Tax Credit Templates

Documents:

3232

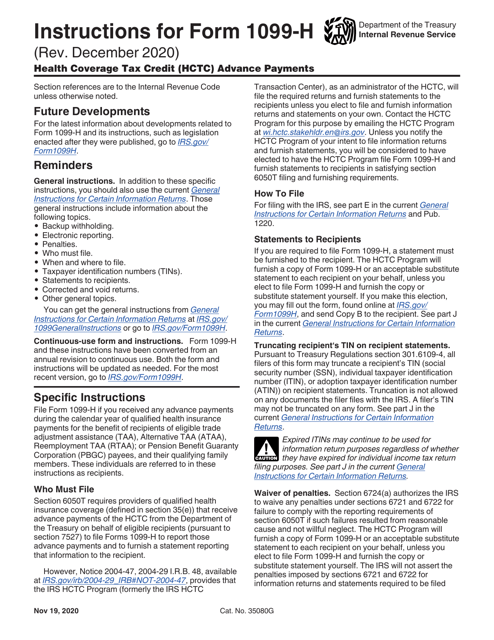

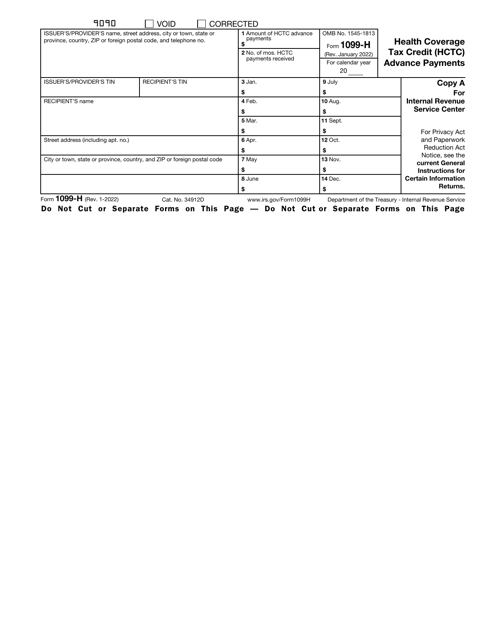

This is an IRS document released for those individuals who got payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance.

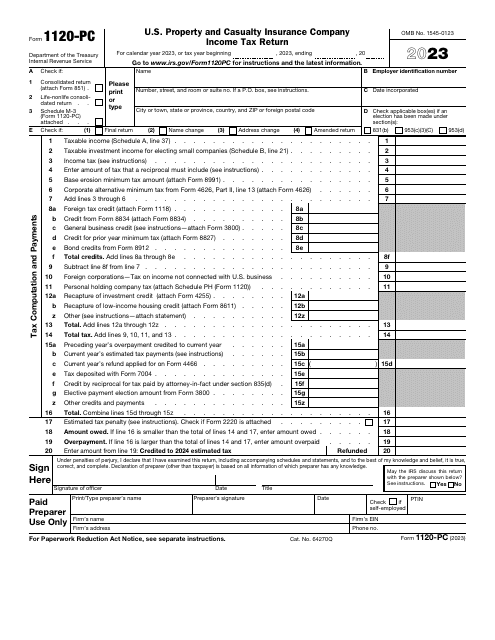

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

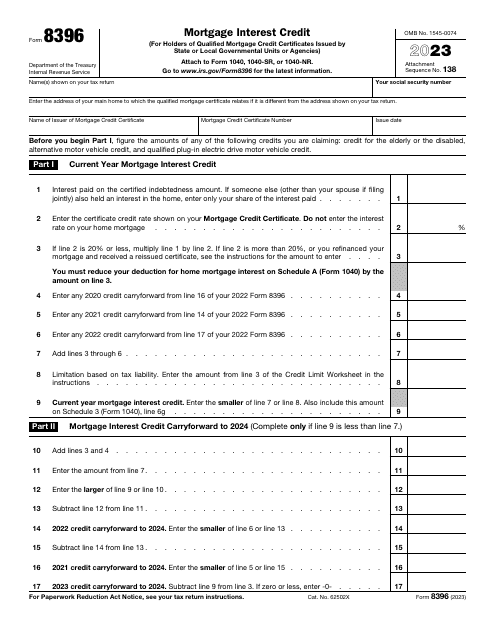

This is a formal document filled out by taxpayers in order to compute the amount of mortgage interest credit over the course of the year and report the information to fiscal authorities.

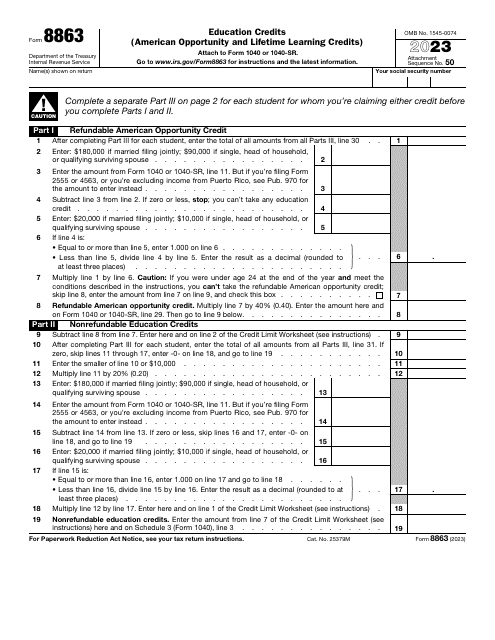

Fill in this form to claim one of the Internal Revenue Service (IRS) educational tax credits. It will provide a dollar-for-dollar reduction in the amount of tax owed at the end of the reporting year for the expenses incurred to attend educational institutions that participate in the student aid programs.

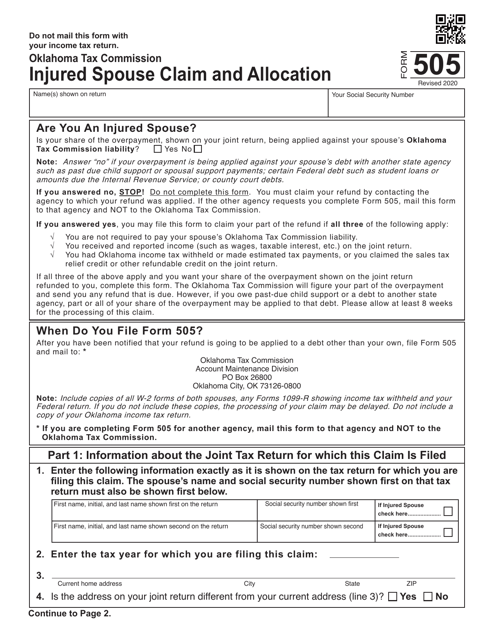

This Form is used for Oklahoma residents who are filing an injured spouse claim and allocation.

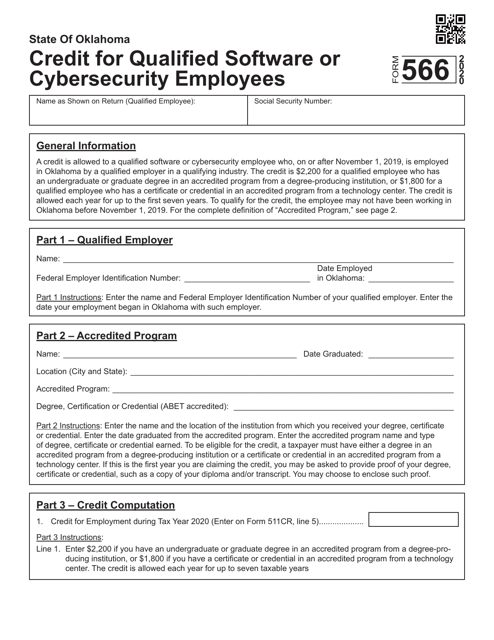

This form is used for claiming the Credit for Qualified Software or Cybersecurity Employees in Oklahoma. It allows eligible employers to receive a tax credit for hiring qualified employees in the software or cybersecurity fields.

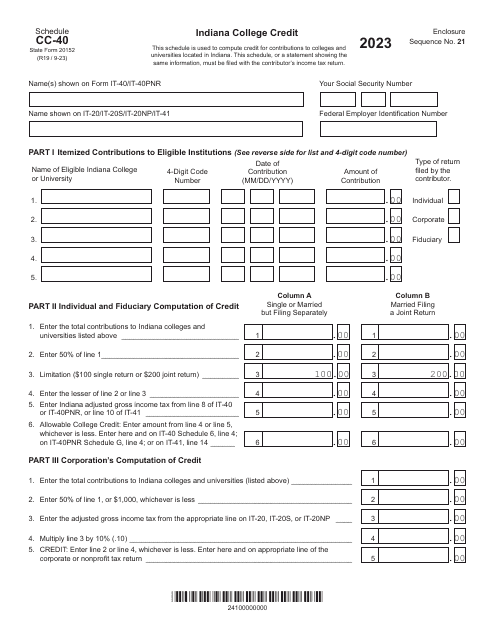

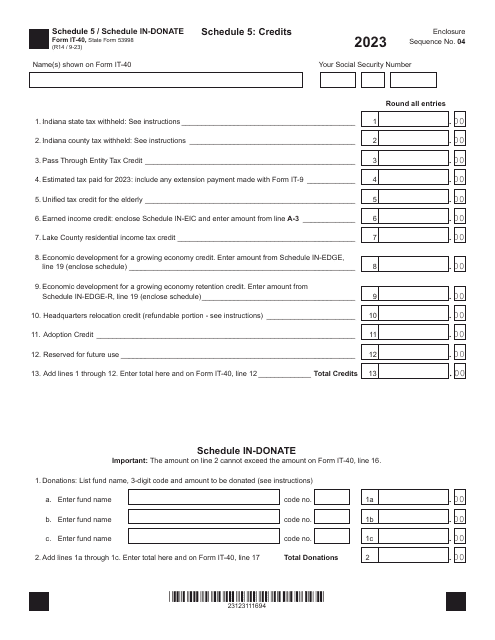

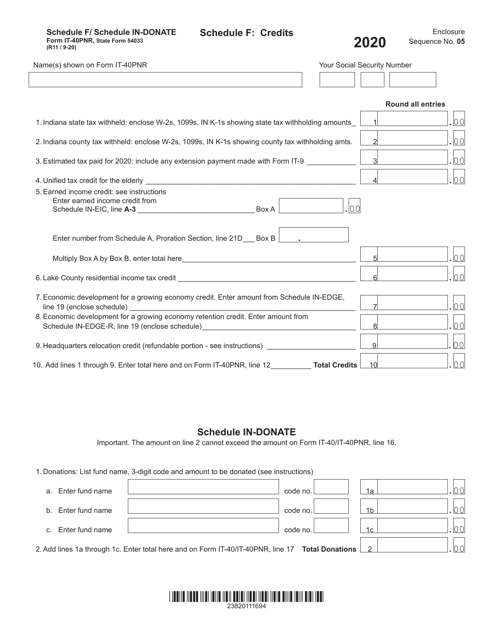

This Form is used for claiming IN-DONATE credits on Schedule F for Indiana state taxes.