Tax Credit Templates

Documents:

3232

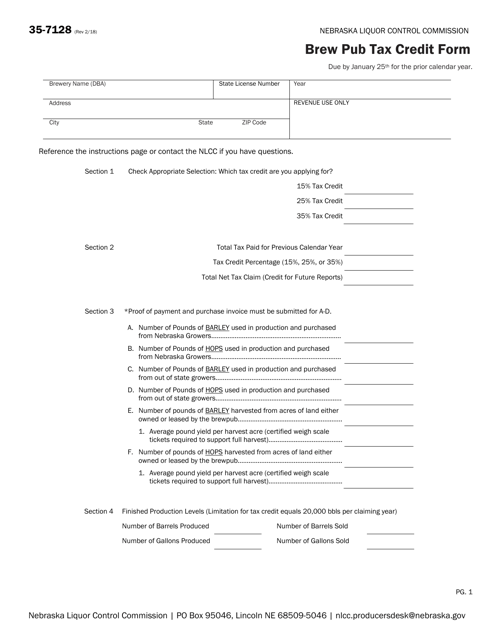

This Form is used for claiming the Brew Pub Tax Credit in the state of Nebraska.

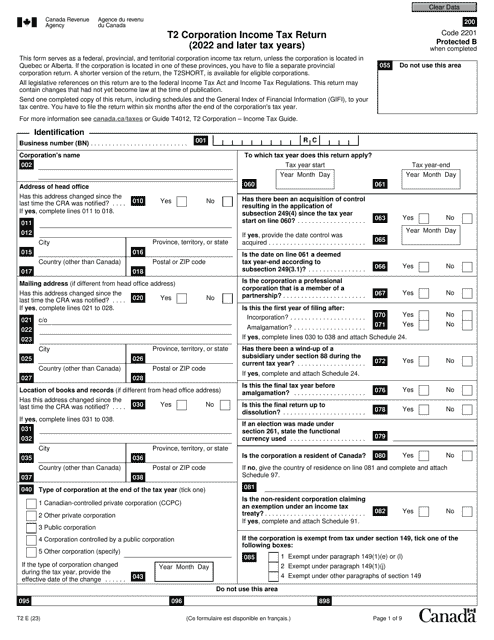

Canadian corporations must complete this main statement every year to report their income even if they eventually do not pay any tax.

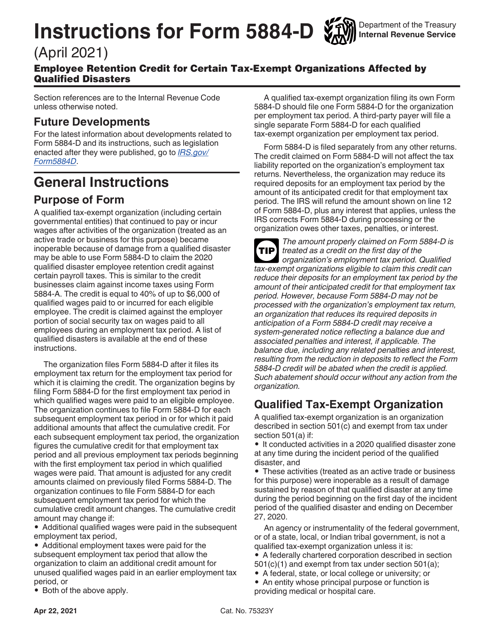

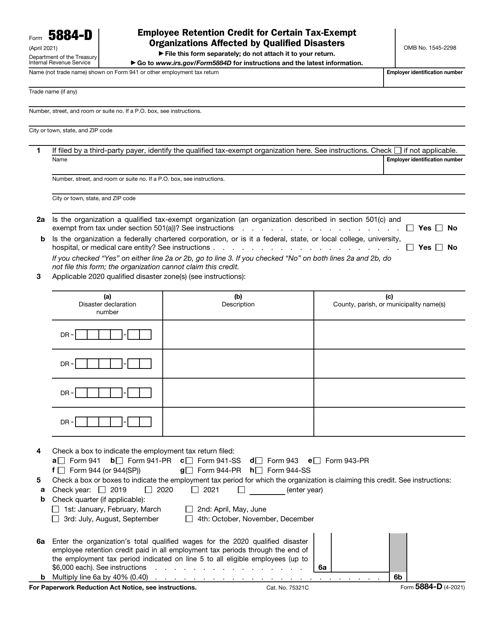

This form is used for claiming the Employee Retention Credit for certain tax-exempt organizations affected by qualified disasters. It provides instructions on how to fill out the form and claim the credit.

This form is used for claiming the Employee Retention Credit by certain tax-exempt organizations that have been affected by qualified disasters. The credit is meant to provide financial relief to these organizations in order to retain their employees.

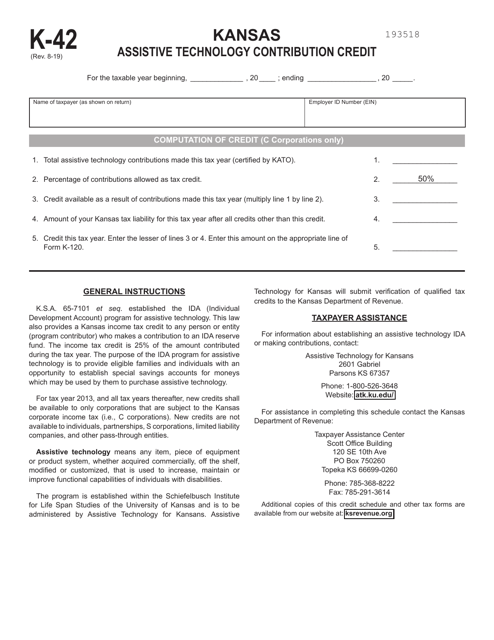

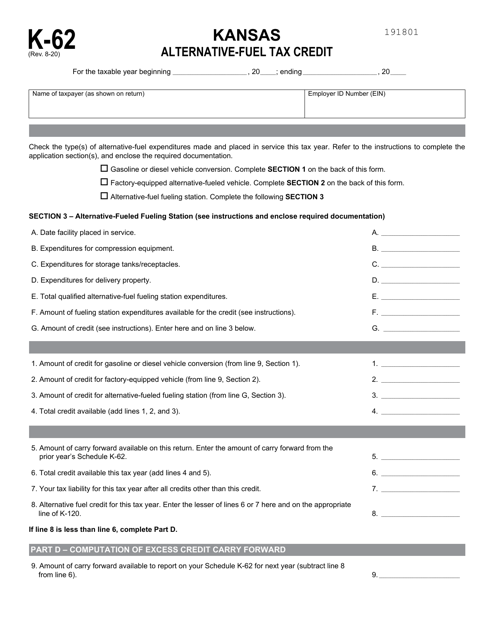

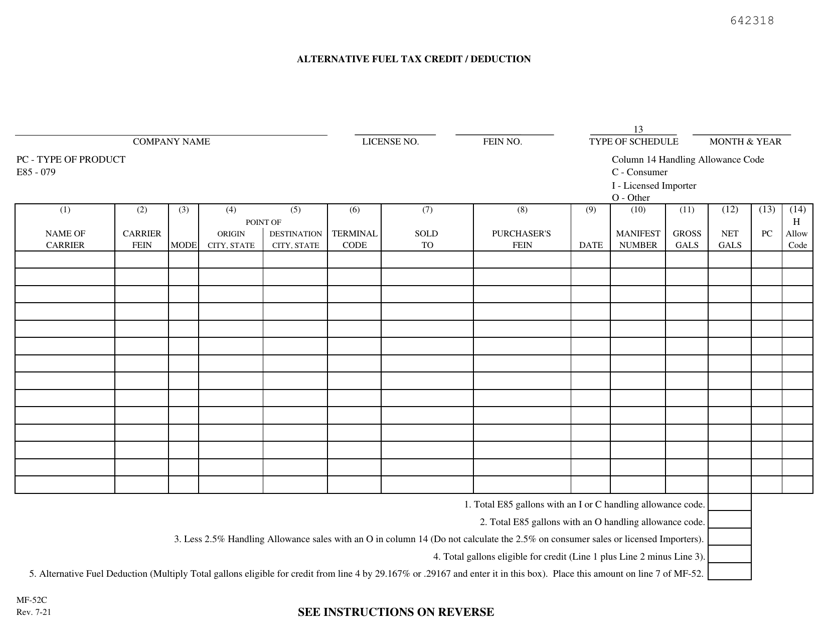

This document for claiming alternative-fuel tax credits in Kansas.

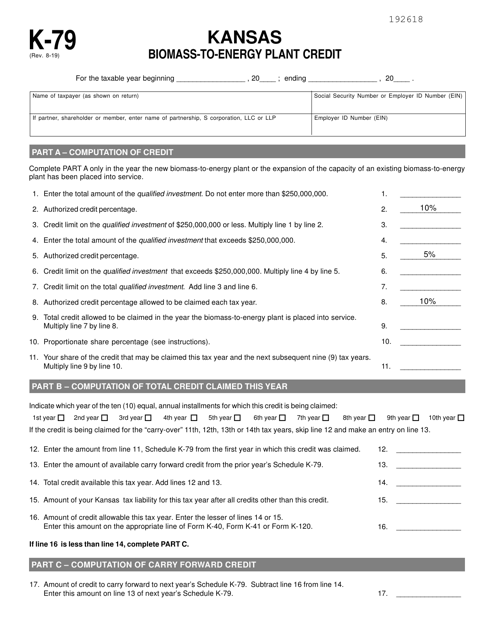

This document is used for claiming the Kansas Biomass-To-Energy Plant Credit in Kansas.

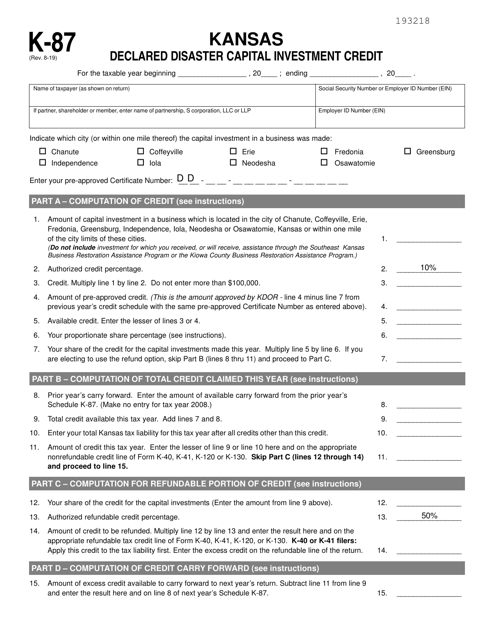

This form is used for claiming the Kansas Declared Disaster Capital Investment Credit in the state of Kansas. It allows businesses to receive a tax credit for capital investments made in areas that have been declared as disaster areas by the state.

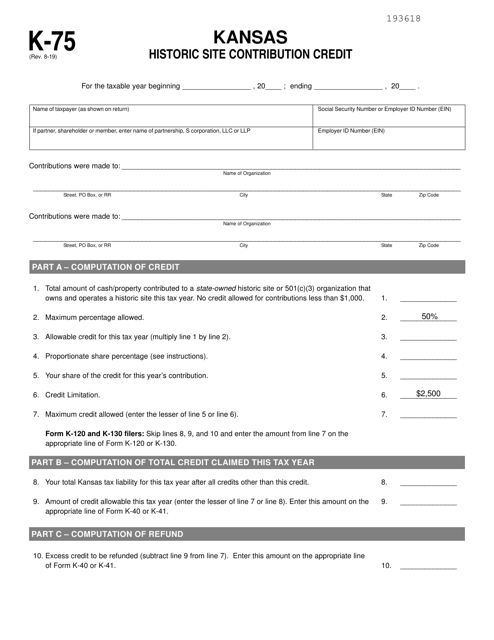

This document is used for claiming the Kansas Historic Site Contribution Credit in the state of Kansas. This credit is available for taxpayers who make contributions to qualified historic sites in Kansas.

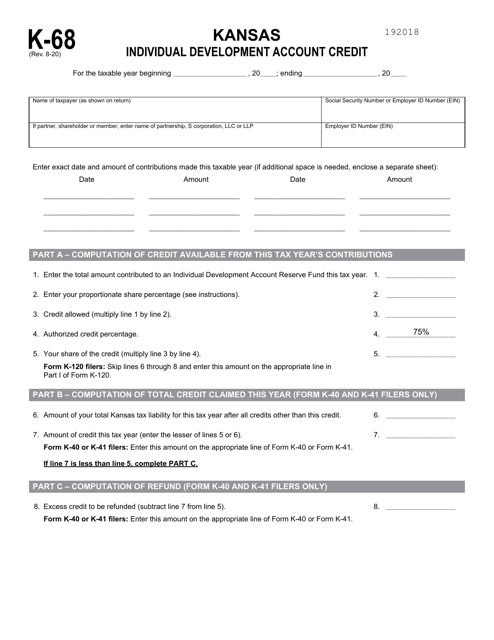

This document provides information about the Schedule K-68 Kansas Individual Development Account Credit in the state of Kansas. It outlines the details and requirements for claiming this credit, which is aimed at encouraging saving and asset building for low-income individuals.

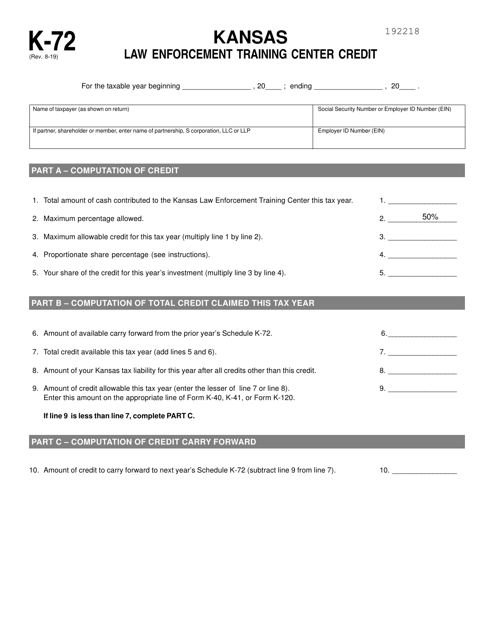

This form is used for claiming the Kansas Law Enforcement Training Center Credit in Kansas. This credit is available to individuals who have completed law enforcement training at the Kansas Law Enforcement Training Center.

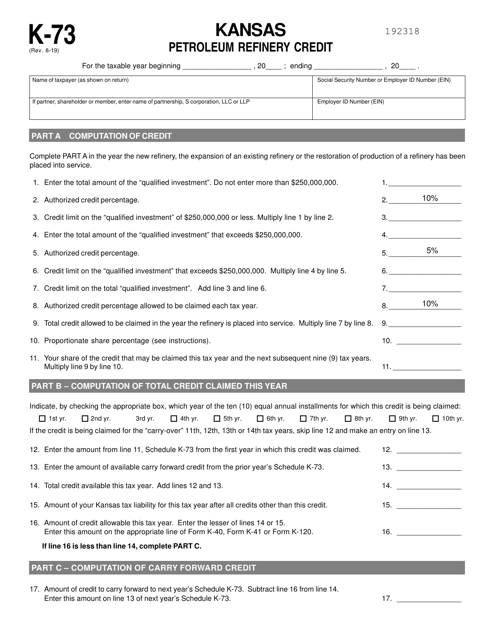

This document is used for claiming the Kansas Petroleum Refinery Credit in the state of Kansas. It allows petroleum refineries to apply for a credit against their tax liability for certain qualified activities.

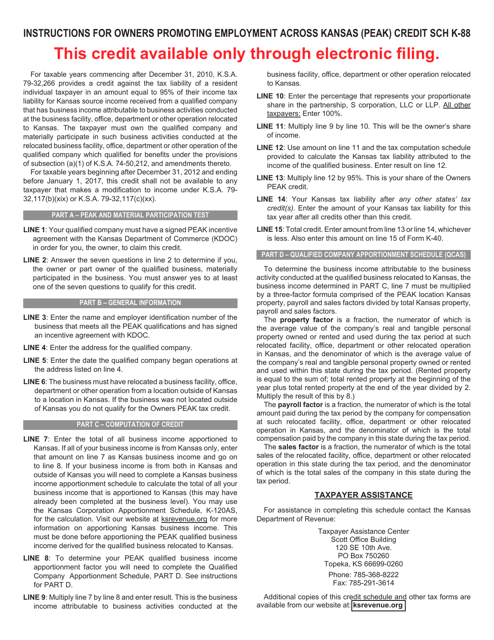

This document provides instructions for claiming the Schedule K-88 Owners Promoting Employment Across Kansas (PEAK) Credit in Kansas. The PEAK Credit is aimed at encouraging job creation and economic growth in the state.

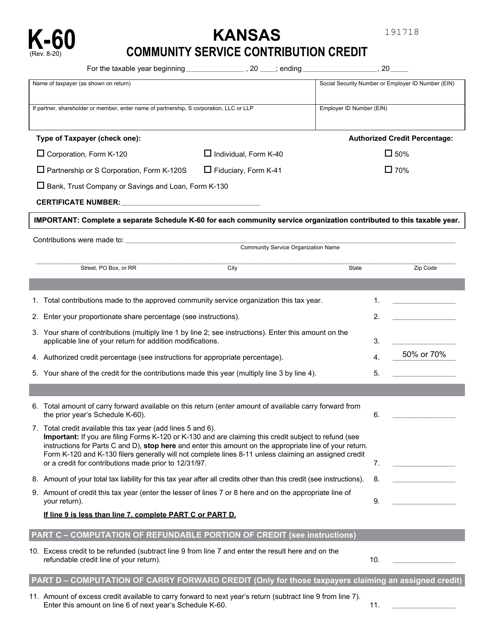

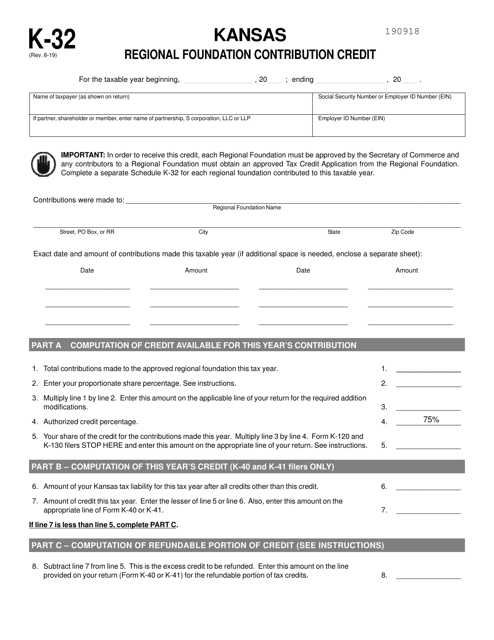

This document is used for claiming the Kansas Regional Foundation Contribution Credit on your state tax return.

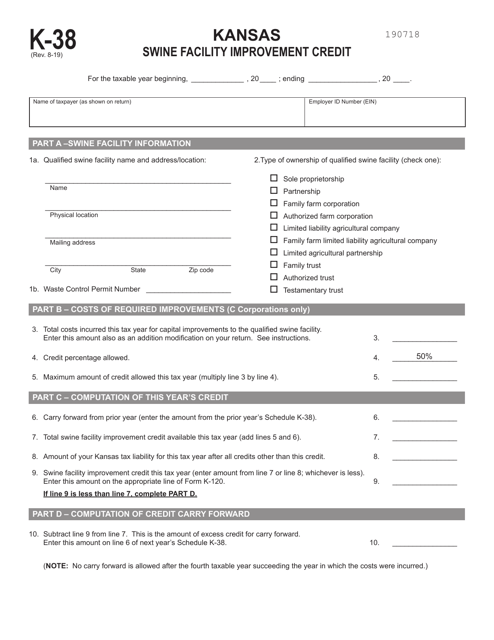

This form is used for claiming the Kansas Swine Facility Improvement Credit on your state tax return if you have made improvements to a swine facility in Kansas.

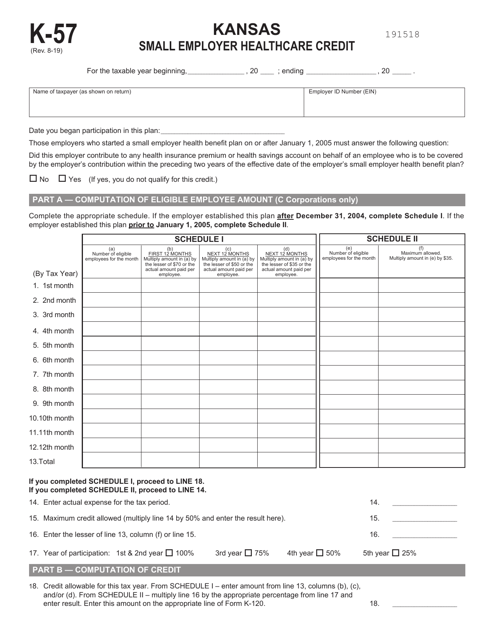

This document is used for claiming the Kansas Small Employer Healthcare Credit in Kansas. It is a tax credit available to small employers who provide health insurance to their employees.

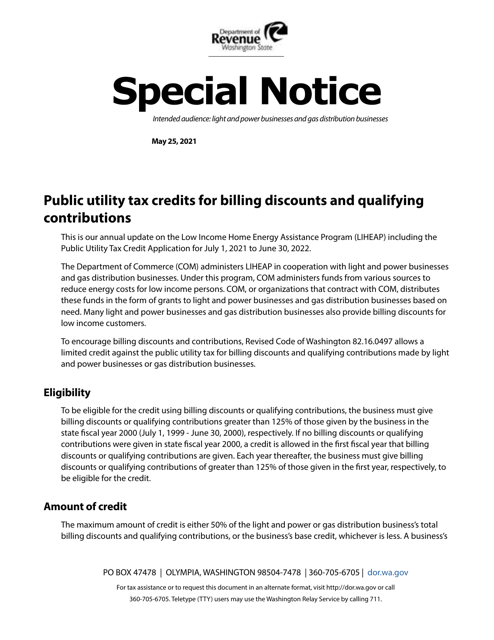

This form is used for applying for a tax credit program called Low Income Assistance in Washington state.

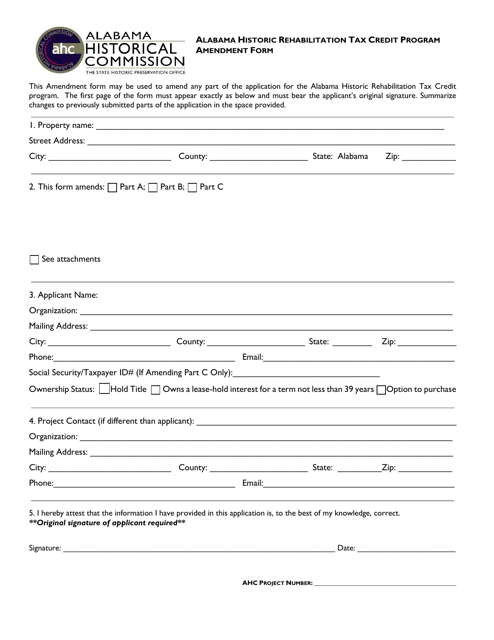

This form is used for making amendments to the Alabama Historic Rehabilitation Tax Credit Program.

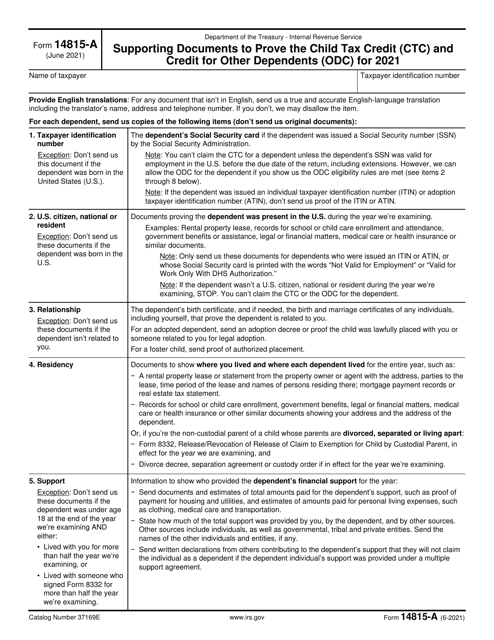

This type of document, IRS Form 14815-A, is used to provide supporting documentation to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC).

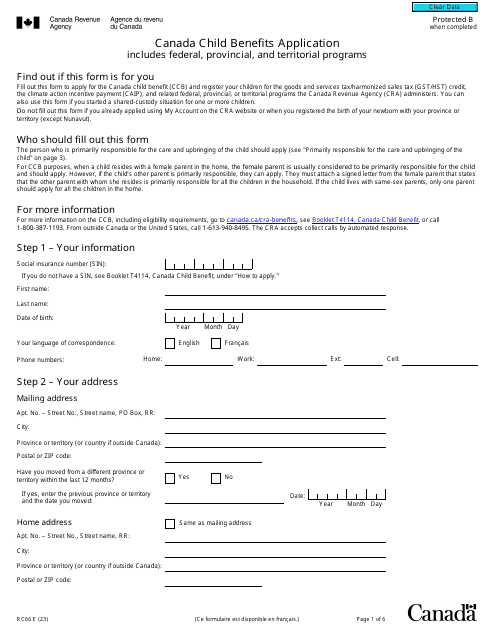

This form is used by Canadian single parents or the guardians of a child or a couple that is separated or divorced to take advantage of the benefits and credits Canada makes available as part of their benefits programs for children.

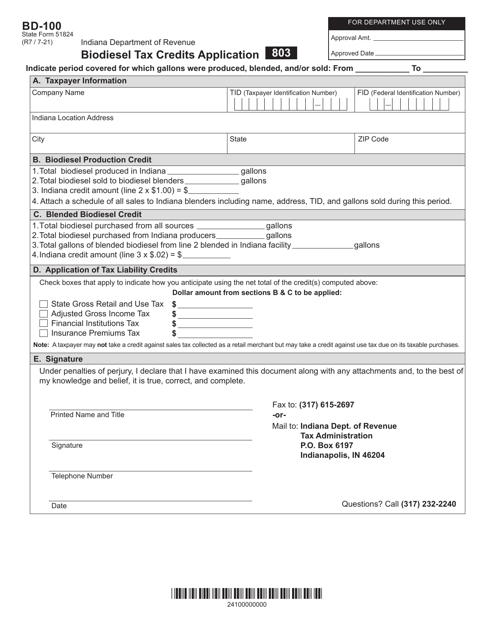

This form is used for applying for biodiesel tax credits in the state of Indiana.