Tax Credit Templates

Documents:

3232

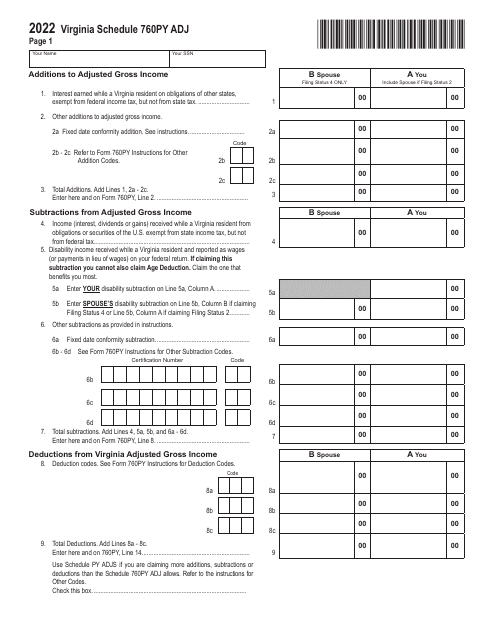

This form is used for part-year residents in Virginia to report adjustments to their income and deductions.

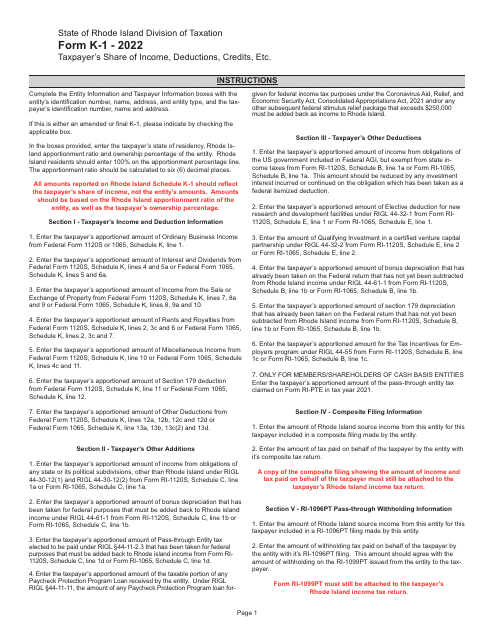

Instructions for Form K-1 Taxpayer's Share of Income, Deductions, Credits, Etc. - Rhode Island, 2022

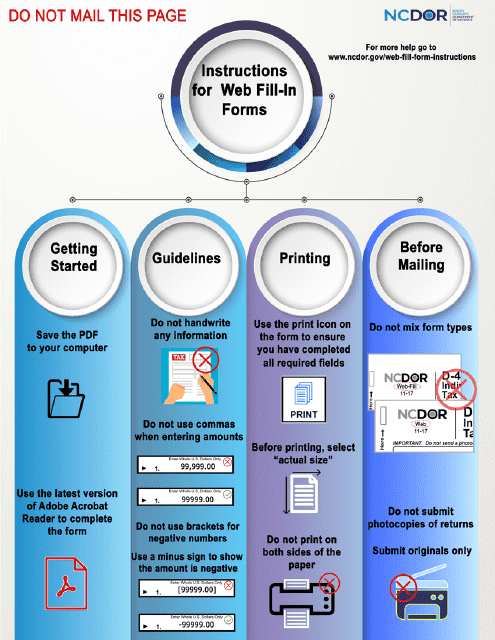

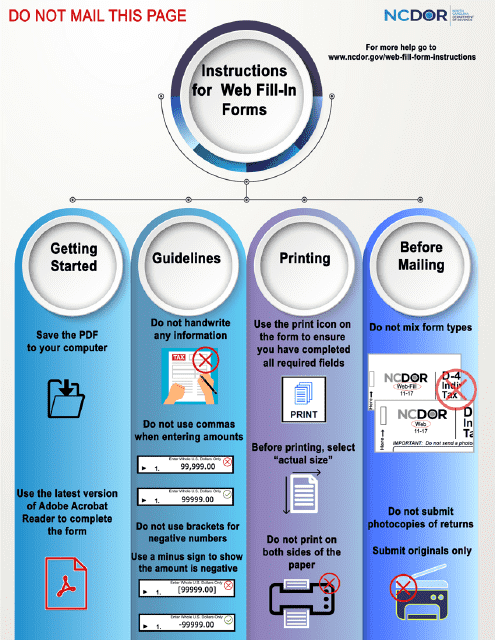

This document is used for reporting additions and deductions for pass-through entities, estates, and trusts in North Carolina. It is a form that taxpayers can use to accurately report their income, expenses, and deductions related to these entities.