Tax Credit Templates

Documents:

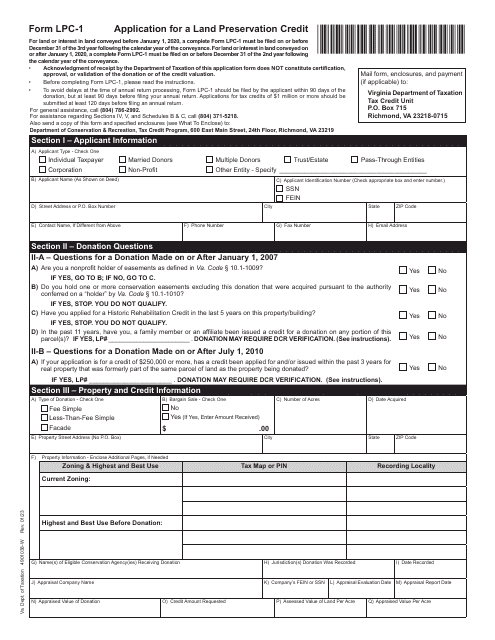

3232

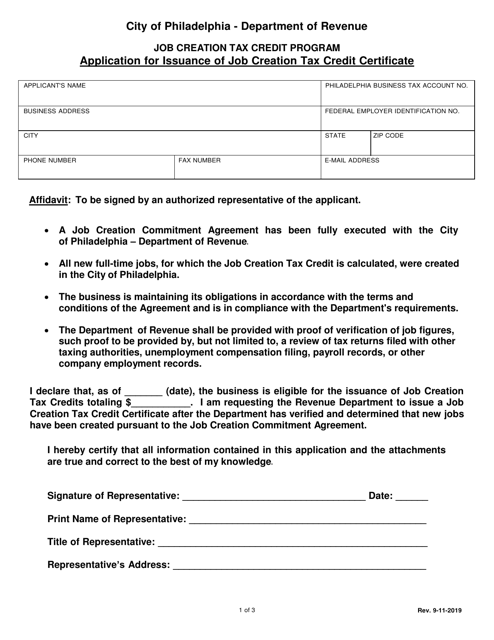

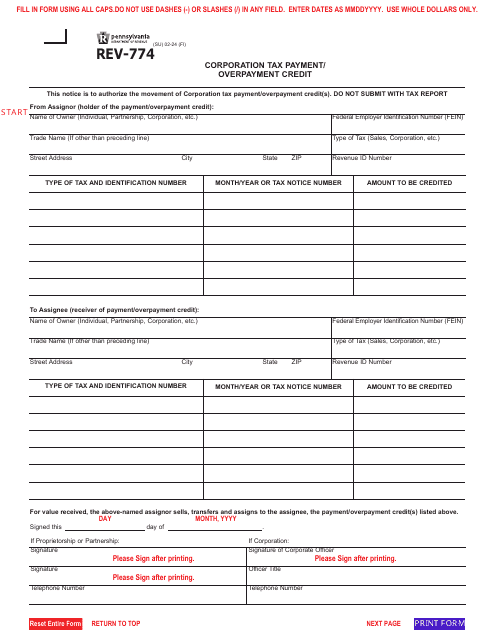

Application for Issuance of Job Creation Tax Credit Certificate - City of Philadelphia, Pennsylvania

This document is used for applying for a Job Creation Tax Credit Certificate in the City of Philadelphia, Pennsylvania. This tax credit is given to businesses that create new jobs in the city, encouraging economic growth and job opportunities.

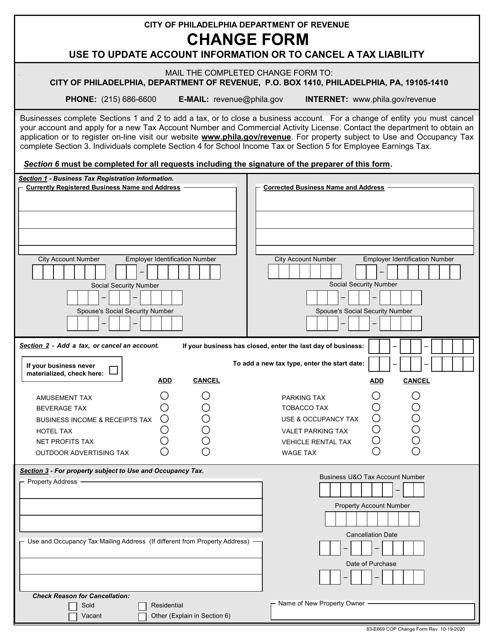

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

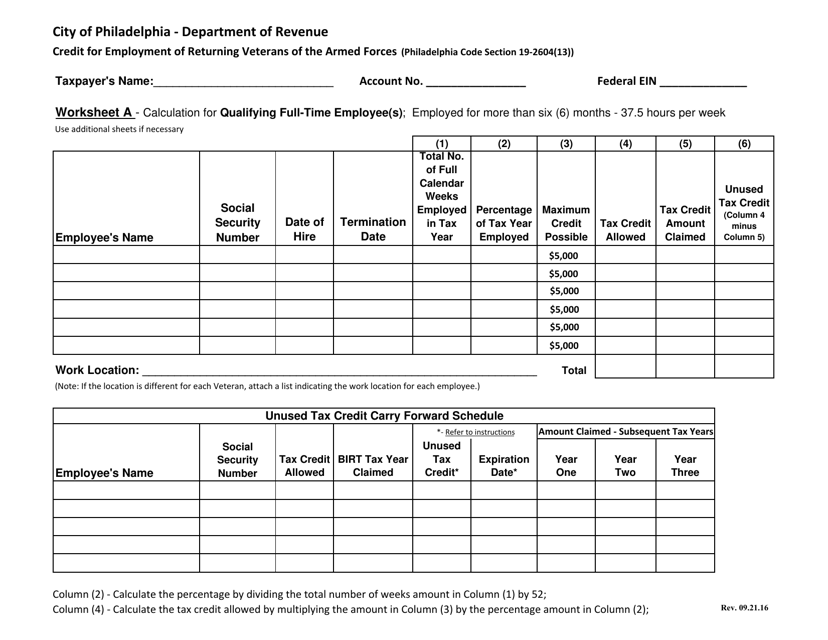

This form is used for calculating and claiming the veterans tax credit in the City of Philadelphia, Pennsylvania. It helps veterans determine their eligibility and the amount of credit they may be entitled to for their property taxes.

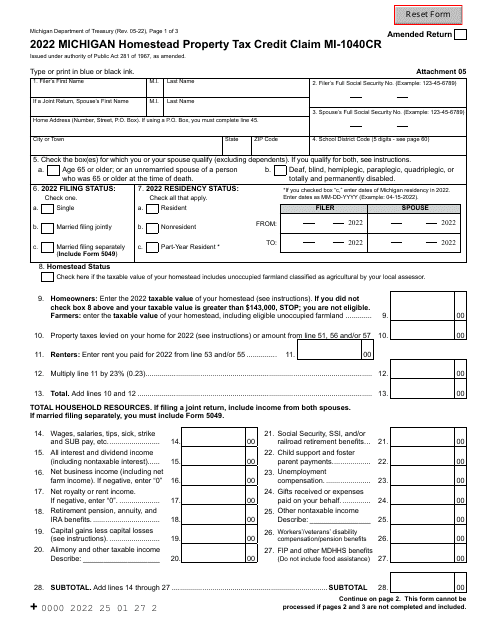

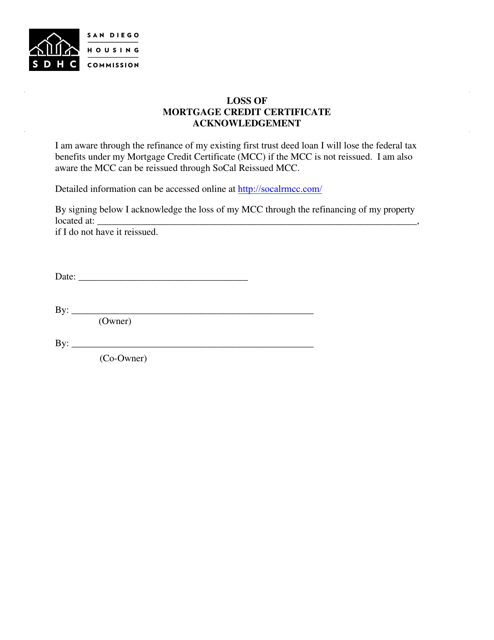

This type of document is an acknowledgement of the loss of a Mortgage Credit Certificate issued by the City of San Diego, California. It is used to report the loss and request a replacement certificate.

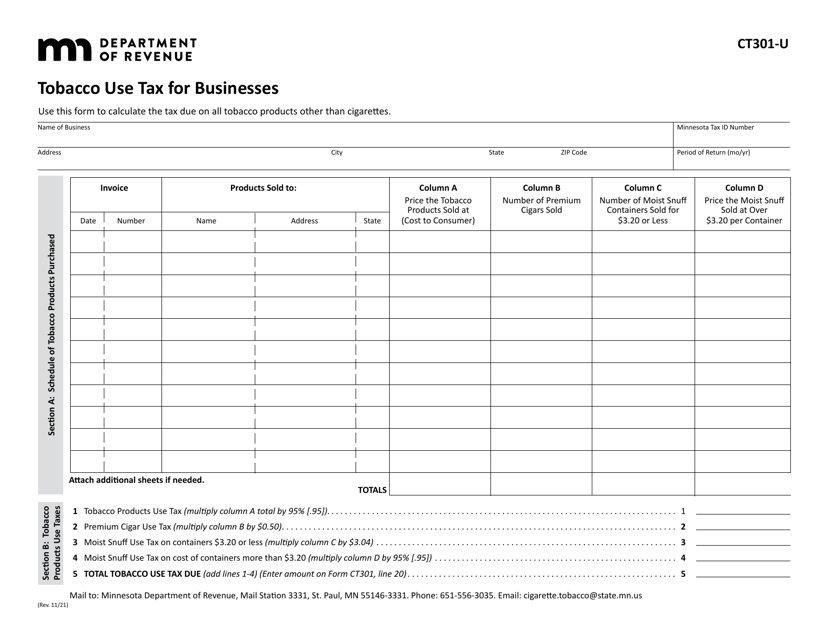

This form is used for businesses in Minnesota to report and pay tobacco use tax.

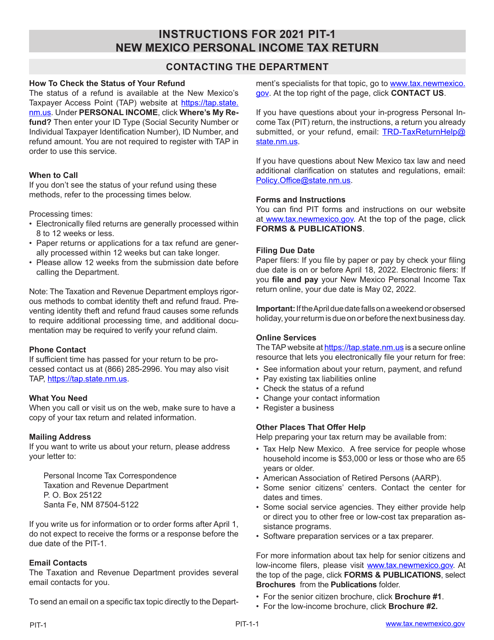

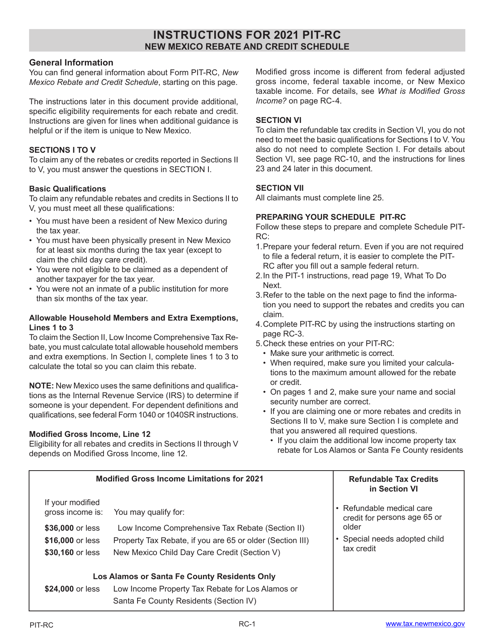

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

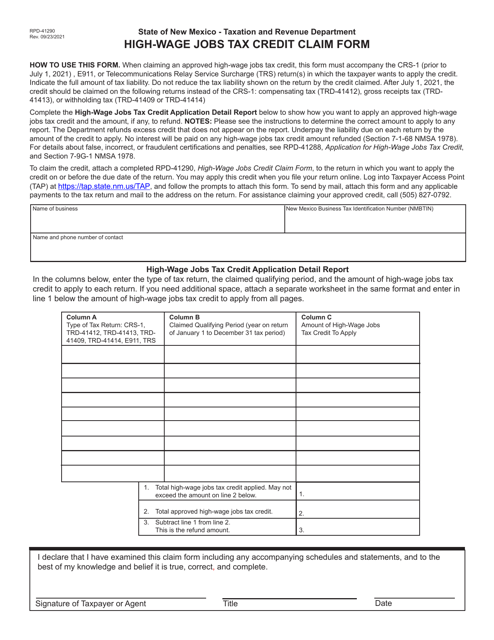

This form is used for claiming the High-Wage Jobs Tax Credit in New Mexico. It helps businesses apply for a tax credit based on creating jobs that pay high wages.

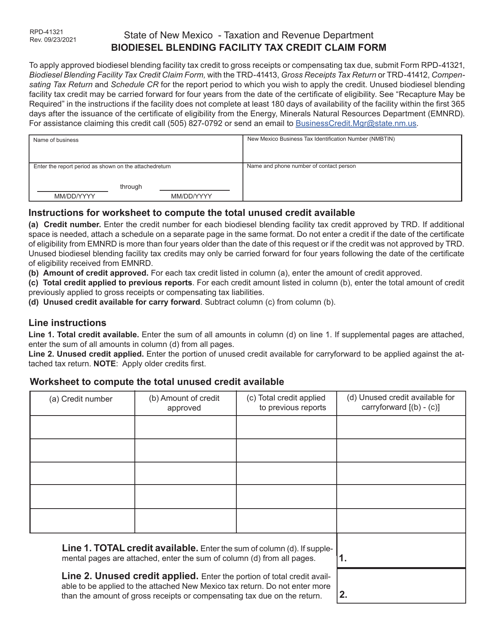

This form is used for claiming a tax credit for biodiesel blending facilities in New Mexico.

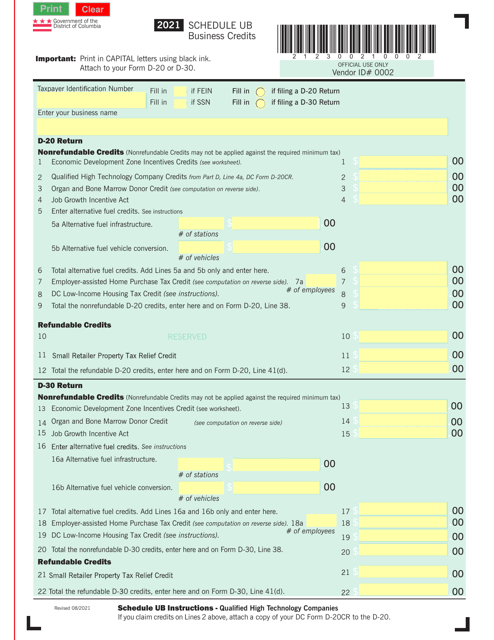

This Form is used for claiming business credits in Washington, D.C. It allows taxpayers to report and potentially reduce their tax liability by taking advantage of various business credits available in the city.

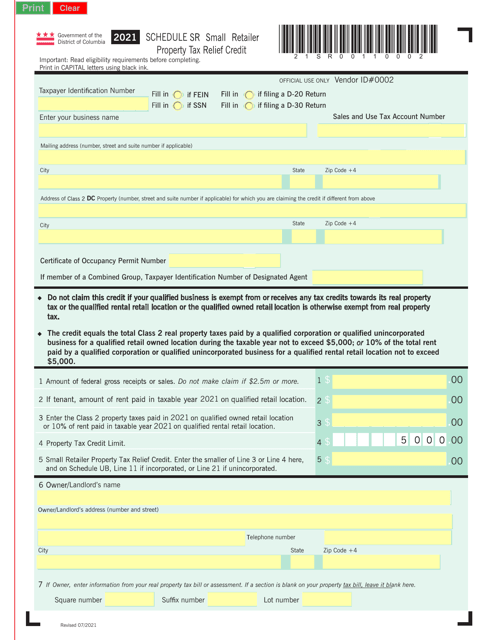

This document is used for claiming the Small Retailer Property Tax Relief Credit in Washington, D.C. It provides a schedule to report information related to the credit.

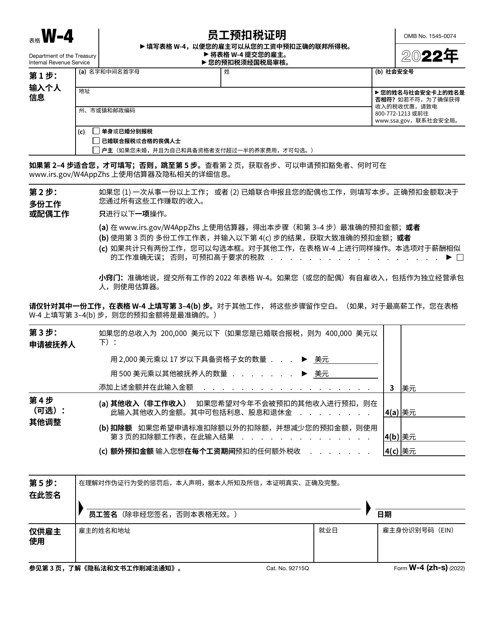

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.

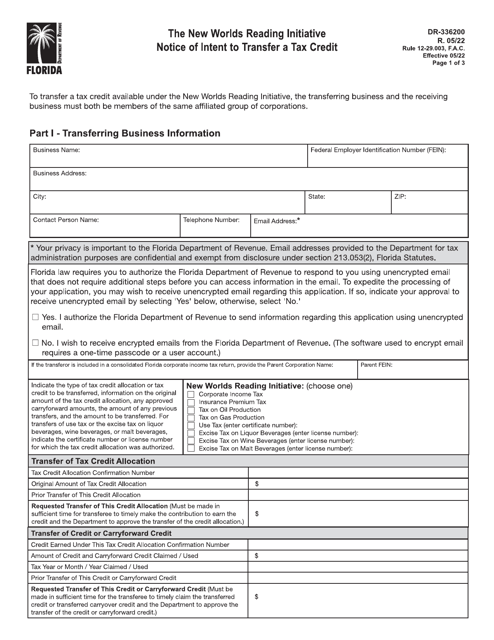

Form DR-336200 The New Worlds Reading Initiative Notice of Intent to Transfer a Tax Credit - Florida

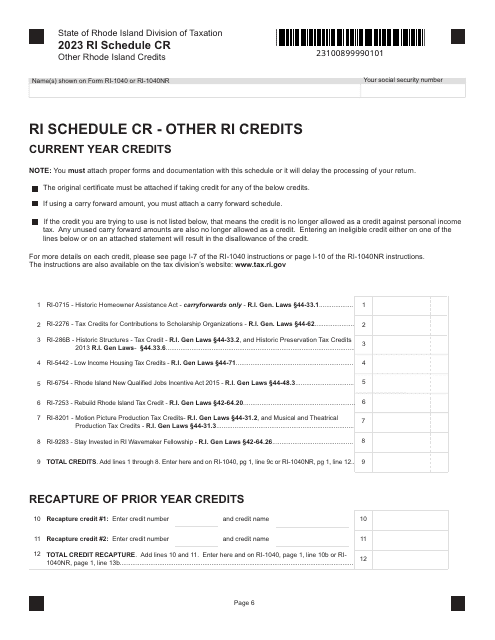

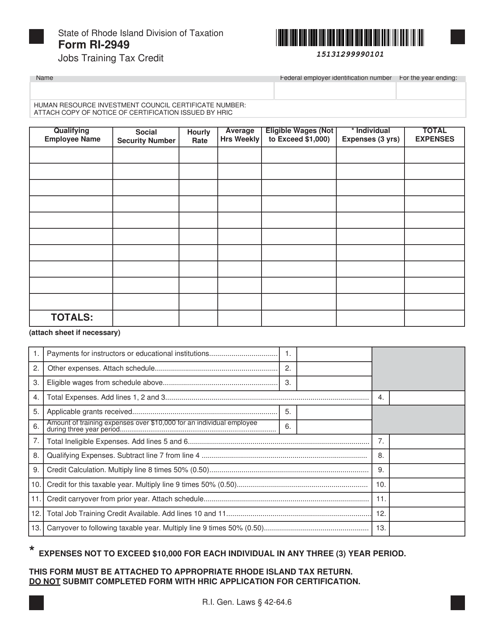

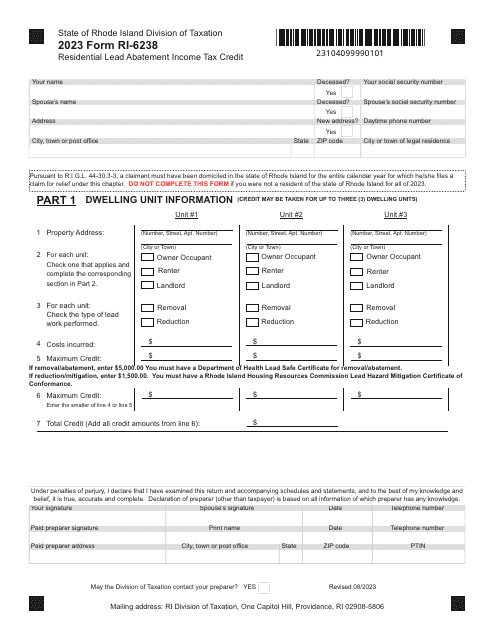

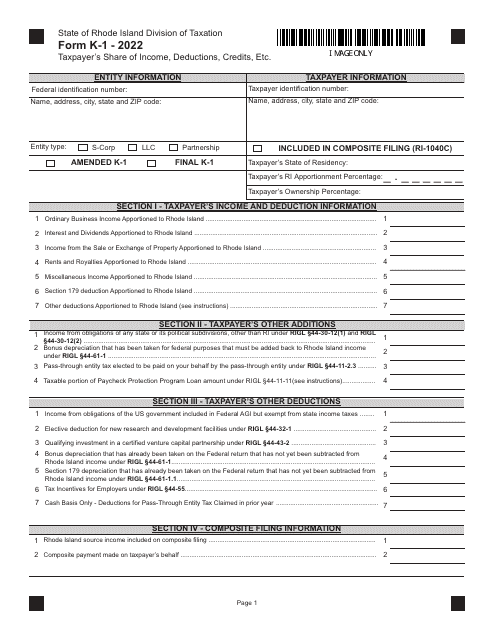

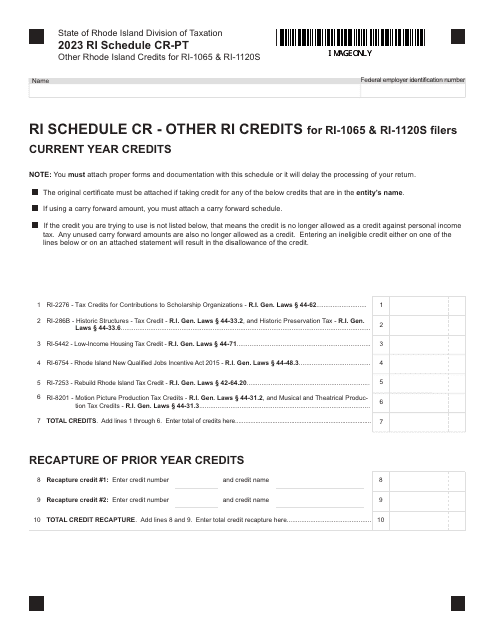

This form is used for claiming the Jobs Training Tax Credit in Rhode Island. It provides businesses with a tax credit for the costs of training employees for new or expanded job opportunities.

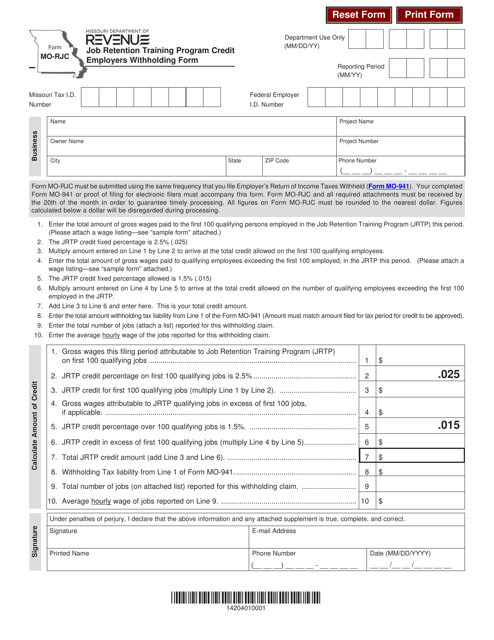

This Form is used for employers in Missouri to claim a tax credit for participating in the Job Retention Training Program.