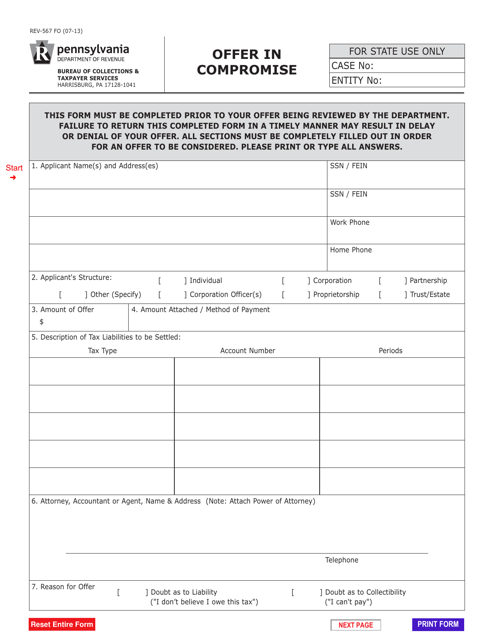

This Form is used for making an offer in compromise with the state of Pennsylvania to settle your tax debt for less than the full amount owed.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

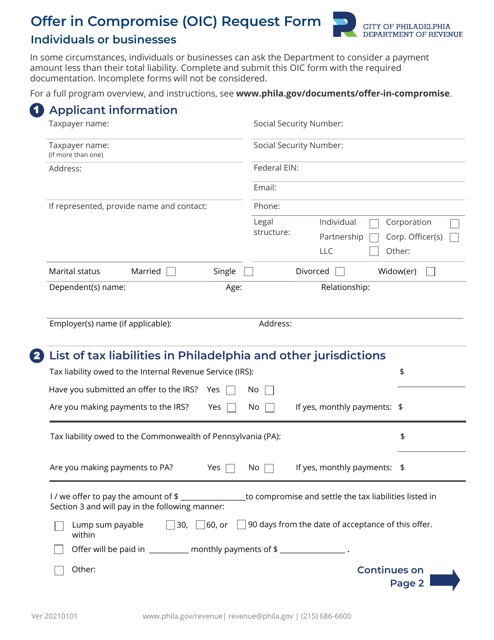

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.

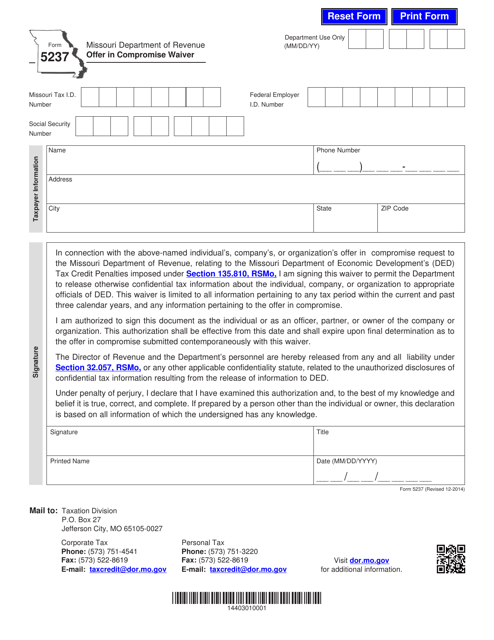

This form is used for applying for an offer in compromise waiver in the state of Missouri.