Qualified Electing Fund Templates

A Qualified Electing Fund, also known as a Qualified Electing Trust, is a financial document collection that is required by the Internal Revenue Service (IRS) for shareholders of Passive Foreign Investment Companies (PFICs). These documents are essential for individuals who have investments in foreign companies and need to comply with tax regulations.

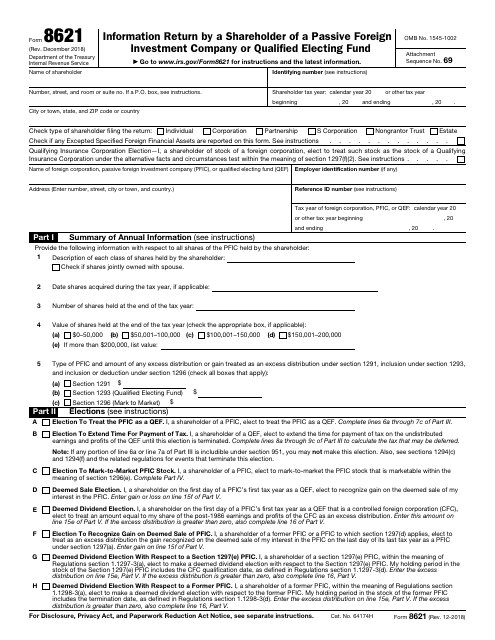

The IRS Form 8621 Information Return is a vital document within the Qualified Electing Fund collection. It provides shareholders with a comprehensive overview of their investments in PFICs, detailing information such as income, gains, and distributions.

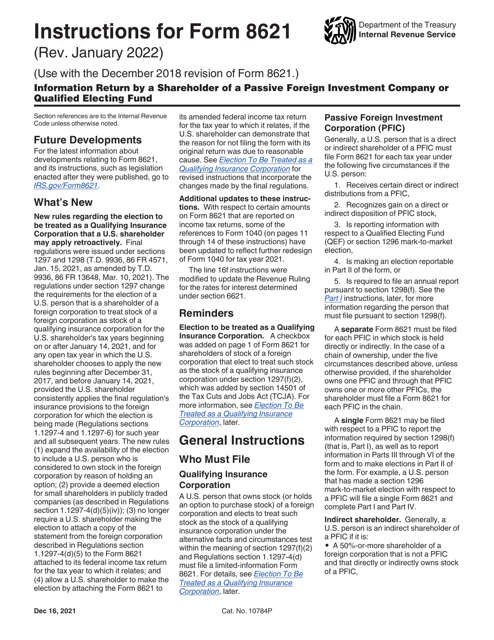

In addition to the Form 8621, the collection includes detailed instructions on how to complete the form accurately. These instructions are crucial in ensuring that shareholders understand their reporting obligations and avoid any non-compliance penalties.

Complying with IRS regulations for PFIC investments can be complex, but the Qualified Electing Fund document collection provides shareholders with the necessary guidance and reporting tools. By accurately completing and submitting these documents, individuals can fulfill their tax obligations and avoid potential audit or penalty risks.

If you have investments in foreign companies and need to report them to the IRS, it is important to understand the requirements outlined in the Qualified Electing Fund documents. By consulting these documents and seeking professional tax advice, you can ensure compliance and peace of mind.

Documents:

5

This form is used for reporting information about a shareholder's investment in a passive foreign investment company or qualified electing fund to the IRS.