Tax Credit Templates

Documents:

3232

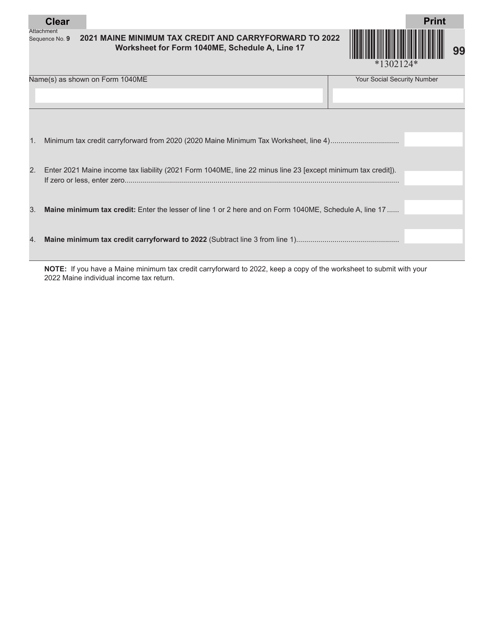

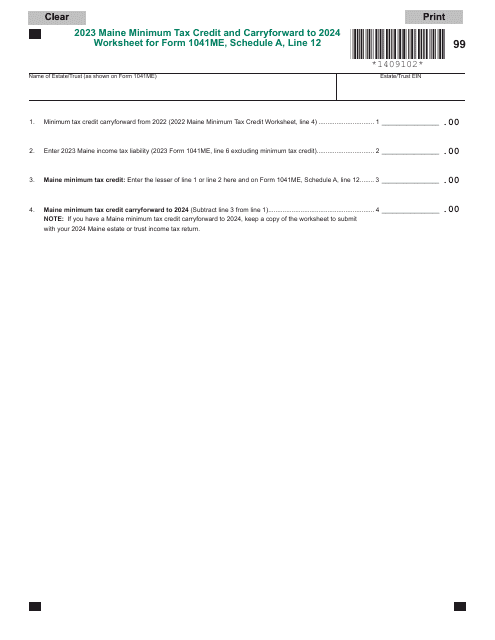

This form is used for calculating and reporting the Maine Minimum Tax Credit and Carryforward for individuals filing taxes in Maine.

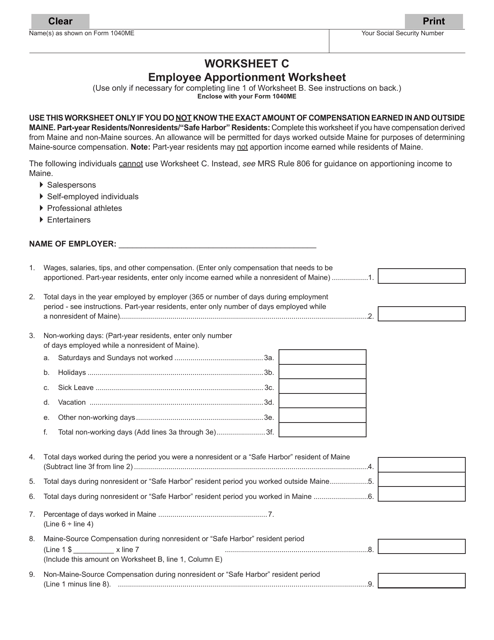

This document is a worksheet used to calculate employee apportionment for state income tax in Maine.

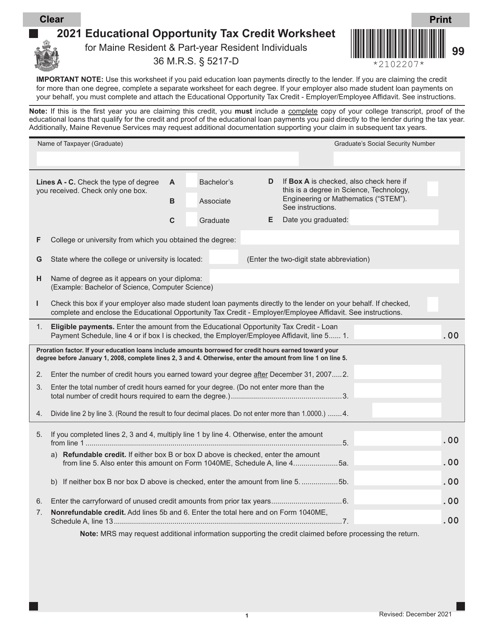

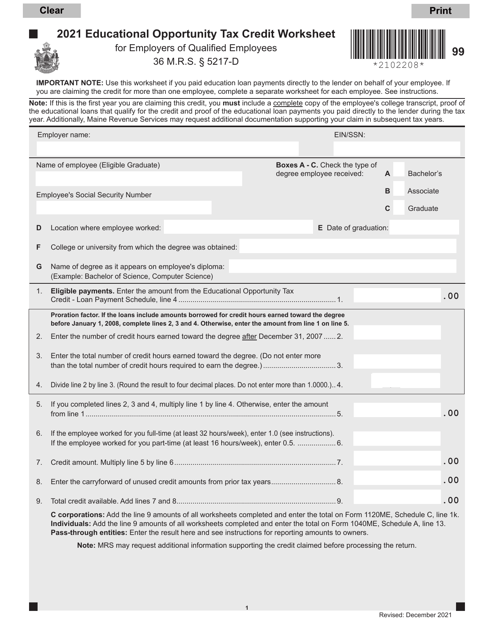

This type of document is used for calculating the Educational Opportunity Tax Credit for Maine residents and part-year residents. It provides a worksheet to help individuals determine their eligibility and correctly calculate the credit amount.

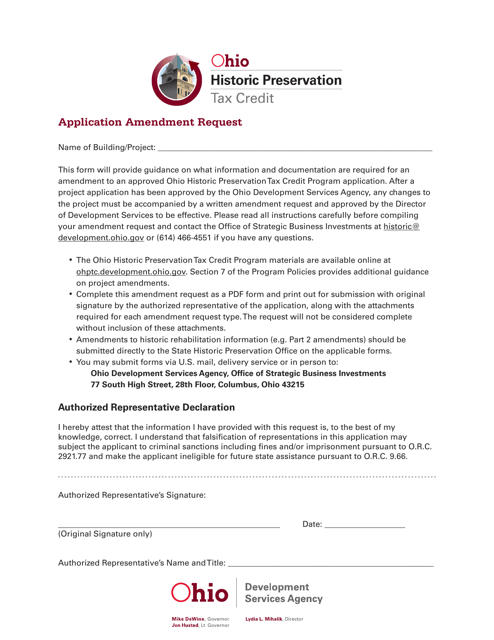

This document is used for requesting an amendment to an application for the Ohio Historic Preservation Tax Credit Program in Ohio.

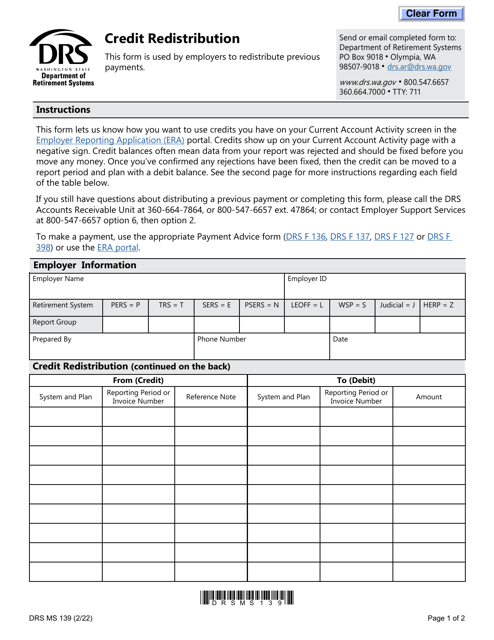

This form is used for credit redistribution in the state of Washington. It provides a way for students to request a change in the allocation of their academic credits.

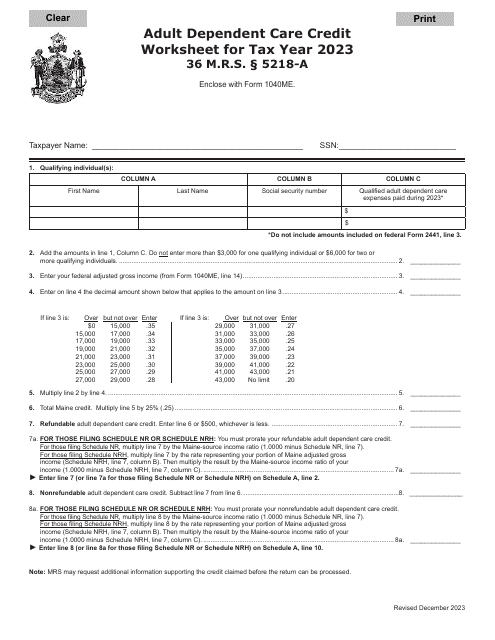

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

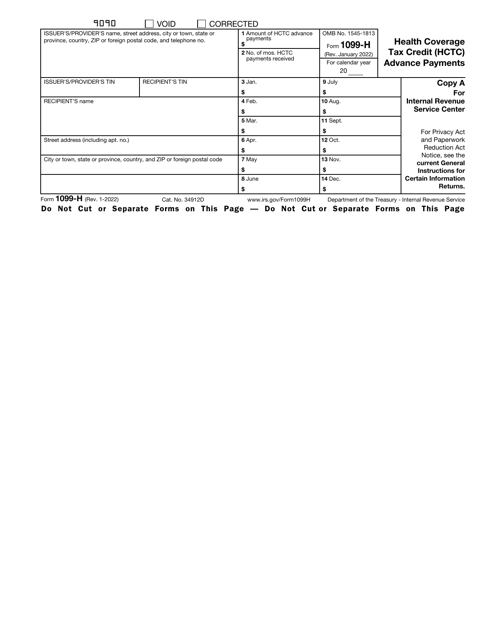

This is an IRS document released for those individuals who got payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance.

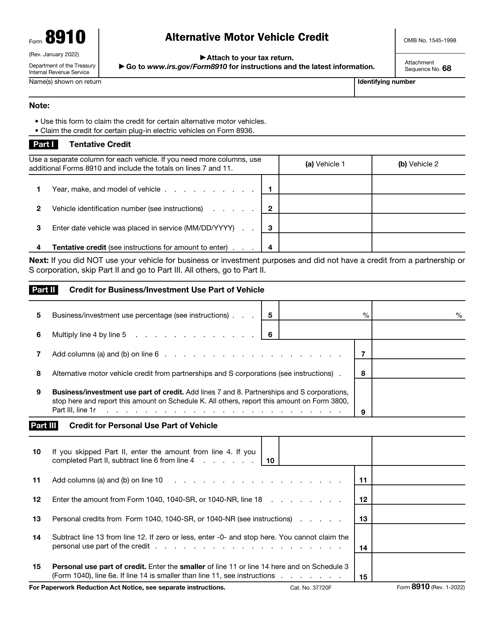

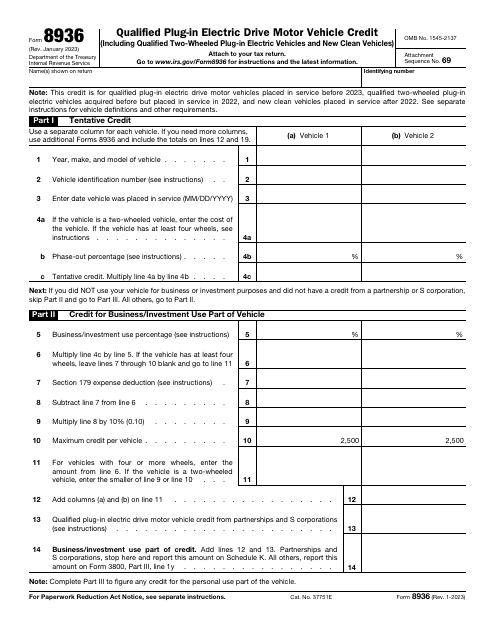

This is a formal IRS form used by taxpayers that purchased electric vehicles in order to claim a tax credit when filing their tax returns.