Tax Credit Templates

Documents:

3232

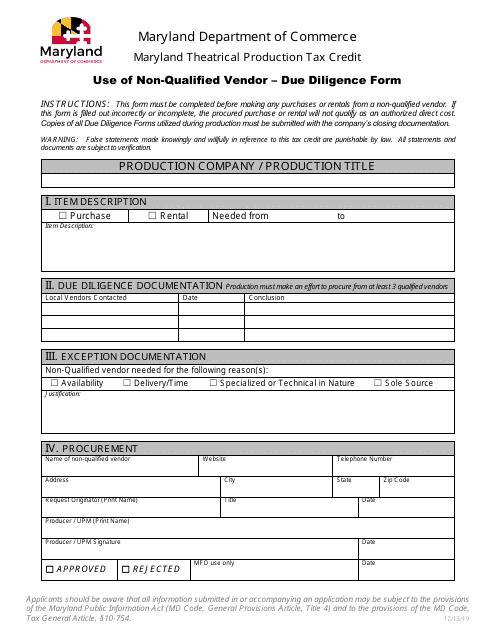

This form is used for conducting due diligence on non-qualified vendors involved in Maryland theatrical production tax credit applications. It helps ensure that vendors meet the eligibility criteria for the tax credit.

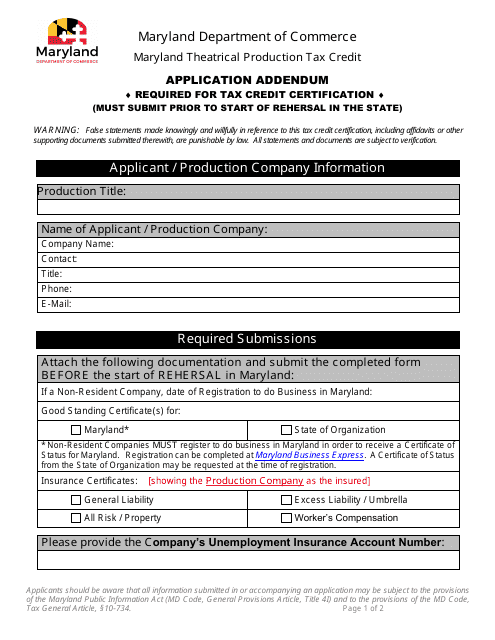

This document is an addendum to the application for the Maryland Theatrical Production Tax Credit in Maryland. It provides additional information or updates to the original application.

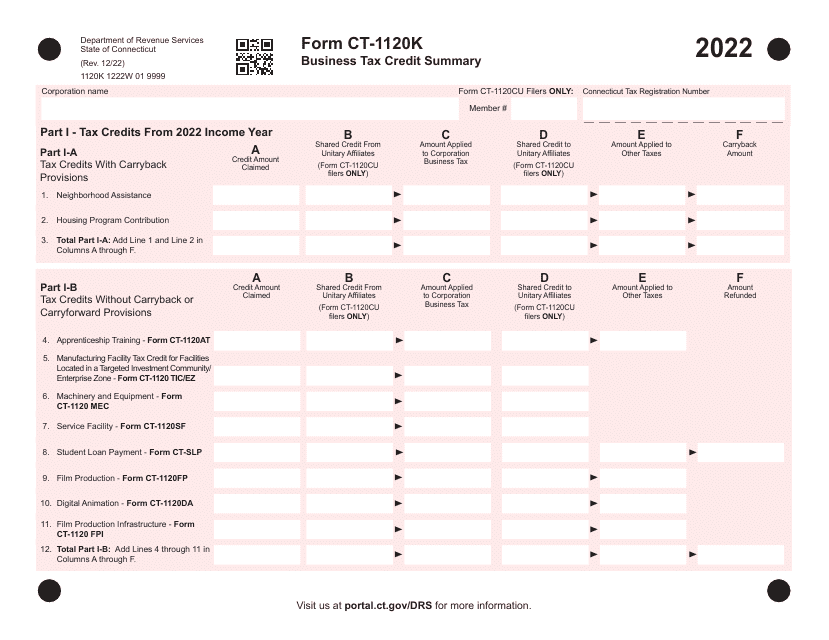

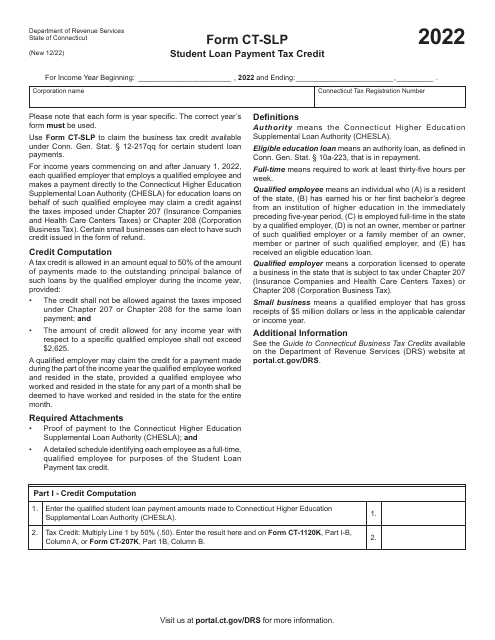

This Form is used for claiming a tax credit for student loan payments in the state of Connecticut.

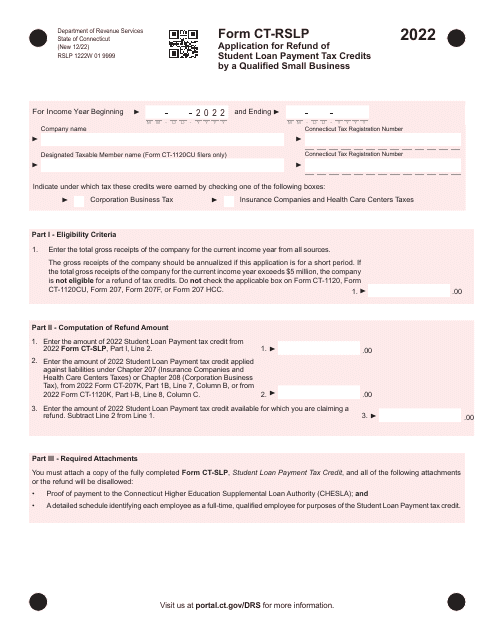

This document is used to apply for a refund of student loan payment tax credits by a qualified small business in Connecticut.

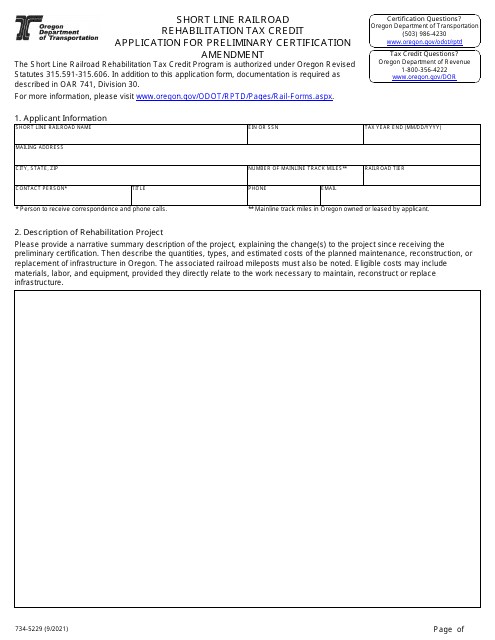

This Form is used for applying for an amendment to the preliminary certification for the Short Line Railroad Rehabilitation Tax Credit in Oregon.

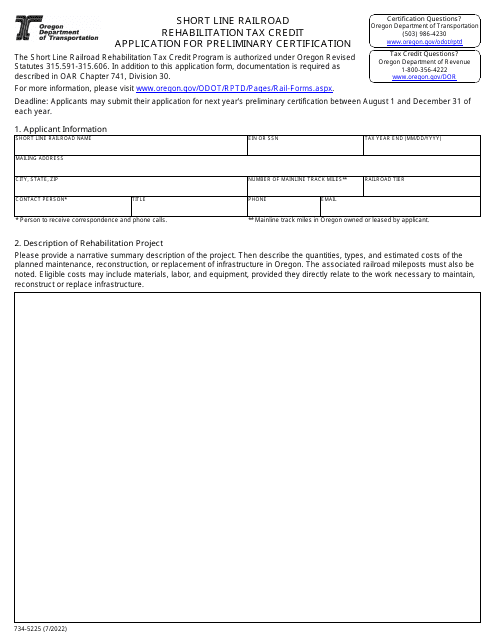

This Form is used for applying for the Short Line Railroad Rehabilitation Tax Credit in Oregon.

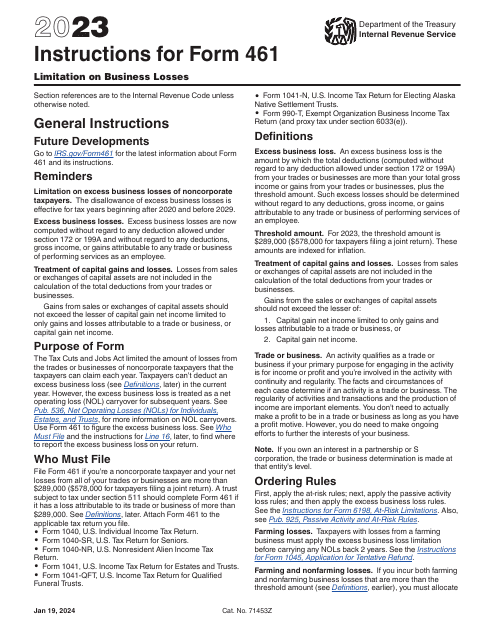

This Form is used for residents of North Carolina to file their state income tax return and claim deductions, credits, and exemptions. The D-400TC Schedule A, AM, PN, PN-1, S are additional schedules that may be necessary depending on your specific tax situation.