Tax Credit Templates

Documents:

3232

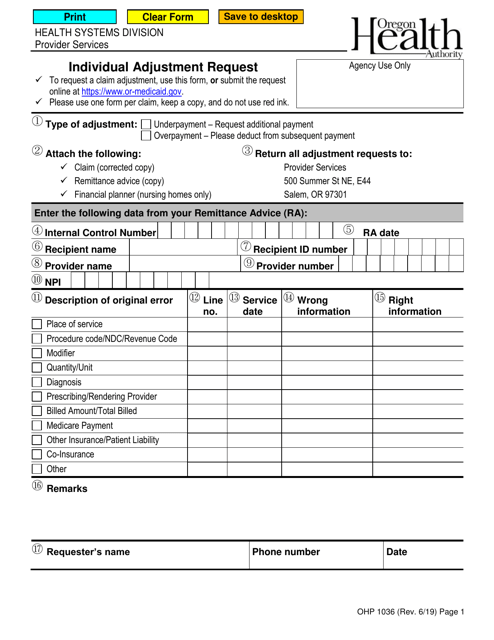

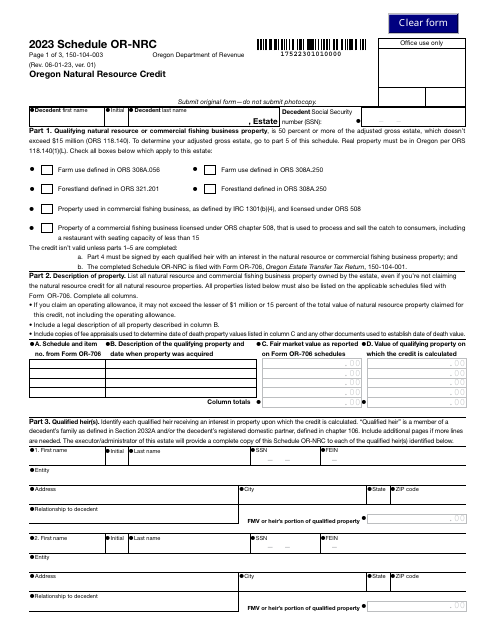

This Form is used for individuals in Oregon to request an adjustment to their taxes or other financial matters. It allows individuals to make changes or corrections to information previously reported to the Oregon Department of Revenue.

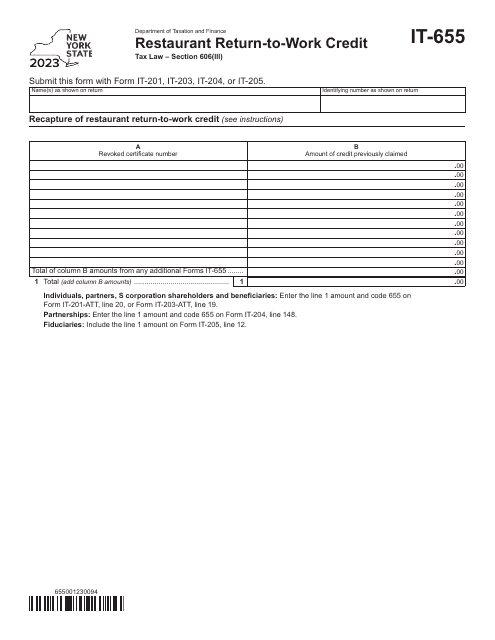

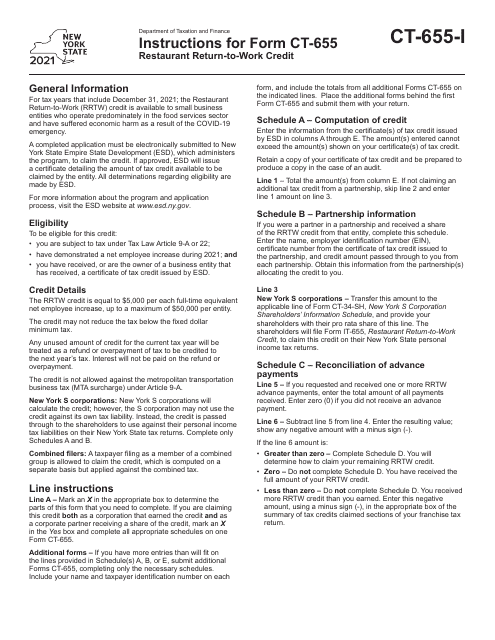

This Form is used for claiming the Restaurant Return-To-Work Credit in New York. It provides instructions for completing the form and claiming the credit.

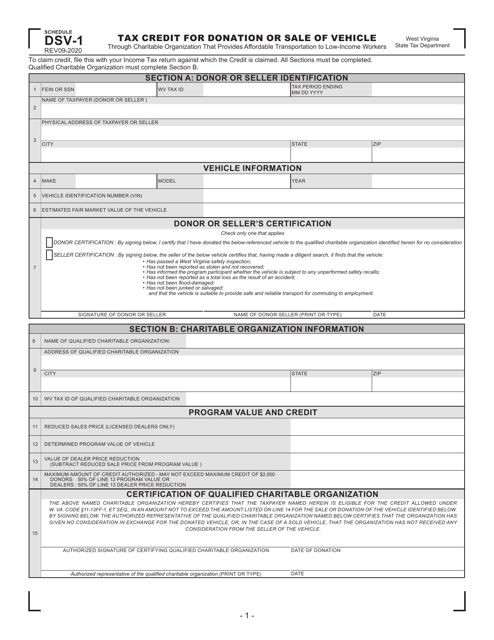

This type of document is used for claiming a tax credit in West Virginia for donating or selling a vehicle to a charitable organization that provides affordable transportation to low-income workers.

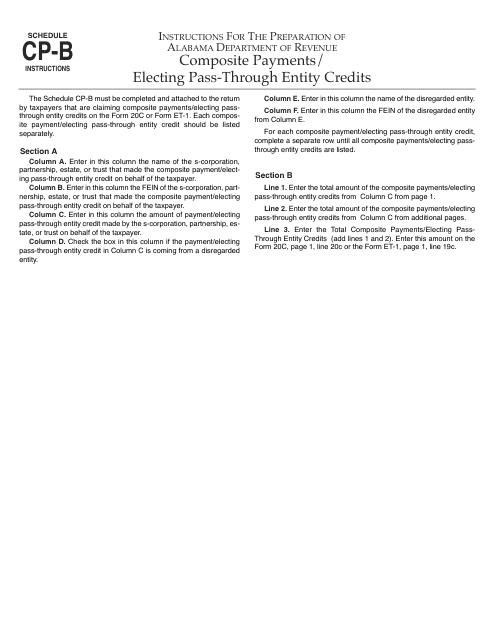

This document provides instructions for Schedule CP-B, which is used for reporting composite payments and electing pass-through entity credits in the state of Alabama. It outlines the steps and requirements for filling out the schedule accurately.

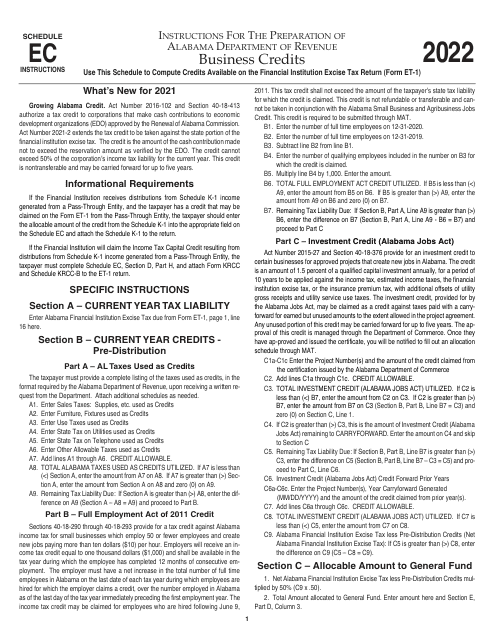

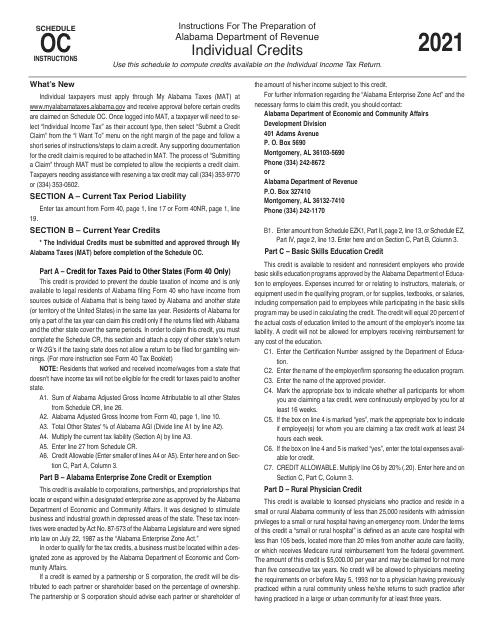

This Form is used for reporting other available credits in Alabama when filing taxes.