Tax Credit Templates

Documents:

3232

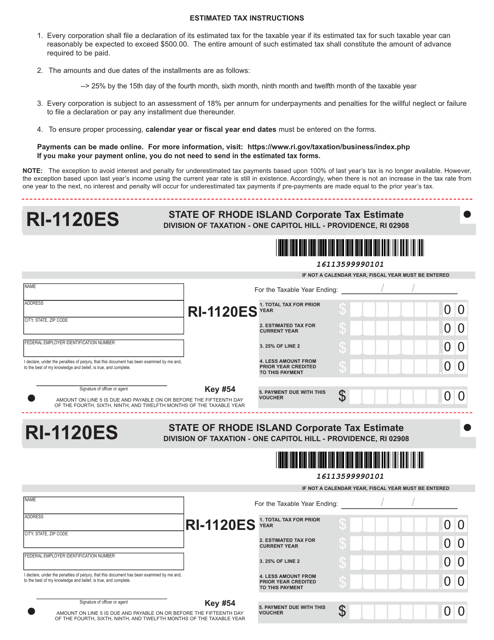

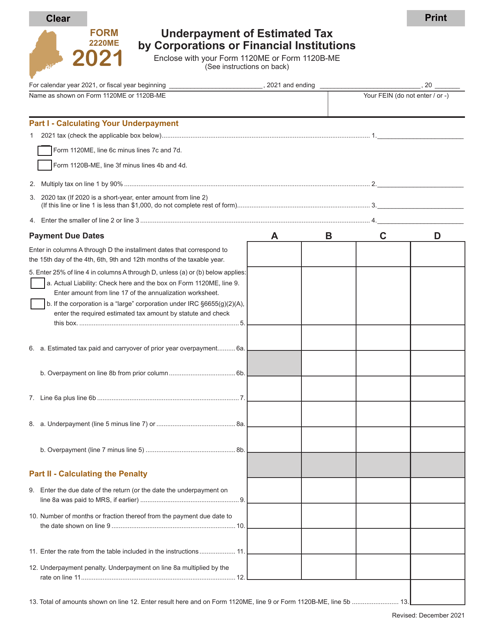

This Form is used for businesses in Rhode Island to estimate and pay their corporate taxes.

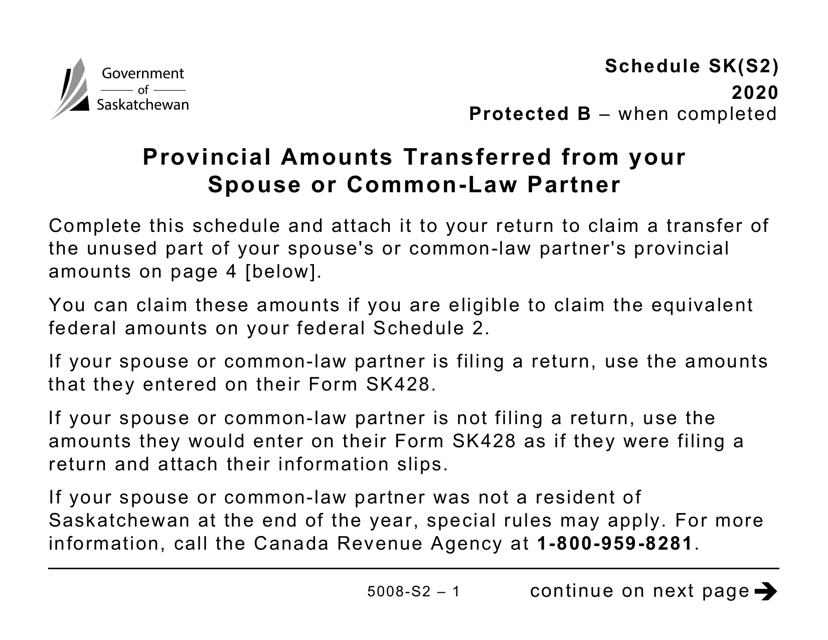

This form is used for reporting provincial amounts transferred from your spouse or common-law partner. It is designed in large print for individuals in Canada.

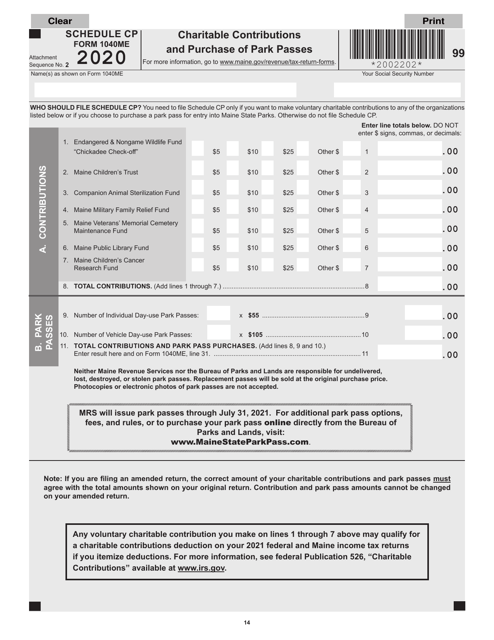

This form is used for reporting charitable contributions and the purchase of park passes in the state of Maine on the Maine tax return.

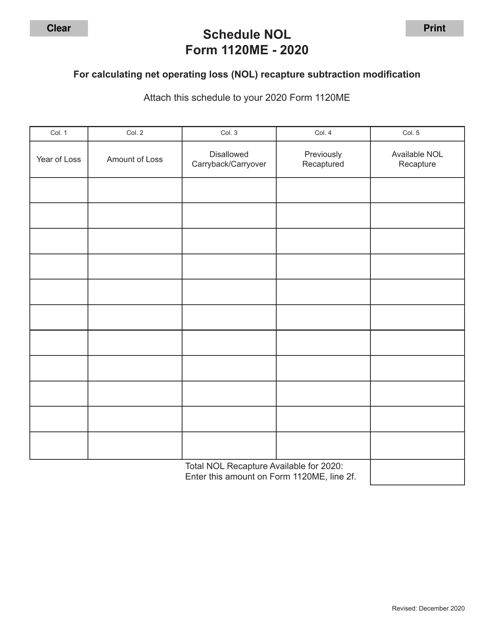

This form is used for calculating the Net Operating Loss (NOL) recapture subtraction modification in the state of Maine for businesses filing Form 1120ME.

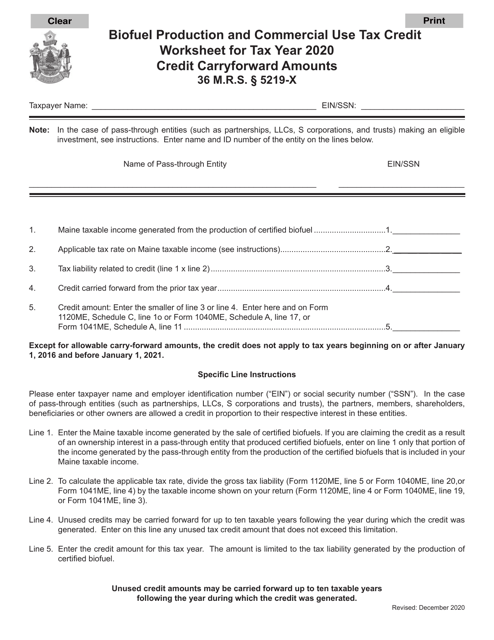

This document is a worksheet used in Maine to calculate tax credits for the production and commercial use of biofuels. It helps individuals and businesses determine their eligibility for tax credits related to biofuel production and use.

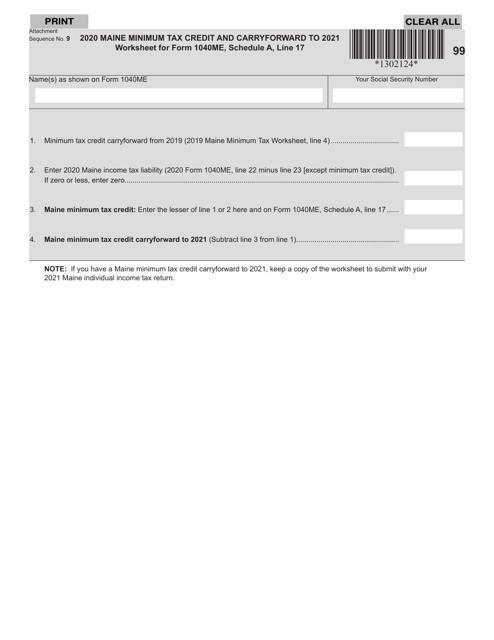

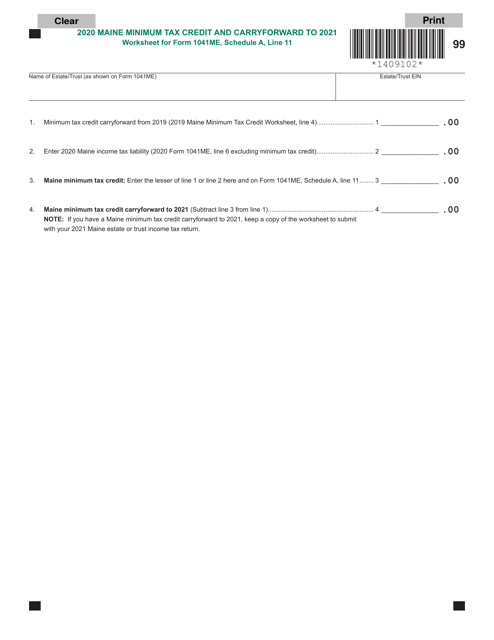

This Form is used for calculating the minimum tax credit for individuals in the state of Maine.

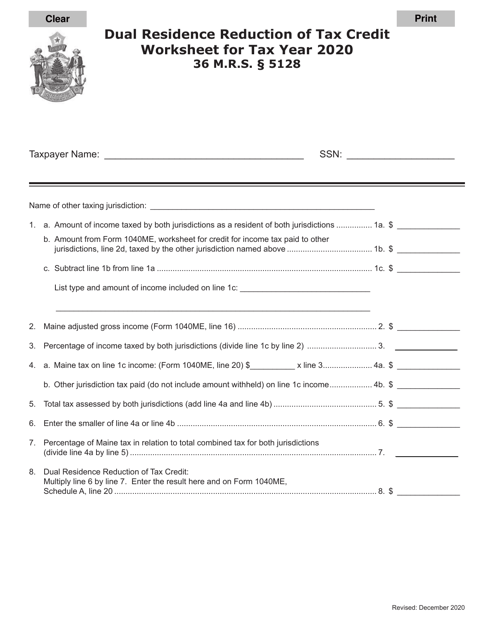

This document helps Maine residents determine their eligibility for the Dual Residence Reduction of Tax Credit. It provides a worksheet that allows residents to calculate the amount of credit they may be able to claim on their taxes.

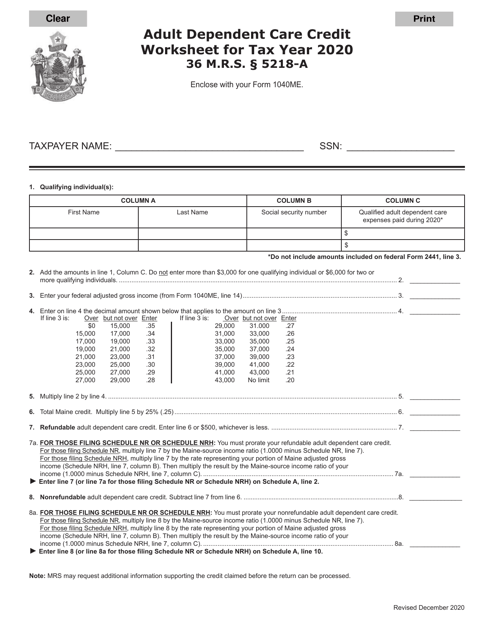

This document is used for calculating the Adult Dependent Care Credit in the state of Maine.

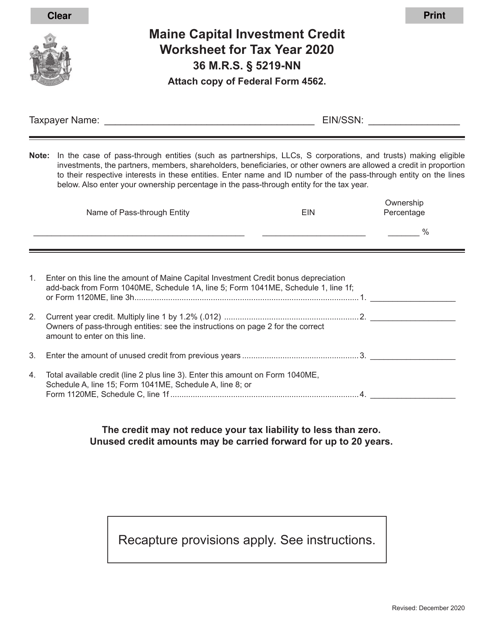

This document is used for calculating the capital investment credit in the state of Maine. It helps individuals and businesses determine the amount of credit they may be eligible for based on their qualified investments in certain industries.

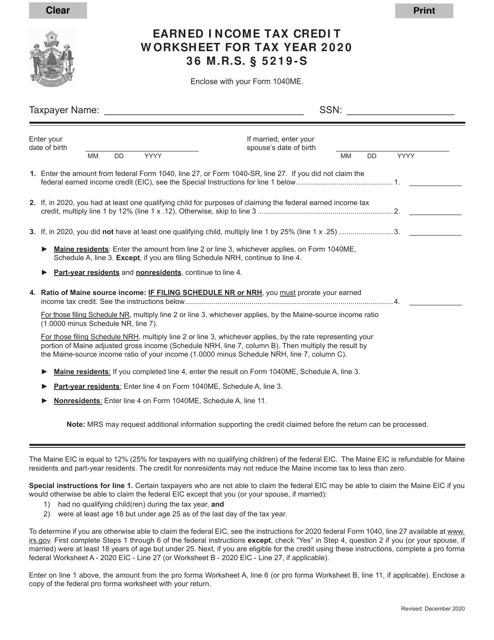

This document is used for calculating the Earned Income Tax Credit in the state of Maine. It provides a worksheet to help residents determine their eligibility and calculate the amount of credit they may qualify for.

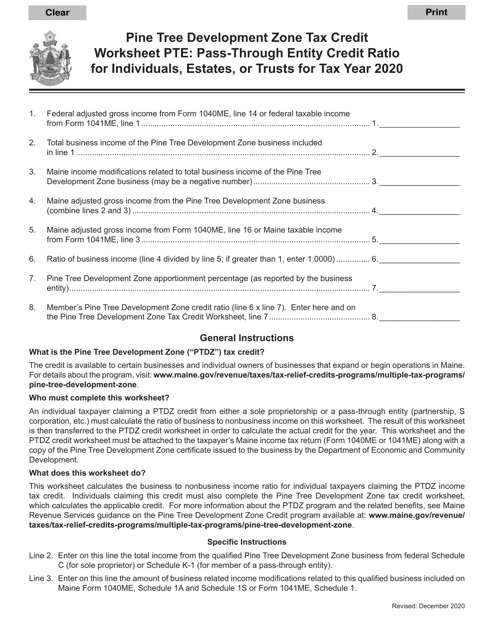

This document is used for calculating the PTE credit ratio for individuals claiming the Pine Tree Development Zone tax credit in Maine.

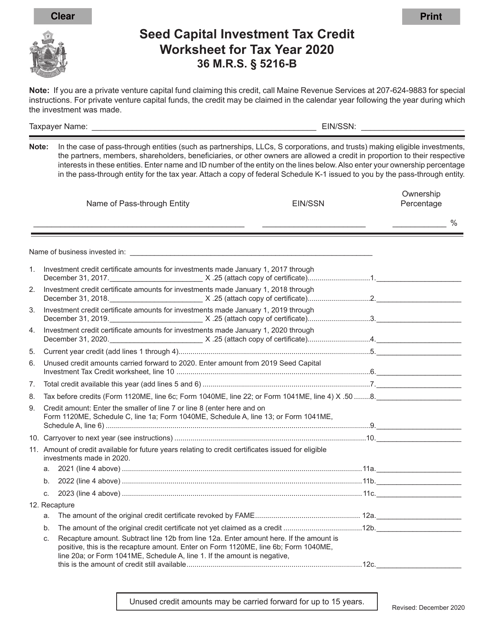

This document is a worksheet used in Maine to calculate the tax credit for investments in seed capital. It helps individuals determine the amount of credit they are eligible for based on their investment amount.

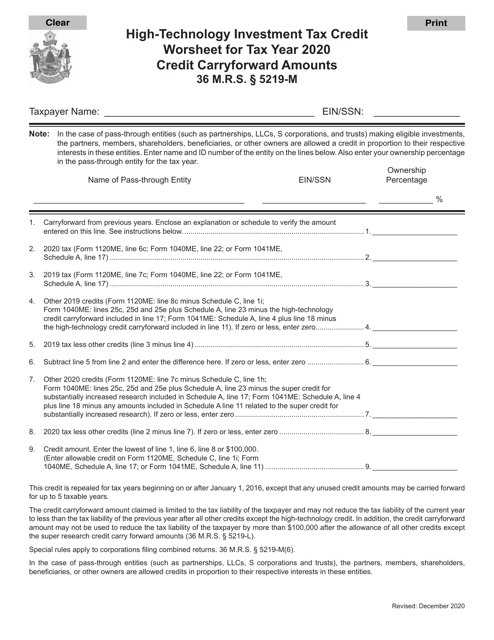

This document is a worksheet used for calculating the high-technology investment tax credit in the state of Maine. It helps taxpayers determine their eligibility and the amount of credit they may be eligible for.

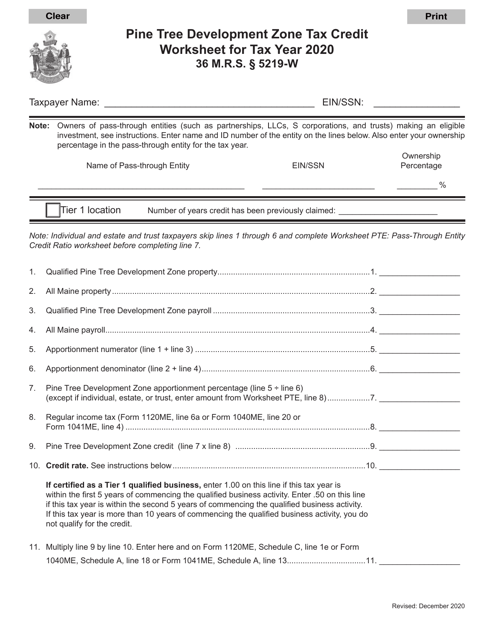

This document is used for calculating the tax credit for businesses located in the Pine Tree Development Zone in Maine. It helps businesses determine the amount of tax credit they are eligible for based on specific criteria.

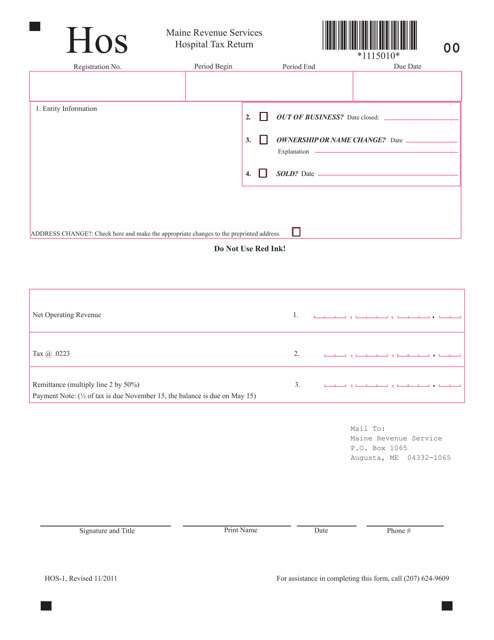

This Form is used for filing hospital tax returns in the state of Maine. It is used by hospitals to report and pay their taxes to the state revenue department.

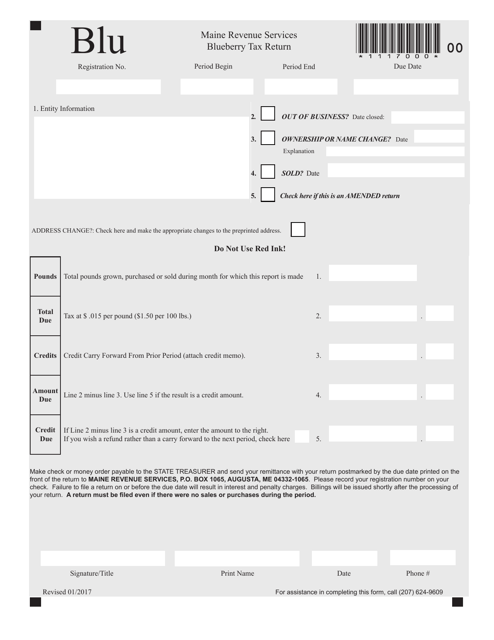

This form is used for the annual tax return specific to blueberry farmers in Maine. It includes information on income, expenses, and deductions related to blueberry farming.

This document provides instructions for completing the Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher in Mississippi. It helps taxpayers understand how to claim a credit in place of making a payment for their income and franchise taxes.

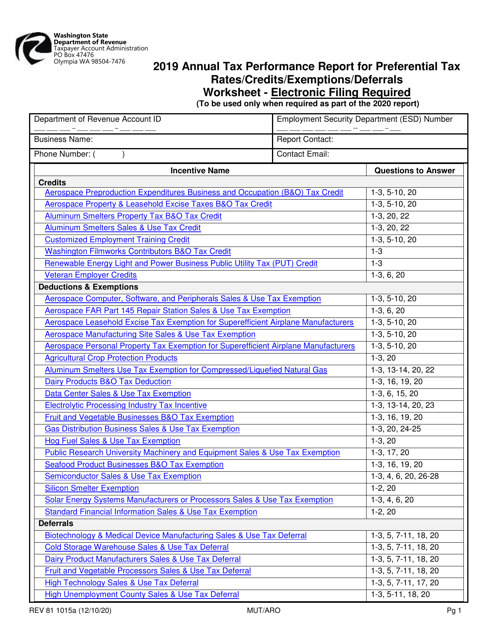

This Form is used for reporting annual tax performance for preferential tax rates, credits, exemptions, and deferrals in Washington state.

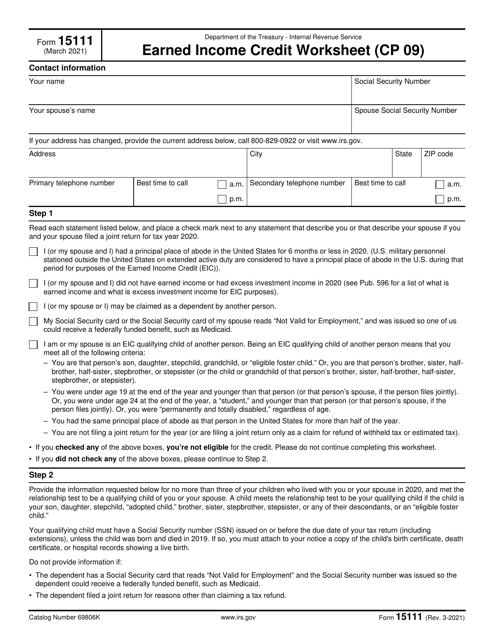

This form is used to calculate the Earned Income Credit for eligible taxpayers.

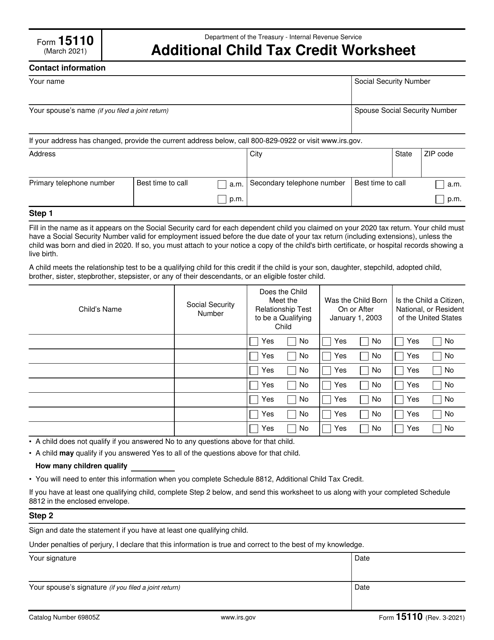

This form is used for calculating the additional child tax credit.